Andrew Burton

Since my last buy rating on Alibaba (NYSE:BABA), the stock has risen 30% and this article aims to look deeper into the company to determine what the outlook for the company is for 2023 and what we should look out for in the next year for Alibaba.

Investment thesis

As mentioned earlier, I have written earlier articles about Alibaba, which can be found here. In my view, the setup is looking great for Alibaba in 2023 as I think that this is likely the best risk/reward opportunity available.

First, the company looks set to be a key beneficiary of the opening up of China’s economy as the country looks to remove covid restrictions. This, along with the low base of the China eCommerce business in 2022, will lead to strong growth in the core China eCommerce segment in 2023.

Second, the cost optimization efforts are going well, and the effects are visible from the bottom-line beats that the company has achieved in recent quarters. Most of its newer and faster-growing initiatives are seeing narrower losses and I think this will continue in 2023 as the cost-saving initiatives will likely bear fruit in the quarters to come.

Third, cloud will also see improving business fundamentals, as non-Internet sectors maintain their momentum and the Internet sector demand recovers in 2023.

China eCommerce to post strong recovery in 2023 on low base

The segment has been rather lackluster in recent quarters. This September 2022 quarter was no exception as China’s covid policies continue to bite.

Alibaba’s 11.11 comments were not as positive as in prior years and this was a result of several negative influences in the 2022 version of 11.11. The bottom line is that China’s strict restrictions may have negatively affected consumption levels in China during this year’s 11.11. As a result, the GMV for this year’s 11.11 was flat compared to the prior year. This flatter growth does imply that the near-term December 2022 quarter may be challenging for Alibaba and thus, the segment will likely pose more of a downside risk. The downside risk, if I were to quantify it, is roughly around 5% in GMV terms as this is the approximate gap between the 2022 11.11 performance and the typical December quarter GMV growth.

For the next year in 2023, I think that Alibaba is actually a key beneficiary of the re-opening of the Chinese covid restrictions. This could be done by March 2022, and I expect that we will see Alibaba’s China eCommerce business to grow by more than 10% in 2023. This is contributed by the high exposure that Alibaba has to discretionary spending, as well as the low base from 2022.

Big profit driver from cost optimization in 2023

One of the biggest positives for Alibaba in 2022 was the success from its cost optimization efforts. The market can see visible signs that the cost optimization efforts are taking effect and it is rewarding Alibaba for the good execution from the cost optimization efforts.

As a result of cost optimization measures, the company has seen bottom-line beats in recent quarters, which is testament to the management’s efforts to drive costs down as the business slows.

I continue to expect that the cost savings will continue to flow through in the coming quarters as we have seen the peak adjusted EBITA loss for the new initiatives that Alibaba is undertaking in the December quarter from last year. For the September 2022 quarter, I think that we continue to see improvement in cost savings in the new initiatives segments as the combined losses amounted to about Rmb6 billion in the recent quarter, compared to Rmb19 billion in the same quarter in the prior year.

For Alibaba’s China commerce segment, its segment margin improved by 1 percentage point compared to the prior quarter to 32% in the September 2022 quarter. This was a result of reduced losses for Taobao Deals and Taocaicai. In addition, international commerce also saw reduced losses as a result of losses being reduced at Lazada and Trendyol as the EBITA loss narrowed from Rmb2,481 million in the prior year to Rmb960 million in the September quarter of 2022. Local services also narrowed losses further in the September 2022 quarter to Rmb3,044 million, down from Rmb4,770 million in the prior year. This was driven by improving unit economics in Ele.me as delivery cost per order was reduced and average order value increased.

I continue to expect that losses will narrow through the December quarter of 2022 and into 2023 as management continues to be effective in driving margin improvement and cost savings across the business. I expect that the cost savings will continue into 2023 and this will drive an adjusted EPS growth of +41% in the next year as the business revenues and profits start to recover.

Recovery in growth for the cloud segment in 2023

For Alibaba’s cloud segment, the outlook for 2023 looks more encouraging than what has happened for 2022. First, Alibaba recently disclosed for the first time ever, its revenue mix between Internet and non-Internet industries. In the September 2022 quarter results, the non-Internet segment grew by 28% year on year and now represents 58% of the total cloud segment. The strong growth in the non-Internet segment is a key driver for continued growth for the overall cloud segment as diversification in sectors within the cloud segment has paid off. This strong growth was contributed by the financial services, telecommunication and public services industries respectively.

That said, the Internet client portion of the cloud segment is still struggling as the revenues for the Internet sector were down 18% year on year. This, again, is due to a loss of one of Alibaba’s key Internet customers, as well as its online education customers, and due to the relatively weaker demand from the Internet sector in general.

