sankai

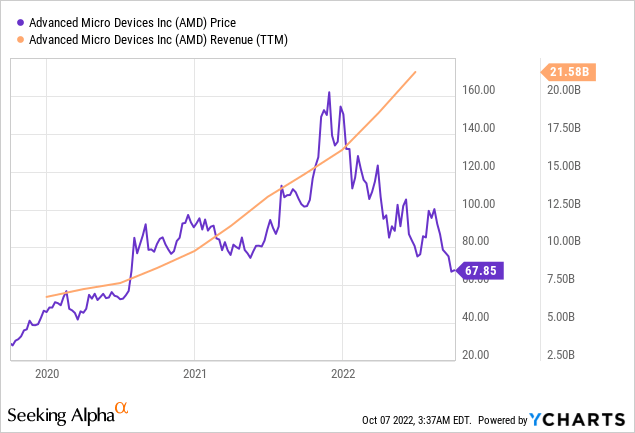

AMD (NASDAQ:AMD) is down more than 60% from its highs as the market is pricing in fears of recession and a slowdown in growth in the near term as uncertainties in the sectors increase. With so much negative sentiment around the stock, I think that this is the time to buy the stock as the company is one of my preferred stocks to own when the recession is over. This article aims to look at how much of the negatives has been priced in and what the recent preliminary 3Q22 numbers means for AMD.

Investment thesis

AMD has been rather weak for the year of 2022 as the sentiment around the stock started to weaken. It started with fears of cooling of demand, and with these fears materializing as semiconductor companies started to show weakness in their results. AMD’s own set of results has showed weakness, particularly in the PC end market, while the data center remains relatively resilient. However, AMD remains to be well positioned to gain market share, especially in the data center segment, as its competitors looks to be not well positioned in the market in the near term.

I think that AMD looks attractive as a contrarian investment as the company’s valuation is pricing in recession fears and a material slowdown in growth in the near-term as the economic situation remains uncertain. My 1-year target price for AMD is $90.50, implying 40% upside from current levels.

Opportunities in the miss in preliminary results

Preliminary 3Q22 results came in weaker than expected as the company reported $5.6 billion revenues for the quarter, lower than the guidance of $6.7 billion. This represents a 16% miss in guidance due to a lower-than-expected client revenue as the PC market was weaker than expected. That said, data center, gaming and embedded revenues mostly met expectations given that most of the $1.1 billion miss in revenues came from client revenues.

Gross margins are expected to be around 50% compared to the guidance of 54%, with the 4 percentage points miss coming from the client segment. This is due to the lower client processor unit shipments, lower selling prices as well as inventory charges. As a result of lower variable compensation expenses, operating expenses is now expected to be $100 million below guidance.

In my view, the current weaker results as a result of the miss of $1 billion in revenues and lower gross margins brings the company’s results more aligned to market expectations. There have been several data sources showing the negative sentiment around the PC supply chain that led to other companies like Micron (MU) and Nvidia (NVDA) coming out with warnings. Micron, earlier in July, came out to warn that they were seeing a cooling of demand for its chips used in smartphones and PCs. Nvidia, on the other hand, was also warning that the United States restrictions on China may result in weakening sales for the company.

Given this recent miss of 3Q22 results to guidance, I think that the guidance for 4Q22 could be further de-risked given that a weaker environment will be taken into account in the guidance. Furthermore, the market consensus, in my view, was relatively elevated and with the reductions in estimates after the negative preliminary results, the stock could be further de-risked.

Lessons from 2Q22 results

I think that 2Q22 results could provide us with an opportunity to review our numbers for 3Q22. In 2Q22, AMD expected a decline by mid-teens in the PIC market which were about 2.5% headwind to my estimates for AMD. That said, it managed to pull together 2Q22 results that were broadly meeting expectations and even maintained its full year guidance.

More importantly, it was evident that AMD continued to gain market share across its portfolio with the 25% year on year growth in PC revenues compared to the -25% year on year growth of Intel (INTC). This was a result of its much higher selling price as AMD moved up the stack.

For the server segment, AMD did grow CPU units by about 100,000 per quarter as it has done so for the past 5 to 6 quarters and the selling price was also up 20% year on year. While I think we did see server CPU revenues decelerate in the quarter, it was still meeting the expectations on my model in terms of unit growth. As such, servers still seemed to remain robust in 2Q22 and I would think that there is nothing negative to highlight in this segment.

Multi-year data center growth

As can be implied from the 2Q22 results, server revenues continued to be robust in the second quarter with no negatives for the quarter, and this continued on in 3Q22, where the data center segment continued to meet market expectations. I think that this implies that market expectations for the data center segment is just about right and that we will likely not see that much of a miss from the segment.

In addition, I think that it remains to be the case that AMD will continue to have its market share gain story in the data center segment. Given that Intel’s data center portfolio looks very much out of position in the next few years, this will lead straight up to AMD’s alley as it can continue to grab opportunities in the many years to come. As such, I think that AMD has a strong competitive position in the data center segment and should see solid growth prospects, in my view.

The main concern for the AMD remains to be the supply situation. AMD would need reliance and access to manufacturing process leadership. This, of course, will have to come from TSMC, while Intel intends to solve this on its own by focusing on its own foundry business.

Valuation

My 1-year target price for AMD is based on a DCF model, forecasting AMD’s financials for the next 5 years, discounting to derive a 2023 target price. Based on this, my 1-year target price for AMD is $90.50, implying 40% upside from current levels. My $90.50 1-year target price implies 20x 2023 P/E multiple, which in my view, shows the de-risked nature of the estimates.

I think that as recession fears are priced into the stock, it becomes more compelling for investors to add AMD to their portfolios as the risk reward perspective is skewed so positively with the estimates looking very gloomy. Based on the Bloomberg estimates of AMD, it is trading at just 15x 2023 P/E. I think that this is pretty much a steal to anyone used to buying AMD in the P/E multiple range of 30x to 60x from 2018 to 2022.

Risks

Macroeconomic environment

As a result of almost 35% of revenues being derived from the PC end market, a weakening of the macroeconomic environment will therefore lead to a material slowdown in the PC end market and thus a weaker revenue growth for AMD. As a result, if the macroeconomic environment worsens and we see a severe downturn or a prolonged recession, this will mean that the PC end market demand could be weaker than expected and lead to lower revenue and earnings estimates for AMD.

Market share risks

While AMD has been rather successful in gaining market share, it does compete with competent companies which may increase competitive pressures to drive up their own market share. With Intel and Nvidia competing with AMD in the microprocessor and graphics markets respectively, I think there is definitely a risk of material market share losses in these segments. If so, this will then lead to downside revisions to my revenue and earnings estimates for AMD.

Customer risks

As Sony (SONY) and Microsoft (MSFT) makes up 35% of its revenues, there could be a negative effect on stock price if there were to be material weakness in orders from either or both companies that will have an effect on my estimates for AMD.

Conclusion

AMD has experienced an extreme change in sentiment from one that was positive to one that is becoming increasingly very negative. As a result, I think that investors can leverage on this negative sentiment and take on a contrarian investment approach with AMD as it looks set to be a winner in the space once the recession ends. I think that its market share gains story remains to be a multi-year development as it remains well positioned in the industry. Given that the company is priced at the 15x 2023 P/E currently, it looks rather reasonable as much of the recession fears and slowdown is priced into the stock. My 1-year target price for AMD is $90.50, implying 40% upside from current levels.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment