maybefalse/iStock Unreleased via Getty Images

After facing massive regulatory headwinds in China, Alibaba’s (NYSE:BABA) management wants to focus on international operations to diversify the revenue base and gain new growth markets. One of the most lucrative markets for Alibaba is Europe where the company’s expansion is firing on all cylinders in important services. Different regions in Europe have their own regulatory environment which also allows Alibaba to focus on key regions.

A good example is Trendyol in which Alibaba has over 85% stake. Trendyol is one of the main ecommerce players in Turkey with a valuation of $16.5 billion or 5% of Alibaba’s current market cap. Alibaba has a major advantage against local players as it can absorb losses for a longer time compared to smaller players.

Alibaba also has a host of services like payments, cloud, delivery, and others through which it can monetize its international customer base. Alibaba will also have an advantage over Amazon (AMZN) in Europe as it can directly source goods from Chinese manufacturing facilities through its local supply chain. If Alibaba continues to show strong progress in Europe, this region will be one of the biggest drivers of stock growth in the next few quarters.

Focus on Europe

Europe has some key factors which work in Alibaba’s favor. Alibaba has not been able to expand in the US due to regulatory and political restrictions. Alibaba also withdrew most of its investments from India after there was border tension between India and China. However, European regions are more conducive to investments from Alibaba. It is possible that Alibaba could see a positive regulatory environment in Europe as long as it convinces them of good privacy and data security measures.

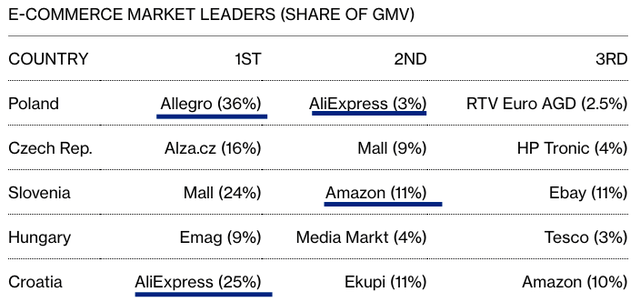

Figure 1: Market share of main e-commerce players in Eastern Europe. Source: Bloomberg

European market is also one of the biggest in the world with nominal GDP of over $23 trillion or 30% of world GDP. The ecommerce market is still in early stages in this region compared to the maturity phase seen in China and US. Another key factor in Europe is that there are different regulatory practices across different regions. Hence, UK’s regulations would be different from Poland which would be different than Turkey. Alibaba can focus its investments where regulations are more attractive to get a foothold and build its logistics.

We have already seen this with its massive stake in Trendyol which is the second biggest ecommerce player in Turkey. Alibaba has over 85% stake in this company and has a valuation of $16.5 billion according to the last funding round. Alibaba is among the top three ecommerce players in Poland, Croatia and many other Eastern European countries.

Opportunity for Alibaba Cloud

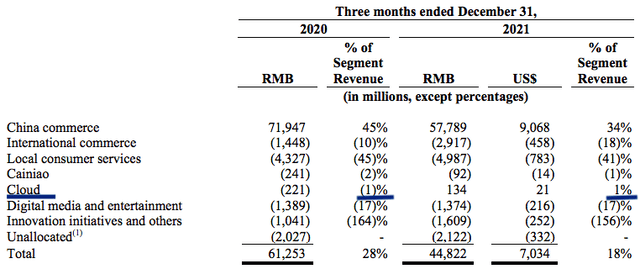

While ecommerce remains the most visible part of Alibaba’s operations, the real profits and margins in the future will flow through its cloud operations. Europe is a very important market for Alibaba Cloud. Currently, the EBITA margin of Alibaba Cloud is 1% while Amazon’s AWS has reported a margin of close to 30% for the past few years. Hence, there is a massive gap in the margins of these two cloud giants.

The main reason behind Alibaba’s low margins is that most of its revenue comes from China which is still a more value-focused market. If Alibaba directly competes with Amazon, Microsoft (MSFT), Google (GOOG), and other cloud players in Europe, we should see a rapid improvement in the margins as Alibaba’s cloud margins get closer to that of other cloud companies.

Figure 2: Alibaba’s revenue and margins in the cloud business. Source: Company Filings

Alibaba Cloud has an annualized revenue base of over $12 billion which makes up 9% of the total revenue base of the company. The growth rate in this segment is also higher than in the core commerce segment. Strong growth in Europe by Alibaba Cloud will improve the runway for future growth and improve the bullish sentiment toward the stock.

