KangeStudio

Considerable loan growth will drive earnings of Amalgamated Financial Corp. (NASDAQ:AMAL) through the end of 2023. The recent team hiring and strong labor markets will likely support loan growth. Further, next year’s earnings will benefit from the rising rate environment. Overall, I’m expecting Amalgamated Financial to report earnings of $2.62 per share for 2022 and $3.23 per share for 2023. Compared to my last report on the company, I’ve increased my earnings estimate mostly because I’ve revised upwards my loan growth estimates. Next year’s target price suggests a moderately high upside from the current market price. Therefore, I’m upgrading Amalgamated Financial Corp. to a buy rating.

Team Expansion, Job Market to Support Loan Growth

Amalgamated Financial Corp’s loan growth continued to accelerate in the third quarter of 2022. The portfolio grew by 6.1% during the quarter, taking the nine-month growth to 16.9%, or 22% annualized. The management gave credit for the exceptional growth to the recently hired bankers, as mentioned in the conference call. The management also mentioned in the conference call that it expects loan growth to moderate in the fourth quarter to around 2% to 3% sequentially. This target does not surprise me because Amalgamated Financial couldn’t have maintained the third quarter’s performance for long in this high-rate environment.

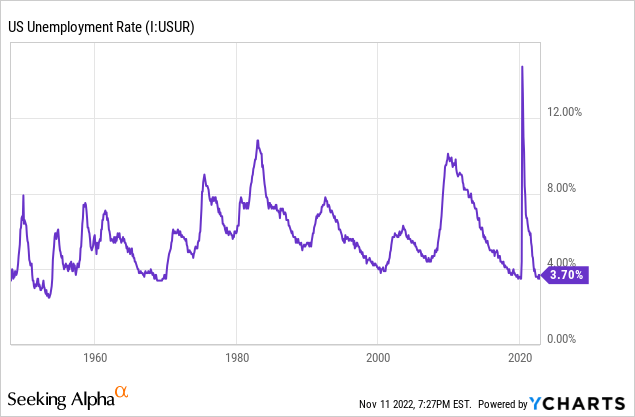

On the other hand, the growth in the number of personnel will likely support loan growth in the foreseeable future. Further, healthy job markets will support economic activity and consequently loan growth. Amalgamated Financial is physically present in only New York City, Washington DC, and San Francisco. However, it caters to customers all over the country. Therefore, the national unemployment rate is a good gauge of credit demand.

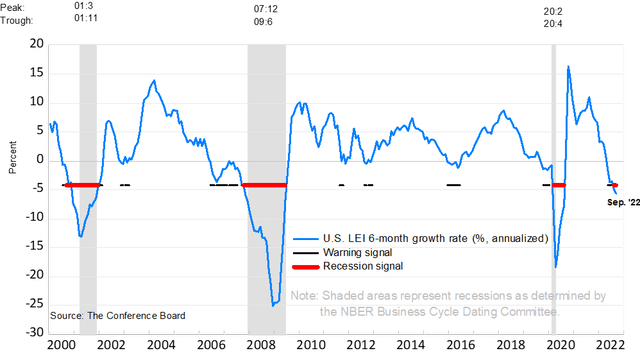

However, the U.S. leading economic index continued on a downtrend in September. The six-month growth rate for the index is now in dangerous territory, as seen below.

Considering the positive and negative factors given above, I’m expecting the loan portfolio to grow by 2% in the last quarter of 2022, taking full-year loan growth to 19%. For 2023, I’m expecting the loan portfolio to grow by 8%. In my last report on Amalgamated Financial, I estimated loan growth of 14.6% for 2022 and 4.1% for 2023. Considering the third quarter’s performance, I think I underestimated the team’s capabilities previously. Therefore, I have revised upwards my loan targets for the foreseeable future.

