Spencer Platt/Getty Images News

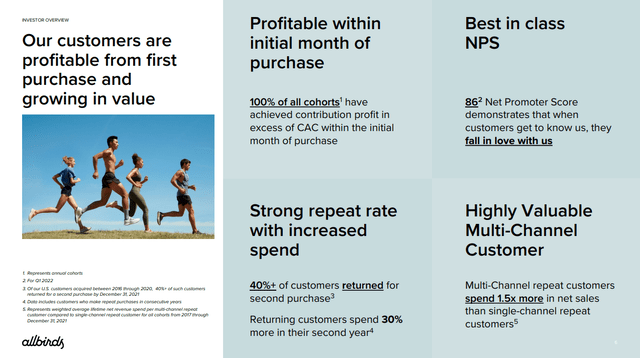

We are rooting for Allbirds (NASDAQ:BIRD) to succeed because its products emit much less pollution than the industry average, and they have a plan to be impact neutral by 2030. Its products and material innovation have also allowed the company to deliver new and differentiated products, and all these while being gentler on the planet. This is reflected in the incredibly high Net Promoter Score of 86 that the company has achieved.

From a commercial perspective, there are also many things to like. For instance, customers are on average profitable from the first purchase, and the company has a strong repeat purchase rate.

Allbirds Investor Presentation

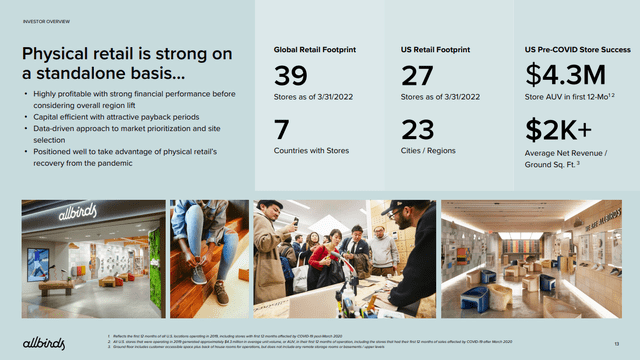

The company sells both direct to consumer online, and through a physical store network that the company is currently building. It sees potential for hundreds of locations in the United States. Its stores have proven 4-wall economics with strong return on capital, and new stores have shown to enhance digital as well. The company sees significant new store opportunities around the globe too.

Allbirds Investor Presentation

In 2021 the company generated $68 million in international net revenue and has been growing since 2018 at an 80% CAGR international net revenue. Some of the main international markets where it operates include Canada, Australia, the UK, New Zealand, China, Japan, South Korea, and the European Union.

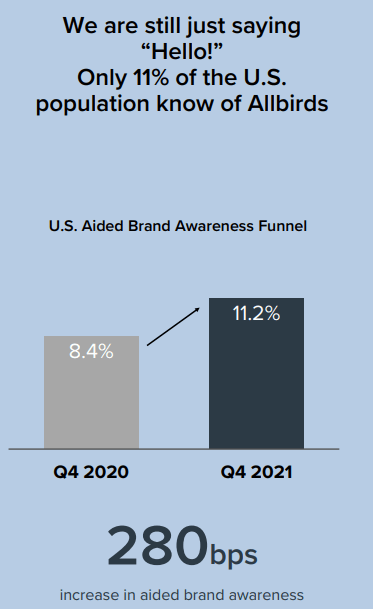

Still, the company remains relatively unknown and with a lot of potential ahead of it. In its most important market, the US, it only has an ~11% aided brand awareness, which means very few people have heard of the brand so far. This is both a challenge and an opportunity for Allbirds.

