Alena Kravchenko/iStock Editorial via Getty Images

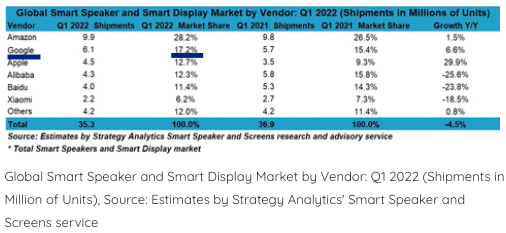

Alphabet ((NASDAQ:GOOG)(NASDAQ:GOOGL)) has performed very well in the smart speaker segment over the last few quarters. A recent report by Strategy Analytics shows that Google is able to defend its market share against Apple (AAPL), Amazon (AMZN), and other competitors. The smart speaker segment is very important for Google and other tech majors because it will lay the path for future smart home devices and helps build a positive ecosystem for products and services of the company. The smart speaker segment is still in the growth phase where strong YoY growth can be seen in US and other international regions.

According to the report, Google’s smart speaker sales have already crossed 25 million on an annualized basis. The average selling price of these devices is quite low with heavy discounts offered regularly. The total revenue from smart speaker segment would be less than $2.5 billion or less than 1% of Google’s annual revenue base. However, smart speakers have a strong impact on other smart home device sales and also boost the potential of future services growth through subscriptions.

Most of the market share outside China will be cornered by Amazon, Google, and Apple in the next few years. If Google is able to expand its market share in this segment, it will be a massive boost to the future growth runway of the company in several product and services categories. Alphabet stock is trading at very low P/E multiple and a strong performance in the hardware business can improve the sentiment towards the stock on Wall Street.

Google defending its turf

None of the major players in the smart speaker segment provide detailed unit shipment numbers. This gives greater significance to third-party estimates. One of the recent reports by Strategy Analytics mentioned that Google has been able to increase its market share to 17.2% and unit shipments to 6 million in Q1 2022. The annualized sales for Google in smart speaker segment are over 25 million. The YoY growth in the first quarter was modest due to headwinds like COVID lockdown in China, Ukraine war and higher inflation.

Figure 1: Google showed improvement in market share and unit shipments.

Strategy Analytics

Apple had to stop its HomePod smart speaker product because it was too expensive compared to the offerings of Amazon and Google. It has launched HomePod mini which is still quite expensive compared to Google’s Nest Mini. The initial reports show that HomePod mini is gaining better reception than HomePod. However, Apple is still way behind in terms of cumulative smart speaker units. This segment has a strong loyalty factor because using the same brand of smart speakers within a single household helps in building a more seamless experience. Customers can also choose from a wide range of other Google smart home products that Apple does not provide.

The first quarter is usually the weakest in terms of unit shipments as it comes after the holiday season in most markets. This is also the first quarter when we get a YoY comparison of the performance of Apple’s HomePod mini which was launched in the last quarter of 2020. HomePod mini helped boost Apple’s smart speaker sales in 2021 showing triple digit YoY sales growth in several quarters. However, we can see from the above chart that the YoY sales for Apple have dropped to less than 30%. It is likely that once the core customers of Apple’s products are saturated, we will see a further dip in sales growth of HomePod mini.

All about ecosystem

Google had over $250 billion of revenue in the last fiscal year. The smart speaker segment alone is not going to move the needle for the company in terms of top line or bottom line. However, the real importance of this business should be looked at from the perspective of the ecosystem. Ideally, Google would want more customers to use its services on its own products. This helps the company create better search services and also limits the increase in traffic acquisition cost. In the last quarter, Google paid a staggering $13.5 billion in traffic acquisition cost compared to $75 billion in revenue. This means that TAC was 18% of the total revenues.

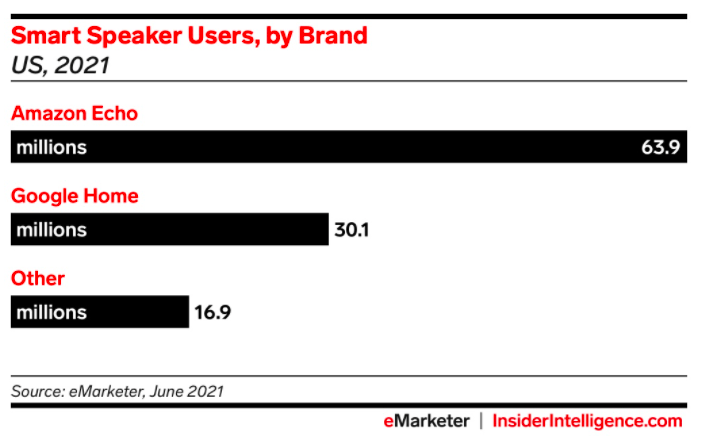

Figure 2: Google’s presence in the smart speaker segment.

eMarketer

If customers end up choosing Google products over other tech giants, it will help Google rein in its TAC significantly. Even if the company does not make any margins on its low-cost products like Nest Mini which are sold for $49, the management would still be pushing for a bigger market share due to the positive impact of these products on its ecosystem and TAC.

There is a gradual move towards selling better smart display systems for home. Amazon has already launched the 15-inch Echo Show 15. Google would likely be entering this space with bigger displays. This should allow the company to improve the sales for its lucrative YouTube Premium subscription. Hence, even if the margins on product sales in this segment are wafer-thin, Google can still monetize the customers through other profitable services.

