Buda Mendes

Intro

Ambev S.A. (NYSE:ABEV) recently reported its third quarter earnings where the company met its earnings expectations (EPS of $0.04) with the Brazilian market once more to the fore. However, weakness in international markets such as Central America as well as the Caribbean is worrying going forward, especially if inflation persists into next year. Suffice it to say, although sales can benefit on the front end from rising inflation, volume growth sooner rather than later has to follow suit to ensure sales can remain in a growth curve. The beer market for Ambev remains resilient, but it will be interesting to see if this trend persists, especially if economic conditions continue to tighten. However, the upcoming World Cup should provide some solid momentum for Ambev’s brands. Management actually reiterated its forward-looking EBITDA guidance to this effect.

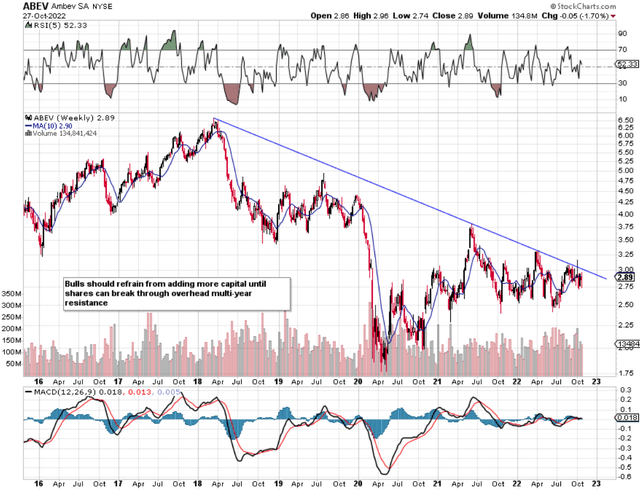

If we pull up a long-term chart of Ambev, we can see that shares continue to have significant overhead resistance above the prevailing share price at approximately the $3 level. Despite the encouraging quarter, the long-term trend (confirmed by lower highs) remains bearish. Therefore, there definitely is an opportunity here if indeed Ambev can break above their heavy overhead resistance. To ascertain whether we believe this is possible over the near term, we like to delve into the stock’s profitability and valuation trends. A strong, sustainable dividend is usually buoyed by a consistent earnings growth curve, so let’s see how these metrics play themselves out below.

ABEV Technical Chart (StockCharts.com)

Pay-Out Ratio

The dividend payout ratio gives a quick snapshot of whether Ambev’s dividend is strong or not. At present, the cash flow pay-out ratio comes in at 75.3%, which is well up from the company’s 60% 5-year average percentage. Remember, due to non-cash costs on the income statement which can sometimes blur the earnings pay-out ratio, we prefer to go with the cash flow alternative for a more accurate picture of affordability. Suffice it to say, despite the higher yield Ambev pays out at present, the company currently has less room to maneuver concerning sustained dividend increases due to a higher percentage of the company’s cash flow being used up for dividend purposes.

Profitability

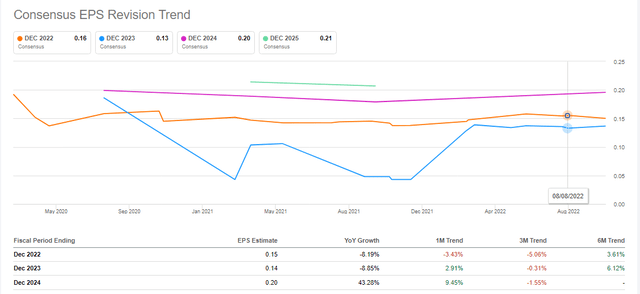

Ambev traditionally has had very strong profitability compared to the sector in general. The company’s return on capital of 11.72% over the trailing twelve-month average remains elevated and demonstrates the company’s prowess in growing its capital. However, it has been the company’s margins that have been coming under scrutiny in recent times. For example, Ambev’s gross profit margin of just under 50% (trailing twelve-month average) is well down from its 57% 5-year average number. To this point, we have seen some weakness with respect to earnings revisions for this present fiscal year, but next year’s profit projections have actually sprung up over the past 30 days. It will be interesting to see how Ambev’s profitability fares over the next 6 months or so.

Ambev Consensus EPS Revisions Trend (Seeking Alpha)

Valuation

Now, given the technical chart above and the sizable drop in the share price since the start of 2018, one could easily make the argument that shares are considerably undervalued at present, all things remaining equal. However, the forward EV/EBITDA multiple of 9.29 comes in just 20.7% lower than the company’s 5-year average multiple of 11.71. This is obviously a much lower percentage than what many would suspect in this play, and this really is the key here. Due to growth issues, the market deems that Ambev’s strong profitability is simply not worth a much higher EV/EBITDA multiple, for example. Furthermore, given the high pay-out ratio, the potential to keep investing aggressively behind the business and/or grow the dividend significantly are both impaired to a point. This is why Ambev remains a hold at present until shares generate the necessary momentum to break out above that significant overhead resistance.

Conclusion

Although there was plenty of encouragement in Ambev’s recent Q3 earnings, the long-term trend remains bearish. Continued strength in Brazil as well as the upcoming World Cup should continue to be able to offset meaningful headwinds in other parts of the business, but overall volume growth remains key. We look forward to continued coverage.

Be the first to comment