undefined undefined/iStock via Getty Images

AMD (NASDAQ:AMD) has been such a strong performer that Wall Street seems to be in disbelief. While the long term growth story of semiconductors remains unchallenged, consensus estimates are arguably too low considering the long growth runway. The stock is trading at only 22x forward earnings in spite of that strong growth outlook. I continue to rate the stock a buy as the company gradually shifts from hyper-growth to becoming a cash flow machine.

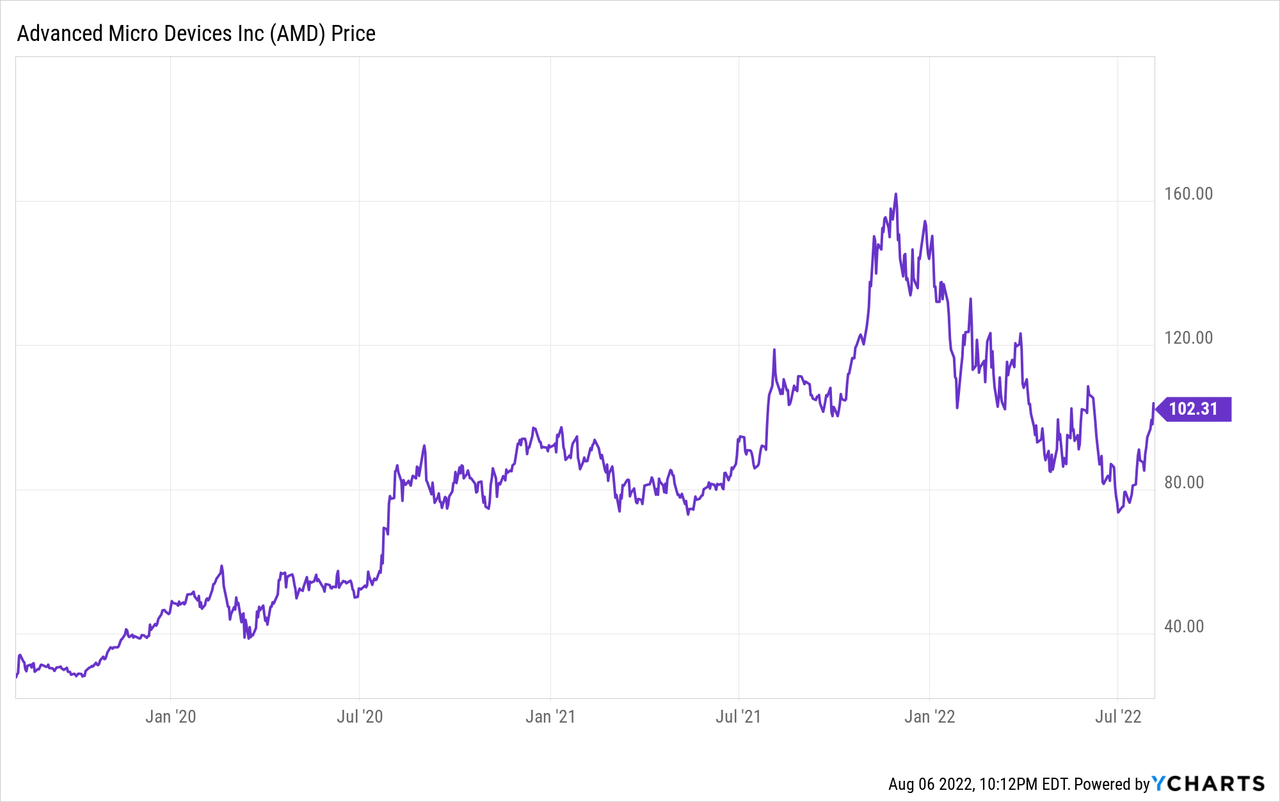

AMD Stock Price

AMD has been a high flyer even accounting for the tech crash.

I last wrote on AMD in April where I discussed what to expect from the stock in 10 years. AMD is the kind of stock that arguably should be held for long time horizons, as the long term compounding potential should eventually lead to operating leverage.

