CComber/iStock Editorial via Getty Images

Description

As I stated in my original post, I believe Allego (NYSE:ALLG) is worth much more than it is now. The same argument applies: ALLG provides a very valuable solution/service to the rapidly expanding EV industry. It should do well in the long run if it continues to invest and execute.

3Q22 review at a high level

Third-quarter revenues of EUR 22.3 million were below consensus projections of EUR 38 million, which I believe is due to consensus underestimating the impact of seasonality. That said, management reaffirmed revenue guidance of EUR 135 to 155 million for 2022, which is expected to be driven by fast charging growth, ASP rises, and Carrefour installs revenues.

Third-quarter EBITDA, on the other hand, was in line with projections. I remain optimistic about ALLG’s ability to increase both sales and profits, and the stock is attractive even after taking into account the company’s possible need for more equity.

3Q22 results

Energy sales totaled 37 GWh, based on 2.2 million charging sessions and an average rate of 11.5%. Energy’s sales were unaffected by the slower-than-anticipated EV deliveries (which forced Wallbox (WBX) to lower its 2022 projection); this was due mostly to the rising demand for fast charging, as evidenced by the high utilization rate.

And I keep hearing and reading encouraging things about the ALLG adoption rate. For instance, there was a rise from 22,222 to 22,962 in the number of public AC chargers that were privately held, and there was a similar rise in the number of Fast and ultra-fast chargers that were privately owned. On the flip side, which was rather negative, the number of third-party AC charging ports decreased from 4,770 to 2,959 because a customer who previously used ALLG’s slow chargers migrated to a different network.

Backlog, services, and installs

As for backlog, things are looking well too. An additional 340 fast and ultrafast charging facilities were added to the backlog in 2018, bringing the total to 1,270, with ALLG projecting that it will have installed a third of those sites by 2023.

I’m also looking forward to the expected increase in services and installations in Q4 of this year. Carrefour anticipates a revenue range of EUR 25-30 million for the final quarter of the year. To refresh readers’ memories, ALLG announced a deal in the fourth quarter of 21 to install and manage a network of over 2,000 charge points across France.

Cost inflation

Overall, it looks like ALLG has done a good job of dealing with the cost inflation challenge by locking in hardware costs by securing all necessary equipment through 2023. They have also increased prices by 10% in the third quarter and another 15% in October, in order to increase margin in the face of growing bulk electricity costs. That said, management estimates a delay of 1-1.5 months before any price hikes are finalized and enacted.

Management hopes to increase the percentage of energy expenses protected by long-term PPAs from the current 30% to 50% by 2023. Over time, management hopes to hedge 80 percent of PPA-sourced energy.

Debt

The debt position was not addressed in my initial report; here is an update. In the fourth or first quarter of 2023, ALLG will refinance its EUR 180 million borrowings, creating an additional EUR 130 million in cash and financing some of the CAPEX needed that year. While doing this, ALLG is securing a nonrecourse loan to cover the remaining 2023 CAPEX.

Guidance

Overall sales outlook for 2022 was restated by management at EUR 135-155 million, which would translate to 4Q revenue of EUR 62-82 million. This is much higher than earlier consensus estimates of EUR 54 million. Additionally, management has projected an energy sales volume of 150-160 GWh, which would translate to a range of 41-51 GWh in the fourth quarter alone.

Management has projected a positive adjusted EBITDA for FY2022, with substantial growth anticipated due to lower and more predictable energy prices made possible by planned PPAs. This will increase margins until the middle of next year, after which they will fall back to historical levels by 2024. All in all, The outlook was in line with expectations, calling for EUR 6 million in Q4 to break even for the year, as opposed to the EUR 5 million expected by most.

Valuation

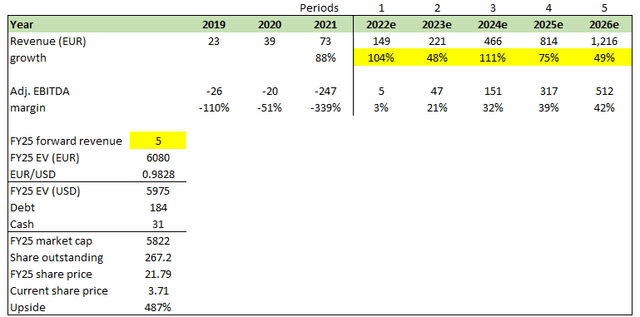

I continue to believe ALLG is worth much more than it is today. There are no particular updates to my model, except a slight increase in FY22 to reflect the new guidance. There are no changes to my price target for FY25 of $21.79, which still represents a significant upside from where ALLG is trading today.

Summary

Even at its present share price, ALLG is still undervalued. In my opinion, ALLG will maintain its position as the market leader in EV charging and eventually come to dominate the industry as long as it maintains its current level of investment in its network of public charging stations.

Be the first to comment