Seiya Tabuchi

Investment Thesis

Alliance Resource Partners (NASDAQ:ARLP) has been on a terrific run of late. And despite it now trading slightly more expensive at 8x next year’s free cash flows, I am still very bullish on ARLP’s prospects.

Not only is the coal market incredibly hot, but I believe that the next twelve months for ARLP could be quite rewarding.

Indeed, investors today are likely to see their cash unit distribution exit 2022 at approximately 8% yield.

What’s more, management hasn’t ruled out adding a variable dividend in early 2023, on top of the fixed dividend.

Simply put, this is a cheaply valued, well-positioned company, that’s paying an 8% cash distribution.

Revenue Growth Rates Coming Up Against Easy Comps

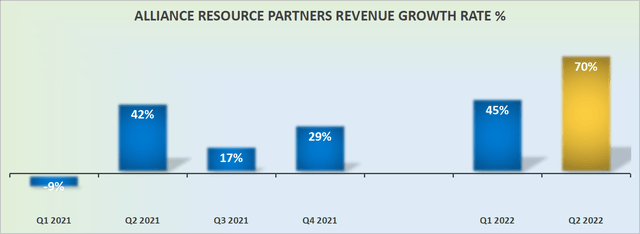

ARLP reported strong revenue growth for Q2 2022. And so what?

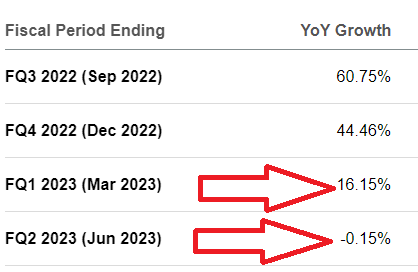

The market is looking ahead now and thinking that while Q3 should be up against a very easy setup, Q4 is now likely to be somewhat more muted. See red arrows, below.

ARLP analysts’ revenue expectation

At least, that’s what analysts are predicting. What’s more, looking further ahead to early next year, that’s when analysts think that the coal party is over.

Now, recall, that earlier in 2022, but after the Russian invasion, analysts were predicting that H2 would see many coal miners’ revenue growth rates mean revert lower. Consequently, the analysts above appear to now indicate that their financial models have simply rolled forward.

And this strikes me as odd. On the one hand, many analysts in the community eagerly believe that most tech companies will be reporting stronger comparables in H1 2023 than in H1 2022.

But at the same time, analysts in the energy sector are typically thinking that a recession is going to dampen the need for energy.

So, which one is it? It can’t be both ways. Either we are going into a recession and the need for energy will fall off a cliff. Or we are not going into a recession, hence the demand for coal is going to remain high.

Why ARLP? Why Now?

In my previous bullish ARLP article, I said,

[…] I contend that while countless analysts still believe that coal usage will turn lower in the coming few quarters, the underlying fundamentals that got us here in the first place are not turning back any time soon.

Indeed, keep in mind that there are two drivers underway that will further support strong fundamentals for H1 2023.

Firstly, during H1 2022 many coal companies had to contend with really poor logistics and restrictive freight availability.

In the second instance, current coal prices in the spot market are not moving down. Hence, coal prices in H1 2023 are likely to be substantially stronger compared to the same period this year.

Altogether, I believe this paints a very favorable picture for ARLP.

ARPL Capital Allocation Program, 7.5% Annualized Cash Distribution

In my previous ARLP article, going into earnings I stated,

[…] it’s possible that in Q2 2022 ARLP will announce a $0.40 distribution per unit.

And lo and behold, ARLP did just that with its recent distribution program. As it stands right now, it’s not unreasonable to believe that ARLP could further increase its distribution to as much as $0.50 per unit.

This would put its total cash distribution at 7.5%. That may not sound like all that much, but that figure is likely to be sequentially increased by 10% to 15%.

So that by the time ARLP exits Q4, its cash distribution will be yielding more than 8%. That’s a very attractive dividend yield, compared with what investors are getting elsewhere in the market.

ARPL Stock Valuation — 8x FCF

As alluded to throughout, investors are looking ahead. More and more investors have come to terms that the elements that led up to this point in 2022, are likely to continue into year-end.

The big question that investors are attempting to come to terms with is what will 2023 look like? I believe that it’s reasonable to assume that 2023 will probably end up in the same ballpark as 2022.

Here’s my assumption laid out. Even if coal prices were to fizzle out in the back end of 2023, at least the start of 2022 should see some of the recent strength continue into early next year.

Accordingly, it’s reasonable to assume that somewhere close to $350 million in free cash flow could be in store for shareholders in 2023.

For this figure, I used the $84 million of free cash flow reported in Q2 and annualized it. Clearly, this is a very crude measure. But I must start my thought process somewhere and extrapolating the previous quarter seems to me to be as good as any other indication.

Indeed, it could be argued that ARLP ends up making much closer to $450 million than $350 million. However, I prefer to leave myself a margin of safety and to be able to sleep well at night.

This puts the stock priced at 8x next year’s free cash flow. This is not as cheap as it once was, but it’s certainly far from overvalued.

The Bottom Line

Many investors have made the argument that energy companies are overbought. And while that could potentially be true, even if I don’t believe it to be accurate, what we can generally agree on is that it’s under-owned.

Simply put, very few investors are willing or able to invest in a coal mine for regulatory, ESG reasons, or other factors.

Hence, this leaves retail investors able to collect on this 8% cash distribution. Oh well, poor retail investors. All alone collecting 8% in dividends while the rest of the market scampers around for 2% to 3% yields.

Be the first to comment