Andrew Burton/Getty Images News

Investment thesis

Alibaba Group Holding Limited (NYSE:BABA) (OTCPK:BABAF) stock price has largely been news-driven and fear-driven in the past year or so. It has faced quite a few uncertainties: fines, anti-trust regulations, and a potential slowdown of the overall China economy.

Under the above background, you will see that the thesis here is really simple – the stock price has become disconnected from the business fundamentals. The stock has actually become unjustifiable cheap now according to the so-call Buffett’s 10x pretax rule. As to be detailed later, if you pay 10x pretax and bought a business that stagnates forever, you would have bought a 10% yielding bond and enjoys a 10% annualized return. And if you get a business that offers ANY growth, you will have a large chance of a double-digit return compounding for a long time.

In BABA’s case:

- It is currently for sale at around 7x pretax earnings when adjusted for its cash positions, and it will not stagnate forever. To the contrary, BABA stands best poised to benefit from our world’s e-commerce movement, particularly in the Asian-Pacific region, the center of the movement.

- The downside is further protected by Beijing’s vows to stabilize the market and its $25B repurchase program. When Beijing announced its support pledges on Mar 16 to stabilize the market and stimulate the economy, BABA stock price rallied by almost 37% during that single day on large trading volume. Also, it just upsized the repurchase program to $25B from $15B, almost 8% of its current market cap. Such a sizable repurchase, at its current undervaluation, will be very effective and accreditive to boosting shareholder returns.

- In the longer term, BABA is well poised to benefit from the world’s unstoppable shift to e-commerce. And the center of the upcoming shift will be centered in the Asia-Pacific region, where BABA is well-poised to benefit.

Before we dive in, let me also make two quick clarifications:

- All the subsequent analyses are made based on a per ADR basis, and there are 8 ordinary shares in each BABA ADR.

- All the financial data used in the rest of this article are either taken from the most recent Value Line reports or from Seeking Alpha.

Buffett’s 10x Pretax Rule

If you’re a devout Buffett cultist like this author, you must have noticed or heard that the grandmaster paid ~10x pretax earnings for many of his largest and best deals. The list is a really long one, ranging from Coca-Cola (KO), American Express (AXP), Wells Fargo (WFC), Walmart (WFC), Burlington Northern, and of course the more recent AAPL purchase.

As detailed in my other earlier writings, it is not a coincidence that most of his best and largest investment success is from buying businesses at 10x pretax earnings, because:

- Buying an average business that stagnates forever at 10x pretax would already provide a 10% pretax earnings yield, directly comparable to a 10% yield bond.

- In case you get to buy an above-average business (like BABA here) at 10x pretax, then any growth would be a bonus on top of the 10% yield above, leading to a double-digit return.

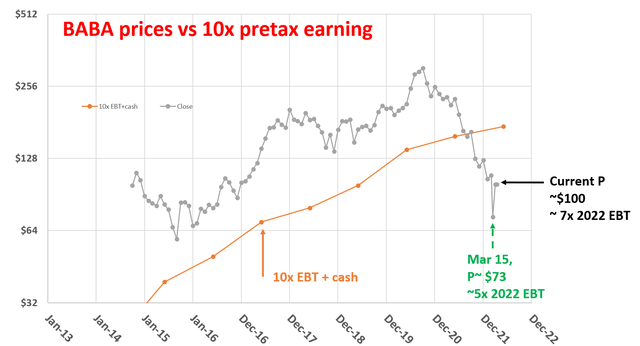

As seen from the chart below, the market now presents BABA as such an opportunity. The following chart shows the price history of BABA and its 10x pretax earnings plus its cash position (since it has a sizable cash position). Pretax earnings are also referred to as “EBT,” Earnings Before Taxes, in this article.

As seen, for a business like BABA, the price should be high above 10x EBT, as it has been in the past. But during the recent market overaction, the price now is actually close to the 7x EBT as seen (again correctly for cash)!

Source: author based on Seeking Alpha data

So, in this case, even if BABA stagnates forever, by paying 7x pretax, the investment would already provide a 14% pretax earnings yield, directly comparable to a 14% yield bond. And to be seen next, BABA has an excellent prospect to grow also.