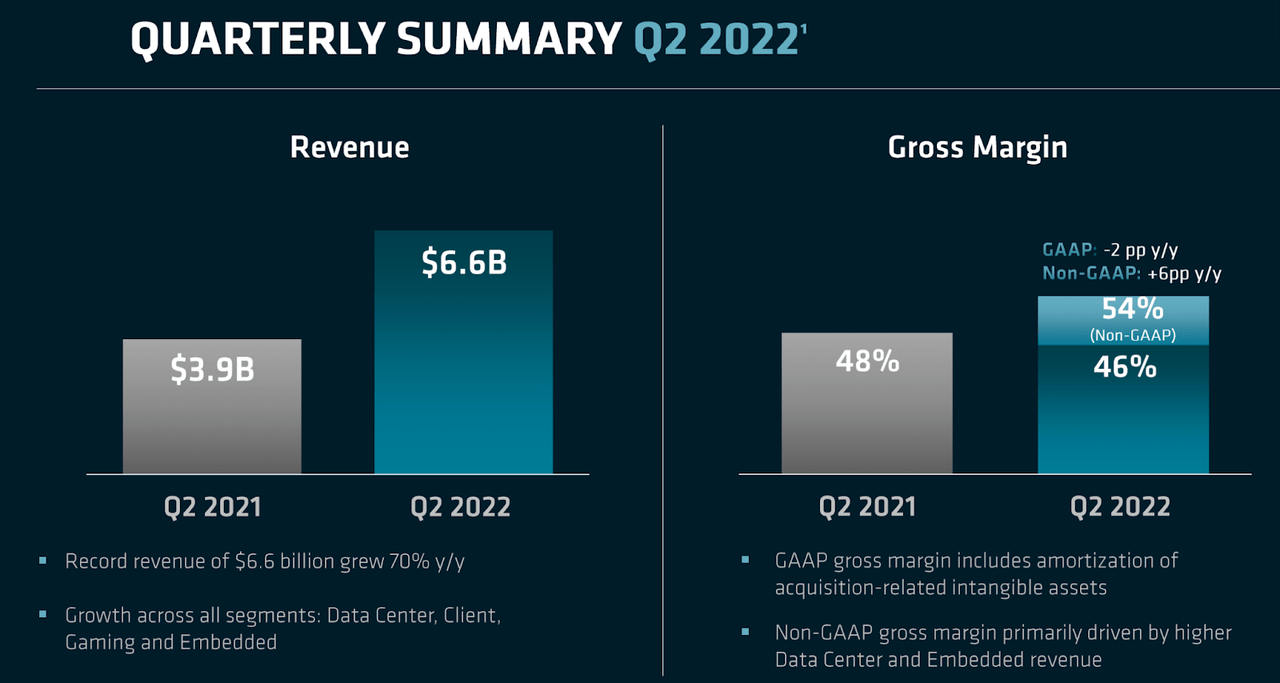

AMD Stock Key Metrics

AMD’s latest quarter showed strong revenue growth with some gross margin expansion.