For 2023, where will we see Alibaba’s cloud segment head towards? I think the answer is increasingly tilted towards a stronger growth profile for the cloud segment. In the near term, we may see that there are still existing headwinds from the company’s Internet sector exposure, but I think that this will improve through 2023. First, I expect that the non-Internet industries will continue to progress and grow robustly as the country comes out from covid lockdowns and removes strict restrictions. Second, I think that we will see that the demand from the Internet sector will also recover as sentiment in the sector improves over the course of the year. Taken together, my expectation is for the overall cloud revenue growth to reach the teens level by next year, as the second half will prove to be a strong quarter for the cloud segment with the continued increasing demand.

Creating value for BABA shareholders in 2023

Alibaba has been an active repurchaser of its shares as it initially has a share repurchase program that was authorized in 2019 for $6 billion to be used over 2 years.

This program has been extended and increased a few times, and the recent announcement in November 2022 was that Alibaba will be increasing its share repurchase program by another $15 billion, to $40 billion. Furthermore, the program was also extended all the way to the end of March 2025.

Alibaba noted that as of 16 November 2022, it has repurchased $18 billion in shares, which means that it has $22 billion remaining for the enlarged share repurchase program that it currently has. For reference, Alibaba’s buyback in the September 2022 quarter represented 39% of its free cash flows. I think that there will be a large percentage of capital that will be committed to share repurchases in the next year as Alibaba continues to execute on its share repurchase program until the end of 2025. At the end of the day, shareholders should benefit from these repurchases as Alibaba executes on the repurchase program.

Valuation

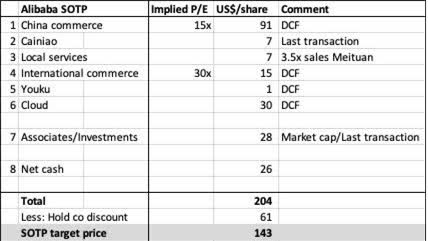

I use a sum of the parts valuation model to derive my target price for Alibaba. This involves determining a value for each part of Alibaba’s business.

- First, for the China eCommerce segment, I think that we will likely see a strong growth return to the segment on the back of a low base and relaxing of covid restrictions in China. This upside has been taken into account for my forecast for 2023. At the same time, there is a risk that the company may face a slowdown as a result of the weakening macroeconomic environment in China. As such, I incorporate conservatism into my financial forecasts to take this into account as well.

- Second, for Local Services, Cainiao and other investments and associates held by the company, I value these by their latest transaction values and market capitalizations of the respective companies.

- Lastly, for Youku, International Commerce and Cloud, I use a DCF methodology to derive the value of these segments. I take into account the long-term growth opportunities for the International Commerce segment and the robust growth opportunities for the Cloud segment.

Taking all these together, I also applied a 30% holding discount. Based on that, my target price for Alibaba is $143, implying around 57% upside from current levels.

Alibaba SOTP valuation (Author generated)

Risks

Competitive pressures

The e-commerce and cloud computing space in China is highly competitive and while Alibaba has a strong competitive position, it risks losing this position if competitors are able to innovate and outcompete the company. In the China e-commerce space, there are established players with specific advantages like JD.com (JD) and Pinduoduo (PDD) that compete with Alibaba for e-commerce market share. In the cloud space, there are large players that continue to vie for market share in China. Lastly, in the international e-commerce segment, Amazon (AMZN) and Sea Limited’s (SE) Shopee are the main contenders for Alibaba’s e-commerce segment in the international region.

Regulatory and political risks

While there have been reports that Alibaba’s founder Jack Ma has been living in Tokyo and that he has come out of hiding, there are still risks that the crackdown on the technology sector and the harsh common prosperity measures may continue to bite Alibaba as Xi Jinping is here to stay for another term.

Cloud risks

Alibaba looks to be gaining business in non-Internet sectors while the demand for Internet sectors remains weak. There is a risk that other players in China may attempt to take share from Alibaba. This includes established cloud players like Huawei, Tencent (OTCPK:TCEHY), and China Telecom. This could slow growth for Alibaba’s cloud segment in the near term as the competitive landscape sours.

Conclusion

2023 will be a great year for Alibaba, in my view. As mentioned earlier in the article, the fundamentals are improving for a business that has seen very negative sentiment for some time now. The improving China eCommerce outlook from the low base in 2022 and the reopening of the Chinese economy, as well as the improving business momentum for the cloud business, will drive future top-line growth to re-accelerate. The cost optimization efforts happening in 2022 will continue to show results in 2023 as the losses narrow for many of Alibaba’s businesses. Lastly, Alibaba remains committed to add value to shareholders and the share repurchase program will continue. I think that the risk/reward perspective for Alibaba looks positive and my target price for Alibaba is $143, implying 57% upside from current levels.

Author’s note: I am starting a marketplace service, Outperforming the Market, which will be launching on 10 Jan 2023. Outperforming the Market aims to help investors identify high conviction growth and value stocks to form a barbell portfolio that outperforms the market.

Mark your calendars, because early subscribers can reserve a spot as a Legacy Discount Member, which gives you generous introductory prices. Thank you for reading and following my work. See you there!

Be the first to comment