vchal/iStock via Getty Images

Introduction

It’s been a while since I’ve covered a mining company on SA, so today I’m taking a look at Alphamin Resources Corp. (OTCPK:AFMJF). It’s a tin miner that currently accounts for about 4% of global production. I wrote two bullish articles about the company in 2019 (most recently here) despite technical issues at its mine and high stock dilution. Today, I think Alphamin is in a strong financial position after repaying its debts in 2021 and finishing Q4 2021 with record EBITDA of $74.3 million.

However, it seems that a significant part of the company’s strong performance over the past year can be attributed to record tin prices resulting from supply chain disruptions. I think this could be a good time for investors to trim or close their positions as tin prices are likely to come down to $20,000 per tonne in the near future. Let’s review.

Overview of Alphamin’s business and the tin market

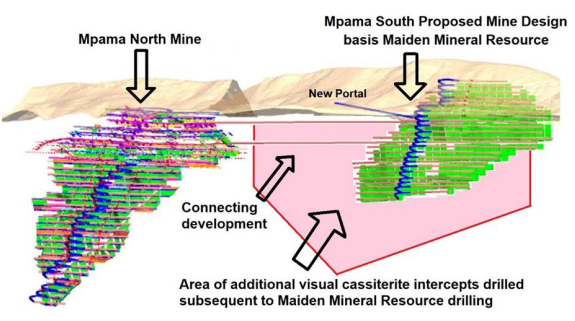

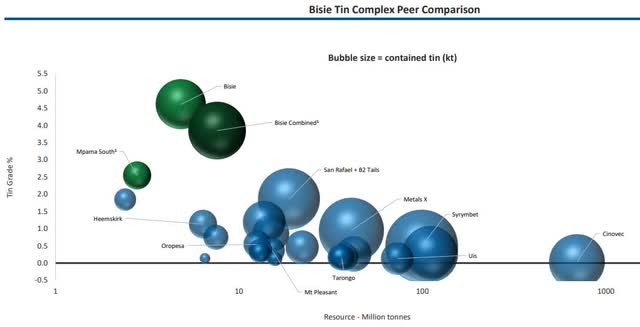

Alphamin owns an 84.1% interest in the Bisie tin mine in the Democratic Republic of Congo, which is among the largest tin projects outside China and Indonesia which dominate the market. Bisie is also the highest-grade tin complex in the world, with its Mpama North deposit containing reserves of 133.4 kt of tin at 4.01% as of December 2019. In 2021, Bisie produced a total of 10,969 tonnes of tin.

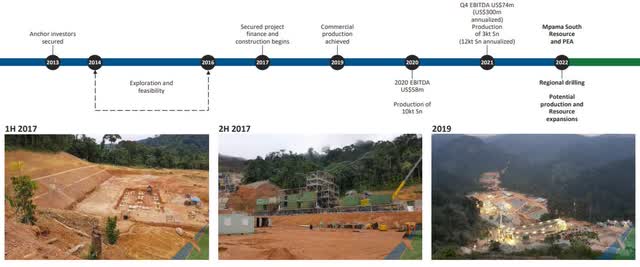

I was impressed that Alphamin progressed Bisie from the exploration to the production stage in just six years. However, this process wasn’t smooth as there were some hiccups along the way, including changing the mining method to cut and fill. With the final stage of the commissioning process delayed, Alphamin was in deep trouble by the time it reached commercial production in the third quarter of 2019 despite a $12 million private placement in April 2019.

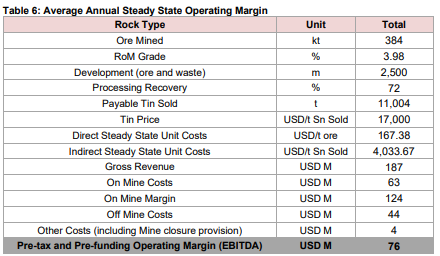

At the end of September 2019, Alphamin had debts of $93 million. However, a new technical report from February 2020 showed that there was still value in Bisie even at $17,000 per tonne of tin as the project would be able to generate about $756 million in EBITDA per year before closing in 2032.

Alphamin

In May 2020, Alphamin closed another private placement for $31 million and after this, the company’s fortunes improved significantly as tin prices started soaring and surpassed $40,000 per tonne in early 2022 due to the rapid growth of economies around the world on the back of easing of COVID-19 restrictions, which boosted demand.

Trading Economics

As you can see from the chart above, we are witnessing tin prices achieving something unprecedented in the last decade. However, tin prices have already declined by over 10% since early March as supply chains are slowly returning to normal. I think it’s reasonable to expect that the price of the metal will return to about $20,000 per tonne once the market is no longer tight.

Alphamin has benefited a lot from high tin prices as they allowed the company to amass a net cash position of $68.2 million as of December 2021 after it closed Q4 2021 with EBITDA of $74.3 million. Alphamin’s market valuation has followed suit and it stands at C$1.54 billion ($1.22 billion) as of March 29. However, I’m concerned that all-in sustaining costs (AISC) were over $15,000 per tonne, which is much higher than the $12,426 per tonne AISC achieved two years ago.

Looking at the capital allocation plans of Alphamin, I think this is a good moment for investors to trim or close their positions. The company distributed a dividend of C$0.03 ($0.024) per share in February 2022, but it seems the majority of its cash position and free cash flow in the near future will go into putting the nearby Mpama South deposit into production.

Alphamin

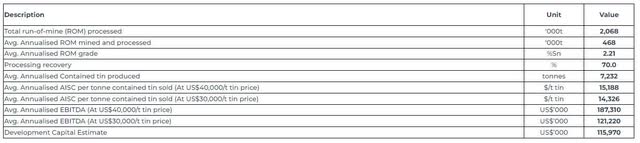

On March 7, Alphamin announced the results of a preliminary economic assessment (PEA) on the latter and I think that the results are underwhelming. The project is expected to produce 7,232 tonnes of tin per year at AISC of $15,188 per tonne, which isn’t far off the costs at Mpama North. However, the estimated capital development cost is $116 million, and the new mine has a 20-month construction timeline. I expect tin prices to be much lower than $40,000 per tonne by then.

Is it worth opening a short position in Alphamin? Well, I think that short selling any company involved in mining is dangerous as this commodities sector is notoriously cyclical and unpredictable. Even if you decided to take a short position in Alphamin, this could be difficult as the company’s shares are listed on the TSX Venture Exchange and the Johannesburg Stock Exchange AltX market. In the USA, Alphamin’s shares trade on the OTC market.

Investor takeaway

I consider Bisie a world-class tin complex and Alphamin is currently reaping strong profits thanks to the record-high prices of the metal. However, I doubt that tin prices can remain this high for much longer. I expect the company’s market valuation to get back to around $400 million when the price of the metal returns to around $20,000 per tonne. The net present value of Alphamin’s stake in Bisie should be close to this number at this tin price.

Alphamin is now betting on the $116 million Mpama South project instead of rewarding shareholders with dividends and share buybacks. I view this as a mistake, as the key financials of this project look good only at today’s record tin prices.

Be the first to comment