4kodiak/iStock Unreleased via Getty Images

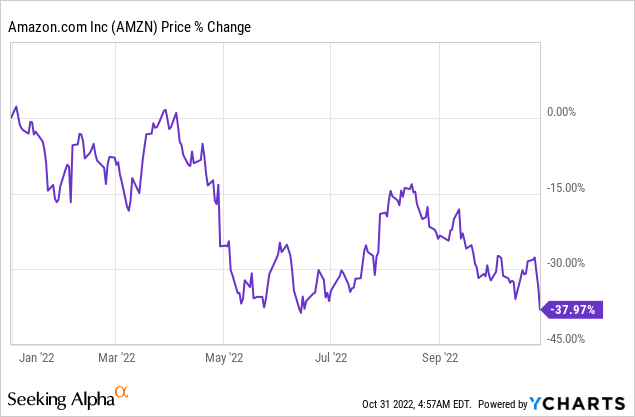

The year 2022 remains very challenging for U.S. companies and this time even GAFAM stocks, the big stars of the last years, can’t escape the gloomy economic development. Amazon (NASDAQ:AMZN) is also facing many problems this year after posting record results in 2021. Sharply rising logistics costs, falling consumer demand and a strong dollar have been clouding the figures and growth particularly badly for months.

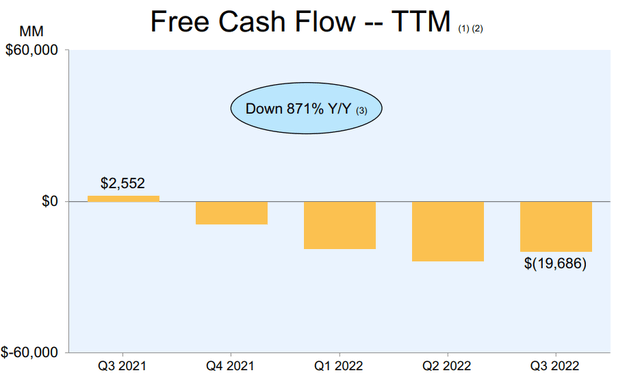

As a result, Amazon has been reporting declining operating cash flows with sharply rising capital expenditures and consequently clearly negative free cash flows for several quarters. The third quarter was no exception. In particular, the outlook failed to meet the high expectations and disappointed Wall Street.

Investors seem to be increasingly doubtful in the face of this development whether the company will ever be properly profitable with its retail business and whether the days of great growth are over now that the cloud also seems to be weakening somewhat.

The stock has lost Ytd almost 40% of its value, but valuation is not easy as common metrics such as the P/E or the P/FCF are currently negative and thus do not help in making an investment decision. I will explain below why I am convinced that Amazon should return to growth after the transition year of 2022 and also surprise in profitability.

Q3 Summary: A Disaster?

First, I’ll briefly review the latest quarterly figures, which generated a lot of discussion among investors. Sales rose to $127.1 billion, a growth of just under 15%. At constant exchange rates, growth would have been 132 billion and 19%. This figure was just below analysts’ estimates and can largely be explained by the stronger-than-expected dollar impact, as Amazon confirmed later in the conference call.

EBIT was $2.5 billion, which on the one hand was only a meagre 2% margin and on the other was almost 50% below last year’s $5 billion. EPS of $0.28 per share beat analysts’ estimates by 7ct thanks to income from the Rivian (RIVN) investment, but ultimately it is the performance of the actual business lines that counts (more on this later).

Amazon Q3 Presentation

Free cash flow also remained negative at -$19.6 billion ttm. The coup de grace was then given to the stock with the outlook, which was about 11 billion dollars below consensus with 144 billion dollars in sales, and the targeted profitability was not convincing. At first glance, the post-market reaction of 20% did not seem unjustified.

At second glance, I would say that while the numbers were not impressive, they were “okay” given the market environment. This impression was echoed by other investors, as the stock quickly rebounded dynamically from its lows near Corona Crisis levels at $87.5 to close at $103 in regular trading. But why weren’t the numbers a disaster? For this, I take a closer look at the individual segments:

Segment analysis: More light than shadow

Online Stores: Amazon’s original core business already started to weaken significantly in Q3 last year as a result of the normalization of the pandemic baseline and has even shrunk since Q4 2021. At least in terms of sales, there are now finally signs of a turnaround and sales have increased by 7% year-on-year, even 13% adjusted for currency effects. This means that the second-highest sales ever were generated in this division. Looking ahead to the next few quarters, a strong signal has been sent that the Post-Covid Era is coming to an end in the core business.

