weible1980/iStock Unreleased via Getty Images

Dividend investing and Altria Group, Inc. (NYSE:MO) are almost synonyms for many dividend investors – many of whom are enjoying a rich retirement thanks to this company’s amazing historical track record. Last year, the company raised its dividend for the 52nd consecutive year. Dependability is an understatement.

Due to more than its fair share of setbacks in recent years, the stock has languished and the dividend growth rate has been slower than in years past. Altria is likely to continue growing at a modest pace for many years to come and, together with its high yield, is likely to produce double-digit returns for investors going forward. The stock offers a compelling combination of current income and growth and should be a part of conservative dividend growth investors’ portfolios.

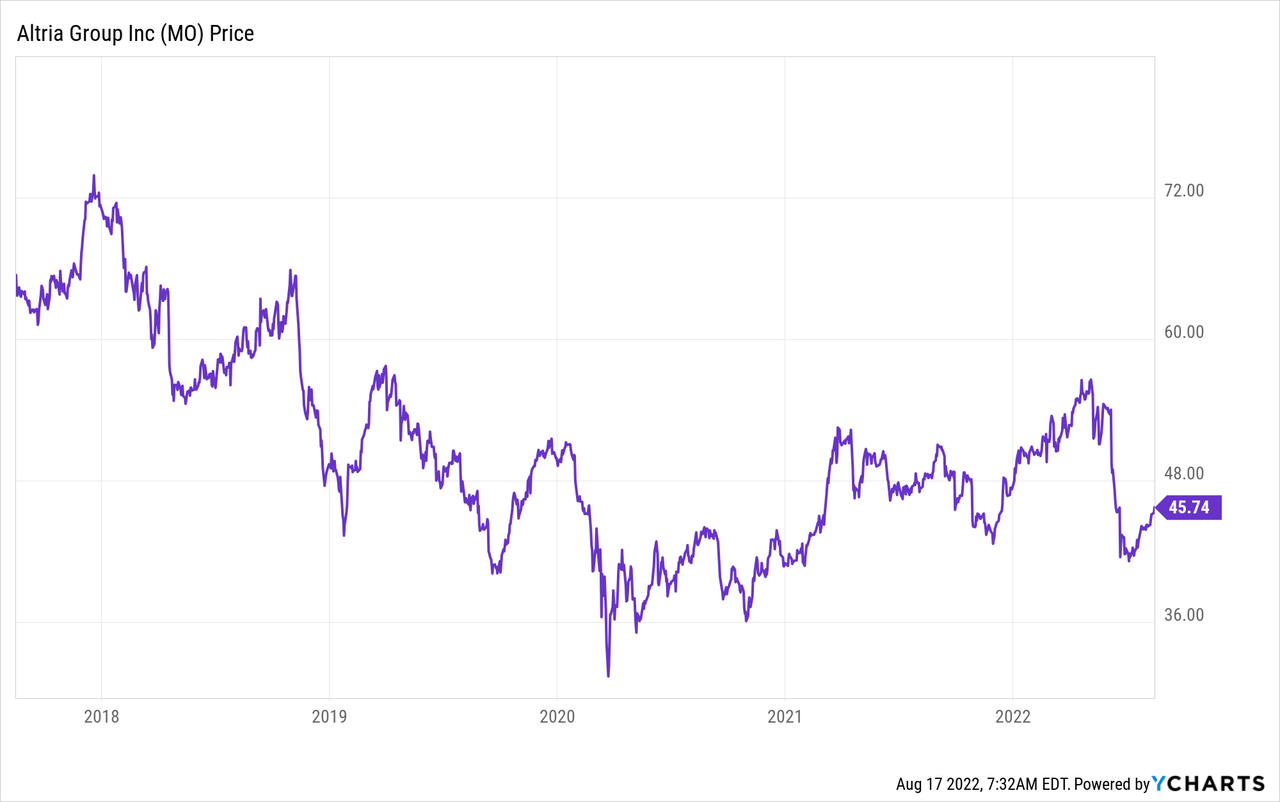

Not the sexiest stock chart I’ve ever seen. I’ll give you that. Over the last five years, the stock has gone from $63.69 to $45.74 for a return of -28.2%. Adding in an approximate dividend of $15 over those years will give us a slightly negative total return. Not a good showing considering how the market has done over the same period.