Allbirds Investor Presentation

Financials

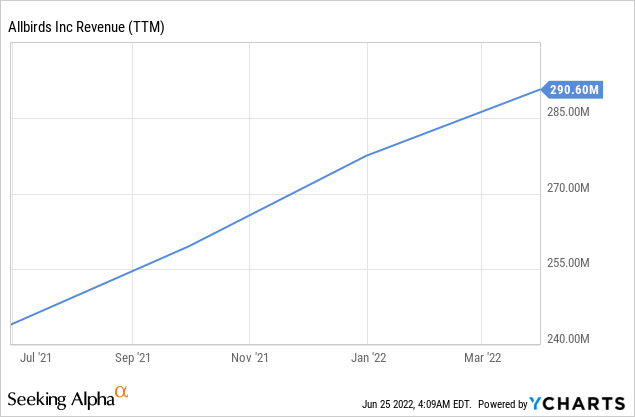

Shares have significantly declined since the company became public, its market capitalization is down to only ~$690 million, and about one third that market cap is in cash and short-term investments. Meanwhile sales have been increasing quickly, and its trailing twelve months revenue is ~$290 million.

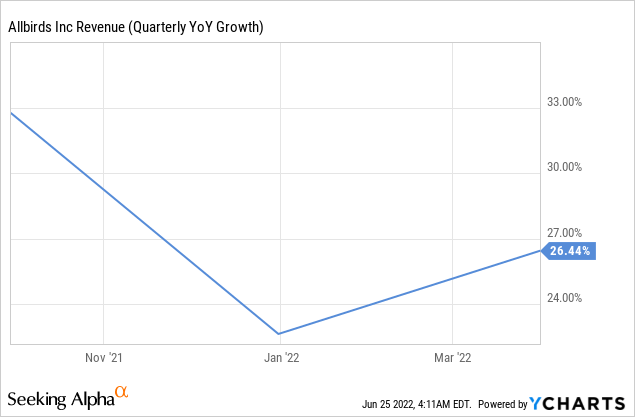

Investors have been disappointed that the growth rate has been coming down, from the 30s to the now high 20s. We believe that as long as the growth rate is sustainable for a long time, and the company becomes more disciplined with cost control, it could still offer attractive returns even at a lower growth rate.

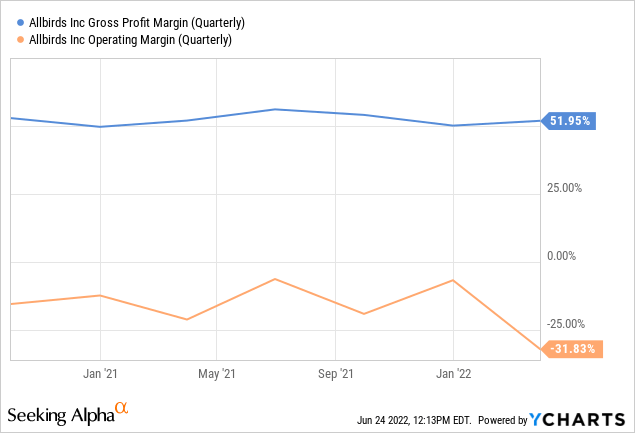

Taking a look at the company’s profit margins, we see a very healthy gross profit margin above 50%, but the operating margin is a scary -31% due to excessive spending. We are also disappointed that we do not yet see any meaningful operating leverage as sales have increased.

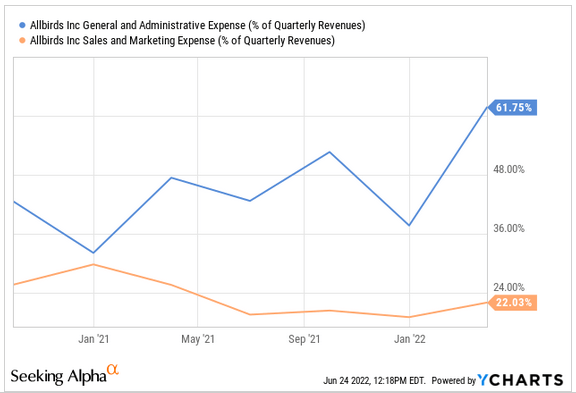

Going into more detail, we see that there is operating leverage in the Sales & Marketing category, with expenses dropping to ~22% of revenues. The problem appears to be the general & administrative category, where expenses have ballooned to ~61% of revenue, something we see as unsustainable. It is likely that the company is making early investments into expansion that are yet to pay off. In any case investors should monitor G&A as a percentage of revenues very closely to see how it trends in the future.

