maybefalse/iStock Unreleased via Getty Images

Investment thesis

My recent articles on Alibaba Group (NYSE:BABA), like many other articles on Seeking Alpha, have focused more on its risks and ways for risk control. In particular, I wrote about:

- How the horrendous uncertainties surrounding BABA are comparable to those faced by American Express during the salad oil scandal

- How potential investors could use a long call option to limit their risks in terms of the total dollar amount exposed

- How a Kelly assessment can help map out the various risks (VIE, delisting, et al) for investors to make an informed bet tailored to their risk appetite.

In this article, I want to shift the emphasis to its valuation because my view is that its risk profile has become much more moderate given Beijing’s recent announcement to support the market. And the thesis is that, under its current valuation, BABA has become close to an asset purchase. Currently, more than 33% of its market cap is in its current assets, and almost 55% in current assets, properties, and equity investments. With its China commerce raking in more than $90B of sales per year, the current valuation is equivalent to A) purchasing its equity at book value, B) paying for its China commerce operation at about 1.6x sales (Amazon is valued at about 3.5x sales in contrast), and C) getting all its other operations for free.

Looking forward, it will only get even closer to a pure asset purchase in the next few years. My analysis projects it to become 100% of an asset purchase by 2025 even if it simply hoards cash from now on.

In the nearer term, BABA investment is further protected at this point by the following two catalysts:

- Its share repurchase plan. It just upsized the repurchase program to $25B from $15B, almost 8% of its current market cap. Such a sizable repurchase, at its current undervaluation, will be very effective and accreditive to boost shareholder returns.

- Beijing’s vows to stabilize the market and stimulate the economy provide another protection, essentially serving as a China Put.

The China Put

First, if you are reading this, you already know that there are tremendous risks and uncertainties associated with BABA. As you can see from the chart below, its stock price has recently become dominated by market sentiment and fluctuated widely. Its stock prices easily fluctuated 30%+ in a few days or even a single day recently in response to news and sentiments changes. As a recent example, an announcement from the SEC on Mar 10 identified five Chinese as potential delisting candidates. And BABA’s price dropped from $93 on Mar 10 to a bottom of about $75 (an almost 20% drop) in the next three trading days even those the SEC’s list did not include BABA. It is of course impossible to identify if the SEC announcement is the cause for the drop (or is the sole cause). But it nonetheless illustrates the volatility and wide swing of market sentiment surrounding BABA.

My view is that now the negative market sentiments may have reached their extreme and now begins to turn. A key event was that Beijing announced its support pledges on Mar 16 to stabilize the market and stimulate the economy. And you can see from the following chart that BABA stock price rallied by almost 37% during that single day (and not the large trading volume on that day too). Its rally kept going afterward. And the current stock price as of this writing is about 50% above the bottom $75 level. I view the China support pledge effectively a put option for BABA investors with a strike price of around $75.

BABA’s assets and liabilities

In addition to the China Put, you will next see that it is very undervalued from an asset purchase point of view.

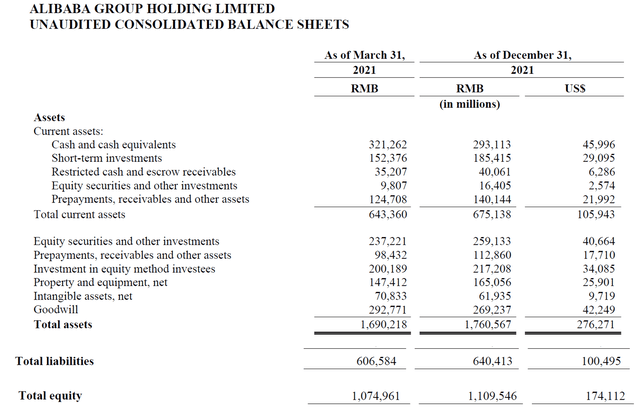

Let’s first take stock of the major items on the balance sheet as shown below. BABA is a conglomerate with many operating business segments (the four major business segments include China retail, China wholesale, cloud computing, and international commerce). But from an asset purchase perspective, let’s only focus on the assets and liabilities, as shown in the next chart.

