Just_Super/iStock via Getty Images

Introduction:

Alteryx, Inc. (NYSE:AYX) is a computer software company. The company’s products are used primarily for data science and analytics, allowing users to quickly analyze and manipulate data. The software is designed to make advanced analytics accessible to anyone, with little to no coding. As Alteryx puts it, “Develop faster results, deeper insights, better decisions, and ultimately, a cultural shift where anyone can drive business outcomes through self-service analytics and data science.”

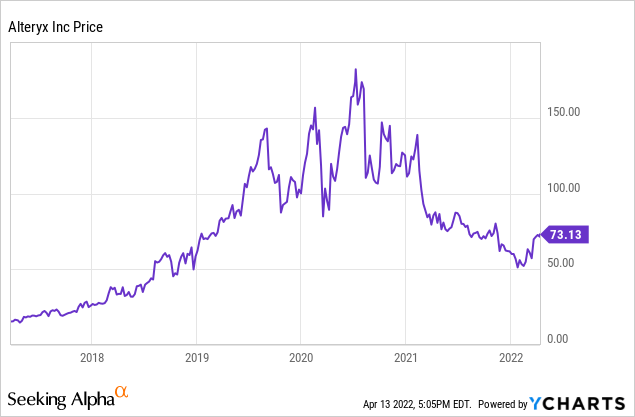

Alteryx IPO’d back in 2017, and here we are already viewing it as a turnaround play. The share price exploded in 2020 on hype and growth, subsequently falling victim to reduced demand during the pandemic. As the below shows, the share price has languished since.

We do not see a systemic issue however. Data analytics is increasingly becoming a necessity for everyday firms, as data is driving growth and efficiencies. Accordingly, firms are racing to up-skill staff as this is no longer an area exclusive to data scientists.

Furthermore, the fundamentals are strong, with a great management team in place. Margins are extremely high, with strong double-digit ARR growth expected. We believe markets are not quantifying the growth of the business correctly, focusing incorrectly on the income statement revenue growth.

With so many tech stocks markedly down from their ATH, there is a real risk that many will be dead money in the medium term. Potential economic headwinds are ahead, but with Alteryx, we see a great business with room to grow at its current valuation. In the medium term, we believe growth can drive alpha as the market begins pricing Alteryx as a 25-30% growth stock again. Thus, we rate Alteryx a cautious Buy.

Is Alteryx even needed?

Why do every-day businesses need to be analyzing data in such a complex way? Is this needed at all? One could argue that the dip in performance in Q2 2020 showed that as businesses begin to struggle, they cannot justify the use of Alteryx.

I would argue that any business which uses Microsoft Excel (MSFT), or an alternative, beyond just data storage would benefit from Alteryx. Data is king in today’s world, and employees are analyzing large data sets using inferior technology. The impact of this is time consuming, laborious activities which could be automated and standardized. Not only that, but businesses are paying consultants to do this for them.

Alteryx, on the other hand, empowers employees to create these analysis workflows, with little to no code, in order to achieve their data solution needs. Training is available, but with the power of the internet, many workflows can be directly downloaded and shared.

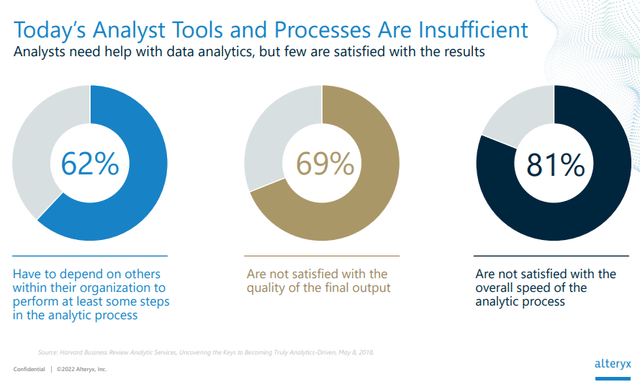

Alteryx’ research has found over 60 billion hours of time is wasted on repetitive, manual work in spreadsheets. This translates directly into expenses which management is incentivized to eliminate. Not only that, but the analysts themselves are not happy with the current processes, as the following shows.

Analyst market research (Alteryx Q4 deck/Harvard)

Therefore, we believe there is a genuine use case for data analytic tools within a business’s operations due to the level of work that can be automated. This suggests strong growth over time is likely, given the lack of data analytic in use currently.

Data analytics industry

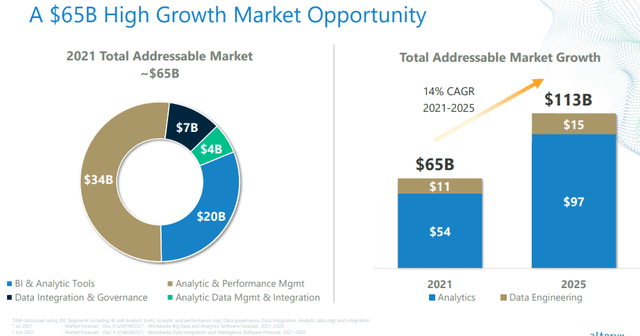

Data analytic services have historically been provided by data scientists. With the recent democratization of these services, we believe the market will now have greater growth, although difficult to quantify. Alteryx estimates their TAM (total addressable market) to be in the region of $65 billion. With their 2021 ARR at $638m, there is significant growth remaining.

