Sean Gallup/Getty Images News

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) reported Q4 2021 last week with revenue coming in 4.4% ahead and EPS 12.3% ahead of Street estimates. Revenue was stronger in its primary advertising business with YouTube reporting slightly disappointing results driven by tougher comps. Cloud continues to outperform Street expectations and saw revenue increase 45% YoY in Q4 2021.

Google Ads revenue come in significantly above estimates

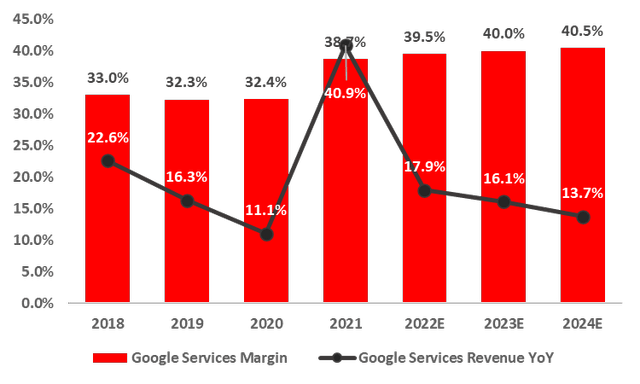

Google Ad revenue increased 33% YoY in Q4 2021 vs our estimates of 28%. The beat was primarily driven by broad based advertiser growth and consumer online activity. Re sectors, management reported strong growth in retail and a bounce back in the travel vertical as the pandemic tails out.

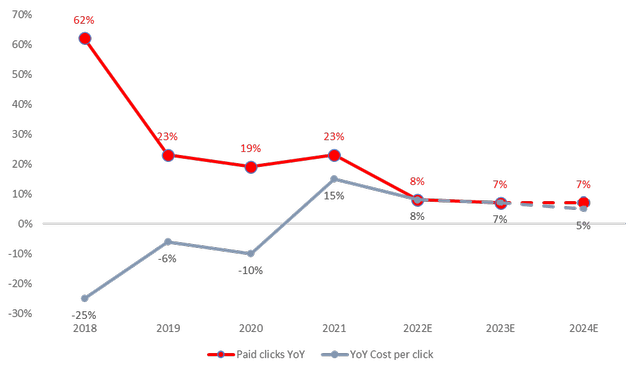

Paid clicks for FY 2021 were up 23% YoY driven by growth in user adoption and increased usage primarily on mobile devices, improvement in ad formats and delivery and increase in ads on Google Play. Cost per click increased by 15% YoY in 2021 underpinning product changes and property mix as well as device and geographic mix (Figure 2 below).

| Figure 1: Google services revenue up 41% as margins expand to 38% in 2021 | Figure 2: Google’s Property sees strong growth in paid clicks and cost per click |

Alphabet filings and AlphaTech estimates |

Company Filings and AlphaTech Equities |

| Source: Alphabet filings and AlphaTech estimates | Source: Alphabet filings and AlphaTech estimates |

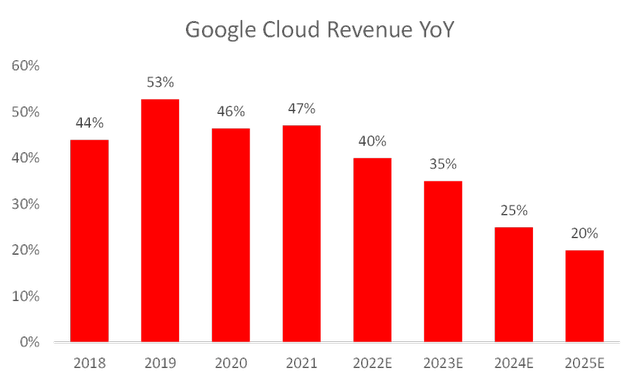

Cloud continues to outperform Street estimates

Cloud revenues came in stronger than expected, accelerating 45% YoY vs our expectations of 40% and consensus at 43% YoY. Interestingly, Google’s backlog increased 70% to $51bn. For FY2021, the tech giant registered 80% YoY growth in total deal volume for Google Cloud Platform and over 65% YoY growth in the number of deals over $1bn.