Third-Party Seller Services: Business with third-party sellers is much more attractive to Amazon than marketing and warehousing products itself, so growth here is also more important. This division also excelled with a growth of 18% and 23% respectively, presenting the strongest growth rates since Q3 2021. Amazon is likely to continue to focus on this division in the future due to more attractive margins, so growth here also suggests a change in profitability trends soon.

Subscription Services: This is the division I was most disappointed in when reviewing the quarterly report. For several quarters now, double-digit growth has been in jeopardy here, which was also missed this quarter at 9%. Admittedly, currency effects also weighed on growth here by 5 percentage points.

Still, it’s a bit low considering that Prime subscription prices were raised significantly recently and, according to management, the Lord of the Rings series resulted in the largest growth ever and Amazon Original NFL Thursday Night Football resulted in the largest global Prime subscription growth of in-house productions ever.

So I had expected more, especially since I’m sure many households de-subscribed to Prime again with the end of the series. Perhaps there will still be a small effect in the fourth quarter, but the Prime offering seems to be slowly reaching its limits.

Amazon Web Services: Arguably Amazon’s most important division at the moment, and not just in terms of profits. Revenues here grew by a stable 27% and were hardly affected by currency effects. However, it must be mentioned that AWS thus falls below the 30% growth mark for the first time in years, which is a small warning signal.

Even though the management repeatedly emphasized in the conference call how the software is constantly being expanded or optimized by new products and functions, it remained quite restrained with a view to the fourth quarter. Accordingly, the company would gain many new customers to optimize its costs with AWS (turning fixed costs into variable costs), but at the moment some customers would also cut their budgets given the macroeconomic uncertainties to save costs.

Towards the end of the quarter, growth, therefore, declined somewhat more significantly, which also resulted in a somewhat weak outlook for the fourth quarter. This is a problem that affects all cloud providers equally, however, so it cannot be interpreted from these results that AWS is increasingly losing strength against Azure and Google Cloud. It is more kind of a cyclical effect that is causing some difficulties for the industry, which is still growing strongly nonetheless.

I am sure that AWS will still have many years ahead of it with 20%+ growth rates. It must also be taken into account that AWS is now at 76 billion in TTM revenue, making percentage growth increasingly difficult.

Advertising: Amazon’s advertising division is one of the company’s newer hopefuls and is exciting primarily because of its higher effectiveness compared to Alphabet and Facebook. As a result, higher margins can be achieved here and growth has been compelling for many quarters.

I was a bit concerned last quarter, as growth had briefly lost significant momentum at 18%. However, in the third quarter, growth was back at 25% (30% excluding F/X). This is even more respectable when you consider the environment, where Alphabet (GOOGL), for example, only grew by 2.5% or even shrank in the case of Meta (META). Together with AWS, Advertising will probably be the biggest value driver for the company.

Physical Stores: There is not much to say about physical stores except that it has seen slow but steady growth since Q4 2020. For the time being, however, this division has virtually no relevance to Amazon’s value.

Amazon is slowly getting its costs under control

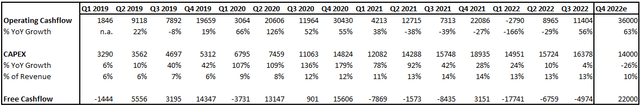

A key negative point for the bears is free cash flow performance, and not without good reason. Since Q1 2021, every quarter apart from Q4 2021 has been significantly negative. In Q1 2022, even operating cash flow was negative, resulting in a free cash flow of -$17 billion. Amazon has long had problems with its Capital Expenditures, as shown once in the chart below.

Author´s calculations, Amazon Quarterly Results

Even before Corona, CAPEX often grew faster than operating cash flow. Then, starting in mid-2020, these values diverged even more significantly. Although operating cash flows have been declining again since Q2 2021, CAPEX has continued to jump, which explains the negative values in recent quarters and certainly calls for caution. While CAPEX was still 6% of revenue in 2019, by Q3 2021 it had risen to as high as 14.3%.