2022 Q2 Presentation

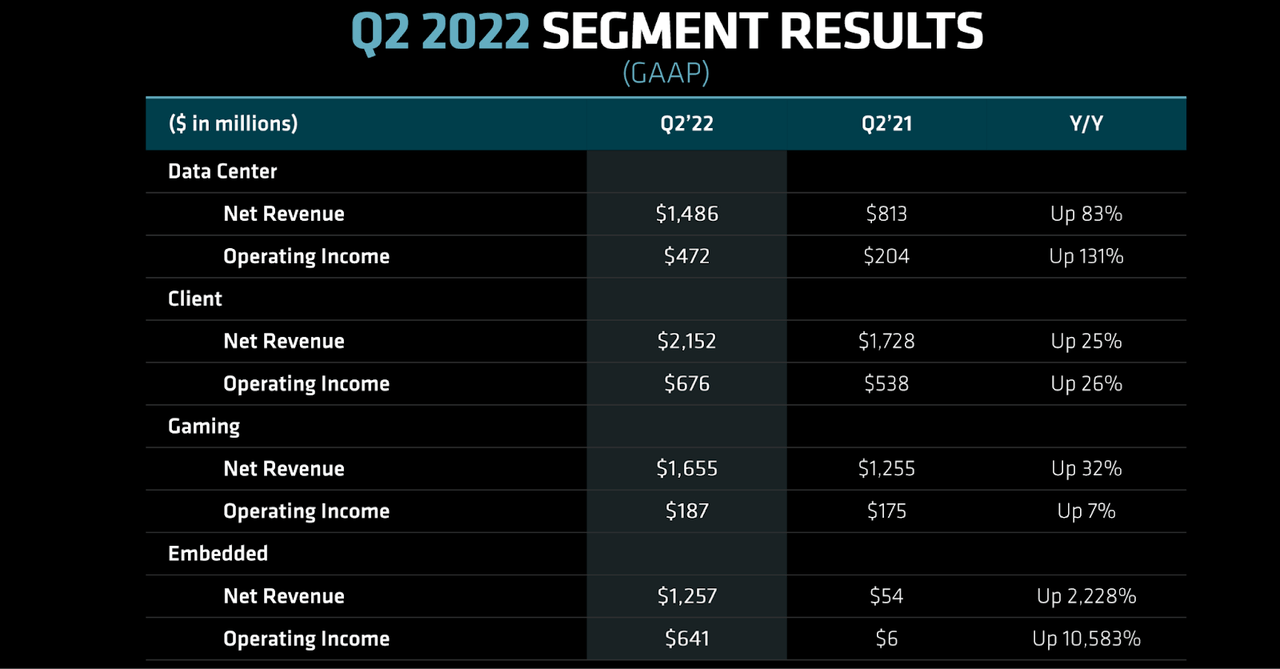

We can see below that data center revenues remain a critical growth driver. Gaming revenues, for which AMD is most well known for, grew 32% which is still respectable considering the tough comparables. It is worth noting that data center revenues are very close to eclipsing gaming revenues. Embedded revenues grew by 2,228% but that was largely due to the closed acquisition of Xilinx. On a per share basis, revenue grew by 28% year over year.

2022 Q2 Presentation

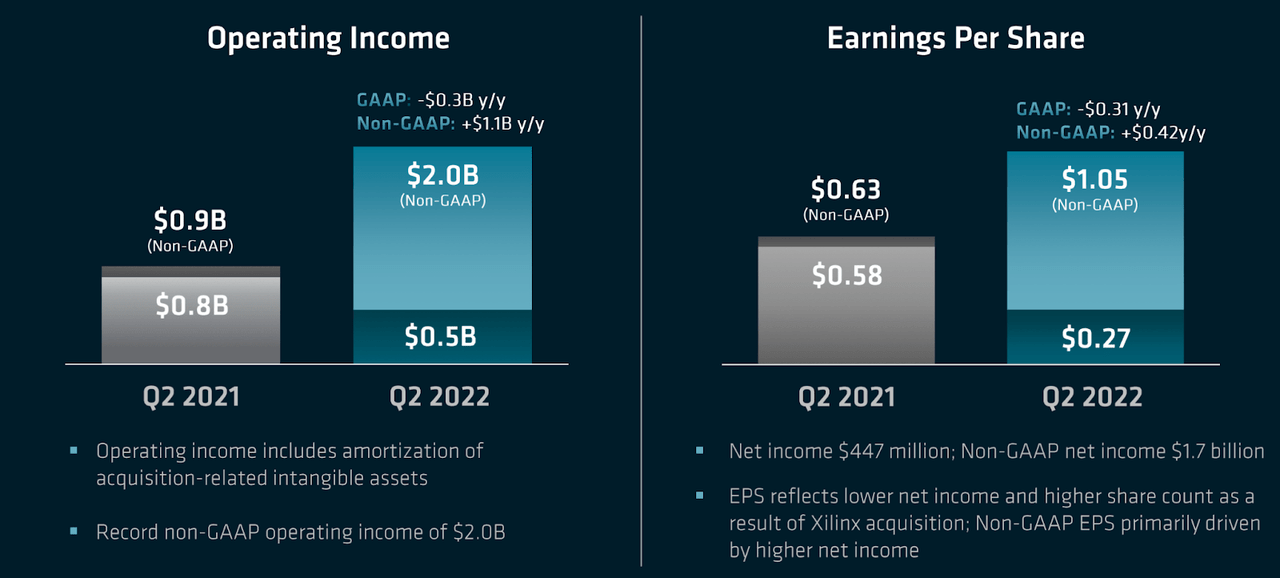

That 28% per share top-line growth translated to 66.7% non-GAAP EPS growth due to operating leverage.

