Tree with Leaves Made Out of Hundred Dollar Bills DNY59

Due to economic uncertainty, the S&P 500 index is down 13% year to date. Yet the index yields a meager 1.54%. This raises the question: What is an income investor to do in this environment?

The good news is that the stock market is a market of stocks. This means there are plenty of safe high-yielders out there; it’s just a matter of finding them. As the largest individual holding in my portfolio, accounting for 2.9% of my annual dividend income, I believe the big tobacco stock Altria Group, Inc. (NYSE:MO) is a reliable pick for income investors.

For the first time since my article last August, I will discuss why I’m confident enough to hold a meaningful position in Altria Group.

This Blue Chip Can Easily Afford A Mid-Single-Digit Dividend Boost

Altria Group’s 8.13% dividend yield is higher than the tobacco industry’s average yield of 6.96%. Despite this mouth-watering yield, the stock’s payout isn’t to be too good to be true.

This is because Altria Group generated $4.61 in adjusted diluted EPS in 2021. Compared to the $3.48 in dividends per share paid during that time, this equates to a 75.5% adjusted diluted EPS payout ratio. For context, this is below the company’s targeted payout ratio of 80%.

Based on Altria Group’s guidance for 2022, the company will generate $4.86 in midpoint adjusted diluted EPS during the year ($4.79 to $4.93 range per page 4 of 28 of Altria Group Q2 2022 earnings press release). Using my projection of a $0.94 quarterly dividend per share for the fourth quarter, Altria Group’s adjusted diluted EPS payout ratio will improve further to just 74.9% in 2022.

Analysts are anticipating 5.1% annual earnings growth from the company over the next five years. And since this is moderately below the targeted adjusted diluted EPS payout ratio of 80%, I believe Altria Group’s dividend growth will slightly exceed earnings growth for the foreseeable future. That’s why I am reiterating my 4% annual dividend growth projection for the long run.

Earnings Continued To Move Higher

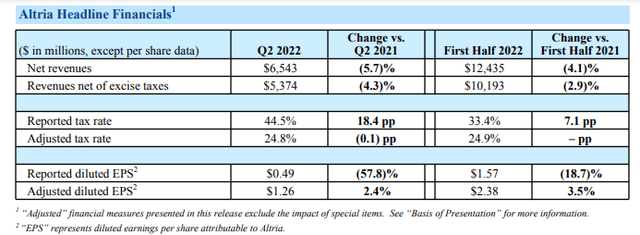

Altria Group Q2 2022 Earnings Press Release

Altria Group Had a Decent First Half of 2022

The company reported $10.193 billion in revenue net of excise taxes through the first half of the year. This was down 2.9% over the year-ago period, which may seem like a negative. But it’s worth noting that this doesn’t take into account the divestiture of its Ste. Michelle Wine Estates business last October (details sourced from pages 1 and 5 of 28 of Altria Group Q2 2022 earnings press release).

Adjusting for the sale of the wine business, Altria Group’s revenue net of excise taxes was up slightly from the year-ago period figure of $10.186 billion (calculation according to data from pages 13 and 1 of 29 of Altria Group Q2 2021 earnings press release). What was behind this marginal topline growth?

The company’s cigarette retail market share remained quite high at 48.2% in the first half of the year. Altria Group was able to overcome an 8.8% year-over-year decline in total cigarette volume for the half. This was thanks to price hikes on its products, which is how smokable products revenue net of excise taxes moved 0.7% higher over the year-ago period to $8.957 billion in the first half of 2022 (all info per pages 10, 9, and 8 of 28 of Altria Group Q2 2022 earnings press release).

Altria Group’s oral tobacco products retail share was down slightly, but still a whopping 46.8% through the first half of the year. A 3.2% year-over-year volume decrease in oral tobacco products was only partially offset by pricing. This is why the company’s oral tobacco products revenue net of excise taxes dropped 2.9% over the year-ago period to $1.217 billion for the first half of 2022 (details sourced from pages 12 and 11 of 28 of Altria Group Q2 2022 earnings press release).

Altria Group recorded $2.38 in adjusted diluted EPS in the first half of the year, which was 3.5% higher year-over-year (according to page 1 of 28 of Altria Group Q2 2022 earnings press release). Due to improved operating efficiency, the company’s non-GAAP net margin increased 180 basis points over the year-ago period to 42.5% for the first half of 2022. Along with a 2.2% reduction in Altria Group’s share count to 1.813 billion shares, this explains how adjusted diluted EPS grew in the first half of the year (calculations per pages 24, 18, and 1 of 28 of Altria Group Q2 2022 earnings press release and page 1 of 29 of Altria Group Q2 2021 earnings press release).