The following table shows my balance sheet estimates

| FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | |||||

| Net Loans | 3,439 | 3,447 | 3,276 | 3,906 | 4,228 |

| Growth of Net Loans | NA | 0.2% | (5.0)% | 19.2% | 8.2% |

| Other Earning Assets | 1,635 | 2,088 | 3,289 | 3,548 | 3,692 |

| Deposits | 4,641 | 5,339 | 6,356 | 7,232 | 7,676 |

| Borrowings and Sub-Debt | 137 | 53 | 132 | 197 | 205 |

| Common equity | 491 | 536 | 564 | 499 | 577 |

| Book Value Per Share ($) | 15.2 | 17.2 | 17.9 | 16.1 | 18.6 |

| Tangible BVPS ($) | 14.6 | 16.6 | 17.4 | 15.6 | 18.1 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | |||||

Impressive Margin Growth Likely to Pause in the Fourth Quarter

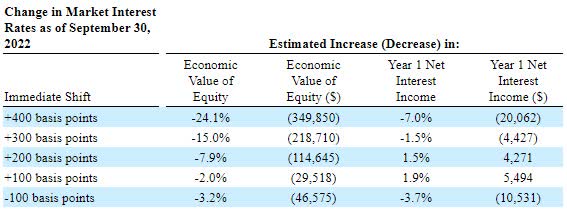

Theoretically, Amalgamated Financial’s net interest income is barely rate-sensitive. The management’s rate-sensitivity model shows that a 200-basis points hike in interest rates could boost the net interest income by only 1.5% over twelve months, as mentioned in the 10-Q filing.

3Q 2022 10-Q Filing

However, in practice, the margin has been much more rate sensitive. The margin surged by 47 basis points in the third quarter after rising by 27 basis points in the second quarter of this year. This variance between theory and practice is a signal of the management’s capabilities. Amalgamated Financial’s management has managed to boost its margin by stifling growth in funding costs despite the up-rate cycle. Its task was made easier by non-interest-bearing deposits which make up a whopping 54% of total deposits. However, adjustable-rate deposits make up 44% of total deposits. The fact that the management was able to hold down the costs of these adjustable-rate deposits is admirable.

In my opinion, Amalgamated Financial will have to let costs on adjustable-rate deposits rise or it’ll risk losing deposits to competitors. Therefore, I’m not expecting the third quarter’s amazing performance to be repeated in the fourth quarter or beyond.

Another factor that will hold back margin growth amid a rising rate environment is the large balance of securities, which make up almost half of all earning assets. Around 63% of securities carry fixed rates, as can be deduced from the details given in the earnings presentation.

Moreover, the management expects an outflow of $400 million to $500 million from political deposits in the fourth quarter, which will start building up again in the first quarter of 2023. Due to the temporary outflow, Amalgamated Financial might have to rely on costly borrowings to fund its assets.

Considering these factors, I’m expecting the margin to remain unchanged in the fourth quarter of 2022 before rising by eight basis points in 2023.

Expecting Earnings to Surge by 23% Next Year

The anticipated loan growth discussed above will be the chief driver of earnings next year. Further, the bottom line will receive some support from margin expansion next year. Meanwhile, the provisioning for expected loan losses will likely remain at a normal level through the end of 2023. I’m expecting the net provision expense to make up 0.28% of total loans next year, which is the same as the average from 2019 to 2021.

Overall, I’m expecting Amalgamated Financial to report earnings of $2.62 per share for 2022, up 56% year-over-year. For 2023, I’m expecting earnings to grow by 23% to $3.23 per share. The following table shows my income statement estimates.

| FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | |||||

| Net interest income | 167 | 180 | 174 | 240 | 285 |

| Provision for loan losses | 4 | 25 | (0) | 14 | 12 |

| Non-interest income | 29 | 41 | 28 | 25 | 22 |

| Non-interest expense | 128 | 134 | 132 | 142 | 161 |

| Net income – Common Sh. | 47 | 46 | 53 | 81 | 100 |

| EPS – Diluted ($) | 1.47 | 1.48 | 1.68 | 2.62 | 3.23 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | |||||

In my last report on Amalgamated Financial, I estimated earnings of $2.35 per share for 2022 and $2.63 per share for 2023. I’ve increased my earnings estimates for both years as I’ve raised my loan growth estimates.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Upgrading to a Buy Rating

Amalgamated Financial is offering a dividend yield of 1.7% at the current quarterly dividend rate of $0.10 per share. The earnings and dividend estimates suggest a payout ratio of 12% for 2023, which is below the 2019-2021 average of 19%. Therefore, there is room for a dividend hike. Nevertheless, I haven’t incorporated a dividend increase in this investment thesis to stay on the safe side.