2022 Q2 Presentation

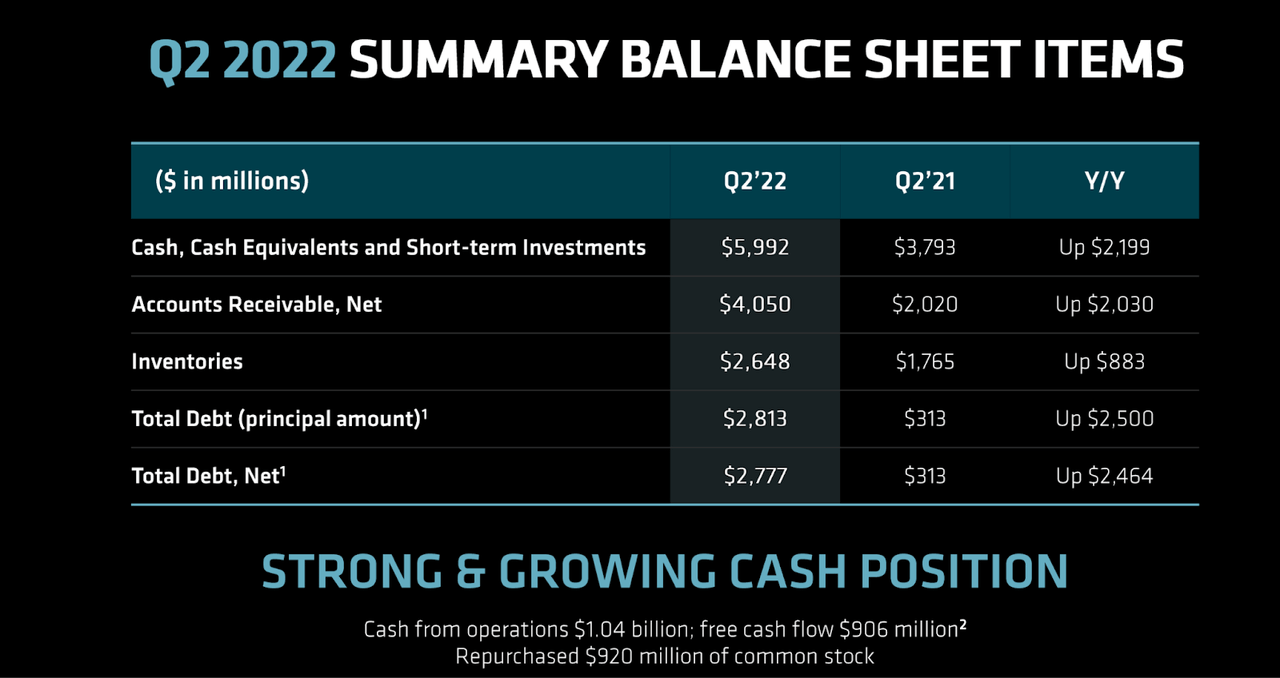

AMD ended the quarter with $6.0 billion of cash versus $2.8 billion of debt – a considerably strong balance sheet which may prove useful amidst the current market volatility.

