David Ryder

Deposits

Where is the first place I look for bear market insurance? Federally insured deposit accounts. Join a credit union such as Affinity FCU. They offer rates up to 3.5% APY and $250k of federal deposit insurance. If they convert to a bank someday, you could get preferential access to an equity offering worth millions. Eastern (EBC) holders that fully participated in that demutualization have each made $2,278,000 so far excluding dividends that we’ve received, quickly more than doubling our investment with virtually no risk to original invested capital. Worth the wait.

Litigation

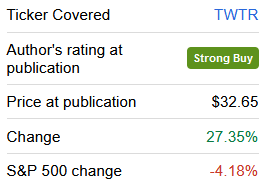

The second place to look is litigation. StW‘s best idea for 2022, Renren (RENN) is a litigation play that could work this year regardless of what the broader indexes do.

One focus in our new StW newsletter has been what to do with their RENN profits.

Arbitrage

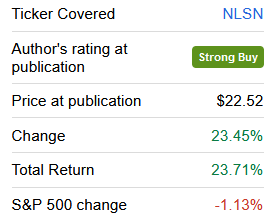

Last but not least: definitive merger arbitrage. Pre-arbitrage takeover candidates have had a disastrous 2022, but definitive merger arbitrage has hung in there. The newsletter picks include two definitive merger arbitrage ideas, Nielsen (NLSN) (since completed) and Twitter (TWTR) (a work in process).

SA SA

Who?

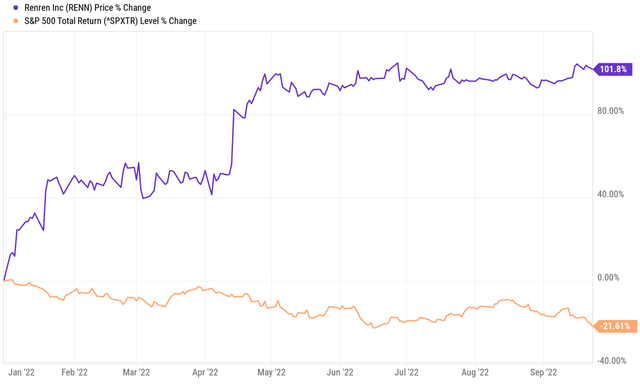

Twitter remains my favorite component of our merger arbitrage basket and at this point you missed Nielsen, but there is a new opportunity to consider. Amazon (NASDAQ:AMZN) is buying iRobot (IRBT) for $61 per share in cash. The target makes robots.

What?

The deal requires approvals from the US, EU, and the target’s shareholders.

When?

The deal will probably close by the second quarter of 2023.

Where?

The target sells their products in the US, Europe, Middle East, Africa, and Japan. They are headquartered in Massachusetts.

Why?

The $3.18 net spread offers an 11% IRR if the deal closes by the second quarter of 2023. This is good, not great. But this one is worth watching carefully; if the market completely collapses, this could get tossed out too, but the outcome doesn’t depend on the market. The buyer has zero financing risk and the deal presents no legitimate antitrust risk.

Caveat

The biggest risk to this thesis is the current leadership in the US antitrust agencies are using their power punitively to attack companies that they hate, especially tech leaders such as Meta (META) and others. They have gone way outside of their mandate to virtually ignore real economic issues. The administration’s “whole of government” approach essentially sets aside agency mandates (for example to prevent price fixing) and instead just pursues their political enemies with whatever power they happen to have, in this case, the power to delay and attempt to block M&A. Will they delay? Quite likely. Block? They would have to convince a judge and have not been good at doing that recently.

Conclusion

If you’re focused on survival, you should consider deposits with potential equity offering kickers, litigation stubs, and definitive arbitrage. iRobot is a good opportunity that could become great if either the equity market collapses and funds are forced to liquidate positions such as this or if the fanatical antitrust authorities sue to block this out of spite against a big tech company. They might be antitrust hipsters, but the judges aren’t. In the past several days, judges have been rejecting one after another of the government’s hipster antitrust suits. This one would be unlikely to get a warmer reception.

TL; DR

Put some money in Affinity and arb spreads such as TWTR stock or their June 16, 2023 $47 calls as well as IRBT if that merger arb spread widens due to crazy regulators or weak markets. Worth being ready. Whatever happens to the credit and equity markets, your money should be safe.

Be the first to comment