georgeclerk

Elevator Pitch

My investment rating for Amazon.com, Inc.’s (NASDAQ:AMZN) stock is a Buy.

My prior March 1, 2022 update for AMZN discussed the pros and cons associated with an investment in the company’s shares. The current article shines the spotlight on Amazon’s deepening presence in healthcare.

Amazon’s recent planned acquisition of One Medical, otherwise referred to as 1Life Healthcare, Inc. (ONEM), sends a clear signal that AMZN wants to gain a strong foothold in the healthcare space. This supports the bull case investment thesis that AMZN’s valuation multiples will continue to expand over time driven by an increased percentage of revenue generated from higher-margin services (e.g. healthcare services). In my view, AMZN deserves a Buy rating in this respect.

Is Amazon Becoming A Healthcare Company?

Amazon is becoming more of a healthcare company than it ever was, as seen with its recently announced M&A (Mergers & Acquisition) transaction.

On July 21, 2022, AMZN disclosed that it “will acquire the primary care organization One Medical.” 1Life Healthcare filed a DEFA14A filing on the same day, highlighting that Amazon is proposing to buy One Medical, because it “wants to be one of the companies that helps dramatically improve the health care experience over the next several years.” ONEM also revealed in its DEFA14A filing that One Medical “will become a subsidiary of Amazon and part of a suite of Amazon health care offerings” when the acquisition is completed; the timing of the expected deal closure isn’t confirmed at the time of writing.

One Medical’s Corporate Profile

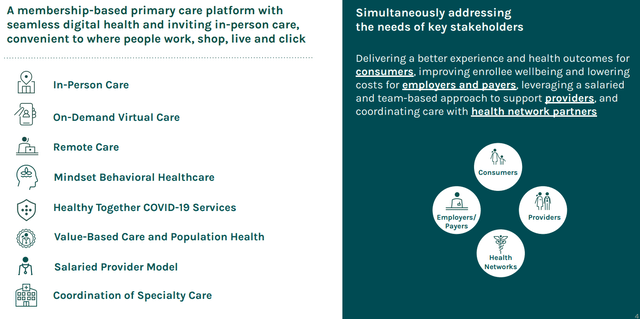

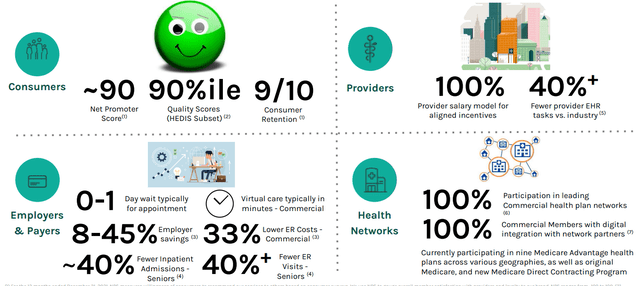

One Medical’s January 2022 Investor Presentation

One Medical’s Value Proposition For Its Stakeholders

One Medical’s January 2022 Investor Presentation

One Medical stands out with its focus on technology, and this possibly explains why AMZN is keen on acquiring One Medical rather than other healthcare companies. In its January 2022 investor presentation slides, One Medical highlighted that approximately 45% of its platform members will use either its online website or its mobile app to access its services at least once per month.

In the next section, I go into more detail about the key metrics of this proposed deal, with the aim of illustrating the significance of this acquisition as it relates to Amazon’s healthcare ambitions.

AMZN Stock Key Metrics

AMZN is willing to pay a meaningful premium to own One Medical, as indicated by an analysis of the key metrics for the acquisition.

The $18 per share acquisition price was +77% higher than ONEM’s last traded share price of $10.18 as of July 20, 2022 prior to the deal announcement.

The $3.9 billion deal consideration translates into a trailing twelve months Enterprise Value-to-Revenue multiple of 4.4 times and a consensus forward next twelve months’ Enterprise Value-to-Revenue multiple of 3.2 times for One Medical.

Peer Valuation Comparison For One Medical

| Stock | Trailing Twelve Months’ Enterprise Value-to-Revenue Multiple | Consensus Forward Next Twelve Months’ Enterprise Value-to-Revenue Multiple |

| Oak Street Health, Inc. (OSH) | 4.3 | 3.0 |

| GoodRx Holdings, Inc. (GDRX) | 3.1 | 2.9 |

| American Well Corporation (AMWL) | 2.3 | 2.1 |

| Alignment Healthcare, Inc. (ALHC) | 2.3 | 2.0 |

| UnitedHealth Group Incorporated (UNH) | 1.7 | 1.6 |

| Cano Health, Inc. (CANO) | 1.3 | 0.9 |

Source: S&P Capital IQ

As highlighted in the peer valuation comparison table presented above, the implied valuation multiples for the Amazon-One Medical transaction represent a substantial premium over the current trading multiples for ONEM’s listed peers.