As you can see, BABA’s total assets are currently $276B and total liabilities are about $100B, leaving about $174B of equity. The main items in the equity are:

- $106B of current assets

- $40B of equity securities and other investments

- $26B of Net Property, Plant & Equipment (“NPPE”)

These three items add up to about $172B, slightly lower than the equity. So for the sake of simplicity and also to be on the conservative side (slightly), this analysis will ignore all the other assets on the balance sheet and will only consider the above three items.

Although let me first point out the uncertainties involved in this asset valuation (or any valuation of complicated assets). The current assets are pretty straightforward. The valuation of the NPPE is less so, but the margin of error should be relatively narrow. The largest uncertainty here involves the equity securities and investments. For those who are not familiar with what’s in the long-term investments: they contain a multitude of investments in a wide range of startups. The biggest one is its 33.3% stake in Ant Financial. It is difficult to estimate the growth potential of these long-term assets. Take Ant Financials as an example. Its private valuation estimation varies in a wide range. During its last fundraising in 2018, it emerged as the world’s most-valuable unlisted tech firm. And it was estimated to be worth $315 billion at the time of its long-anticipated IPO. After the failed IPO, the estimated valuation varied from $150 billion to over $200 billion. For example, Warburg Pincus LLC valued Ant at about $220 billion at year-end based on 2020 earnings and comparable company analysis.

I am optimistic that many of its long-term investments would eventually become unicorns and worth more than what they are now (especially with China’s recent gesture to tune down its crackdown efforts). But given the variance in their estimated valuation and also again to be on the conservative side, this analysis will ignore the appreciation potential of all its long-term investments.

How close is BABA to an asset purchase now?

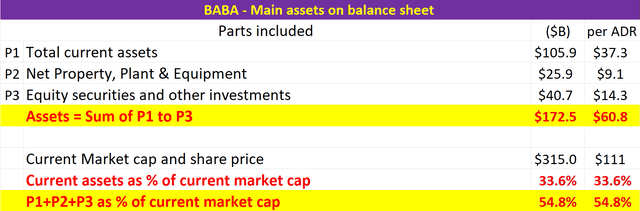

With the above understanding, in the following table, I’ve considered its valuation of the three items mentioned above. As you can see, at its current price, more than 33% of its market cap is just current assets. And almost 55% of its current market price is just current assets, NPPE, and equity investments.

Now, let’s add its operating businesses into consideration. Its total revenue is approximately $135 billion TTM. Its bread-and-butter operation is its China commerce segment, which rakes in more than $90B of sales per year. So its current valuation is equivalent to A) purchasing its equity at book value, B) paying for its China commerce operation at about 1.6x sales, and C) getting all its other operations for free.

In contrast, Amazon (AMZN) is valued at about 3.5x sales. Adjusting for AMZN’s equity won’t make too much of a difference (it would reduce the price to sales ratio to about 3.3x). Because AMZN’s equity is only a small fraction of its current market cap. Its total equity is about $122 billion, only about 7% of its total market cap.

Looking forward, it will only get closer

Many of BABA’s business segments are high-growth and high-margin segments like the cloud computing business. Many readers are (or were) concerned about the regulatory risks. First, these risks are much lower now given China’s recent announcement to support its financial market and stimulate its economy. Secondly, these regulations should not impact BABA’s many business segments (such as its enterprise cloud services, international commerce, digital media, and many of its strategic investments).

As such, I am very optimistic about BABA’s growth ahead. Looking forward, when such growth potentials are considered, BABA investment will only get closer to a pure asset purchase.

As seen from the following chart, it can become almost a 100% asset purchase around 2024 to 2025 by simply hoarding its free cash flows from now on. Note that this analysis is again on the conservative side because it subtracts all the CAPEX expenses – which contains both maintenance CAPEX and growth CAPEX. If a business truly wants to hoard cash, it should only spend maintenance CAPEX, stop spending on growth CAPEX, and hence can hoard cash faster.

