David Ziegler/iStock via Getty Images

As a dividend growth investor, I try to keep up with my watch list of over 100 stocks that I either own or would like to someday hold in my dividend growth stock portfolio.

Not all stocks on my master list are buys at any given time. But it’s important to have my desired entry point in mind for these stocks so that I can seize the moment when they do come down to buyable levels.

One stock that currently looks to be a hold is the electric and natural gas utility Alliant Energy (NASDAQ:LNT), which is a core utility position within my portfolio. For the first time since my previous article last November, let’s discuss the details of Alliant Energy’s fundamentals and valuation to determine why I have downgraded the stock to a hold.

The Dividend Remains Safe

Aside from a stock’s operating fundamentals (e.g., growth outlook and financial condition), I’d argue that dividend growth investors should use two metrics in evaluating the safety of a dividend.

First, Alliant Energy’s 2.66% dividend yield is slightly below the regulated electric utility industry average of 2.89%. This signals that the dividend is likely to continue growing. That’s because a lower dividend yield generally means that a stock is retaining more of its earnings, which acts as a buffer to keep growing the dividend in challenging environments. And it also means that a company is investing more capital back into growing its business, which often translates into growing earnings.

Second, Alliant Energy produced $2.63 in non-GAAP EPS in 2021. Against the $1.61 in dividends per share paid during the year, this is equivalent to a 61.2% non-GAAP EPS payout ratio.

Alliant Energy’s non-GAAP EPS midpoint is $2.74 for 2022 and its slated dividends per share for the year is $1.71. The stock’s non-GAAP EPS payout ratio will marginally increase to 62.4% in 2022.

This is well within Alliant Energy’s target payout ratio range of between 60% to 70% of non-GAAP EPS (according to slide 4 of Alliant Energy’s March 2022 Investor Presentation). That’s why I believe the dividend will grow a bit ahead of earnings in the years ahead. And with analysts forecasting 6.5% annual earnings growth over the next five years, I believe my 7% annual dividend growth rate is reasonable.

Alliant Energy Had An Excellent Year

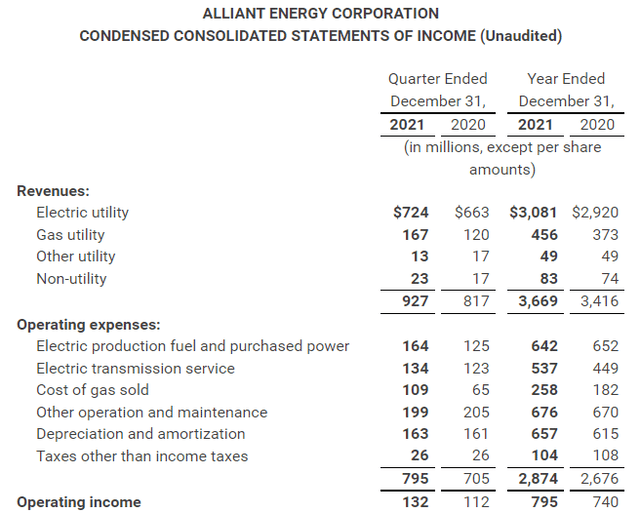

Alliant Energy Q4 2021 Earnings Press Release

Alliant Energy recorded $3.67 billion in revenue during 2021, which works out to a 7.4% growth rate over the year-ago period (details sourced from Alliant Energy’s Q4 2021 earnings press release).

According to CFO Robert Durian’s opening remarks during Alliant Energy’s Q4 2021 earnings call, the company had one of its strongest years of incremental customer growth in the past decade. This was one of the factors that explained Alliant Energy’s solid revenue growth.

The company’s sales to industrial and commercial customers were also up 1% over 2019 levels as indicated by Durian. All the while, sales to residential customers remained modestly higher than 2019 levels per Durian.

