Fertnig/E+ via Getty Images

Investment Thesis

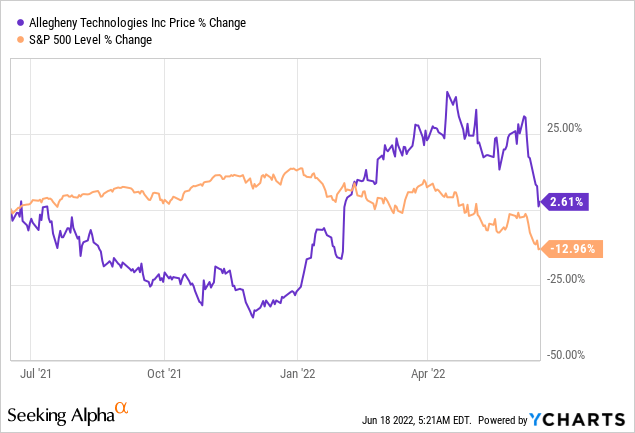

Allegheny Technologies Inc. (NYSE:ATI) is up over 40% YTD when the S&P 500 is almost 23% down while also outperforming the market in the previous 52 weeks. The company has shown robust growth and expects strong results for the year concurrent with the rapid recovery and growth of its primary end-user markets, i.e., aerospace, and energy markets.

The company is exhibiting and expecting strong growth in light of a bullish aerospace market and is relatively undervalued, which makes me rate the stock as a buy.

The Company

ATI manufactures and sells technically advanced specialty materials and complex components primarily for the aerospace & defense, and energy sectors, which accounted for 44% and 19% of the revenue in the MRQ.

The company engages in end-to-end product provision, from cast and powder alloy development to the production of highly engineered finished components, including next-generation jet engine components and 3D-printed aerospace products.

Accordingly, it has 2 revenue-generating reportable segments; the High-Performance Materials & Components segment, accounting for 41% of net revenue and 47.5% of EBITDA, and the Advanced Alloys & Solutions segment, accounting for 59% of net revenue and 52.5% of EBITDA.

Strong Growth Prospects

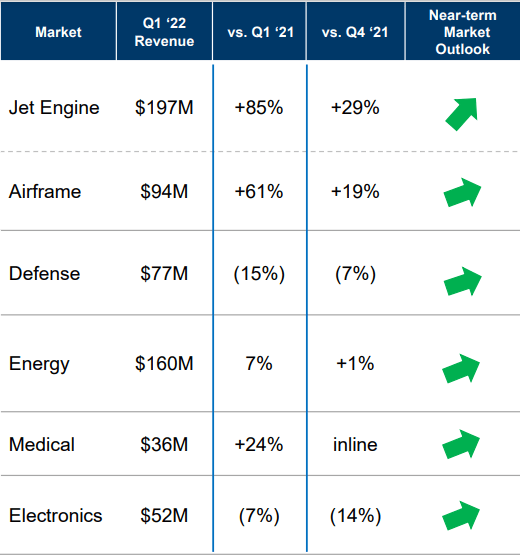

ATI’s net revenue grew by 20% from $692.5 million in Q1 2021 to $834.1 million in the MRQ, primarily driven by an increase of 77% in sales to the commercial aerospace market, including an 85.3% increase in jet engine materials and components.

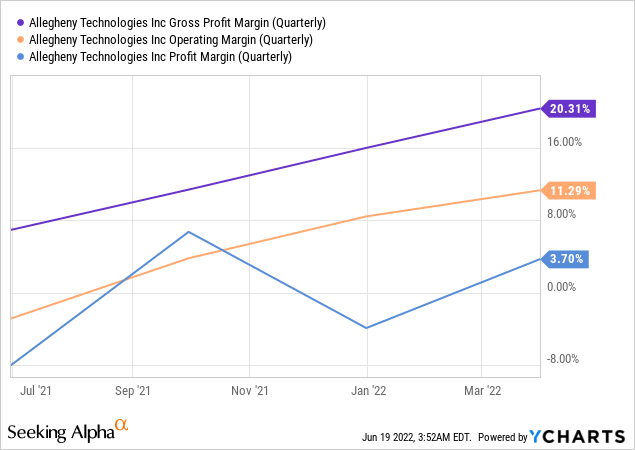

The company’s gross margin of 20.3% for the MRQ is up almost 80% YoY from 12.4% in Q1 2021 because of a strong demand recovery in the commercial aerospace and energy industries. Higher unit sales partially drove the gross margin increase, despite higher raw material costs, due to the recovering end-user markets and aggressive cost-cutting actions taken in 2020.

ATI Earnings Presentation

This improvement carried down the line as the operating margin doubled from 4.6% to 9.2%, including a net loss of $18.3 million from the sale of assets, which included a $25.1 million loss on the sale of Sheffield, UK operation and a $6.8 million gain from the sale of Pico Rivera, CA operations.

ATI also recorded $28.7 million of benefits received from the United States government as part of COVID-19 relief, including $11.2 million under the Aviation Manufacturing Jobs Protection (AMJP) Program and $17.5 million in employee retention credits, primarily for retaining jobs throughout the pandemic-related economic downturn.

Accenture reports that 76% of aerospace industry executives expect revenues to increase within 18 months, while multiple sources, including research & markets and fortune business insights, etc., are bullish on the jet engine market with estimated growth at an average CAGR of almost 10%.

The company is strategically maintaining its inventory levels to accommodate this anticipated demand growth to avoid any shortcomings because of supply chain disruption, etc., and leverage the market growth to achieve a robust topline growth.

Similarly, McKinsey & Company reports that the electricity demand is expected to triple by 2050 because of electrification and living standards growth. These projections indicate that the demand growth for ATI’s largest and fastest-growing segments is expected to be robust in the coming fiscal periods.

