georgeclerk

Amazon (NASDAQ:AMZN) has recovered substantially since mid-June, seeing a recovery of more than 30%. That’s pulled the company back up over a $1 trillion market capitalization, as investors cheered on strong results in the AWS division. Despite that, as we’ll see throughout this article, the company’s results were surprisingly weak in our view, which’ll result in poor returns.

Amazon Financial Performance

Amazon had a tough quarter financially despite its upbeat forecast.

Amazon Financial Performance – Amazon Investor Presentation

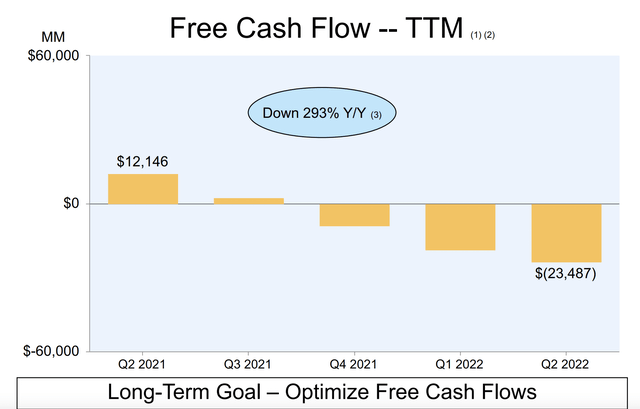

The company’s financial performance tanked in the most recent quarter. The company said it didn’t see a demand slowdown from inflation, but it still has substantial expenditures. That negative FCF is given the company’s valuation of more than $1 trillion, when we’d like to see the company earning $10s of billions in cash flow.

The company has said that it’s continuing to invest in growth, however, revenue was up a mere 7% year-over-year, not even matching inflation price gains for those dollars. Despite the strength of AWS, in our view the company’s financial strength was disappointing.

Amazon’s Revenue Struggles

Unfortunately for Amazon, the company’s revenue growth is slowing down.

Amazon Revenue Struggles – Amazon Investor Presentation

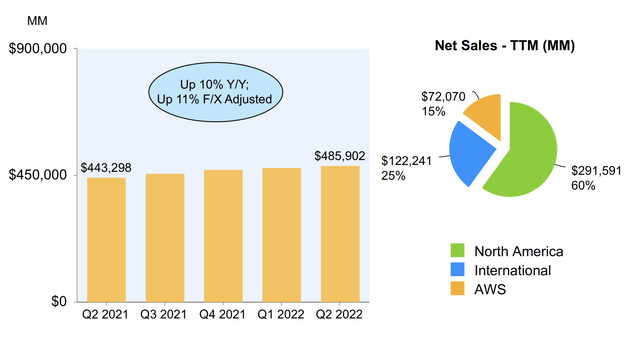

The company’s continued struggle is growth given its size. AWS is now 15% of sales at $72 billion for TTM while the company’s total TTM revenue was $486 billion. The law of large numbers means that continued growth in the company’s revenue can be expected to slow down and be much less reliable. Revenue growth was just 1% over inflation.

The one current plus worth paying attention to is that the company has so far managed to handle the market slowdown. If the economy keeps weakening, there’s no indication that the company will weaken faster than its peers.

Amazon Outstanding Share Growth

A consistent problem we’ve highlighted with Amazon is that recent events indicate the company might not have much concern about shareholder dilution.

Amazon Share Growth – Amazon Investor Presentation

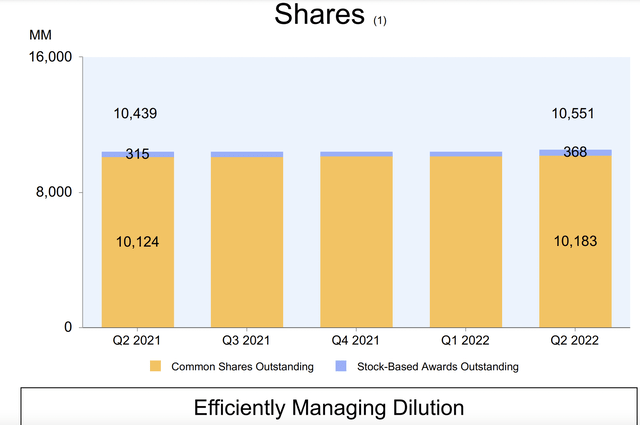

Year over year, not only has the company’s common shares outstanding grown, but the company’s stock-based outstanding awards has increased significantly. That’s a sign of future dilution to come. The company has been forced to increase employee compensation as a result of increased competition among tech firms.

More importantly, Amazon traditional gives back-weighted RSUs (5/15/40/40) and the rumor is that it assumes 15% annualized growth in share price. That’s very significant because it means that the company is assuming ~50% share price growth by the time the last 40% of RSUs gets awarded.

That assumption worked out as Amazon stock appreciated rapidly towards its value of more than $1 trillion. However, we expect that 15% annualized growth is in the past, given the law of large numbers, which would explain the company’s growing equity awards. The 368 million outstanding shares or 92 million shares / year is almost $13 billion / year.

That’s roughly 3% of the company’s net sales alone, and a substantial impact on a company with negative profit. Another way to look at it is it’s 60% of AWS’ annualized operating income, the company’s strongest division.

Our View

Our view is that Amazon is at a crossroads.

The company, at some point, needs to start looking at potential shareholder rewards. The company is barely FCF positive with massive investments and that doesn’t count the continued dilution of shareholders. Counting that and the company’s financial position becomes substantially worse. The company doesn’t seem to have the cash to reward shareholders even if it wanted.

The company has announced a $10 billion buyback, but that’s expensive and doesn’t even handle dilution. The company can spend several additional years chasing growth, but we expect that the company’s multiple expansion of the prior years is over and its share price growth will be based on earnings growth which will be difficult.

That makes the company a poor investment in our opinion.

Thesis Risk

The largest risk to the thesis is Amazon’s attempt to be a “jack of all trades”. The company has raised Amazon Prime prices several times and so far has not lost significant subscribers. That’s because the service is fast shipping, Netflix, and Spotify all at once. We don’t feel the existing businesses justify the company’s valuation, but the company could always find a new business.

Conclusion

Amazon has been successful in the past. The company has several unique businesses and its recent earnings performance has been on the back of the success of AWS. However, the company still has numerous conundrums that will impact its ability to continue providing long-term shareholder rewards and growth.

First, the company’s growth rates have slowed down significantly. Revenue growth is barely matching inflation. The company is still at negative FCF and diluting shareholders. At some point, it needs to begin generating shareholder rewards, and we expect that the company will struggle to do so. That risk is worth paying close attention to.

Be the first to comment