Tom Cooper

On the Q3 earnings call, AMC Entertainment (NYSE:AMC) CEO Adam Aron indicated that the biggest problem for AMC and other movie theater operators is the lack of movies, not streaming, or COVID-19. I completely disagree, as Q2 2022 had Top Gun Maverick out for Memorial Day, and AMC still generated -$16.2 million in operating income, -$76.6 million in cash from operations, and -$121.6 million in net income. Top Gun Maverick is the 11th highest-grossing film of all time, generating more than $1.48 billion in sales. While more quality content for movie operators wouldn’t be a bad thing, I don’t believe it’s going to solve AMC’s operational shortfalls. The world has changed, and the numbers indicate that movie theaters are losing their relevance. Put the whole APE Investment scenario aside and look at AMC for what it is operationally. AMC has been FCF positive 1 out of the last 11 quarters as they generated $5.6 million in FCF in Q4 2021, on a net income basis, AMC hasn’t been profitable since 2018, and there is -$2.58 billion of equity on the balance sheet, and AMC is burning through cash. Times have changed, and movie theaters have tremendous amounts of competition. The bottom line is that AMC has $10.2 billion in total debt and $684.6 million in cash on the books without a clear path to sustainable profitability. AMC isn’t worth the $4.22 billion its market cap is at today, and the rally from its closing price of $5.19 on 11/9 will probably be short-lived. I do not have a position in AMC and have never owned shares or had a short position. I am writing this article from the point of neutrality as AMC appreciating or declining doesn’t benefit me at all.

Income Statements, Balance Sheets, and Cash Flow Statements do not lie, and AMC is in trouble

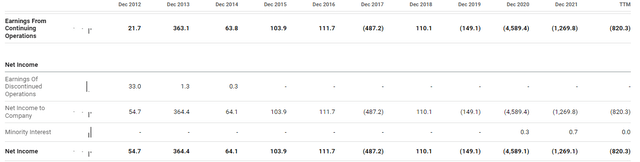

Operationally AMC is in trouble. On a trailing twelve-month (or TTM) basis, AMC hasn’t generated positive operating income since Q1 of 2020, which incorporated the last 3 quarters of 2019 (pre-pandemic). I am struggling to understand why more people are admitting that maybe operating movie theaters isn’t a great business venture in 2022. Over the past decade, AMC has generated $38.17 billion in revenue and $4.85 billion in gross profit. AMC has failed to generate positive operating income, net income, or FCF over this period. Over the past decade, AMC has generated -$823.2 million in operating income, -$2.58 billion in FCF, and -$6.51 billion in net income. At some point, numbers have to matter, and the financial statements can’t be ignored. AMC doesn’t have a track record of long-term profitability over the past decade, and this fact can’t be refuted.

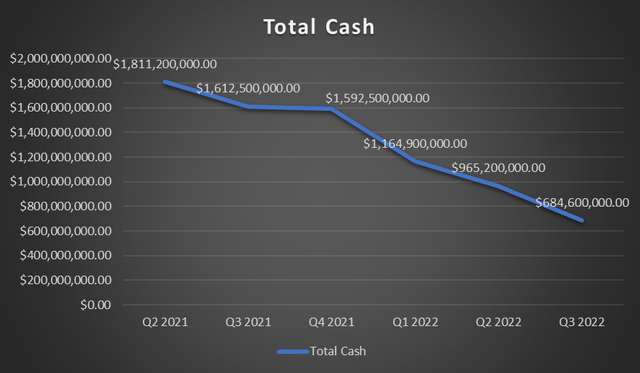

AMC’s balance sheet is a disaster, and Adam Aron is being left with limited options. AMC is burning through its cash pile as it’s unable to generate profitability from its operations. Over the previous 5 quarters, AMC has seen its cash pile decline by -$1.13 billion or -62.2%. Over the past quarter, AMC burned through -$280.6 million, or as its cash declined by -29.07%. AMC has been able to keep the lights on, but it’s been at the expense of its balance sheet.

Steven Fiorillo, Seeking Alpha

After reading through the entire balance sheet, I am unsure why people continue to defend AMC as an investment they want to keep their capital in. The facts are that AMC has $9.21 billion in total assets and $11.79 billion in total liabilities, placing its equity at -$2.58 billion. AMC’s book value per share is -$4.99, and the company’s tangible book value is -$5.03 billion. AMC has $10.19 billion in total debt and $9.49 billion in net debt on its books. Of AMC’s $5.2 billion in long-term debt, $128.1 million is coming due under its current liabilities, and this will continue to eat away at its cash reserve in addition to its operational losses. AMC is leveraged, and unless AMC becomes operationally profitable, I am not seeing a way for them to meet their financial obligations in 2023 without shareholder dilution or restructuring.