The European market is very diverse where different countries have their own approach toward foreign tech companies. Many countries prefer a mix of different companies instead of relying only on US tech companies. This should help Alibaba gain market share as long as it can guarantee data security and privacy for the regulators in this region.

Underestimating Growth Opportunities

Alibaba’s opportunity in Europe is massively underestimated. The company has built a strong ecosystem in China and it now needs to replicate it in Europe within different regions. The margins for various business segments like cloud, subscription, and advertisement could also be higher in Europe compared with China.

Alibaba has a strong supply chain within China where it picks up manufactured goods from factories and directly delivers them to customers. The company can leverage this business model by extending its supply chain to Europe. It would be very difficult for Amazon to replicate this supply chain with similar margins as it does not have a big presence in China. Smaller local ecommerce players in Europe will also not be able to compete with Alibaba in terms of logistics.

Amazon is still in a leadership position in Western European countries like France, Spain, UK, and others. However, Alibaba is showing stronger growth as it expands its logistics operations. While valuing these operations we should look at a multi-year growth trajectory as it takes a lot of time to build the requisite warehousing, logistics, and delivery network. Alibaba is on a good path in its European operations which should allow the company to gain a sizable chunk of market share in the next few years.

Impact on Alibaba stock

Alibaba is facing massive regulatory hurdles in China and hence it needs to diversify the revenue base out of China. A rapid growth in Europe would provide Wall Street the confidence in the company’s management and its business model. Alibaba is already a big player in many regions of Europe. Alibaba owned Trendyol is the leading player in Turkey. In recent months, Trendyol was valued at $16.5 billion or 5% of the total market cap of Alibaba. Alibaba has a strong presence in many other European countries and the standalone valuation within these regions would increase as Alibaba improves its operations.

Alibaba Filings

Figure 3: Trendyol is showing close to triple-digit YoY growth in Turkey. Source: Alibaba Filings

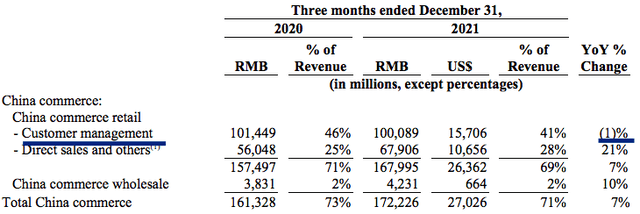

Figure 4: Customer management business within Core Commerce declined by 1% YoY. Source: Alibaba Filings

The local business of Alibaba in China is reaching saturation as the company has reached the entire addressable market. On the other hand, the growth runway in international markets like Europe is much bigger. It is likely that a bulk of future stock appreciation in Alibaba will be based on the performance of the company in these international regions.

Alibaba can expand into ecommerce, cloud, payments, delivery, subscription, advertising and other segments in the international markets. After the initial phase of heavy investment in logistics, we should see better margins from its European operations.

We can also look at the market share metrics of Alibaba and Allegro which is the leading ecommerce company in Poland. Allegro has a 36% ecommerce market share in Poland while Alibaba has close to 3% in this region. Alibaba is expanding its logistics ability to improve customer retention in this region. The PS ratio of Allegro is significantly above Alibaba. The main reason is that Eastern Europe is still considered a growing ecommerce market while China’s ecommerce operations are in the maturity phase.

Alibaba’s ecosystem of services is also much more developed than smaller local players. It is also possible for Alibaba to absorb losses in these markets for a longer time in order to gain market share.

We should see good progress by Alibaba in Turkey, Poland, Spain and other European markets in the near and medium-term. This will help in the diversification of Alibaba’s revenue base and provide a better growth runway for the company. The impact on Alibaba’s valuation should be massive as the company reports a higher revenue share from these international operations compared to its home business in China.

Investor Takeaway

Alibaba’s European business is firing on all cylinders. The company is looking to expand in different regions with a host of services including ecommerce, payments, cloud, delivery, and others. It is likely that Alibaba will gain better margins in Europe because this market has not reached a saturation point similar to China. A big growth opportunity for Alibaba will be in the cloud business where it will directly compete with US tech majors to gain market share. This should reduce the margin gap which the company is showing compared to other cloud players in the US.

Rapid expansion in Europe will reduce the regulatory worries faced by the company in China. Alibaba already has an advantage over Amazon in this region due to a strong connecting supply chain in China. We should see an increase in the market share of Alibaba in ecommerce and other services within Europe over the next few quarters which will become one of the main growth drivers for the stock.

Be the first to comment