alexsl/E+ via Getty Images

Shares of Alnylam Pharmaceuticals (NASDAQ:ALNY) surged last month after the company reported positive topline results from the APOLLO-B trial of Onpattro in ATTR amyloidosis patients with cardiomyopathy. The trial met the primary endpoint and showed favorable safety data and the company intends to submit the supplemental NDA to the FDA by the end of the year. The company shared detailed data this month, but the results do not look convincing enough to threaten the leadership position of Pfizer’s (PFE) tafamidis (Vyndaqel) which is an oral treatment option, and which has long-term outcomes data.

However, the safety data are trending in the right direction and the success of the company’s TTR franchise rests on the shoulders of Amvuttra (vutrisiran) anyway. And this is probably the reason the market shrugged off the unconvincing data the company presented this month.

Although I removed Alnylam from our model portfolio last month, I remain bullish on the company’s long-term growth prospects and would be a buyer again on a more meaningful pullback.

APOLLO-B data are not enough to successfully compete with tafamidis

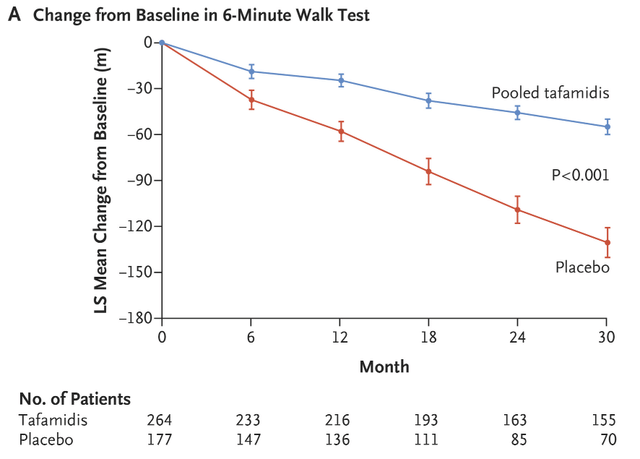

The APOLLO-B trial represented the fastest way for Onpattro to reach ATTR amyloidosis patients with cardiomyopathy. That is why Alnylam used the 6-minute walk test as the primary endpoint because getting outcomes data would take much longer.

The trial met the primary endpoint by demonstrating a statistically significant difference to placebo on the 6-minute walk test. We did not know the absolute numbers in August when the stock surged to new highs, but the company presented the data in early September and the difference is somewhat underwhelming – patients in the placebo group experienced a 21-meter reduction (worsening) after 12 months and patients treated with Onpattro had an 8-meter reduction.

Cross-trial comparisons are somewhat pointless for an endpoint such as the 6-minute walk test, but if we do this exercise, Onpattro has no advantage over tafamidis as its delta to placebo after 12 months is around 30 meters. But if we look at the data, we can see why the comparisons are pointless – the placebo in Onpattro’s trial did better after 12 months (21-meter decline) than tafamidis’ treatment effect (30-meter decline).

The New England Journal Of Medicine

One could also claim that Onpattro is much better if we look at absolute numbers – an 8-meter decline versus an approximately 30-meter decline for tafamidis after 12 months of treatment.

Either way, I do not believe the 6-minute walk test will lead to treatment decisions in the majority of cases because tafamidis currently has two significant advantages over Onpattro – it is an oral drug while Onpattro is administered as an intravenous infusion every three weeks, and the second and more significant advantage is that tafamidis has positive cardiovascular outcomes data from the ATTRACT trial.

In the absence of outcomes data, I doubt Onpattro can threaten tafamidis’ leadership position in the cardiomyopathy market because the value proposition is not there. But there will be a place for it in the market before vutrisiran arrives as patients are progressing on tafamidis and there could be a place for Onpattro as an add-on to tafamidis.

On the other hand, I do think the data will further strengthen Alnylam’s position in the polyneuropathy market where Onpattro and Amvuttra look like a better option than tafamidis, and that includes the mixed phenotype patients (those that have both cardiomyopathy and polyneuropathy).

This polyneuropathy market is significant for Alnylam and a multi-billion-dollar opportunity as Onpattro’s annualized run rate is already in excess of $600 million as of the second quarter of 2022.

Safety data offer positive read-through to HELIOS-B trial of vutrisiran

The possible, and perhaps probable reason why Alnylam is holding up despite the somewhat underwhelming data presentation earlier this month is the safety data Onpattro generated in the APOLLO-B trial. The safety data offer a positive read-through to vutrisiran’s HELIOS-B trial which will generate very important outcomes data in the cardiomyopathy population.