In exclusion of the geopolitical factors and inflationary pressures affecting selling prices, the company’s financial performance improvement pertaining to end-user demand growth, sale volume increases, and cost controls presents a prominent signal of sustainable profits and margin growth resulting from core business processes and operations augmentation.

Improving Profitability

Even though the company’s top line growth is expected to be strong and its profitability is improving, the margin improvement needs to be robust as it is currently underperforming its competitors in that area. ATI’s gross margin of 20.3% is noticeably lower than the industry median of 31.85%. Similarly, its EBITDA margin of around 17% and a net margin of 3.7% are also lower than the industry medians of 21.33% and 8.78%, respectively.

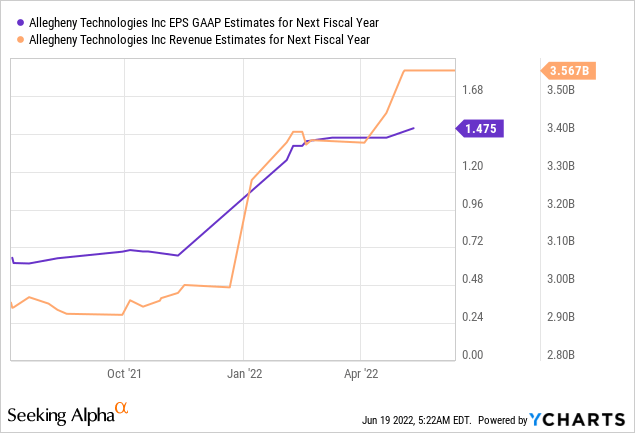

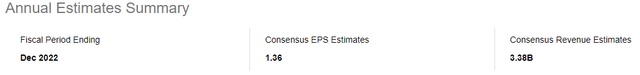

However, the company’s 2022 expected revenue of $3.38 billion shows a YoY growth of over 20%. In contrast, the expected annual EPS of $1.36, which has had multiple upward revisions in recent months, shows a phenomenal growth of over 9.4 times, indicating vigorously improving profitability metrics.

With a forward EBITDA growth rate of almost 40%, a long-term forward EPS growth CAGR of 140%, and a 54.48% forward FCF per share growth rate, the company’s growth prospects and expected margin improvements are indeed strong.

Valuation

The company’s stock is currently trading at a higher price-to-earnings and book ratios than its peers, with a forward P/E of 16.5x and a forward P/B of 3.39x, compared to 10.71x and 1.79x. In contrast, it is trading at a lower forward P/S and P/CF ratios of around 1.01x and 4.72x, compared to the industry medians of 1.21x and 6.14x.

Similarly, due to the lower than industry profitability metrics, its other TTM-based relative valuation metrics, such as EV/EBIT and EV/EBITDA, are also higher than industry metrics. Still, high growth prospects make it substantially cheaper when using the PEG ratio.

Accordingly, using any of these ratios in isolation would be unwise. I prefer comparing company metrics against averaged-out industry medians and the company’s 5-year metrics as a price tag. For ATI, I will be using only the industry median forward metrics, as the financial performance dynamics during 2022 are visibly different than those of prior years because of pandemic-related disruptions.

|

Ratio |

ATI |

Sector Median |

ATI Price per Industry Medians |

|

P/E Non-GAAP |

16.53 |

10.24 |

$ 13.91 |

|

P/E GAAP |

21.7 |

10.71 |

$ 11.09 |

|

PEG Non-GAAP |

0.12 |

1.07 |

$ 200.27 |

|

EV / Sales |

1.31 |

1.42 |

$ 24.35 |

|

EV / EBITDA |

8.93 |

6.2 |

$ 15.59 |

|

EV / EBIT |

13.22 |

9.18 |

$ 15.60 |

|

Price / Sales |

0.82 |

1.21 |

$ 33.14 |

|

Price / Book |

3.39 |

1.79 |

$ 11.86 |

|

Price / Cash Flow |

4.72 |

6.14 |

$ 29.22 |

| Average Price | $ 39.45 |

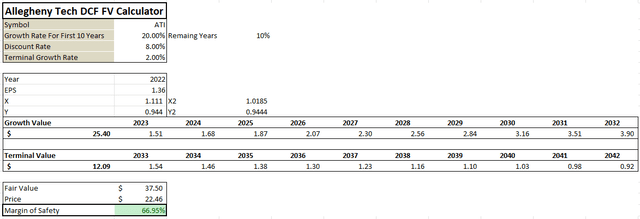

The resultant target price from the method is $39.45, exposing an almost 76% upside. Further, using an EPS-based DCF model, utilizing its forward EPS of $1.36, Discount rate of 8%, terminal rate of 2%, a 10-year growth rate of 20%, and 10% annual growth rate beyond that, a target price of $37.50 is revealed, an upside of almost 67%.

However, this is predominantly predicated on the company achieving its financial performance targets. It appears likely in the current circumstances, given its $2.4 billion backlogs. Still, it may drastically change if the possible upcoming recession halts growth in ATI’s end-user markets, making its backlogs obsolete.

Conclusion

ATI is expected to show robust growth in the coming fiscal periods as demand in its end-user markets has rapidly recovered in 2022 and is expected to flourish in the coming years. The company’s growth and profitability are not a by-product of rising prices but organic growth, achieved through unit sales expansion, indicating strong and sustainable growth.

Apart from being relatively undervalued, I have rated the stock as a buy because, despite the market downturn in 2022, the company is gaining an upward momentum because of improving financial performance in the wake of a recovering aerospace industry and a growing energy sector.

Be the first to comment