Fortunately, this seems to have been the high point and CAPEX is slowly stabilizing, albeit at high levels. Just this quarter, CAPEX increased only 3% YoY, while operating cash flow increased 56%, finally signaling some strength. In the conference call, management mentioned that they are planning for a CAPEX of $60 billion in 2022. Since $47 billion CAPEX has already been incurred in the current year, CAPEX in the fourth quarter should therefore only be around $14 billion.

This would be a decrease of 26% and an important indication that the company is increasingly getting its costs under control. In the medium term, CAPEX should again be slightly below 10% of sales. Analysts expect a free cash flow of -$7.7 billion in FY 2022. Since almost $23 billion have already been incurred negatively in the current year, free cash flow is expected to be $22 billion. Whether this is realistic, I still dare to doubt, but at least Amazon should close a quarter clearly in the plus again.

Because of these figures, I do not think it is appropriate to speak of a disaster. Not even if you take into account the outlook for the fourth quarter. Even if it is true that year-on-year growth is expected to be only 7%, this growth will probably have to be shouldered by AWS, Ads and Prime alone.

Some investors see this as proof that Amazon is no longer a growth company and thus needed to be valued lower. I find this thesis somewhat questionable, considering the high comparison base of the previous year. The Covid effects are almost completely absent this year and, in addition, the economic situation is becoming very cloudy, so every percent of growth is currently welcome.

In addition, the low growth is mainly due to the retail business, which also explains the missed $11 billion in the outlook. In my last analysis, I already pointed out why the low-margin e-commerce business has a much lower relevance for the company value than many market participants assume. I will show this again in a moment in my sum-of-the-parts analysis.

Valuation

As I mentioned before, classic valuation metrics are not meaningful due to Amazon’s transition year. I, therefore, update my sum-of-the-parts analysis from my last article. The assumptions are similar, but I am adapting them somewhat to the environment.

The Online Stores segment earns only a P/S multiple of 0.8 (instead of 1 before) since losses were written here internationally and on the home market, and internationally the loss was even widened. Amazon first has to show that it can return to profit here in the medium term.

Third-party seller services have returned to growth in the last quarter and continue to be the focus of Amazon. Since the margins here are significantly higher, this segment must also be valued higher at 2.5 (instead of 2 previously).

The Prime segment has disappointed me and is struggling to maintain double-digit growth. I am therefore lowering the fair P/S multiple to 4 (down from 5).

Amazon Web Services is increasingly feeling macroeconomic uncertainties. For the first time, the cloud market does not seem to be completely resistant to the economy. I now take this risk into account additionally and rate the cloud division with a P/S of 9 (previously 10-12).

Advertising continues to impress with high margins and is growing dynamically despite economic developments. Therefore, this remains valued with a P/S of 8.

| Umsatz TTM | P/S Multiple | Fair Value | |

| Online Stores | $ 221.548 | 0,8 | $ 177.238 |

| Physical Stores | $ 18.694 | 1 | $ 18.694 |

| Third-Party | $ 107.697 | 2,5 | $ 269.243 |

| Subscription | $ 34.152 | 4 | $ 136.608 |

| AWS | $ 76.498 | 9 | $ 688.482 |

| Advertising | $ 35.898 | 8 | $ 287.184 |

| Others | $ 3.634 | 2 | $ 7.268 |

| $ 1.584.717 |

With these assumptions, we arrive at a fair market value of $1580 billion. Amazon is currently valued at $1050 billion, which corresponds to a potential fair value of 50%.

This shows how pessimistic the market is currently looking at the company and how the relevance of the e-commerce business is still overestimated. I am almost certain that the $10 billion in missed revenue is almost entirely due to the e-commerce business, which makes a difference of $10 billion * 0.8 = $8 billion in market value terms.

However, it in no way justifies the $250 billion in market value that the stock lost in the meantime after the figures were announced. If you consider that AWS and Advertising alone almost reach the current market value, I think the stock is undervalued at the current level.

The Bottom Line

So far, 2022 has brought little joy to Amazon shareholders. However, the third quarter was not as weak as the market reaction suggests.

Key businesses have returned to growth and the company finally seems to be getting its costs under control. The fact that CAPEX in 2022 is expected to be at the same level as in 2021 with higher sales suggests that free cash flows will be positive again in 2023 and that the challenging year 2022 can be overcome.

Growth rates should then also pick up again, as the basis for comparison was no longer influenced by Corona. In terms of valuation, the stock is also very cheap and the retail business is currently valued by the market at almost 0.

For these reasons, I consider Amazon to be a clear buy at the current level.

Be the first to comment