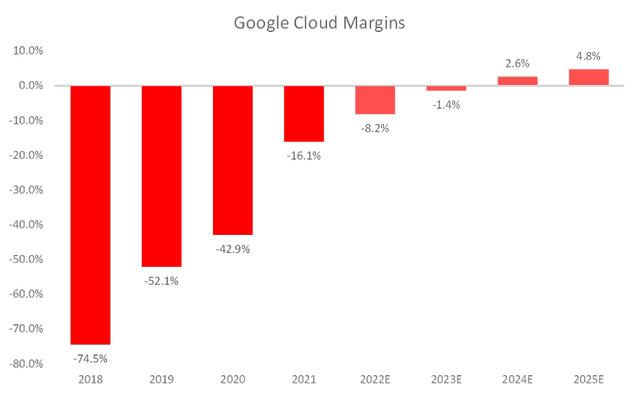

| Figure 3: We expect cloud revenue to grow c.40% in 2022…. | Figure 4: and see margins becoming profit accretive in 2024E |

Company Filings and AlphaTech Equities |

Company Filings and AlphaTech Equities |

| Source: Company filings and AlphaTech Equities estimates | Source: Company filings and AlphaTech Equities estimates |

Cloud margins deteriorate a smidge but long-term trend remains intact.

Cloud margins deteriorated a smidge falling to -16.1% in Q4 2021 from -12.9% in the previous quarter but came in significantly better than -32.4% in Q4 2020. We highlighted in our initiation coverage report previously that one of the key reasons to hold Google over the long term will be the increasing Cloud margins and its significant contribution to EPS growth. However, as the company rolls out its cloud infrastructure which remains relatively in the early stages, we see margins remaining volatile in the short-term. We see cloud margins increasing from -16.1% in 2021 to 2.6% in 2024 (Figure 4 above).

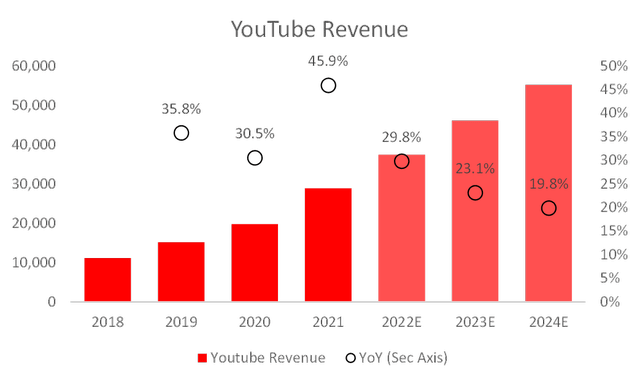

YouTube revenues decelerate driven primarily by strong comps

YouTube revenues climbed 25% to $8.6bn, underpinned by the strength in both direct response and brand advertising. The deceleration in the growth rate vs Q3 21 (43% YoY) was primarily on account of the lapping in strong recovery it registered in Q4 2020.

| Figure 5: We see YouTube revenues growing @24% CAGR over the next three years. |

Company Filings and AlphaTech Equities |

| Source: Company filings and AlphaTech Equities estimates |

We see YouTube revenues continue to grow 24% CAGR over the next three years driven by:

- Higher engagement through Connected TV and YouTube Shorts.

- Higher commercialisation as Alphabet continues to invest heavily in the creator economy and introducing new products making it simpler for advertisers to drive action. Some examples include innovative product feeds and video action campaigns and emerging formats like Live commerce.

20 for 1 Stock-Split should broaden appeal with retail investors.

