spooh/iStock Unreleased via Getty Images

I waited with bated breath for AMD’s (NASDAQ:AMD) earnings as the semiconductor industry hasn’t had the best forward-looking news this earnings season. Look no further than Intel (INTC), as it should have stopped writing the report because of how bad it was. Or look the other way and see Micron’s (MU) poor guidance from a few weeks ago due to a weak retail market. So, I wondered, would AMD suffer the same fate? But the report provided a sigh of relief with a decent quarter while giving a “good enough” inline guide for Q3, following it up with an above consensus full-year guide. Combined with a low valuation and bullish technical chart picture, AMD appears to be one of the better semiconductor investments in this recessionary environment.

AMD stands out in the semiconductor sector, leveraging its growing share to offset market weaknesses. Its report showed it didn’t even blink at the deteriorating economic environment, proving it can work through the weaknesses via other outperforming segments and market share gains. While the broadly understood PC weakness was acknowledged by management during the call, it didn’t overshadow the results or the guide for both Q3 and (implied) Q4.

…while there has been additional softness in the PC market in recent months, we believe we are very well positioned to navigate through the current environment based on the strength of our existing product portfolio and upcoming product launches.

– Lisa Su, CEO, Q2 ’22 Earnings Call

And this is the difference between Intel and AMD – product launches. Intel has continued to delay product ramp after product ramp due to one issue or another, typically on the fabrication side. At the same time, AMD relies on the stability of Taiwan Semiconductor (TSM) to get its product out the door. Product ramps help with the natural decelerating revenue throughout a product’s cycle.

While Intel cuts guidance and delays products, most notably Sapphire Rapids, for yet another time, AMD will be launching its RDNA 3-based discrete GPUs and its Genoa server chip at the end of the year, on time.

But to blame manufacturing alone would be a mistake. That’s because Intel has admitted there are inherent flaws in the design of the latest Xeon chip causing security defects – severe ones, some claim. While I won’t argue Intel isn’t innovative, capable of providing superior functionality, it hasn’t figured out how to streamline the process without delays in the post-10 nanometer world. So it winds up creating a product launch cycle that places it on top of the next generation, in this case, Emerald Rapids, expected in late 2023. This execution creates an innovative dream, not a product toasting heatsinks in the data center keeping the coffers full.

It also creates a loss of market share.

This is where AMD has capitalized; selling its latest processor into the data center market, generating 65% year-over-year growth (after backing out my estimation of $150M in Xilinx data center contribution) in the reported quarter. Contrast this with Intel’s 16% decline in data center revenue and expectations for more of the same in the current quarter.

But some will say, “Well, Intel’s absolute dollar amount crushes AMD.” But the problem with this is thinking the market cares about that. It cares about growth. It cares about market share.

It’s like belittling people taking a dietary supplement or even a drug and saying, “It’s not doing anything for you. Scientifically, it doesn’t help your XYZ symptom.” But my typical response is, “I don’t care if it’s a placebo effect. If I’m getting the desired result, as long as I’m not hurting myself, what difference does it make?”

And so, with AMD, if the market is willing to pay for growth, as long as it’s sustainable and real dollars, what difference does the amount of dollars make?

The Differentiator

The struggle in today’s market is finding businesses whose sales, growth, and core business are not shrinking or being impacted by budget cuts. Of course, no one wants to hold the next surprise guidance cut or weak link management team, especially if the economic situation isn’t going to get better anytime soon. However, AMD is proving to be one that can execute around the weakening end markets.

Despite the current macroeconomic environment, we see continued growth in the back half of the year, highlighted by our next-generation 5-nanometer product shipments and supported by our diversified business model.

Lisa Su, Q2 Earnings Call

Combined with expanding margins, AMD looks to be operating in an entirely different industry than Intel. Gross margins expanded 6% year-over-year to 54% for Q2, while operating margins were 30%, up from 24% a year ago. Some are quick to point out the Xilinx acquisition is the reason for the “puffed up” results and expanding margins. Yes, it was definitely an accretive acquisition. It says to me AMD married up. That’s a beautiful thing.

I’m looking for stocks where leadership knows how to find the right company to acquire, one that will lift its current financials, not drag them down. AMD accomplished what Nvidia (NVDA) did in acquiring Mellanox – buying a highly synergistic and profitable company, pulling them up, not down.

