Pgiam/iStock via Getty Images

Investment Thesis

Rule 1: Equity investing is about making more capital gains than taking losses.

Rule 2: Doing that requires good forecasts, so find good forecasters. Like Market-Makers.

Rule 3: Test all forecasts for how well they may help you reach your goals.

Rule 4: Compare available current forecasts on all available-choice alternatives before deciding to act.

How the Amazon.com, Inc. (AMZN) Prospect Looks Now

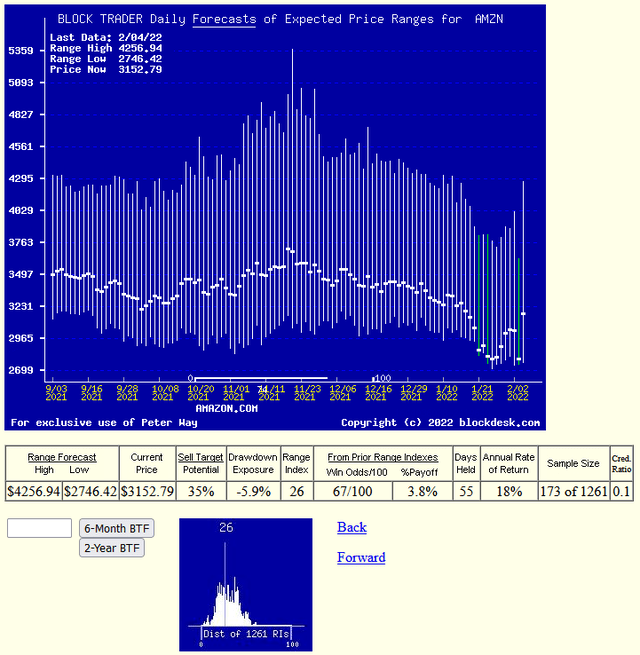

Figure 1

This is the same format picture as presented in the previous article, but updated for the day’s trade implications as the far-right vertical price-range forecast and the day’s close price. For comparison, Figure 2 provides Friday’s MM forecast price range and history of prior standard portfolio management discipline outcomes.

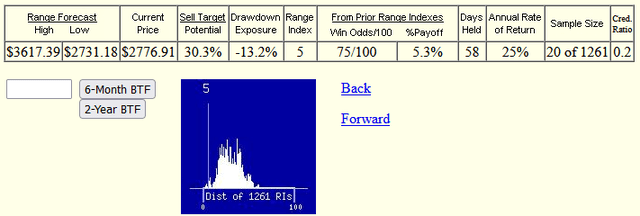

Figure 2

While the current-day forecast rose to an upside of +35% from the day’s close of $3152, the downside also expanded by its limit rising less than the market price, widening the forecast range from 32% to 55%. The reward-to-risk ratio rises from 2.3 to 1 to 5.9 to 1 in the process.

That may sound all very advantageous, but the evidence of now a much larger sample of prior experiences operating under the changed circumstances produced a net gain average of only 3.8% per trade, compared to 5.3% under the Wednesday’s expectations. Between the two days the odds of having a profitable transaction fell from 6 out of every 8, a 75 out of 100 odds, to a 2 out of 3 propositions, or 67 out of 100.

The more complete measure of the changing proposition is that the CAGR annual rate of return in the earlier situation was +24% a year, and now it is expected to be +18%.

From an opportunity-competition point of view, when we look to see AMZN’s ranking in the list of best CAGR producing prospect equities there are over 250 more-able CAGR prospect investments than AMZN when similar evaluations are made to their situations and forecast expectations. Of the top 20 of those 16 propose triple-digit CAGRs.

Conclusion

We may have missed a neat opportunity to pounce on a one-day +15% gain, but were distracted by many more enticing prospects based on equivalent-source information. The attraction of present-day Amazon seems out-competed by many readily available alternatives. Tomorrow is another day to invest in pursuit of good opportunity to build financial wealth. Please stay in touch via Seeking Alpha.

Be the first to comment