2022 Q2 Presentation

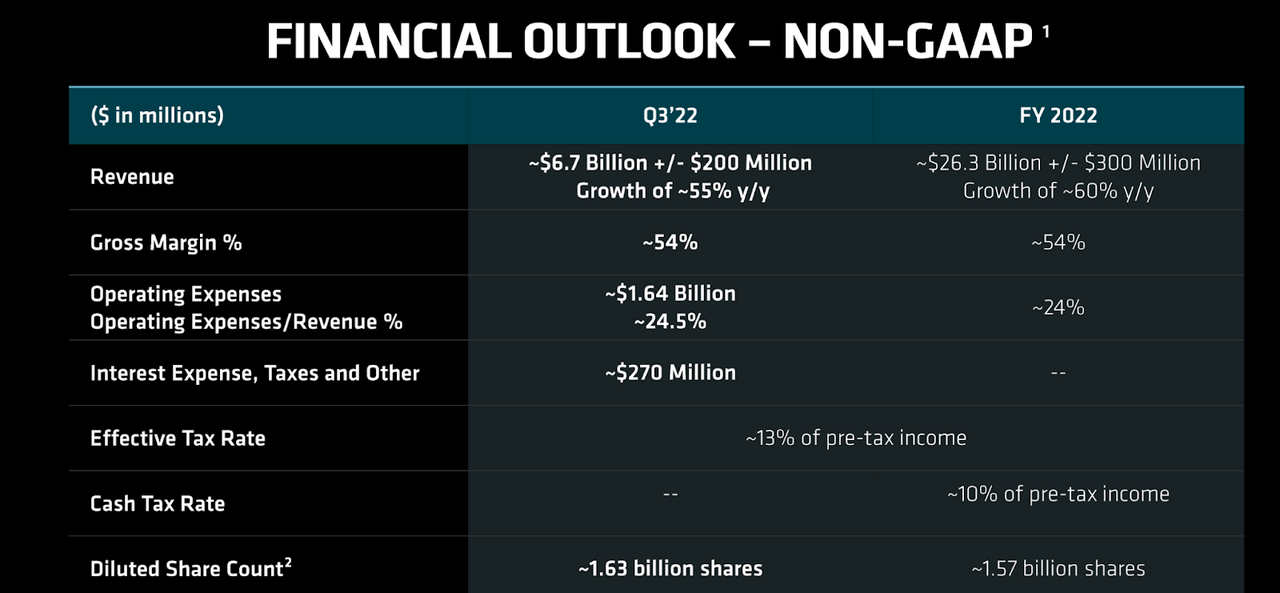

Looking forward, AMD expects the third quarter to show 55% revenue growth to around $6.7 billion, with the full year seeing 60% growth to $26.3 billion.

2022 Q2 Presentation

These are strong numbers which are even more impressive when taken into the context that they are lapping the tough comparables of 2021.

Is AMD Stock A Good Value Now?

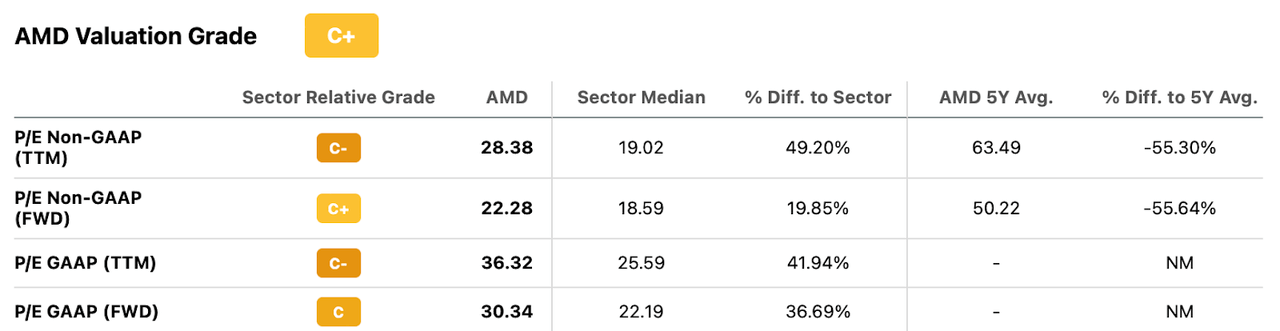

Seeking Alpha’s valuation system rates AMD with a C+ rating, apparently because its valuation is at a significant premium to peers.

Seeking Alpha

I will discuss my view on the valuation below.

How High Is AMD Stock Expected To Go?