Wholly Undervalued

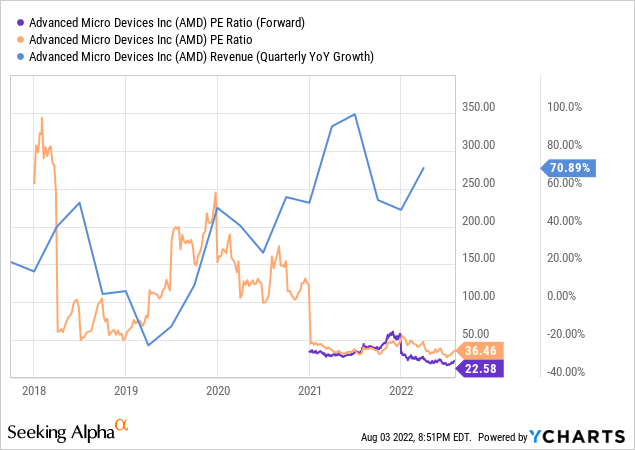

Getting more to the point, the valuation doesn’t represent what AMD is building or accomplishing in the market. For example, its revenue growth has consistently increased throughout the pandemic, yet its P/E ratio is at historic lows.

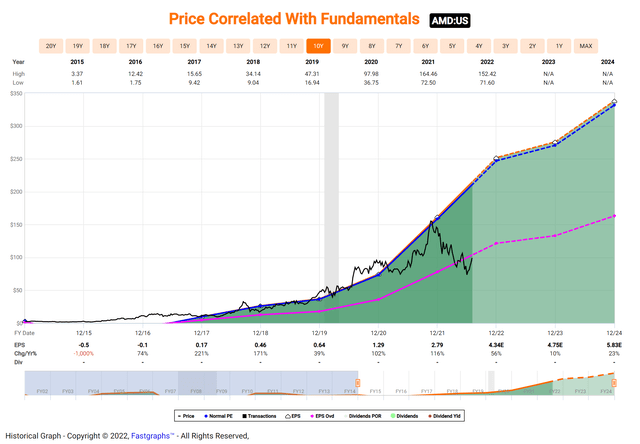

AMD is trading at the cheapest it has traded in the last ten years. Of course, naturally, the financials have begun to catch up to the valuation over the years, but growth has continued to stay ahead.

Even a F.A.S.T. graph has shown AMD trading at ten-year valuation lows. Right now, anything under $122 is fair value, according to the graph.

The market has been expecting growth to slow down, yet its Q3 guide of $6.7B was just a tick below estimates for $6.8B and made up for the slight underperformance by implying Q4 guidance of $7.16B (using full-year guidance of $26.3B) versus consensus between $6.96B and $7.09B, balancing the growth out in the end. This means Q3 will generate 55% growth while Q4 will see 48% growth, for total year growth of 60%. And, with realistic expectations for 2023 revenue growth of 35% and EPS of 38%, I’d say a forward P/E of 22 puts AMD in a very undervalued position even at $100.

Chart Has Gotten Bullish

Lastly, to follow up on my last article, where I accurately called for 25% near-term returns based on the chart, we’re now at the point of seeing the potential of a breakout. The breakout ahead of earnings pushed the stock above the downward channel.

Even post earnings, the stock didn’t retreat into the channel. Now, there’s plenty of time for this to become a false breakout, which would happen if the stock breaks back below the upper blue trendline. The rest of this week should show us where the chart wants to head, either a breakout and push back into triple digits or a retreat back to $85.

In either case, this downward channel has been predictable and has provided solid support and resistance levels to work from. My Tech Cache subscribers get real-time updates on this along with options trades as the chart progresses.

Recessionary Resilience

AMD is proving when the chips are down, it has the chips coming off the production line. Its execution has been flawless; its chips have been gobbled up by hyperscalers, enterprises, and even the retail market during this struggling economic time. Intel can’t say the same, and its stock returns prove it. Considering AMD’s valuation and expected growth over the next year-and-a-half, the stock continues to be a buy as it breaks out on the chart. We’re watching the cream rise to the top in tech stocks, and AMD is proving it’s a winner, not a loser.

Be the first to comment