Tim Boyle/Getty Images News

After a short break from writing articles over the last couple weeks, I wrote up British American Tobacco (BTI) yesterday, explaining why I’m still very bullish on the company even after its outperformance to start 2022. Today the article is on Altria (NYSE:MO) and why the company is now a strong buy, even after a recent analyst downgrade.

Investment Thesis

Altria is one of the largest tobacco companies in the world and owns the famous Marlboro brand here in the US. Shares sold off more than 10% since Morgan Stanley wrote a bearish note and assigned a $50 price target. While investors should read the note and decide for themselves, I’m using the 10% selloff to fill out my position. At 10.5x earnings and a 7.3% yield, the risk/reward profile is very favorable for investors with a long-term time horizon. The company has an impressive margin profile, is buying back stock at a decent clip, and is due for another dividend hike in September. Investors looking for current income might want to take advantage of the recent selloff to add to their position or start a new one in Altria.

A Thank You Note To Wall Street

Shares of Altria took a nosedive last week when they were downgraded by Morgan Stanley. I was looking for an opportunity to add to my Altria position one more time in 2022, and I was hoping for a dip below $50 to do it. That puts the yield well above 7%, and in my opinion, limits further downside for long term investors. While the price could head lower in the short term, there is a wide margin of safety at the current price for new investors.

While I think long investors should always read more bearish viewpoints to get both sides of the coin, I’m not too worried about any of the points that the analyst mentioned. Altria will continue to make money, pay out dividends, and buy back stock. The business will continue to generate gobs of cash at impressive margins, and best of all, investors can buy a piece of the business at cheap valuations.

Valuation

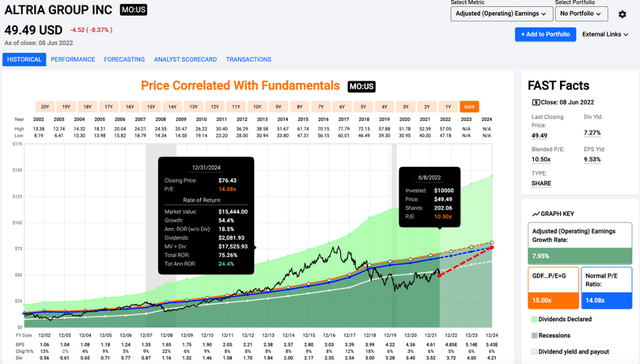

Altria hasn’t participated in the so-called everything bubble of the last couple years. I think part of it is due to the exclusion from the ESG movement, but that’s a rant for another time. Shares currently trade for 10.5x earnings, which is too cheap for a company that is poised to grow its EPS for years to come. It’s also a discount to the average earnings multiple of 14.1x. I think the business deserves a higher multiple, but the cheap valuation limits the downside for investors with a longer time horizon.

Price/Earnings (fastgraphs.com)

While I’m not counting on multiple expansion, I think it’s certainly more likely than multiple compression from here. Altria has an impressive margin profile and a solid balance sheet, pays a juicy 7.3% dividend, and is buying back stock. Altria still had 1.25B left on the buyback authorization at the end of Q1, and I’m expecting buybacks for a long time to come. Another thing I’m expecting from Altria is continued dividend raises.

Dividend Reinvestment

I will be reinvesting my dividends and I would strongly recommend investors do the same if you don’t need the cash payouts. Here’s the thought experiment on why I think reinvesting is a good idea for investors looking to compound the original investment. For under $10k, you can buy 200 shares of Altria.

Assuming Altria doesn’t cut the dividend (which is a safe assumption given their Dividend King status), you will receive $180 if you buy the shares today before the 6/15 payout ($0.90 per share). Every quarter you will receive a growing payout from a combination of annual dividend increases and the increased share count. Give it five years and I like my chances of making double digit returns even if the broader equity market doesn’t do very well.

I don’t count chickens before they hatch, but Altria is due for a dividend hike in September if they stay true to form. I think it will be a decent hike, and if I had to guess, it will probably be near $0.05 per share. For me, reinvesting dividends is a great way to start the compounding effect for a long-term holding like Altria.

Conclusion

There aren’t many stocks that I think are undervalued in today’s market, even after a weak start to 2022. Altria and British American Tobacco are a couple that are still undervalued and have juicy dividends to pay investors to wait for further price appreciation. The recent analyst note raised some concerns for Altria and led to a 10% selloff, but I think the cheap valuation combined with a 7.3% dividend and buybacks will lead to double digit returns from here. Long term investors might want to consider adding or starting a new position in Altria.

Be the first to comment