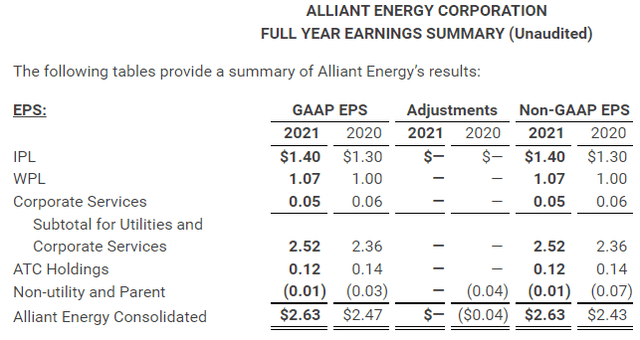

Alliant Energy Q4 2021 Earnings Press Release

Along with Alliant Energy’s higher revenue base, its non-GAAP net margin remained steady at 18% in 2021. This explains how the company’s non-GAAP EPS surged 8.2% higher year-over-year to $2.63 in 2021 (data according to Alliant Energy’s Q4 2021 earnings press release).

Looking out over the next four years, Alliant Energy plans to split $6.1 billion in capital investments between renewable projects, electric distribution, and gas distribution. This is expected to result in 6% annual growth in its projected rate base (figures per slide 11 of Alliant Energy’s March 2022 Investor Presentation), which should also power earnings growth in that ballpark.

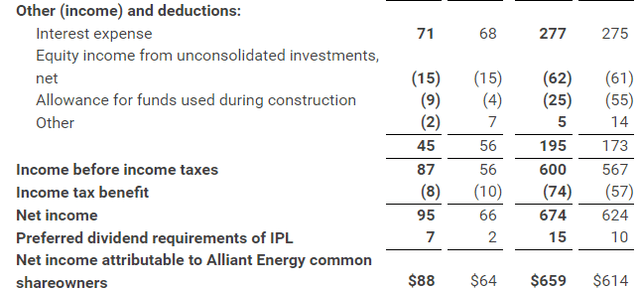

Alliant Energy Q4 2021 Earnings Press Release

And if investors are worried that Alliant Energy may not be able to afford such a significant capital spending program to upgrade its infrastructure and grow its customer base, they shouldn’t.

That’s because the company’s interest coverage ratio improved from 3.1 in 2020 to 3.2 in 2021 (calculations made from data sourced from Alliant Energy’s Q4 2021 earnings press release). This means that the company is profitable enough to withstand a significant economic downturn.

Overall, Alliant Energy is a healthy stock whose fundamentals appear to be intact. That’s why the stock could be a great buy for long-term investors at the right price.

Risks To Consider:

Alliant Energy is a quality stock. But investors need to be aware of the near-term risks that it faces.

The stock’s 6% year-to-date gain is substantially better than the S&P 500 index’s 6% decline over that time. However, Alliant Energy’s stock could underperform over the next year for a couple of reasons.

As I have detailed in my last two articles, the inflation rate in February 2022 surged 7.9% higher year-over-year. This could lead to a greater than anticipated increase in the company’s costs, which could be a drag on margins and earnings until regulatory commissions approve rate requests.

There are other risks to Alliant Energy that are linked to the decades-high inflation rate. On one hand, the Federal Reserve could be too aggressive with interest rate hikes. This could propel the U.S. into a recession, which could hurt Alliant Energy’s commercial and industrial sales. On the other hand, a relaxed approach to rate hikes could fail to curb inflation.

The Valuation Isn’t Ripe For Investment

Investors are best served by insisting on investing in only the best stocks at sensible valuations. I’ll use two valuation models to establish a fair value for Alliant Energy’s shares.