As also detailed in my earlier writings, a strong warning is in order here:

- I am NOT suggesting you go out and start buying every/any stock that is below 10x EBT. As investors, we face many risks. Two of the major risks are A) quality risk or value trap, i.e., paying a bargain price for something of horrible quality, and B) valuation risk, i.e., paying too much for something of superb quality. The 10x pretax rule is mainly to avoid the type B risk AFTER the type A risk has been eliminated already.

- Then how do we eliminate type A risks? I look for three things primarily. First, the business should have not an existential issue in the long run. However, in the end, this is largely a subjective judgment. Second, the business should have no existential issue in the short run either. This can be quite reliably and objectively evaluated based on the cash flow and debt coverage. And finally, the business should have a decent chance to grow its earnings in the long term (and estimate the so-call perpetual growth rate). This will be a plus.

So with this framework, let’s examine BABA more closely.

BABA: does it have any existential issue?

I really do not see any existential issue for BABA either in the short run or the long run. I will just be brief and go through my thought process here and then move on to focus on the growth perspective.

Existential issues, in the long run, are largely subjective judgments. If some of us even entertain the possibility that BABA would have trouble surviving, the root of our concern is probably the Chinese government. My judgment is that the Chinese government will not only not let BABA fall, but will also work with BABA to make sure it continues to prosper. I have traveled extensively in China and read extensively about its recent history. The current regulatory shock waves are nothing new historically. They’ve happened before (even at a larger scale and with stronger intensity) and will happen again most likely. As for BABA, it’s reached a status of too big to fail, and also at the same time, too good to fail. It is in the Chinese government’s best interest to keep it alive and thrive – which leads me to the next point.

And I interpret the following recent developments as supporting evidence to my above view:

- I view the announcement back in Sept 2021, that BABA will invest RMB100 billion (about $15.5B) in the Chinese Common Prosperity fund as a key positive step. To me, this announcement shows convincingly that a path forward is being worked out for BABA – and it is a peaceful path that is nothing like what the market has feared.

- Then, in 2021, Charlie Munger doubled his position twice, which also seems to support my above view. With Munger’s long track record as a disciplined and long-term investor, he must have no doubt at all about the long-term staying power of BABA.

- Finally, more recently, on March 16 this year, Beijing announced its support pledges to stabilize the market and stimulate the economy. BABA stock price rallied by almost 37% during that single day on large trading volumes. Furthermore, the progress made by the Chinese and U.S. on their audit dispute provides another potential catalyst. To me, it is a no brainer that both sides recognize effective and sustainable cooperation is in the best interests of the capital markets of both countries and also global investors.

Short-term existential issues are a lot easier. This can be quite reliably and objectively evaluated based on the cash flow and debt coverage. And BABA certainly does not have any of these issues at all.

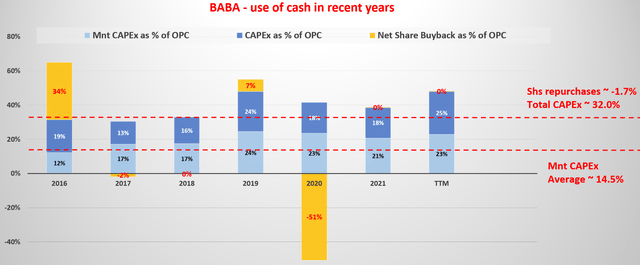

Just take a look at the following snapshot of its capital allocations in the recent year. The picture is really simple here: BABA earns a load of cash organically from its operations – even considering its fines, commitment to the common prosperity fund, and potential tax rate raises. And it does not need to spend much. Just take a look at its finances in recent years. It generates more than $30B of operating income per year in recent years. BABA is effective debt-free (its debt interest expenses are merely $0.5B).

BABA does not pay a dividend. And its CapEx is only about $6.4B, about 20% of its operating income. When we expand our horizon a bit wider and examine its capital allocation over the past a few years, the picture does not change that much, as shown in the next chart.

