Daria Nipot

Introduction

My thesis is that Amazon’s (NASDAQ:AMZN) commerce ecosystem is much more valuable than Walmart’s (WMT). Previously, I covered Amazon on July 31st.

Amazon’s quarters coincide with calendar quarters, but Walmart’s quarters end a month late. When we talk about periods like 2Q22 in this article, it means the quarter through June 2022 for Amazon and the quarter through July 2022 for Walmart.

Current And Future Volume

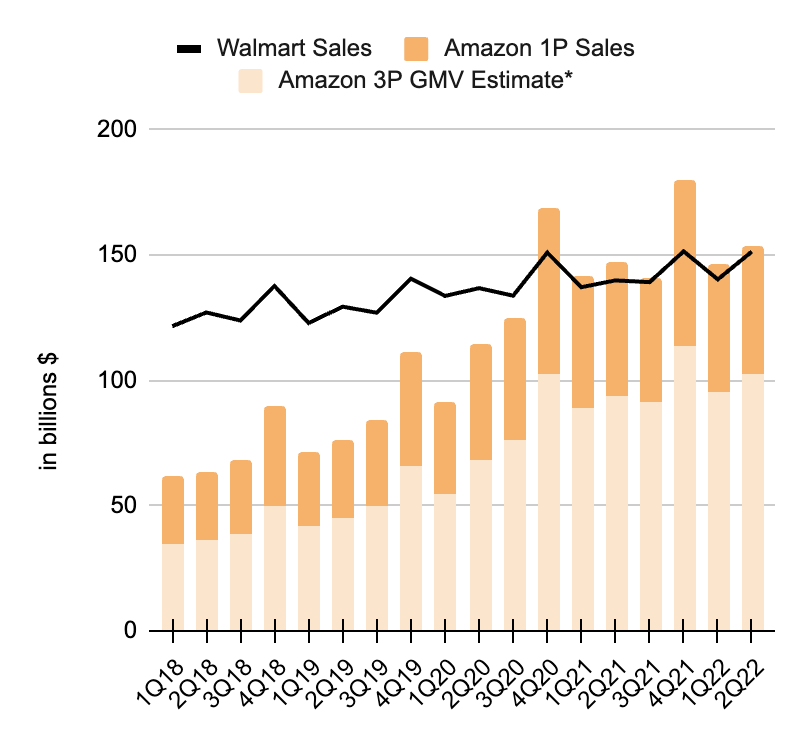

Ever since 4Q20, Amazon and Walmart have moved a similar amount of volume through their ecosystems. Both systems move close to $150 billion per quarter, but Amazon’s system has historically grown much faster up until 4Q20:

Merchandise volume (Author’s spreadsheet)

*Our estimate for Amazon’s 3P GMV is 3.75x sales.

Walmart tends to be reticent in terms of sharing their online marketplace figures, so some of their volume above is understated. In other words, some of the Walmart “sales” above are commissions from their marketplace, such that the volume figure is a multiple of the sales commission figure.

If we ignored the pull-forward impact of the COVID pandemic and just looked at the volume numbers from 1Q18 to 4Q20, then we would be extremely optimistic about the growth in Amazon’s commerce ecosystem. At that point, we would give Amazon’s commerce system a much higher valuation than Walmart’s. Online commerce has leveled off since 4Q20 such that we look at the future outlook differently now, but Amazon still has tremendous potential.

