spooh

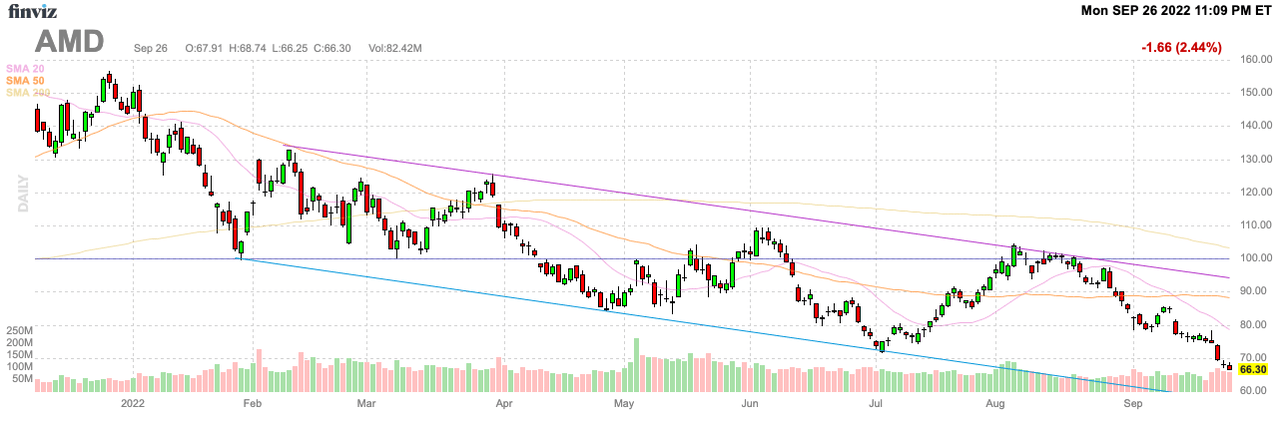

Suddenly, Advanced Micro Devices (NASDAQ:AMD) trades below $70 despite no evidence the company is facing serious reduction to growth targets. A few analysts have cut financial estimates in limited reduction to expectations, mostly due to a weak PC market. My investment thesis is ultra Bullish on the stock trading below $70 due to long term growth drivers.

Source: FinViz

Tough Market

A lot of chip companies have lowered estimates, but a lot of the leading companies have maintained strong growth for the year. The auto and server markets remain strong, even with a looming global recession.

According to Morgan Stanley, AMD will miss financial targets due to a weak PC market. The chip company has already highlighted the inability to meet demand in the server market and for the Xilinx product line. AMD has struggled to produce enough chips to even focus on the base PC market hit by covid pull forwards facing a tough market dynamic. The major impact of the PC weakness has hit Intel (INTC) flush with low-end chips.

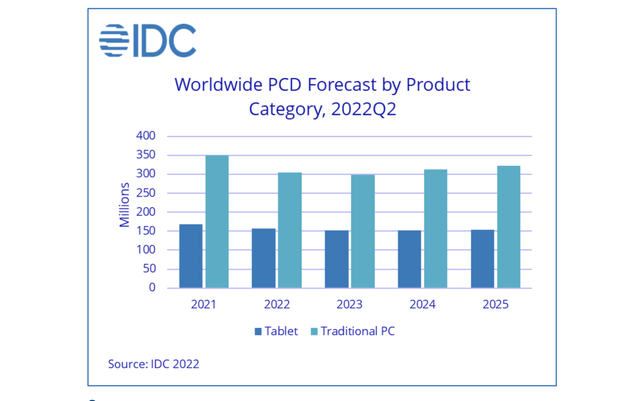

IDC forecasts traditional PC shipments to fall 12.8% in 2022. The research firm even forecasts a minor dip in 2023 before the industry rebound in 2024/25.

The key here is that the majority of the declines come in the consumer sector where low-end PCs are bought. The enterprise segment is forecast at relatively flat.