Total addressable market (Alteryx 2021 deck)

Who are Alteryx’ competitors?

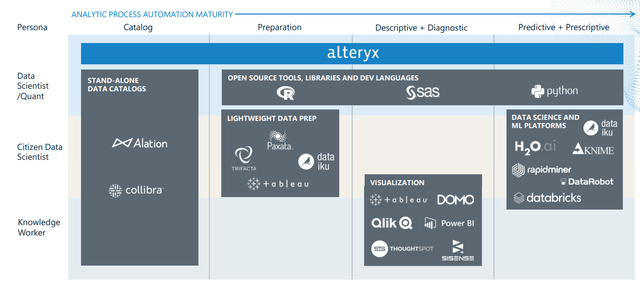

What makes Alteryx unique is its ability to allow simple data preparation and analysis, while also having more sophisticated analytics available, such as machine learning. All of which is offered on an easy-to-use platform.

When we look at the market, we see a host of businesses offering specialized software, catering to a specific use case. The following table illustrates this.

Analytics market (Alteryx Q4 Investor Deck)

To those who say Alteryx has many competitors, this cannot be disputed. However, how many businesses can do everything Alteryx can? Not many. Therefore, for those firms looking for a more general all-in-one data analytic tool, Alteryx is their best option. As we have established, the number of these firms is increasing quickly. Alteryx’ biggest competitor is arguably Microsoft Excel, which is inferior in the data analysis space.

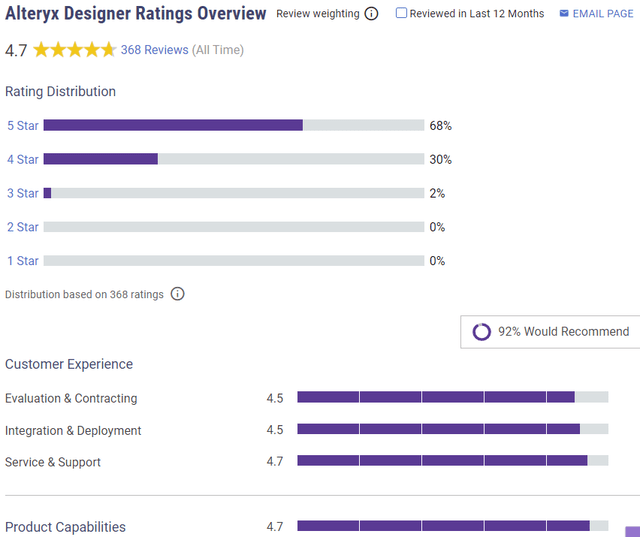

Furthermore, Alteryx’ reviews are unanimous.

Garter 2022 Alteryx reviews (Garter)

Clients are extremely happy with the service and are bordering on fanatical.

Consequently, Alteryx is within a competitive market but is unique in its offering. We consider it a market leader in data analytics.

Economic considerations

Q2 2020 is only the second quarter in which Alteryx did not grow, year-on-year. This suggests Alteryx is sensitive to economic conditions, as GDP growth within the US was the worst in a decade. The reason this is important is because we are currently experiencing a period of monetary tightening, as western economies look to rein in inflation. If this is not balanced correctly, there is a risk that we may face another recession in the short term and, at the very least, reduced demand. The yield curve, which is seen as a leading recession indicator, inverted recently. Should a recession occur, it is likely Alteryx’ growth will stagnate slightly, until demand picks up.

Having said this, revenues were still up in 2020. This suggests that the impact was not as significant as the share price drop suggests. The reason for this is likely due to their ability to retain clients. Once on board, it would be difficult to untether their processes from Alteryx.

Therefore, we believe there is material uncertainty around economic growth in the short term. We argue, however, it is unlikely that Alteryx will lose a noticeable number of clients, just observe a reduction in growth. So, we must consider if the current valuation compensates for the economic risk ahead.

New leadership

Alteryx’ leadership team has changed significantly since October 2020, when founder/CEO Dean Stoecker stood down. As we noted above, this was a time of great difficulty for Alteryx, with performance waning. The objective was to quickly get revenue growth back to expected levels, and continue to improve the product offering. Their execution looks successful, with ARR growth back to 30%. When we dig deeper, we believe management has been making extremely shrewd decisions, safeguarding the long-term competitive advantage of their offering.

First, they have been expanding into cloud services. This is important, as their offerings did not have any cloud integration, which is critical for many businesses. Further, in order to fast track this, Alteryx acquired Trifecta. This business has been operating on the cloud for several years and so capabilities can be leveraged. Most significantly of all, Suresh Vittal has been appointed the company’s Chief Product Officer. Suresh previously served as VP within Adobe’s (ADBE) Experience Cloud division, and so has a proven track record of developing one of the largest cloud based services.