Alphabet announced a 20 for 1 stock split which should make its shares more accessible to retail shareholders, increasing its appeal and liquidity. This sees it follow the likes of Apple (NASDAQ:AAPL), Tesla (NASDAQ:TSLA) and Nvidia (NASDAQ:NVDA) which had announced stock splits in 2020.

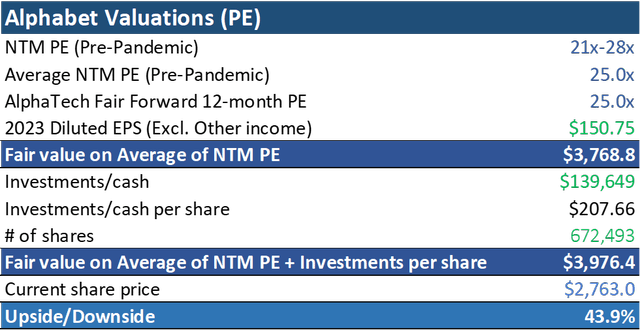

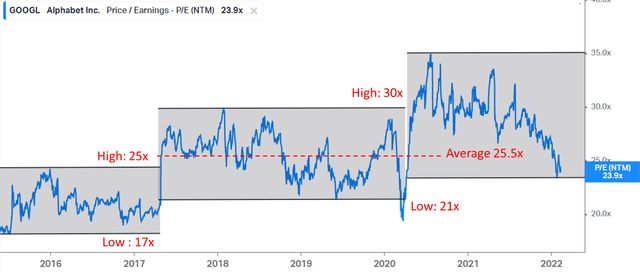

Valuations remain undemanding for social media giant pulling ahead of competition

Currently, Alphabet trades on an NTM PE of 24x which is slightly below its pre-pandemic average of 25.5x. We see shares as undervalued especially when paired with its future growth profile as we see EPS growing 22% over the next year and @20% CAGR over the next three years.

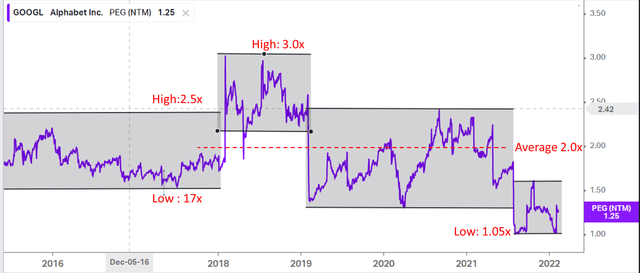

Alphabet trades at PEG ratio of 1.25x, very close to its lowest level in the last six years affording an attractive entry point for the long-term investor.

| Figure 7: Current PEG ratio 1.25x sees Alphabet trade close to its historical lows. |

Koyfin |

| Source: Koyfin |

We see an NTM PE of 25x as fair for Alphabet (in line with its pre-pandemic average), implying a 12-month target price of $3,976 and imputing a 44% upside to its current share price. We reiterate our “Buy” rating on the stock.

| Figure 8: Average NTM PE of 25x imputes a 44% upside to current share price. |

AlphaTech Equities |

| Source: AlphaTech Equities |

Conclusion

We see Alphabet’s valuations as undemanding when compared to its historical levels and derive a 44% upside from its current level on a 12-month time horizon based on a pre-pandemic average NTM PE of 25x. Q4 2021 revenue print was 4.4% and earnings were 12.3% ahead of Street estimates. Cloud revenues came in stronger than expected, accelerating 45% YoY vs our expectations of 40% and consensus at 43%. YouTube revenues climbed 25% to $8.6bn, underpinned by the strength in both direct response and brand advertising but decelerated vs Q3 21 (43% YoY) hindered by tougher comps. Google Ad revenue increased 33% YoY in Q4 2021 vs our estimates of 28% driven primarily by broad-based advertising market strength with management calling out stronger growth in retail and travel. We reiterate our “Buy” rating on Alphabet.

Be the first to comment