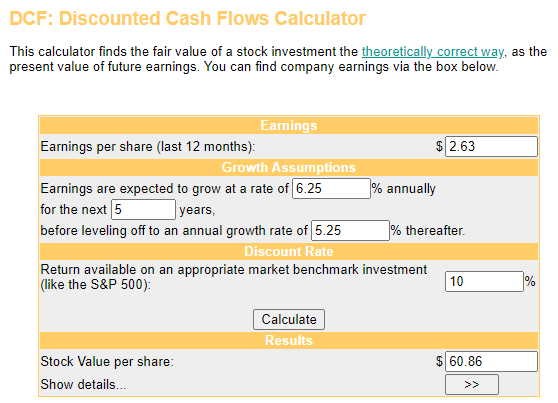

Money Chimp

The first valuation model that I will utilize to estimate the fair value of shares of Alliant Energy is the discounted cash flows model or DCF model, which consists of three inputs.

The first input for the DCF model is earnings over the last twelve months. This amount is $2.63 in non-GAAP EPS for Alliant Energy.

The next input into the DDM is growth assumptions. These must accurately be forecasted to produce a relevant fair value output.

I’ll assume a 6.25% annual non-GAAP EPS growth rate through the next five years and model in deceleration to 5.25% thereafter.

The final input for the DCF model is the discount rate, which is another term for the annual total return rate that an investor requires from their investments. My personal preference requires 10% annual total returns.

Using these inputs, I arrive at a fair value output of $60.86 a share. This implies that Alliant Energy’s shares are trading at a 5.7% premium to fair value and pose a 5.4% downside from the current price of $64.33 a share (as of April 7, 2022).

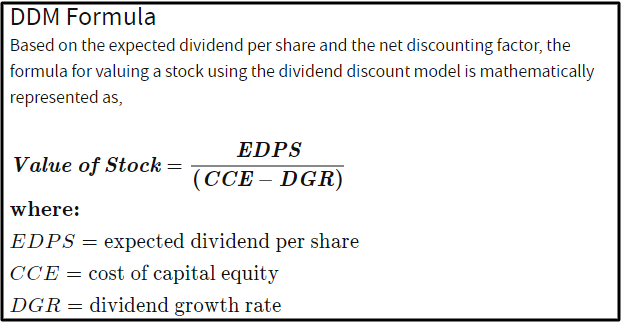

Investopedia

The other valuation model that I’ll employ to gauge the fair value of shares of Alliant Energy is the dividend discount model or DDM, which also has three inputs.

The first input into the DDM is the expected dividend per share, which is the annualized dividend per share. This amount is currently $1.71.

The second input for the DDM is the cost of capital equity, which is simply the annual total return rate that an investor requires on their investments. I’ll again use 10% for this input.

The third input into the DDM is the annual dividend growth rate or long-term DGR.

While the first two inputs into the DDM require minimal effort to retrieve the annualized dividend per share and to set an annual total return rate, correctly projecting the annual dividend growth rate requires an investor to contemplate several elements: These include a stock’s payout ratios (and whether they are poised to remain unchanged, expand, or contract over time), future annual earnings growth, industry fundamentals, and the health of a stock’s balance sheet.

As I alluded to in the dividend section above, I believe that a 7% annual dividend growth rate is realistic.

Factoring these inputs into the DDM, I am left with a fair value of $57.00 a share. This means that Alliant Energy’s shares are priced at a 12.9% premium to fair value and pose an 11.4% capital depreciation from the current share price.

Upon averaging these two fair values together, I compute a fair value of $58.93 a share. This suggests that shares of Alliant Energy are trading at a 9.2% premium to fair value and pose an 8.4% downside from the current share price.

Summary: A Hold For Now

With 19 straight years of dividend increases under its belt, Alliant Energy is just 6 years away from becoming a Dividend Aristocrat. This is a true testament to the stock’s quality. Alliant Energy’s steadily rising earnings and low non-GAAP EPS payout ratio make it almost certain that it will soon become a Dividend Aristocrat.

But the stock’s rally this year appears to have made an already fully valued stock somewhat overvalued. That’s why I will be awaiting a retreat to the upper $50 range before considering adding to my position in Alliant Energy. Until then, I rate the stock a hold.

Be the first to comment