If one is to glean something positive from the chart, it must be that the multi-year downtrend seems to have ended with the onset of the pandemic in early 2020. There have been serious setbacks since, but in general, we have a chart going slowly northwards. As investors were pretty happy up there at $50+ the FDA once again came out with bad news for Altria – namely that they denied the authorization to market Juul products. It had a pretty severe impact on the share price. But as is often the case, after the initial shock the stock recovered somewhat.

So there’s been a lot of bad news with this name, but as I’ll lay out below, bad news can be good news for investors getting in at these levels. The market – and Altria itself – has already written off almost the entire Juul stake, which means there isn’t much more to write down. If they can do what they’ve always done with the core business and be moderately successful in the non-combustible area, investors can achieve pretty nice returns going forward.

Historical Dividend Growth

More than five decades of continuous dividend growth says something about the dependability and quality of this company. For decades, investors have slept well at night knowing their income from Altria would rise at a much faster clip than inflation over time – thereby securing their retirement incomes.

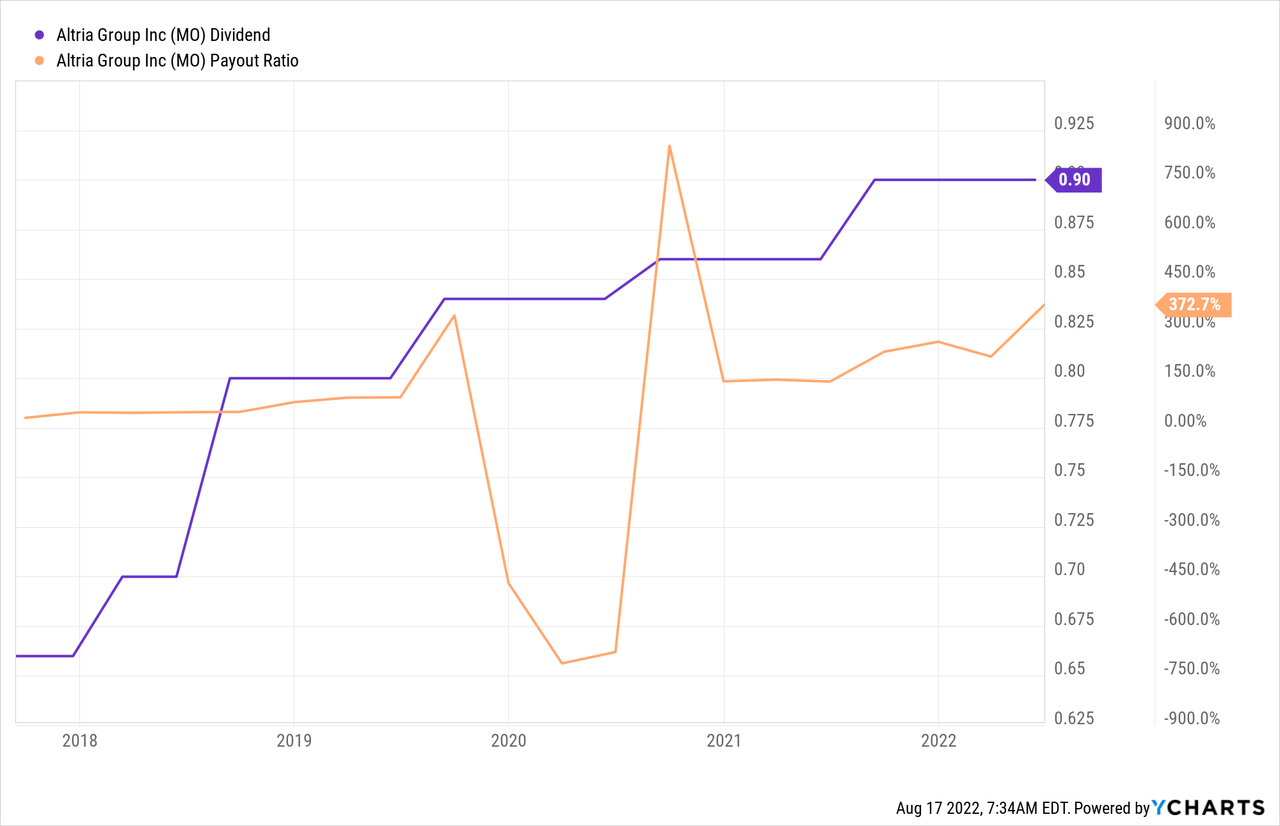

The chart above is a chart of ever more hikes. In 2018, it even raised the dividend twice, due in large part to the tax cuts of that year. Five years ago, the dividend stood at $0.61. Currently, it is at $0.90, which translates into an average annual growth rate of the dividend of 8.1%.

The last couple of years has been dragging down the average as it hiked the dividend by 4.7% last year and a puny 2.4% the year before that. Naturally, value-destroying investments, like the Juul investment, will show up in earnings and dividends over time no matter how much the adjusted EPS figure is adjusted. Luckily, most of that is history and the write-down has happened.

The payout ratio above is more concerning, it is all over the place. This is where we see the difference between reported diluted EPS and adjusted diluted EPS. In the chart, the payout ratio is calculated based on the reported number. On the adjusted number the payout ratio is still below 100% and much closer to the Board’s long-term target of 80%. Going forward I expect the two EPS numbers to be closer together as the worst of the Juul write-down is now behind us. In the last quarter alone, the Juul charge was $0.64 per share.

I am not worried about the payout ratio even though it looks erratic above. On adjusted EPS, which is what the Board is using when deciding the dividend, the payout ratio is in safe territory. Last quarter it was at 71.4%.

August Dividend Hike