In other words, the key metrics for AMZN’s recent proposed M&A transaction imply that Amazon is eager to expand in the healthcare space.

What Healthcare Services Does Amazon Provide?

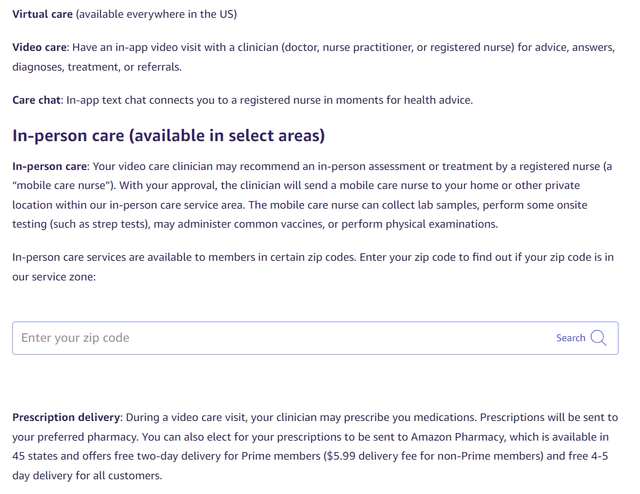

Amazon ventured into the healthcare space in the middle of 2018, when it bought out “online pharmacy start-up PillPack” as reported by Seeking Alpha News on June 28, 2018. The key milestone for AMZN’s healthcare business was its initial introduction of Amazon Care for its staff in September 2019. In a press release issued on March 17, 2021, the company announced its plans to widen the reach of Amazon Care to serve employees from other corporations as well.

Healthcare Services Provided By Amazon Care

Even prior to the One Medical deal announcement, Amazon already offers a wide range of healthcare services through Amazon Care as mentioned above. Moving forward, One Medical will enable AMZN to have a bigger presence in the healthcare industry, which will be positive for its future prospects.

Is Amazon’s Increased Healthcare Presence Good For Their Outlook?

Amazon’s growing healthcare presence, following the completion of the One Medical acquisition in the future, will be good for the company’s long-term growth outlook in a number of ways.

Firstly, Amazon Care is in a good position to grow its employer client base with the company’s purchase of One Medical. Previously, Amazon Care’s growth was constrained by the fact that it is challenging for AMZN to provide a good combination of both virtual and in-person care without a meaningful physical presence in key cities in the US. The purchase of One Medical might help to address the issue, as it has offices in markets like New York, San Francisco, and Los Angeles, etc.

Secondly, One Medical has the potential to expand aggressively going forward with the support of Amazon. One Medical has a physical presence in 20-plus markets within the country according to AMZN’s July 21, 2022 deal announcement press release. In its January 2022 investor presentation, One Medical also highlighted that its physical primary care coverage in the US is about 40%. In other words, One Medical has substantial growth upside, as seen with the opportunity to launch physical primary care facilities in new markets.

Thirdly, there are potential synergies between Amazon Prime and One Medical that could be exploited. In ONEM’s DEFA14A filing referred to earlier, it was highlighted that “it’s too early to say whether and how One Medical might partner with Amazon features or programs in the future” when addressing a potential query about whether “One Medical be a part of (Amazon) Prime.” This implies that both Amazon and One Medical aren’t ruling out the possibility of an integration of Prime and the One Medical platform in some way or another, which will either improve the stickiness of current Amazon Prime members or help to attract new Prime members.

Is AMZN Stock A Buy, Sell, or Hold?

AMZN stock is a Buy. Amazon is moving towards becoming a more profitable company boasting growing profit margins, as revenue contribution from services such as AWS (Amazon Web Services) and advertising increases over time. The planned takeover of One Medical and the increased healthcare presence are steps in a similar direction and part of Amazon’s plans to derive a higher proportion of its revenue from higher-margin services, including healthcare. This will continue to drive a positive re-rating of AMZN’s valuations in tandem with an improvement in profitability.

Be the first to comment