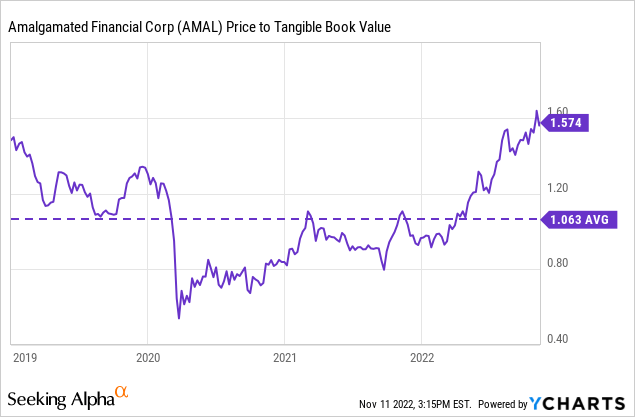

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Amalgamated Financial. The stock has traded at an average P/TB ratio of 1.06 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $18.1 gives a target price of $19.2 for the end of 2023. This price target implies a 20.3% downside from the November 11 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.86x | 0.96x | 1.06x | 1.16x | 1.26x |

| TBVPS – Dec 2023 ($) | 18.1 | 18.1 | 18.1 | 18.1 | 18.1 |

| Target Price ($) | 15.6 | 17.4 | 19.2 | 21.0 | 22.8 |

| Market Price ($) | 24.1 | 24.1 | 24.1 | 24.1 | 24.1 |

| Upside/(Downside) | (35.3)% | (27.8)% | (20.3)% | (12.8)% | (5.3)% |

| Source: Author’s Estimates |

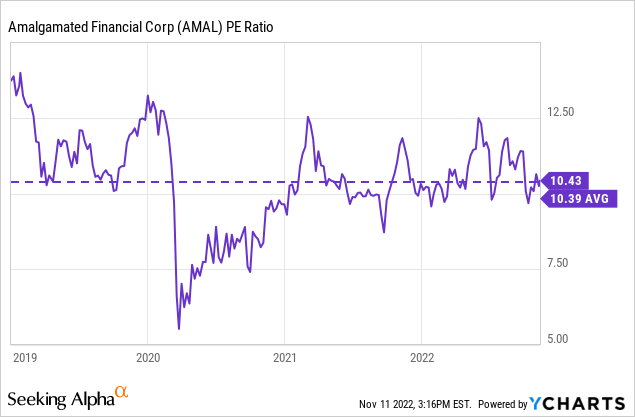

The stock has traded at an average P/E ratio of around 10.4x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $3.23 gives a target price of $33.5 for the end of 2023. This price target implies a 39.2% upside from the November 11 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.4x | 9.4x | 10.4x | 11.4x | 12.4x |

| EPS 2023 ($) | 3.23 | 3.23 | 3.23 | 3.23 | 3.23 |

| Target Price ($) | 27.1 | 30.3 | 33.5 | 36.8 | 40.0 |

| Market Price ($) | 24.1 | 24.1 | 24.1 | 24.1 | 24.1 |

| Upside/(Downside) | 12.4% | 25.8% | 39.2% | 52.6% | 66.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $26.4, which implies a 9.4% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.1%. In my last report, I gave a target price of $23.0 for December 2022 and adopted a hold rating. I’ve now rolled over my target price to the end of next year and raised my earnings estimates. Based on my updated total expected return, I’m upgrading Amalgamated Financial Corp. to a buy rating.

Be the first to comment