We’re fast approaching the end of August, which of course means dividend raise time for Altria investors. According to its Dividend Information website, the next declaration date is August 25. There’s no question that the dividend will be raised, the only question is by how much. Last year the dividend was hiked by 4.7%, which was higher than the year before of 2.4%. So it is allowed to think that the hike two years ago really did mark the low point in terms of dividend growth from Altria. Let’s look a bit closer at the numbers in order to evaluate the potential magnitude of the dividend raise this year.

If we look at the Q2 report, we can see that it just barely managed to grow EPS from the prior year period, clocking in an adjusted diluted EPS growth of 2.4%, driven primarily by stock buybacks. For the first half, the corresponding number was 3.5%. The two most important news I think were the further write-down of the Juul stake of $0.64 per share (on page 6 in the press release) and the smokable shipment volume decline of 11.1% on page 8. That is a pretty steep decline compared to the level of the last few years. It is actually quite impressive that it managed to grow EPS with such a decline. There is certainly a shift going on in the market, as we also see internationally. For instance, Philip Morris (PM) derives 29.9% of its revenues from smoke-free products. This shift and how Altria will manage it will be very important going forward, to say the least.

As for the Juul write-down, the good news in the bad news is that the current value in the books is just $450 million. As the write-down in Q2 was more than a billion, it means that the maximum potential further loss on this investment is approximately $0.30 per share. With just a minimum of luck, the product might still be allowed on the market or could be sold internationally. In other words: there is virtually no downside left. Investors have taken a beating up until now, but going forward, this risk is as good as gone though there is still an optionality value left. In this case, bad news is good news for future returns.

Speaking of the future: The most important point for investors is what’s going to happen going forward. To that end, management reaffirmed its full-year guidance of an EPS of $4.79-$4.93 for a midpoint of $4.86 for fiscal year 2022. This represents a growth rate from 2021 of 4% to 7% for a midpoint of 5.5%. If this were to happen, EPS will grow pretty much at the same rate as investors have been used to in recent years.

As stated both on page 2 in the press release and on its website, the company aims to pay out approximately 80% of adjusted diluted EPS in the form of dividends. Currently, it pays out $3.6 of $4.61 in adjusted diluted EPS for 2021, corresponding to a payout ratio of 78%. This means the company is a tad lower than its long-term target.