Source: author and Seeking Alpha.

BABA: what is its growth potential?

It is an unstopped trend that our world is moving toward e-commerce. Even though many of us are already impressed by the success of e-commerce giants like BABA and Amazon, the movement toward e-commerce has just actually gotten started and the bulk of the growth is yet to come.

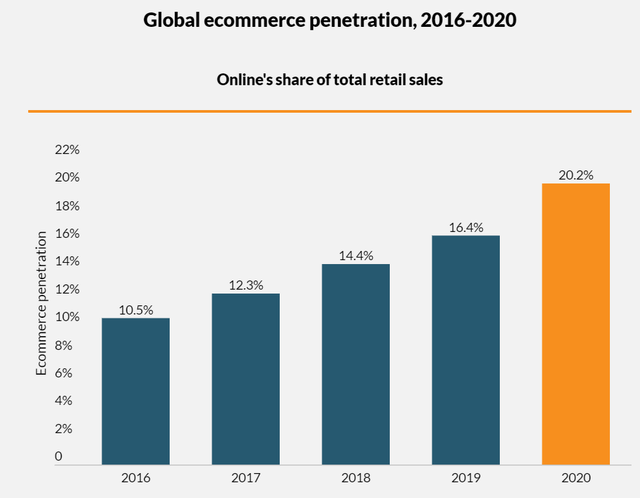

As you can see from the following chart, the global e-commerce penetration has been in steady and rapid increase. The e-commerce penetration has almost doubled from its 10.5% level in 2016 to the current level of 20.2% in merely 4 years, a CAGR of nearly 19%.

However, the current e-commerce rate is still ONLY at about 20%. Meaning 80% of the commerce is still currently conducted off-line. Global retail e-commerce sales have reached $4.2 trillion in 2020. And they are projected to almost double by 2026, reaching $7.4 trillion of revenues to the retail e-commerce business. The e-commerce movement is just getting started and the bulk of the growth opportunity is yet to come.

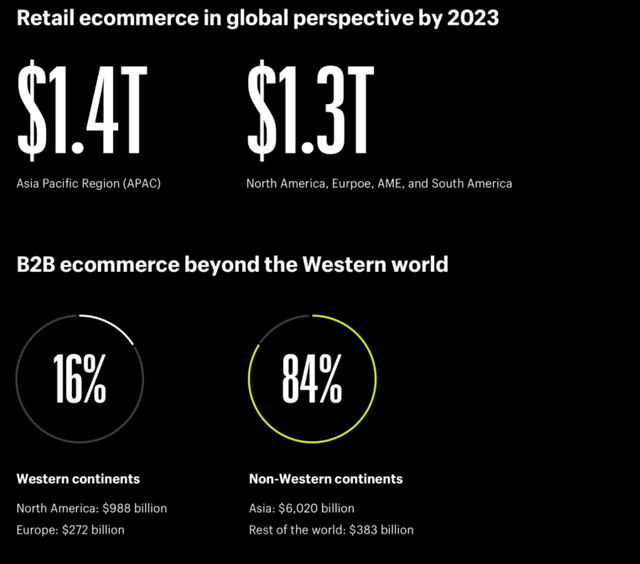

And the center of the remaining movement will be in the Asia-Pacific region, where BABA is well-poised to benefit. In a nutshell, even by as early as 2023 – in about 2 years time, that is – retail e-commerce sales in Asia-Pacific are projected to be greater than the rest of the world combined.

As shown in the next chart below, the total retail e-commerce in the Asia-Pacific region should reach $1.4 trillion US dollars by 2023. In contrast, the total retail e-commerce by the rest of the world would be about $1.3 trillion only. In relative terms, by 2023, the Western continents will contribute 16% of the total B2B e-commerce volume, while the remaining 84% would come from the non-Western world.

The secular trends driving such distribution include: (1) the dominant portion of the world population residing in the Asia-Pacific regions; (2) the rapid urbanization and technological advancements in those regions; (3) more than 85% of new middle-class growth residing in the Asian-Pacific region; and (4) lastly, the incentive from the government and also the initiatives from the private sector (such as in China and Indian) to accelerate the transition to e-commerce.