Second, management has forsaken greater revenue certainty, via long-term contracts, by moving clients to one-year contracts. The issue with the previous model was that Alteryx would offer discounts, as large as 30%, in order to secure these deals. This however went against the identity of Alteryx. If the software was so beneficial once the workflows were built, why would a discount be given for the later period of time when the client would benefit? In changing this, Alteryx has lost very few clients, but can now earn more on average and can potentially up-sell every year.

Therefore, we believe management is showing a clear direction, with their key KPI suggesting improvements in performance. All M&A activity has been in order to improve the quality of their offering, rather than to acquire growth. Further, better commercial decisions are being made, which should maximize the performance of the company.

Analysis of Alteryx’ financials

Alteryx’s performance was strong in 2021. Revenue growth, however, was lackluster, at a measly 8.2%. ARR, on the other-hand, was $638m, implying growth of 30% YOY. Revenue growth is fairly useless as a metric compared to ARR growth as, due to their move from long-term contracts to short, the accounting standards mean revenue growth is understated. Alteryx does do a fantastic job of illustrating this on pages 34 and 35 of their investor deck. 30% growth is incredibly impressive, and puts Alteryx in the top tier of tech businesses.

Furthermore, Alteryx’ gross profit margins have remained consistently in the 90% region, which is best-in-class within its industry. The vast majority of this will subsequently flow into profits, as their largest expense is S&M.

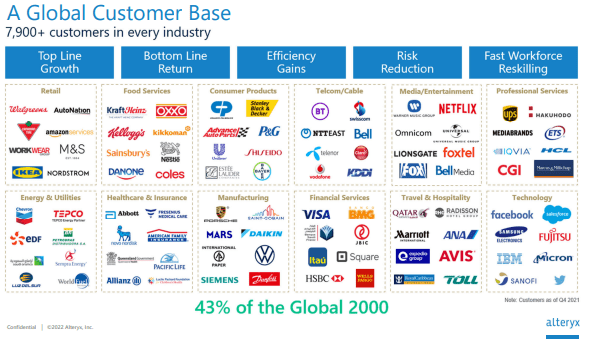

Customer count has increased 11% to 7.9k. Alteryx continues to expand its offering to a wide range of businesses, offering trials in order to entice sales.

Alteryx’ clients (Alteryx Q4 Investor Deck)

This is their proof of their mission’s success. The fact a British up-market retailer, M&S (OTCQX:MAKSF), and a US social media business, Twitter (TWTR), can both use Alteryx to benefit themselves shows that this can be used by anyone.

What is problematic, however, is their DBE rate change over time. It has fallen from 128% in 2019 to 119% in 2021. Although this is still an impressive amount, it suggests growth is slowing in spite of these new customers. As the business is fundamentally changing for the better, with their expansion into the cloud, it is too early to raise the alarm bells. Our expectation would be an improvement in 2022. If this does not occur, we would consider this a serious issue, as Alteryx has had multiple years to improve this.

Management is guiding $810m in ARR for 2022, suggesting growth of 27%, while guiding 32% growth in revenue. This is a respectable number when we consider Alteryx’ average contract duration will further decline and lead to revenue catching up to ARR. This may act as a catalyst to wake markets up on Alteryx’ growth.

Overall, we are impressed by Alteryx’ financials. Its growth has been strong, and their profitability is market leading. This said, there is real uncertainty as to whether growth will continue at its current rate. If it does not, this will have a material impact on the attractiveness of the business.

Valuation

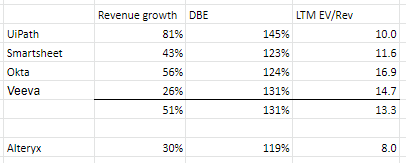

As we have mentioned, there are not many directly comparable businesses. Alternatively, we have looked at software businesses growing at a similar rate.

Comparable companies (Tikr Terminal)

What we see is that most businesses are growing faster than Alteryx, but are also considerably more expensive. We have taken the LTM EV/Revenue valuation due to greater economic uncertainty in 2022. Our belief is that Alteryx should be trading at a discount, but not by almost half.

It is difficult to derive a specific price target, given Alteryx is still loss making and growing at the rate it is. We believe growth can be robust long-term with demand remaining sticky. This should result in an uptick in the share price, reflecting the future profitability of the business. Alteryx should be able to trade in the region of 9-11x its ARR, while it remains in its expansion phase.

Investment risks

Current economic conditions do make us nervous. Should demand begin to contract, there is a real risk that ARR/revenue will follow suit. Management guidance looks strong, but is based on bullish assumptions on the economy. Should this occur, we would potential adjust our view on Alteryx.

Final thoughts

I am an Alteryx user. I can confidently say that it has saved me countless hours and improved the margins on my services. It is truly a revolutionary offering which has the potential to be a upgraded version of Microsoft Excel. That said, a great product does not make a great investment. We are in uncertain economic times which has the potential to materially impact the outlook of Alteryx. The valuation however is attractive, and importantly, we believe that Alteryx can maintain sustained growth long-term. We rate Alteryx a cautious buy.

Be the first to comment