On the low end for this year I will assume that the Board will continue being cautious in this dynamic environment, that is to say, it would prefer staying just below rather than above 80% and assume a modest EPS growth. It would take a lot to end up below its lowest point in the range of 4% as this company historically has tended to end within its guidance range. A new quarterly dividend of $0.94 would represent an increase of 4.4%. This would be ultra-conservative as it would represent a payout ratio of just 78.5% in the case of just 4% EPS growth. This is thus the absolute minimum I would expect.

If we put on our slightly more optimistic glasses, without getting excessive, an increase of 5 cents per share would entail a growth of 5.6%. This is exactly at the midpoint and would mean a still conservative 78% payout ratio if the company were to achieve this middle-of-the-road EPS for 2022. The Board does have more to play with, but I do not expect them to go for the maximum possible amount for two reasons: 1. Nobody expects them to come up with a bumper increase, and 2. There are a number of uncertainties relating to the macro economy and the tobacco market so it would be prudent to have some headroom left.

My prediction is therefore for an increase in the dividend of 5 cents per share per quarter for a new quarterly dividend of $0.95.

Risk Factors

A major risk is one I have written about above, namely further troubles and write-downs relating to the infamous Juul investment. On the positive side, there is little left to write down so this pain is mostly historic. But Juul is not the only one, there’s also Cronos (CRON), which was written down by $0.06 per share in Q2. On the bright side, the investment is relatively small so it will not really move the needle going forward. Another risk is the pretty steep decline in smokable volumes. The company needs to emerge as one of the leaders in new non-smokable products such as nicotine pouches and heat-not-burn devices. The IQOS deal with Philip Morris doesn’t really seem to ever materialize. Lastly, if inflation is here to stay eating away at people’s wallets, Altria runs the risk of people permanently leaving Marlboro for lower-cost products such as Edgefield.

Current Valuation

I like to always look at the company and its fundamentals first, and then look at valuation. But I always do look at valuation before making an investment decision. I also like to compare it with peers in order to see if the company I’m looking at deviates a lot from the others. As peers, I’ve chosen two companies with a strong presence in the U.S. market, namely British American Tobacco (BTI, OTCPK:BTAFF) and Imperial Brands (OTCQX:IMBBF, OTCQX:IMBBY).

| Altria | British American | Imperial Brands | |

| Price/Sales | 3.9x | 2.7x | 2.1x |

| Price/Earnings | 9.5x | 9.3x | 7.8x |

| Yield | 7.9% | 6.9% | 7.8% |

Source: Seeking Alpha

Altria is the most expensive when it comes to Price/Sales with Imperial Brands the clear winner. When we look at Price/Earnings the picture is the same with Imperial the clear winner and British American and Altria very similarly valued. As for the dividend yield, finally, Altria managed to win a category with its 7.9% yield, barely besting Imperial and beating British American by a full percentage point. Last year the picture was the opposite, an indication that Altria on a relative basis is a better buy today than a year ago.

All of these companies look pretty cheap with a P/E comfortably below the double-digit mark. There are not that many stable companies out there selling for less than 10 times earnings and paying a dividend of almost 8% as in the case of Altria.

As for future growth, analysts expect Altria to clock in an annual EPS growth over the coming five years of 4.7%. This is slightly below the midpoint range of 2022. If we assume no change to the already low P/E multiple and add in the dividend yield of 7.9% we arrive at an expected total shareholder return over the coming five years of 12.6%. This is comfortably above the long-run return of the S&P 500, and you get it from a Dividend King. What’s more, most of the expected return comes from the dividend, which is highly secure. If future EPS growth declined all the way down to 2.1% annually, investors would still attain 10% total returns. And that 2% EPS growth can be achieved through its standard buyback program. For dividend growth investors Altria’s bad news is good news: You now have the chance to get in at an auspicious buy point increasing the chance of high long-term returns.

Conclusion

Over at Altria, there’s been a lot of bad news for years now, the most recent being the blow from the FDA regarding Juul. However, that money is water under the bridge, it’s already lost and is thus irrelevant for investors contemplating getting in now. Even modest growth going forward should secure double-digit returns when you factor in the almost 8% dividend yield. In late August the company is likely to hike its dividend by 5.5%, adding a healthy amount to the already high dividend yield. Conservative dividend growth investors should use this auspicious buy point to add some Altria to their portfolios.

Be the first to comment