This projection is made based on the following assumptions, which we will justify one by one immediately below:

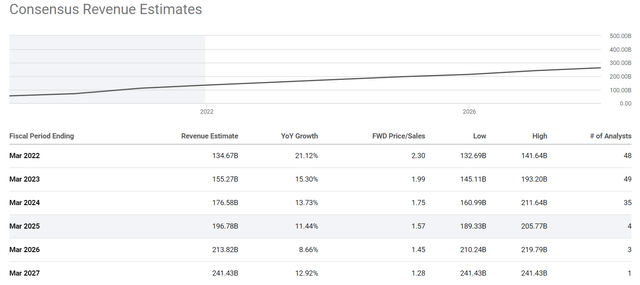

- Sales grow at a CAGR of about 13% in the next few years

- Operation cash flow maintains at its current level of 25% of sales

- CAPEX expenses grow at 7% CAGR

First, let’s examine sales growth. As aforementioned, many of BABA’s business segments are high-growth and high-margin segments immune from the crackdown. And the consensus estimates also show strong confidence in such growth potential. As you can see from the chart below, consensus revenue estimates for the next few years all project double-digit year-over-year growth rates. And the revenue is projected to reach $241 billion from the current level of $134 billion, a CAGR growth rate of almost 13%.

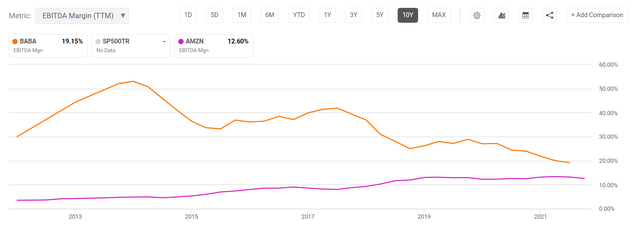

Now onto the margin. BABA’s margin has been declining over the years as the next chart shows. However, comparing it to the margin against Amazon puts things under better perspective. As can be seen, BABA’s profit margin is still almost a whopping 7% above Amazon. And the two have been showing a converging trend to each other, suggesting the ongoing formation of competitive equilibrium and stabilizing margins. BABA’s operating cash flow is currently about 25% of its sales. And with such a converging trend, it is reasonable to assume it stabilizes at this level in the next few years.

What are the risks?

The risks associated with BABA in general (VIE, delisting, et al) have been detailed in my earlier article and won’t be repeated here. Here, I will focus more on the risks specific to the asset valuation approach presented here.

First, this analysis did not include the future installment of BABA’s commitment to the Chinese Government common prosperity fund. It could impact this analysis in both ways. If you consider the commitment to be purely a business expense, then it will make the analysis further away from a net-net deal – but not by that much given that the commitment is about $3.1 billion per year for the next five years. However, in reality, from the language of the announcements (you can see it here), such a contribution may actually generate some return for BABA. The language reads like it’s a venture capital fund. In this sense, it could make the analysis further on the conservative side.

Second, the Chinese government could interfere with BABA’s business and hence cause a slowdown to BABA’s growth in the cloud segment. The China government is known for handling its sensitive information through the cloud. It recently requires all state firms to migrate their data from private cloud providers such as BABA’s cloud to a state-backed cloud service. Interference like this could hinder BABA’s growth. But I think in the long term, A) there is almost a large enough market for BABA outside government businesses and state-owned firms, and B) the 13% growth rate assumed for the next few years are already quite conservative.

Conclusion and final thought

Alibaba Group, under its current valuation, has become close to an asset purchase. In particular,

- Currently, more than 33% of its market cap is in current assets, and almost 55% is in current assets, net properties, plants, equipment, and equity investments.

- Looking forward, it can become a pure asset purchase at today’s valuation in a few years (around 2024 to 2025) by simply hoarding cash.

- It is no wonder that it just upsized its share repurchase program from $15B to $25B. The repurchase, at the current compressed valuation, will shrink the share counts by about 8%, providing a strong catalyst to boost shareholder returns.

- Beijing’s vows to stabilize the market and stimulate the economy provide another protection, essentially serving as a China Put with a strike price near $75.

Be the first to comment