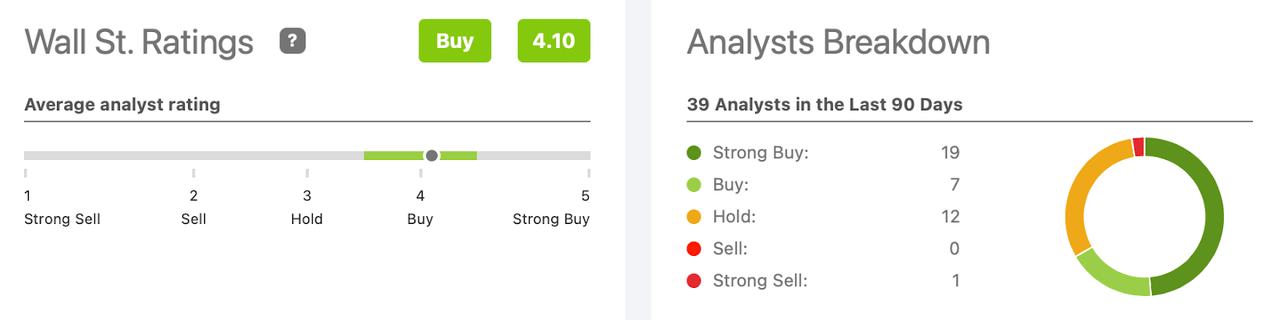

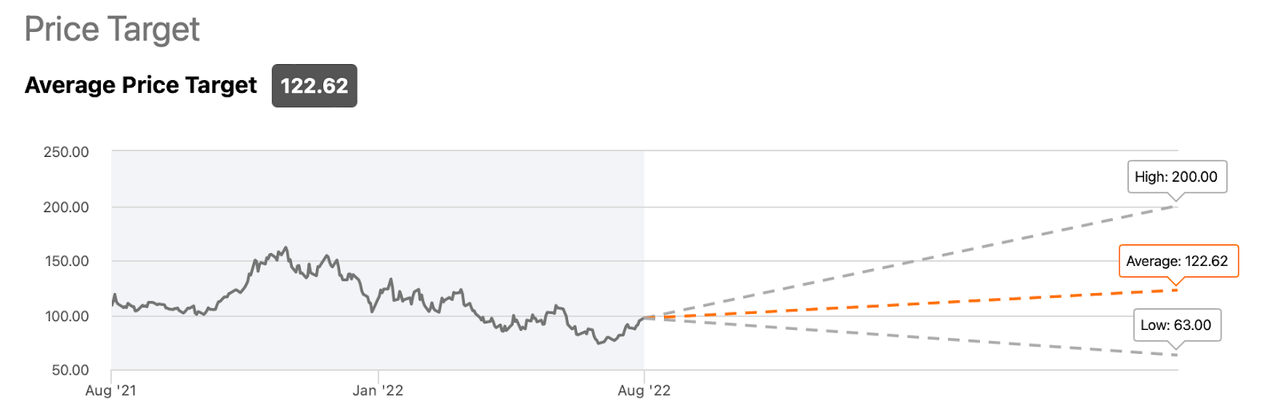

Wall Street analysts are more bullish, with a 4.1 out of 5 buy rating.

Seeking Alpha

The average price target of $122.62 per share reflects around 20% potential upside.

Seeking Alpha

Where Will AMD Be By 2025

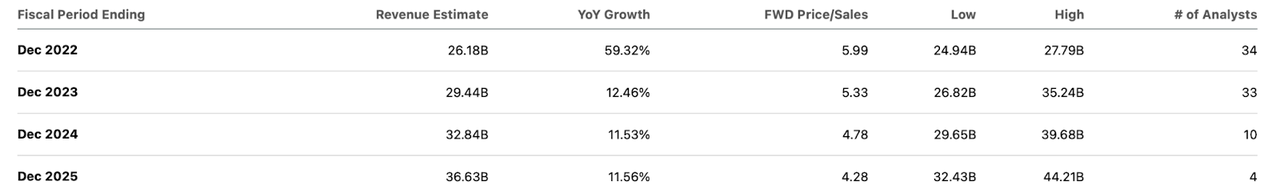

Looking ahead, I expect AMD to continue growing rapidly, led by growth in its data center business. Wall Street consensus estimates are less certain. Consensus estimates call for growth to decelerate rapidly, with revenues growing in the low double-digits following 2022.

Seeking Alpha

That is expected to lead to some operating leverage.