Google’s Advantage over Amazon and Apple

The smart speaker segment is transforming into a race between three Goliaths. Most of the market share outside China has been cornered by Amazon, Google, and Apple. Due to the rock bottom prices offered by all these companies, it is unlikely that we see another big competitor enter this space. Google has a significant advantage over Amazon and Apple due to its search engine and YouTube platform.

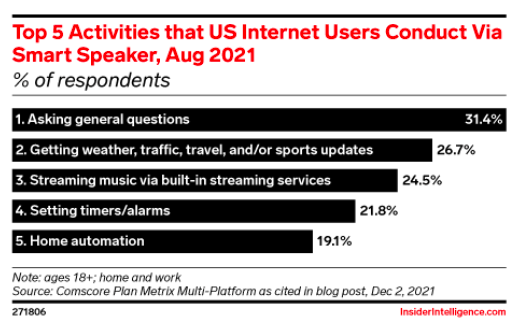

Figure 3: Top activities of users on smart speakers.

eMarketer

We can see from the above image provided by eMarketer that most of the smart speaker customers use the device to ask general questions. Google’s search engine is the best option for this activity and the company is continuously improving its search capabilities through investments in AI and other initiatives.

YouTube Music and YouTube Premium subscription will also improve the sales potential within the smart speaker and smart display market. Amazon and Apple are investing billions of dollars in their respective streaming services. However, the variety of content on YouTube is still significantly better than competitors.

Future growth trajectory

The smart speaker segment is just the tip of the wide range of smart home devices which are interconnected. Google is making a big play in smart display devices by giving discounts on the 7 inch Nest Hub and 10 inch Nest Hub Max. Amazon has recently launched Echo Show 15 as a command center display option through which customers can control all devices provided by Amazon. Google could jump on this bandwagon and provide a similar command center option. The smart home device segment is still in its initial stages and there is a massive growth potential in various categories. Another interesting launch by Amazon has been its home robot called Astro for $999.

Google is close behind Amazon in most of the smart home categories. We should see a big increase in the variety of products launched by Google over the next few quarters. It should be noted that the adoption of these devices is equally strong outside the domestic U.S. market. China has been a leader in the smart devices segment but most of it is cornered by tech giants from China. In international regions like Europe, Latin America, South Asia, and others there is mostly a three-way fight between Amazon, Google, and Apple.

Currently, Google is able to gain a good foothold for smart devices in many international regions. The annualized sales in the smart speaker segment is over 150 million. It is likely that we’ll see a strong growth in this segment as new devices are launched. Higher quality display devices will also help in improving the average selling price, ASP, for this segment.

Even at a modest YoY growth rate of 25%, we could see unit shipments in smart speaker and smart display devices reach 500 million by 2025. If Google retains its market share of close to 20%, it would lead to annual unit shipments of 100 million. This is a staggering number when we look at other products like the iPhone which have annualized unit shipment of 200 million to 250 million.

The trend towards higher definition smart displays should help improve the average selling price for this segment. If Google is able to reach ASP of $200 in this segment by 2025, the overall revenue base could reach $20 billion on annual unit shipments of 100 million. Additionally, Google would also be able to monetize customers through its YouTube Premium subscription.

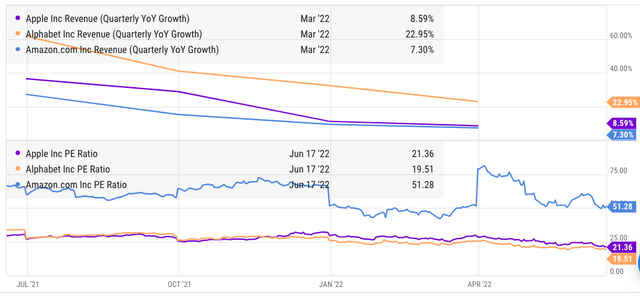

Figure 4: Alphabet stock is the cheapest while showing better revenue growth.

YCharts

The future valuation of Alphabet stock will depend on the ability of the company to deliver progress in products and services outside its core advertising business. Google is already showing strong sales in the smart speaker business. Future product improvements could deliver rapid growth in revenue and also help in giving strong tailwinds to lucrative subscription business.

Despite a massive revenue base of over $250 billion, Alphabet has a number of growth drivers. The company is gradually moving towards improving hardware sales. We can already see good numbers in the smart speaker business. At less than 20 times the P/E multiple, Alphabet stock is quite cheap. One or two hit products in the smart home category can rapidly improve the sentiment towards the stock and give it a more bullish momentum.

Investor Takeaway

Google is showing strong performance in the smart speaker segment as it competes with market leader Amazon – and Apple. Despite the brand image, Apple has not been able to corner a significant market share in the smart speaker segment. If Google continues to increase the unit shipments in the smart speaker and smart home device market, it would help limit the future growth of its TAC. The massive amount of TAC puts a limit on the margin expansion of the company. Even if the smart speaker segment does not move the needle in terms of bottom line or top line for Google, it would help in reducing the future increase in TAC.

The smart device industry is still quite new where customers are trying different products to find an ideal fit for their lifestyle. We should see a massive increase in the quantity and quality of smart products over the next few years. Google already has a significant market share in this segment. If it expands its presence in this category, it can build more bullish sentiment towards the stock.

Be the first to comment