AMC needs to clear up -$2.58 billion in liabilities or increase its assets by this amount just to get to an equity-neutral position. I haven’t seen a plan in the recent conference calls that can realistically get AMC back to sustained profitability and start to chip away at its upside-down balance sheet. At this rate, AMC could burn through its cash by Q3 2023, and Adam Aron complaining about the number of movies isn’t a good sign because it’s something that AMC has zero control over. If he is correct and this is the main reason why AMC is in its current situation, maybe, AMC’s best option is to buy or create a movie studio, create its own movies, put them in its theaters, and have them live on an AMC streaming service after they run their course. This is unlikely and would be extremely capital intensive, but if he is correct and movie studios are controlling his destiny, then maybe the only long-term viable option is to take control of their own destiny and own the entire supply chain, from content creation to distribution.

The Relevance of movie theaters has been decimated

I don’t understand why Adam Aron would speculate that steaming doesn’t impact movie sales. Go back to the 1980s, 1990s, or even the early 2000s for a moment. Back in the 1980s and 1990s, to consume content, there were cable, premium pay channels such as HBO, video rental stores such as Blockbuster, Pay-Per-View, and movie theaters. In addition to having less competition, home entertainment equipment was nowhere near the quality of what is available at the lower end of the spectrum today. Movie theaters had a much better chance of attracting people to the theaters as options were limited for consuming content. HBO didn’t have several HBO stations, HBO on-demand wasn’t created, and HBO Max wasn’t even a thought. Movies made for TV were low-budget, and the only place to experience new movies was movie theaters. There was also the aspect that nobody knew when a title would come out on video so once it was out of the movies, someone was in limbo until the title made it into a video store or on cable.

Today, customers have basically unlimited options for consuming media content. This was Adam Aron’s exact quote:

“At this point, there is only one topic that should be on the top of all minds and the tip of all tongues. It’s not the coronavirus, it’s not streaming, it’s not windows. It is this, movie theater operators need more movies”

To say the number of movies being created for the theater is the only aspect people should be concerned about is ridiculous. Streaming has become a formidable opponent and is just as much responsible for AMC’s hardships. Today the consumer has access to an immense amount of content from anywhere, regardless if it’s on their phone, tablet, computer, or home entertainment center. Times have changed, and streaming services are in competition with not just AMC but themselves. Streaming services have created original content that never hits the movie theater and goes directly onto their service.

Home entertainment systems have also impacted AMC. You can purchase a 86-inch 4K Smart TV from LG for $1,199.99, and Samsung has created a TV Wall that comes in 110 or 146 inches and is 4KUHD. When you think about the level of technology in a home today, it’s significantly more advanced than ever before. Then when you add the internet and streaming, the amount of content at your fingertips is sometimes overwhelming. I personally have cable TV, HBO Max, Showtime On-Demand, Hulu, YouTube Premium, and Amazon Prime. I honestly haven’t had the urge to go to a movie theater in years, considering I can always find something I want to watch.

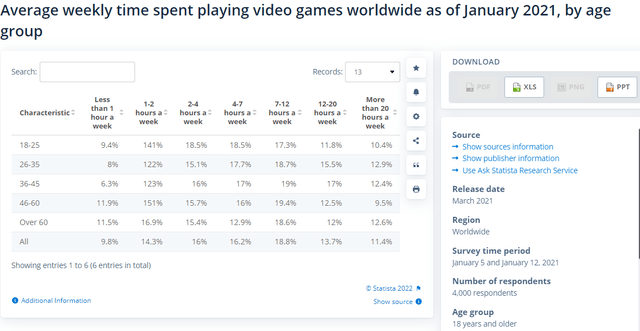

AMC also has to deal with the indirect impact from video games. While video games aren’t a direct competitor, they are an alternative option of entertainment that wasn’t available in this capacity in previous decades. In a study from January 2021, across all age groups over 18, 16.2% of people played for 4-7 hours per week, 18.8% for 7-12 hours per week, 13.7% for 12-20 hours per week, and 11.4% played for more than 20 hours per week.

Whether Adam Aron or AMC bulls want to admit it or not, the relevance of movie theaters has diminished a great deal. AMC is fighting a battle against cable networks, streaming services, video games, an immense amount of original content that isn’t available in the movie theaters, and home entertainment setups that make people question if it’s even worth it to go to the movies. The other aspect is the psychology of the consumer and how it has changed. Many people have become accustomed to instant gratification, and the movie-going experience is time-consuming. Traveling to the destination each way, waiting in line for popcorn, and watching the movie can take 3 hours or more in some cases. People can’t pause the movie to use the restroom or go back to the main screen and select a different title if the movie isn’t as captivated as they thought it would be. Society is changing, and Adam Aron needs to find a way to change with it.

Conclusion

I don’t see how AMC can go through 2023 without diluting shareholders or restructuring the organization unless they make significant operational improvements. There is a reason short interest is over 20% and it’s not because AMC is a meme stock. AMC’s balance sheet is in shambles, its cash stockpile won’t last through 2023 at its current cash burn rate, and the probability of sustained profitability is likely. AMC has negative equity, book value, and tangible book value on its balance sheet, and over $5 billion of long-term debt without a sustainable profit center to alleviate these issues. I believe AMC will issue more shares in 2023 out of necessity and further dilute shareholders.

Be the first to comment