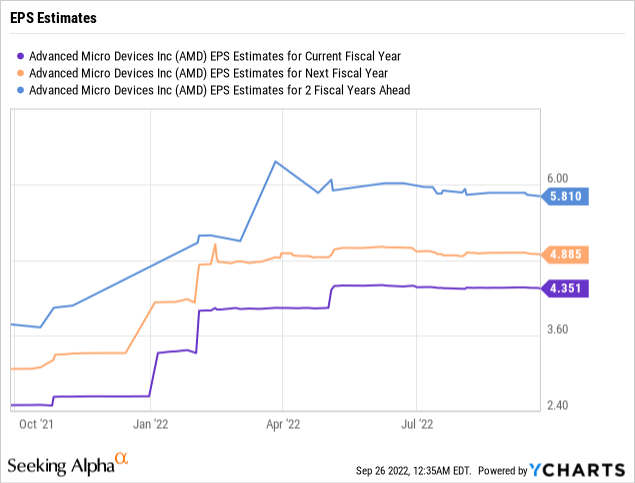

Regardless, analyst Joseph Moore cut the AMD EPS targets to $4.02 in 2022 and $4.40 in 2023. The analyst cut $0.22 and $0.32 off the prior estimates, respectively. Morgan Stanley was already below the consensus estimates by roughly $0.15 for each year.

One has to realize that this analyst was already generally negative on the numbers provided by AMD. The consensus revenue estimate is now down to just $26.2 billion while the company offered up a view of $26.3 billion when reporting numbers at the end of July.

AMD attended several conferences recently with no hint of weakness the company wouldn’t overcome. Forrest Norrod, Sr. VP of Datacenter and Embedded Solutions, spoke of an inflection point in the cloud and hyperscalers and strong momentum in the enterprise segment, with no signs of a slowdown:

But I think we are going to keep growing and taking share really independent of the environment.

The executive continued to speak of supply constraint issues

Yeah. I think for us we have been completely — in the Data Center business, we have been completely supply gated for quite some time. So we are — our growth is utterly modulated by supply. And it’s not wafer supply, we can get all the silicon, we need our partnership with both TSMC and GLOBALFOUNDRIES, it has been great and those guys have been very responsive.

For us, it’s really about substrates. So the underappreciated piece of fiber glass and metal that connect the chips encapsulate the silicon dye and connect them to the motherboard. That’s been the constraint… those substrates are a little bit simpler to manufacture and that constraint, I’d say, is gone for the rest of the business by the end of the year. But for servers, I think, we are still going to be somewhat modulated by that into next year, but again, modulated it, it’s growing in a pretty stiff cliff.

Remember, AMD is hitting 35% organic growth targets for this year and reaching our goal for 20% growth next year actually hits a $6+ EPS. Analysts have a $6 target for 2024, but the numbers don’t really add up to why AMD would add $0.53 to the 2023 EPS estimates and $0.93 in 2024.

The Xilinx deal did provide the promise of $300 million in synergies, but AMD is likely to see the biggest upside from those savings through 2023. The deal closed at the start of 2022 providing plenty of time to implement cost savings this year.

Look Beyond The Disruption

I think the only reason AMD is trading below $70 after hitting $164 last year is the short sightedness of the stock market. The chip company hasn’t warned or cut targets for the year.

The business is only forecast to continue taking market share over the year with estimates in the data center market with market share closer to 20%. AMD could easily grab 50% to 75% share in no time with Intel struggling to get the latest chips to market.

In addition, the upcoming launch of new GPUs has the potential to take share in this segment similar to what Ryzen did in CPUs and what EPYC has accomplished in servers. The key here is that AMD is taking market share and not impacted by the current semiconductor cycle.

The addition of Xilinx provided another avenue to growth with the FPGA chip firm clearly failing to hit demand prior to closing the deal. AMD has provided access to greater chip supplies with TSMC (TSM) boosting sales.

On top of all of these opportunities for existing market share gains, the company is only now forging a path into the booming auto tech sector. The total addressable market is forecast to reach $135 billion by 2026 with the addition of the $29 billion opportunity in the Embedded segment from the addition of Xilinx.

Source: AMD Q2’22 presentation

Nothing going on right now impacts these targets. The PC market is weak due to covid pull forwards. The market will ultimately stabilize back at prior levels with possibly increased demand due to home and office needs in a more diverse work away from the office environment.

Whether AMD hits the analysts consensus targets of nearly a $6 EPS in 2024 or the estimates of Stone Fox Capital for a $6+ EPS in 2023, the chip company is on the path to far higher earnings when the current macro issues are resolved. The stock shouldn’t be trading at close to 11x the logical earnings stream out one or two years.

Takeaway

The key investor takeaway is that AMD is far too cheap here. The market has priced in exceptional weakness that isn’t even likely to happen. Investors buying the stock here are able to acquire shares at only 11x earnings.

Be the first to comment