Noah Berger

Why Is Amazon’s Stock Surging?

Amazon’s (NASDAQ:AMZN) stock rose sharply last week in response to Q2 earnings. As a long-term shareholder, I was pleased with the reaction (what can I say? I like making money) but also puzzled by the over-the-top praise heaped on the company.

The stock rose sharply immediately after hours before the earnings report could be dissected appropriately and digested. The immediate rise suggests it was initially due to top-line revenue growth, sentiment, and relief.

This begs the question: would the same reaction from analysts and writers have come out had the stock initially dipped after hours? The stock was up big before the glowing reviews began, making me wonder. Often I feel there is a chicken-or-the-egg effect surrounding earnings, commentary, and stock movement. And there is definitely a powerful herd mentality in short-term market movements.

There is also a level of relief and acceptance in Q2 that didn’t materialize in Q1. Many of us warned that Q1 would appear extremely weak due to well-known headwinds. But still, headlines following the quarter were touting a “surprise loss” and “unexpected setback.” I wrote about this in detail here, explaining why I would buy the dip. I won’t belabor the point here, except to say that expectations have finally aligned with reality – it just took an extra quarter to get here.

How Were Amazon’s Q2 Earnings?

There was a lot to delve into in Q2, and I became more encouraged the deeper I got. There was much not to like on the surface, but many silver linings.

Let’s sift through some fuzzy numbers.

Cash Flow

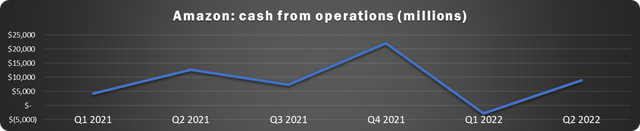

Cash from operations (CFO) decreased substantially in Q2 2022 year-over-year (YOY) falling 40% from $59.3 billion to $35.6 billion on a trailing-twelve-month (TTM) basis. Free cash flow sunk to a net outflow of $23.5 billion, adding to the $18.6 billion outflow in Q1.

Amazon’s free cash flow is measured by taking cash from operations and subtracting net investments in property and equipment. I am much more concerned with CFO than free cash flow as a performance measure. CFO is a better measure of whether the core business is profitable. I consider investments in property and equipment positive signs even if free cash flow is reduced.

The good news is that CFO rose this quarter compared to last quarter. In Q1, Amazon lost $2.8 billion from operations and in Q2 showed a $9 billion gain. This indicates that management is getting a handle on ballooning costs. The chart of CFO below clearly illustrates this positive direction.

Data source: Amazon. Chart by author.

Sales

Overall sales were a mixed bag, however, with an exciting caveat. Net product sales declined from $58 billion in Q2 2021 to $56.6 billion in Q2 this year. However, net service sales rose 17%, from $55.1 billion to $64.7 billion.

This is terrific news in my book. Amazon’s services, like AWS and third-party fees and advertising, will be much more profitable than product sales. Amazon has always struggled to make a significant profit on retail sales; discount retail is simply a low-margin business. Just ask Walmart (WMT).

Total sales were up a respectable 7% YOY.

Margins

Profit margin is much more important than overall sales in my book. Results were poor on the surface, but when looking deeper many positives can be seen.

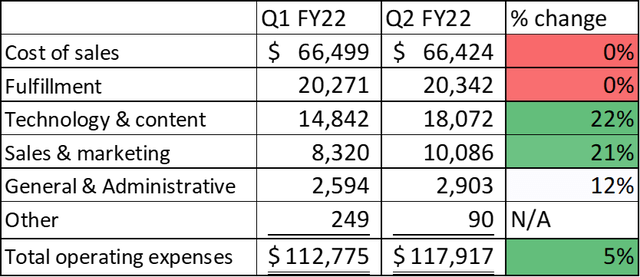

Operating margin dipped overall to just 2.7% in Q2, decreasing YOY from 6.8% and a decrease from Q1’s 3.2%. This appears to be a step back, but the reason for the decline might not be what you think. As shown below, the biggest culprits for the decline in margin from Q1 to Q2 were technology and content; and sales and marketing.

Data Source: Amazon. Chart by author. Dollars in millions.

Once again, this appears to be quite positive. We might have expected the cost of sales and fulfillment to continue rising as Amazon grapples with inflation, but that wasn’t the case.

Technology and content expenses include salaries for employees involved in research and development; infrastructure costs, including support, servers, and equipment; and other costs for AWS, among others. Both of the areas where expenses increased substantially are investments in the future.

AWS And Digital Advertising

I’ve written extensively about the remarkable rise of AWS, which has been well-covered by others post-earnings. The AWS segment accounts for all of Amazon’s operating profits, as the other segments have produced significant losses this year. This isn’t surprising. The cloud market continues to expand, and serious headwinds affect the rest of the business.

If one wanted to find fault with AWS in Q2, the operating margin fell from 35% in Q1 to 29%. This appears directly related to the increase in technology and content spending above, and probably is related to timing more than anything. The operating margin for the first half of 2022 is 32%, higher than the lauded 30% margin in 2021.

AWS sales are on pace to easily pass $80 billion in 2022.

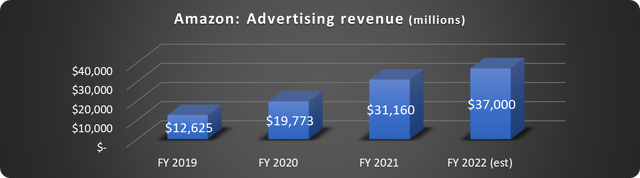

Digital advertising continues to impress with 18% YOY growth in Q2 and 20% growth for the first half of 2022. It looks like it will soon surpass subscription services revenue – quite an accomplishment.

If this pace continues, it will nearly triple sales in three years by the end of 2022, as shown below.

Data source: Amazon. Chart and estimate by author.

Amazon doesn’t report operating revenue independently for its advertising sales, so profitability is a question mark. However, given the success of other digital advertisers, it is probably at least cash-flow positive and possibly much more.

What’s The Verdict?

Amazon’s earnings weren’t a blockbuster revelation or a wolf in sheep’s clothing. And that’s ok. The company is advancing despite economic headwinds. AWS is stellar. Advertising is a force. And the future remains bright for long-term shareholders.

Be the first to comment