A reality check shows asymmetric return/risk profiles

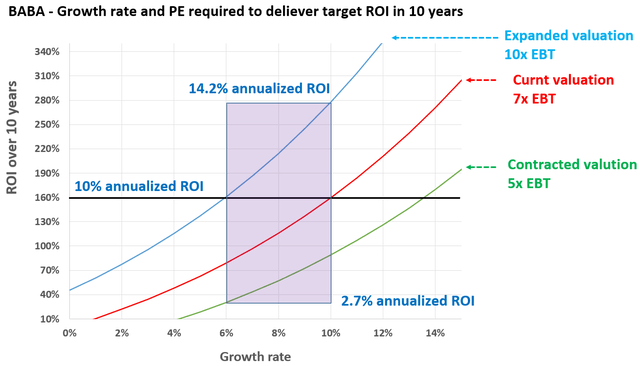

Finally, what I always like to do is a reality check as shown in the chart below. It is essentially a back of the envelope calculation to estimate what is the growth rate and valuation required to deliver a target ROI over the next few years, say, 5 or 10 years. And see if such growth rate and valuation can pass a common-sense test.

As an example to provide a tutorial to read this chart, if we require a 10% annual ROI, represented by the black horizontal line (10% annual return translates to 160% total return in 10 years because 1.1^10=260%), the growth rate will have to be about exactly 10% if the valuation ratio does not change from its current level (i.e., 7x EBT) – something we all know already. And if the valuation contracts to 5x EBT as shown by the green line, the growth rate would have to be about 13.5% to deliver the required 10% ROI.

With the above background, we can see that the current valuation easily passes the reality check. In particular, investment here enjoys a large margin of safety from several factors:

1. A large gap between market perception and fundamentals. As seen, under the current valuation, we are very likely to enjoy double-digit returns even if growth is not double-digit. To put things into perspective, BABA’s recent “slowed” growth rate is still 20%+. And the secular trend can easily support a double-digit e-commerce growth in the next decade.

2. A very compressed valuation. If you pay 10x pretax and bought a business that stagnates forever, you would have bought a 10% yielding bond already. At BABA’s current 7x pretax valuation, even when growth slows all the way to 6% AND valuation further contracts (say to 5x EBT, the lowest point historically), the investment still won’t lose money.

Risks

First, there’s always the risk that the Chinese government could confiscate foreign investments in BABA if they decide those investments under the VEI structure are illegal. This is very unlikely to me for so many reasons. Readers who want a detailed discussion of this scenario could see my Kelly analyses of the risks.

Second, the ongoing Chinese-U.S. negotiations on the audit disputes still face uncertain outcomes. I am optimistic that eventually an agreement will be reached; however, the path may be long and tortuous. However, in case it fails, there is a chance that BABA could be delisted from the US stock market. Delisting Chinese stocks has just happened recently (the DIDI case, for example). Although, even if BABA stock indeed ended up delisted, that would not necessarily lead to a total loss of capital (again, see the DIDI case as an example).

Conclusion and final thoughts

The recent market overreaction presents an opportunity to buy a great company that is having temporary trouble while it is still on the operating table – as Buffett and Munger have done so masterfully in the past. The thesis of this article is, therefore, really simple – companies like BABA should never be priced below 10x EBT as it is now.

The current pricing is such that BABA is valued significantly below 10x pretax earnings. And as a result,

- Even buying an average business that stagnates forever at such a valuation would already provide a doubt-digit return.

- Yet, BABA is anything but an average business that will stagnate forever. BABA stands best poised to benefit from the world’s movement towards e-commerce and especially the Asian-Pacific momentum. To put things into perspective, BABA’s recent “slowed” growth rate is still 20%+ YoY. And the global secular trend, especially in the Asian Pacific region, can easily support a double-digit e-commerce growth in the next decade.

- The margin of safety is so thick here that even when growth slows all the way to 6% AND valuation further contracts to 5x EBT (the lowest level historically), the investment would still make a small profit and won’t lose money.

Be the first to comment