Comstock Images/Stockbyte via Getty Images

As a recession is looming, a financial stock like Ally Financial (NYSE:ALLY) is a complicated investment to own. The company faces the risk of a recession with consumers less able to pay auto loans, but also an auto industry still struggling to produce enough vehicles to meet demand. My investment thesis remains ultra Bullish on the auto lending firm expanding beyond related loans and not completely loaded up on auto loans due to a lack of vehicle supply.

Big Question

Ally Financial investors face a quandary with the company just coming off reporting near-record numbers for Q1’22. Revenues were a robust $2.14 billion and EPS for the quarter again topped $2 per share.

Despite the financial reporting an $8+ EPS in the TTM period, the stock now trades at just $35. While the economy faces a recession and some financial products face lower demand, Ally Financial focuses on an industry where supplies have been limited and sales restricted.

The company had record net financing revenue, but higher noninterest expenses and provisions for credit losses crimped profits ever so slightly. While other divisions continue to generate larger revenue streams, Ally is still primarily focused on Automotive Finance where elevated used car prices booted loan financing levels despite weak volumes.

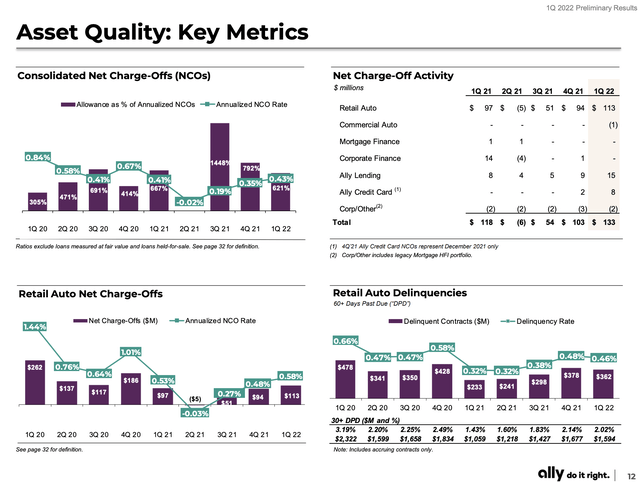

The biggest question is whether credit quality becomes a larger issue. During Q1’22, Ally Financial took a credit charge of $167 million. The company took net charge-offs of $118 million in the quarter, but retail auto delinquencies (60+ days past due) were only $362 million. The 30+ DPD were only 2% of auto loans at $1.6 billion. Both numbers were mostly inline with the delinquency rates of the last couple of years.

Source: Ally Financial Q1’22 presentation

The biggest fear is for the asset quality to have deteriorated over Q2 and for the rest of the year. Ally definitely faces a bigger challenge this year after the federal government helped reduce loan charge-offs in the COVID recession and the company reported Q1’22 results back in mid-April before aggressive Fed rate hikes.

Analysts have only cut 2022/3 EPS targets to the $7.70 range. The stock only trades at 5x forward EPS targets, so these numbers have to be cut substantially for the stock to not be attractive here.

Along with the Q1’22 earnings call, CEO Sean Leary provided some data points suggesting Ally benefitted from a strong quarter even with the challenges:

Despite low levels of inventory and new unit sales, consumer originations were up 14% year-over-year demonstrating the agility and scale of our auto business, allowing us to consistently generate volume at attractive risk adjusted returns. Credit normalization through the first quarter has been in line with expectations and retail NCOs of 58 basis points remained well below pre-pandemic levels. We continue monitoring broader market indicators of consumer health, including wage and price inflation, employment conditions and overall payment trends. While the current inflationary environment will add some pressure to households, consumers are generally well-positioned with healthy balance sheets.

The company continue to report supply chain challenges that left floor plan inventories low suggesting revenues were constrained. Such a scenario could help Ally Financial from facing a pullback in demand in autos, though the mortgage business will clearly struggle.

The business already has aggressive allowances for loan losses per CFO Jen LaClair back on the Q1’22 earnings call:

Allowance for loan losses of 2.63% or $3.3 billion represents over 2.5x our reserve level in 2018 and approximately $700 million higher than our CECL day 1 requirement. Our CET1 level remains elevated at 10% which results in approximately $1.5 billion of excess capital relative to our internal operating target and nearly $3 billion above our SCB requirement positioning us well to support accretive customer growth and capital returns.

On the flip side, the new credit card business saw balances jump 73% to loan balances surpassing $1 billion and Ally Lending volumes more than doubled to $442 million. The numbers are relatively small to an auto lending business with $11.6 billion worth of originations in the last quarter alone. Over time, the credit card business will gain steam.

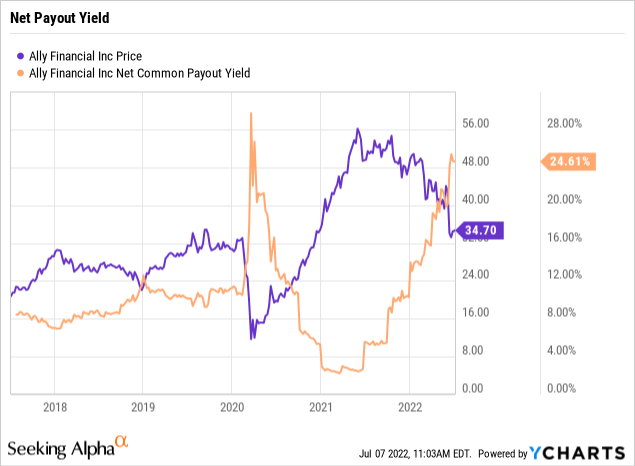

Big Yields

The net payout yield continues to purport a massive net payout yield reaching nearly 25% now. The yield combines the dividend yield recently hiked to $0.30 per quarter and the net stock buyback yield. Due to the recent $20+ dip in the stock, Ally Financial has a massive yield just from the $600 million stock buyback in the last quarter alone.

The company has aggressively repurchased shares and recently had a cash balance of $3.6 billion highlighting the potential valuation discrepancy in the stock. The higher interest rates with the Fed already hiking the funds rate by 150 bps and potentially more rate hikes along with treasury yields used to price auto loans already up, the auto loan market will be volatile. Ally Financial will most likely face higher delinquencies and a mixed picture where a lack of vehicles could keep loan demand strong, but lending tough.

The financial predicted up to $2 billion in share buybacks this year leaving another $1.4 billion this year. With the market cap at just $11.2 billion, Ally Financial could repurchase over 10% of the outstanding shares this year in the period following March.

Takeaway

The key investor takeaway is that Ally Financial appears exceptionally cheap and priced for a recession here having already fallen over 35% from peak prices. The best opportunity is to probably wait until the company reports Q2’22 results on July 19 and right sizes the expectations for auto lending in the 2H of the year. An investor might lose out on some upside gains, but one could avoid a 20% loss like Upstart Holdings (UPST) after cutting Q2 targets.

Be the first to comment