Seeking Alpha

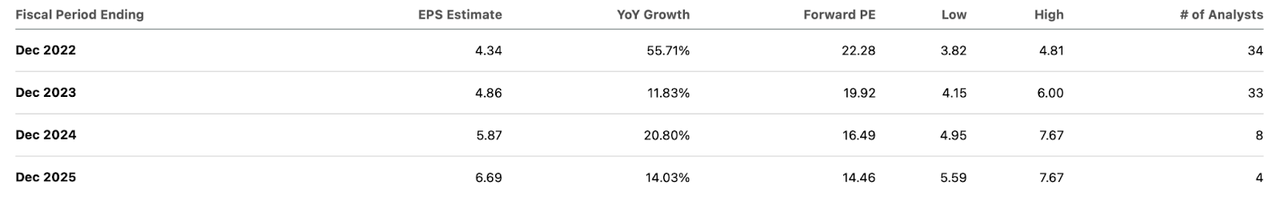

On the other hand, management has given guidance at their 2022 Analyst Day calling for around 20% long term top-line growth.

2022 Analyst Day Slides

Assuming management can execute on that target, AMD might be generating around $45 billion in revenues by 2025. Assuming a similar multiple to today, AMD might be trading at around $170 per share by 2025.

Is AMD Stock A Buy, Sell, or Hold?

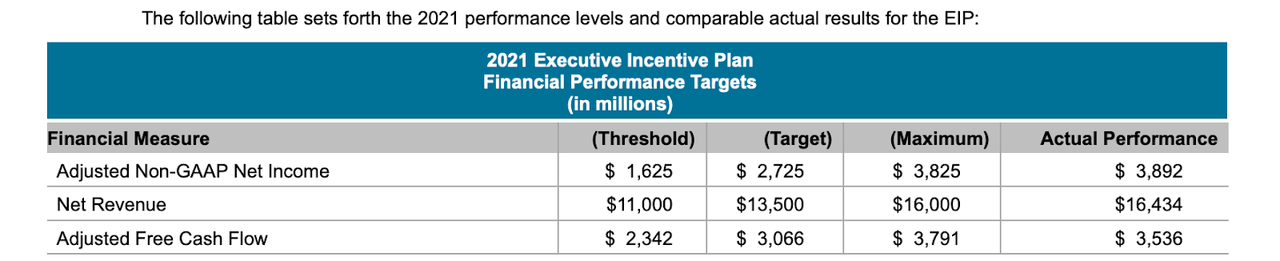

The answer to that question depends on one’s conviction in management’s ability to hit their aggressive guidance. Conventional wisdom suggests that consensus estimates are not too far off the market, as it wouldn’t be totally surprising for growth to decelerate after the rapid growth these past several years. We are seeing e-commerce and fintech companies show decelerating growth as they lap tough comparables – perhaps that may happen to AMD as well. AMD is currently trading at around 22x earnings but that is on a non-GAAP basis. It is worth noting that equity-based compensation does not make up a huge proportion of non-GAAP profits as it stood at only 11% in 2021. As a result, non-GAAP earnings are arguably a reliable metric to count on. With a bit of operating leverage, consensus estimates of 11% top-line growth might lead to around 13% to 15% earnings growth. The stock is trading at a price to earnings growth ratio (‘PEG ratio’) of less than 1.5x, which is arguably quite reasonable. AMD is already repurchasing stock and may not be too far from beginning a quarterly dividend. The company appears to be stable enough of a financial position to warrant a premium valuation. But what if management is correct regarding its 20% top-line forecast? That’s when the value proposition gets more interesting. The company might be able to grow its bottom-line at around 22% to 24%, which at a 1.5x PEG ratio would warrant a 35x earnings multiple. AMD would have 60% upside and that is not including any upside from growth. Even here, it is easy to believe such a thesis considering the ever-present demand for semiconductor chips. Key risks here include disappointments on projected growth and potential exposure to an economic slowdown. While I view AMD’s data center business to be mission critical, it is possible that the company has (for example) underestimated its exposure to the collapsing crypto market. The stock is not necessarily pricey here, but the projected upside would decline considerably if growth rates compressed. One underappreciated risk may be related to interpretation of the 20% growth guidance. Management’s incentive compensation is based on nominal amounts as seen below:

2022 DEF 14A

AMD’s earnings releases also do not break out “organic” growth versus overall growth, which is arguably much more pertinent to shareholders. It is possible that AMD is guiding for 20% nominal growth, which would have far less benefits for shareholders. I still rate the stock a buy due to 22x earnings being an undemanding valuation.

Be the first to comment