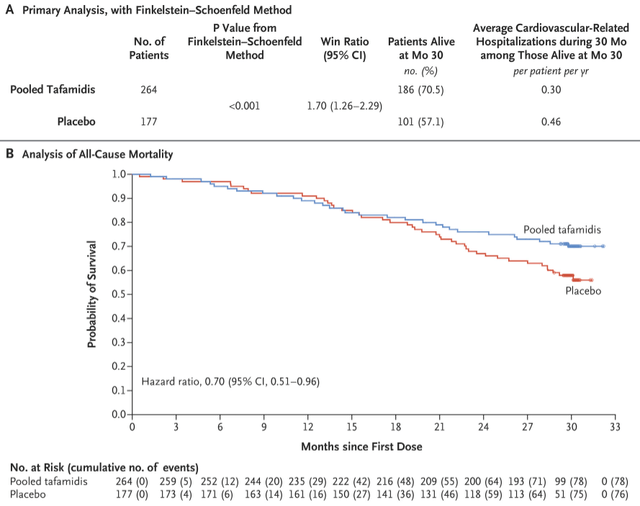

All-cause hospitalizations, urgent heart failure visits, or deaths trended in Onpattro’s favor with a hazard ratio (‘HR’) of 0.839. A hazard ratio below 1.00 indicates a treatment benefit of Onpattro.

All-cause mortality was also in favor of Onpattro – 5.6% of patients in the placebo group died versus 2.2% of patients in the Onpattro arm (HR estimate 0.355).

In addition to safety data trending in Onpattro’s favor, it was encouraging that these trends were observed after just 12 months of treatment. It took much longer for the all-cause mortality curves in the tafamidis trial to separate. A treatment benefit becomes obviously visible only after 20 months of treatment.

The New England Journal Of Medicine

I believe this bodes well for vutrisiran’s HELIOS-B trial which will generate outcomes data in the first half of 2024. The success of this trial would likely make Onpattro obsolete by early 2025 as vutrisiran is a far more convenient treatment option than Onpattro – vutrisiran is administered as a subcutaneous injection every three months, and potentially every six months if data from an ongoing trial are positive later this year, versus Onpattro’s intravenous infusion every three weeks. And the other more obvious advantage would be the HELIOS-B trial which is focused on outcomes versus a 6-minute walk test as the primary endpoint in Onpattro’s APOLLO-B trial.

For these reasons, the safety data from the APOLLO-B trial were more significant than the 6-minute walk test data, at least in terms of the long-term success of Alnylam’s TTR franchise.

If approved without delays next year, Onpattro would only have 5-6 quarters of cardiomyopathy sales before vutrisiran is approved for this indication, assuming the HELIOS-B trial is a success and vutrisiran is approved in the first half of 2025.

Other considerations

We should see additional APOLLO-B data this week at the Heart Failure Society of America, and after this presentation, investor attention should turn to other areas.

The commercial momentum remains solid and should improve with the recent approval of Amvuttra for ATTR amyloidosis polyneuropathy. The improved convenience of Amvuttra should lead to the cannibalization of Onpattro, but also to enhanced growth of Alnylam’s TTR franchise. The company says some patients are on the fence due to the requirement of having to take an IV infusion of Onpattro every three weeks.

The company’s pipeline continues to expand and mature and the key readout in the near term is the phase 1/2 data of ALN-APP in patients with early onset Alzheimer’s disease. This is Alnylam’s first central nervous system (‘CNS’) candidate to enter the clinic and the company’s first candidate with a target outside the liver. This will be early-stage data and I would not expect to see a treatment benefit, but the importance of the data is to show whether Alnylam’s candidates work safely outside the liver and whether and how well ALN-APP reduces gene expression in this patient population.

We should also see the phase 1/2 results of ALN-XDH in healthy volunteers later this year and the biannual dosing regimen data of Amvuttra. If Amvuttra can be dosed every six months instead of every three months, this should further improve its convenience and value proposition.

And in 2023, we should see results from two phase 2 trials of zilebesiran in patients with hypertension. The phase 1 results were already good with strong reductions in blood pressure and the phase 2 results should provide additional clinical validation and show how safe zilebesiran is in this patient population as monotherapy and in combination with existing blood pressure medications.

But overall, I would not expect significant share price movements based on these readouts and we will probably have to wait until the first half of 2024 for the most important one – the HELIOS-B results of Amvuttra in ATTR amyloidosis cardiomyopathy.

Conclusion

Shares of Alnylam are holding up well after APOLLO-B data despite the somewhat underwhelming difference on the six-minute walk test, and the likely reason is the relative unimportance of Onpattro for Alnylam in the long run and the importance of the safety data from the trial that point to the success of vutrisiran in the HELIOS-B trial.

I remain bullish on Alnylam’s long-term growth prospects, although the risk-reward does not look attractive enough for the stock to remain in our concentrated model portfolio in the near term.

After APOLLO-B results, the focus should turn to commercial products, primarily the launch progress of the recently approved Amvuttra, and to the earlier-stage pipeline with ALN-APP as the key early-stage readout that should show whether Alnylam’s candidates can reduce gene expression outside of the liver.

Be the first to comment