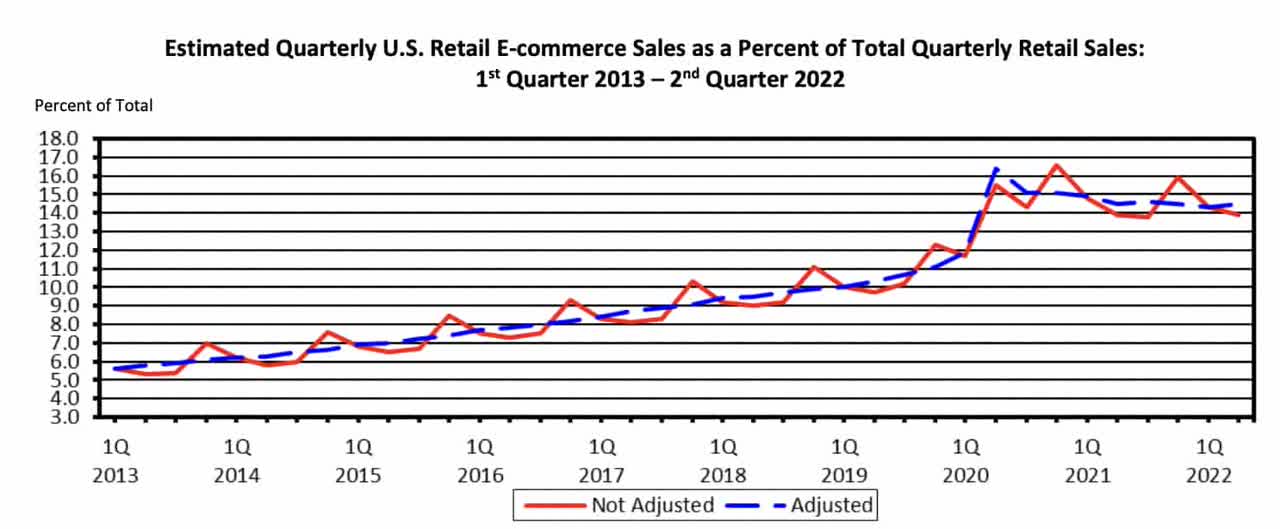

Most of Walmart’s sales are in-store, whereas the above sales for Amazon are online. Excluding AWS, Amazon had revenue of $101,495 million in 2Q22 and 73% of this or $74,430 million came from North America. Per numbers from the U.S. Census Bureau, there was a pull-forward for online sales during the COVID pandemic, but I expect U.S. online sales to grow as a percentage of overall sales in the years ahead:

Online sales as a % of overall sales (U.S. Census)

We see above that online penetration in the U.S. is a little under 15% right now, which is well below levels we see in other countries. Per the Office for National Statistics, online sales were 26.3% of all retailing in the UK during the month of July.

There are many reasons why online sales continue to climb as a percentage of overall sales. Online commerce systems like Amazon can compete better than in-store systems on price, seeing as there is little in the way of shrinkage online. It is also more convenient to shop online, where the selection at Amazon is vast compared to any single physical store. Online penetration is sure to continue climbing in the U.S. during the decade ahead. Although Walmart offers online sales, this increase of online penetration in the U.S. benefits Amazon more than Walmart.

Other Considerations

Multiple segments are excluded from the volume figures above. Physical stores, subscriptions and advertising are excluded for Amazon and their 2Q22 sales numbers are as follows:

$4.7 billion physical stores

$8.7 billion subscriptions

$8.8 billion advertising

Amazon’s advertising segment is special. The first quarter where I see it broken outside of “other” and into its own segment is from the 4Q21 release where we see that it was just $5 billion back in 3Q20. The growth to $8.8 billion in just 7 quarters has been remarkable. This segment has more opportunities than what we see for Walmart because it is online as opposed to in-store. It is more efficient than the ad systems we see at Google (GOOG) (GOOGL) and Meta (META) because it is where people are actually making purchases online. Per my July 31st article, I believe the advertising segment alone has a valuation range of $260 to $305 billion.

The membership and other income segment is excluded for Walmart above and this figure was $1.5 billion for the July 2022 quarter.

Valuation

Walmart’s market cap at the time of this writing is about $368.4 billion based on 2,714,237,937 shares outstanding as of August 31, 2022 and the September 7th price per share of $135.74. I believe Amazon’s commerce segments are worth substantially more than this figure.

My Amazon valuation thoughts haven’t changed substantially since my July 31st article. Again, I believe the advertising segment is worth $260 billion to $305 billion. I think the 1P, 3P, physical stores and subscription segments have a cumulative valuation range of $505 to $555 billion.

Adding AWS gives Amazon as a whole a valuation range which is well above today’s market cap in my opinion, such that the stock is undervalued.

Be the first to comment