YCharts

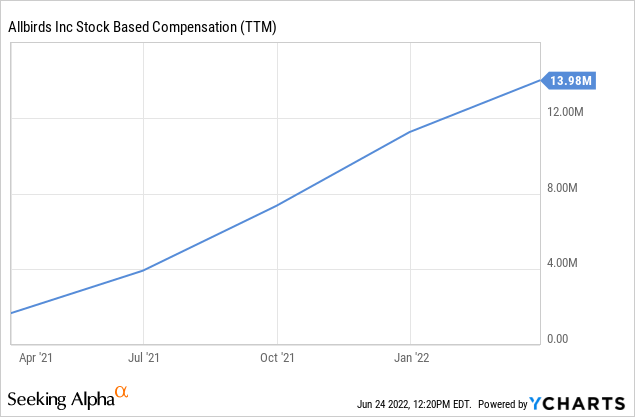

Another expense to monitor closely is stock-based compensation, which has been increasing at a rapid pace, and which is an expense that we think should not be added back when calculating adjusted EBITDA, even if most companies do so.

ESG

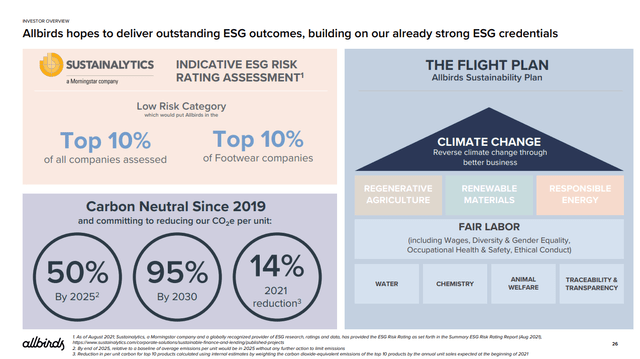

Many investors will find a good reason to invest in Allbirds to support its important sustainability mission. The company estimates that if all shoes produced in 2019 had the same 30% lower carbon footprint as Allbirds, the industry would have saved in CO2 emissions the equivalent of taking 21 million cars off the road.

The company also seems to treat its employees very well, since it has one of the highest Glassdoor scores we have ever seen at 4.5 stars and 100% approving of the CEO. The company also has top ratings from ESG rating organizations like Sustainalytics.

Allbirds Investor Presentation Glassdoor.com

Valuation

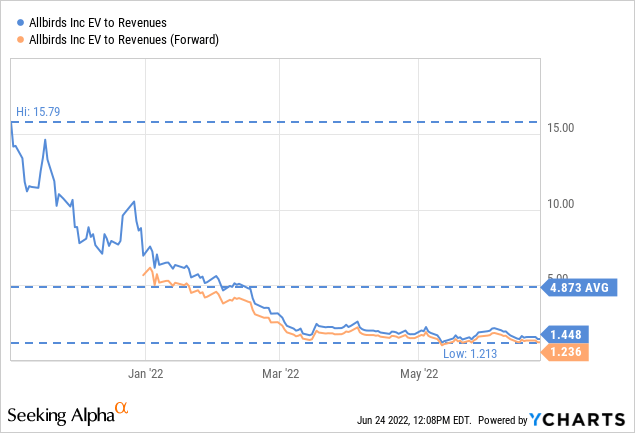

If the company manages to control costs enough to become profitable, we can make a case in favor of the company’s valuation. It is currently trading at an undemanding ~1.2x forward EV/Revenues, but this won’t mean much until the company becomes profitable. Fortunately for the company, it has enough cash to finance losses for many quarters while it optimizes its business model and gains scale, and hopefully it will be profitable before it runs out of cash.

Risks

We do not see any immediate risks, as the company has a significant amount of cash on its balance sheet, but longer-term we see a big risk of failure if the company does not control costs in order to become profitable.

Conclusion

Allbirds is a company we would like to see succeed given its mission to bring sustainability to the shoe industry. Shares look cheap trading with a low EV/Revenues multiple, and with the company still posting decent revenue growth rates. This will all mean very little, however, if the company does not become more disciplined in controlling costs. Fortunately for the company it has enough cash on the balance sheet to operate at a loss for some time, but we sincerely hope that it become more disciplined with its expenses in order to achieve profitability soon.

Be the first to comment