Risks To Consider:

Altria Group is a wonderful business. But it still has its risks.

With inflation clocking in at 9.1% in June 2022, consumers are being negatively impacted by falling discretionary incomes. This could further pressure Altria Group’s volumes, which could harm financial results in future quarters.

The more than doubling of the on! nicotine pouch brand’s market share to 4.5% in the first half of 2022 demonstrates a company that is clearly in touch with consumer preferences (details sourced from page 12 of 28 of Altria Group Q2 2022 earnings press release). But the biggest long-term risk to the company is arguably not keeping up with the shifting demands of consumers. That’s why it will be important to monitor the company’s market share moving forward.

A Deeply Undervalued Stock

Altria Group is a Dividend King. However, that doesn’t change the fact that investors must avoid overpaying to have a chance of doing well over the long term.

That’s why I will be utilizing a couple of valuation models to value shares of Altria Group.

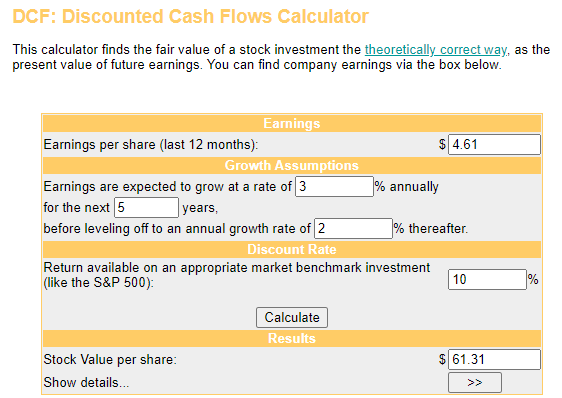

Money Chimp

The first valuation model that I’ll employ to estimate the fair value of Altria Group’s shares is the discounted cash flows model, or DCF, model. This is made up of three inputs.

The first input into the DCF model is the trailing-twelve-month adjusted diluted EPS. This is $4.48 for Altria Group.

The next input for the DCF model is growth assumptions. I will assume a 3% annual adjusted diluted EPS growth rate for the next five years and a drop-off to 2% in the years that follow.

The final input into the DCF model is the discount rate. This is another way of saying the required annual total return rate. I’ll use 10% for this input.

Factoring these inputs into the DCF model, I get a fair value of $61.31 a share. This implies that shares of Altria Group are trading at a 27.8% discount to fair value and can provide a 38.5% upside from the current price of $44.26 a share (as of August 4, 2022).

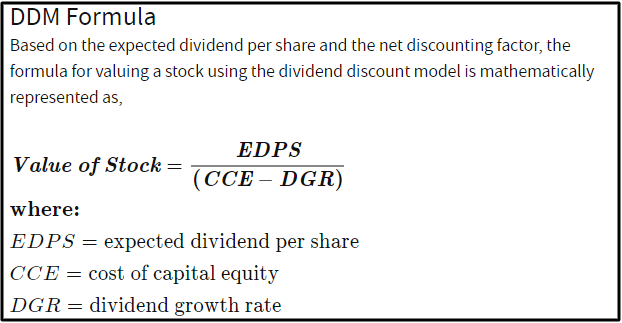

Investopedia

The second valuation model that I will use to approximate the fair value of Altria Group’s shares is the dividend discount model, or DDM. This also consists of three inputs.

The first input for the DDM is the expected dividend per share, which is the annualized dividend per share. With a 4.4% dividend increase coming soon, I will use an annualized dividend per share of $3.76.

The second input into the DDM is the cost of capital equity, which is the annual total return required by an investor on their investments. I’ll again use 10% for this input.

The third input for the DDM is the annual dividend growth rate or DGR over the long term. I will use a 4% annual dividend growth rate as I explained in the dividend section above.

Plugging these inputs into the DDM, I calculate a fair value of $62.67 a share. This means that shares of Altria Group are priced at a 29.4% discount to fair value and offer 41.6% capital appreciation from the current share price.

When I average out my two fair values, I compute a fair value of $61.99 a share. This suggests that Altria Group’s shares are trading at a 28.6% discount to fair value and can provide a 40.1% upside from the current share price.

Summary: Collect Huge Income While You Wait For A Valuation Rerating

Altria Group will soon raise its dividend for the 53rd consecutive year. And given that the adjusted diluted EPS payout ratio will come in well under 80% in 2022, there should be many more dividend increases in the years to come.

Altria Group’s adjusted diluted EPS is steadily moving higher, which should also support higher dividend payments going forward. And the stock is massively undervalued.

Put it all together and I believe that Altria Group will deliver low-double-digit annual total returns to investors over the next decade. This is an interesting proposition for income investors, which is what makes the stock such a strong buy.

Be the first to comment