brytta/E+ via Getty Images

The Q4 Earnings Season for the Silver Miners Index (SIL) has finally ended, and one of the last companies to report its results was Alexco Resource (NYSE:AXU). Unfortunately, like Americas G&S (USAS) and Pure Gold (OTCPK:LRTNF), the best was not saved for last, with Alexco having a disappointing year operationally. This was evidenced by Q4 production coming in well below the ~4-million ounce run rate mark previously discussed in Q1 2021. Given the lukewarm 2022 outlook combined with additional share dilution, I have lowered my price target to US$1.70.

Keno Hill Silver District Operations (Company Website)

Alexco Resource (“Alexco”) released its Q4 and FY2021 results last month, reporting annual production of ~621,000 ounces of silver, ~4.77 million pounds of lead, and ~1.66 million pounds of zinc. This was well below my estimates of more than 1.0 million ounces of silver produced. While the full-year results wouldn’t have been overly disappointing if the Q4 results were strong, this was not the case, with throughput rates coming in at 253 tonnes per day in Q4, which was a country mile short of the 400 tonnes per day expected in Q4 in the Q1 2021 Conference Call. Let’s take a closer look below:

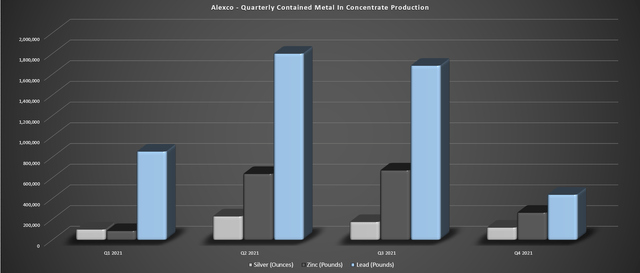

Alexco – Quarterly Metals Production (Company Filings, Author’s Chart)

Looking at the chart above, we can see that Alexco saw a sequential decline in production in Q4, which was partially related to headwinds due to COVID-19 and lower grades from transitioning away from Bellekeno plus a slower transition to Flame & Moth. This led to a sharp decline in silver production to just ~119,200 ounces. The silver lining is that the mill is operating well and can operate well above the 400 tonnes per day design capacity. The bad news is that with mining rates well below planned levels, it’s unable to take advantage of this capacity (~5,000 tonnes of ore mined in Q4).

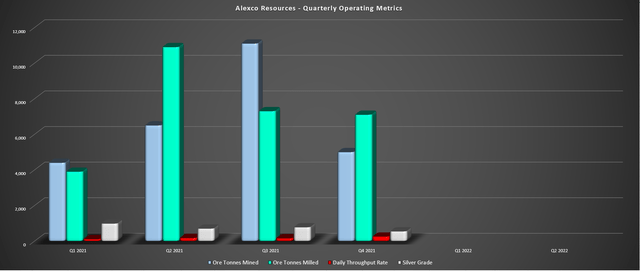

Alexco Resource – Quarterly Operating Metrics (Company Filings, Author’s Chart)

If we look at Alexco’s quarterly operating metrics, we can see that tonnes of ore mined dipped sequentially in Q4 (~5,000 tonnes vs. ~11,000 tonnes), more than offsetting the higher daily throughput rate of 253 tonnes per day. Combined with much lower grades in the period after transitioning away from Bellekeno, which has higher base metal and silver grades, it’s no surprise that production fell sharply. While a single bad quarter isn’t a huge deal, the commentary on Q1 wasn’t any more encouraging, with a reduction in the available workforce due to COVID-19 isolation requirements and supply chain issues related to critical spares in February.

Based on Alexco’s most recent update, the company noted that it is three to four months behind schedule and now expects its design capacity of 400 tonnes per day to be reached in Q3 of this year. Assuming this target is met, this would be roughly nine months behind schedule (previous target: Q4 2021). So, with a weak Q1, it’s now looking like Alexco will be lucky to produce 2.4 million ounces of silver this year, well below its previous projections of a 4.0 million-ounce run rate as of Q4 2021 and its 2022 estimate from its Q4 Presentation of ~3.7 million ounces.

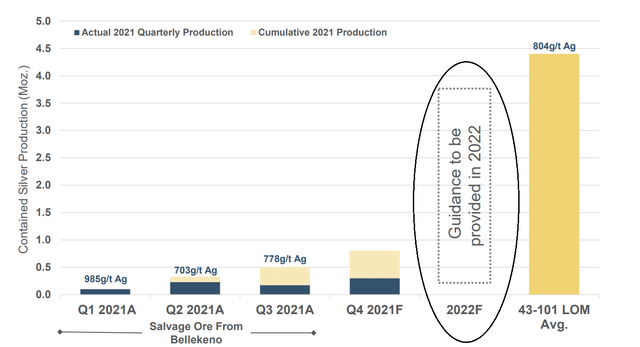

Alexco Production Estimates – Corporate Presentation (Company Presentation)

Given the delays, Alexco was forced to raise additional capital earlier this month, with its fully diluted share count now up ~14% from Q1 2021 levels to ~174 million shares. Assuming the company can meet its targets, the company should get through the year with minimal additional share dilution. However, suppose we see continued COVID-19 headwinds or supply chain issues. In that case, this could affect the share count further, on top of what’s already been a hefty amount of share dilution for a company that should have been free cash flow positive in Q4 2021 under previous estimates.

So, is there any good news?

While Q1 silver production should come in below 100,000 ounces due to the headwinds that affected development rates and reduced equipment availability, production should increase to at least 500,000 ounces in Q2, with production likely to ramp up closer to 700,000 ounces by Q3. This would translate to a significant increase in annual revenue (excluding revenue from reclamation management), with FY2022 revenue likely to come in above $50 million, or a ~160% increase from FY2021 levels.

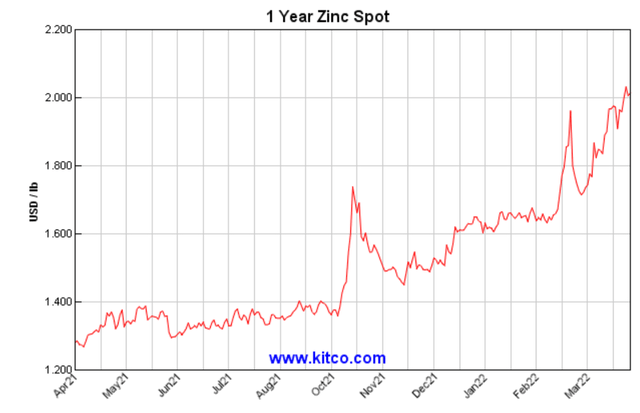

6-Month Zinc Price (Kitco.com)

Meanwhile, the company noted that analysis of infill drilling of initial stoping areas in Flame & Moth resulted in an increase in available ore from ~28,900 tonnes to ~48,900 tonnes at higher grades. This is a welcome surprise in what’s been a period of under-delivering on its promises. Finally, while sales have been deferred, which has led to a more bloated share count, it’s comforting to know that the value of the metal in the ground is increasing, with zinc prices soaring above $2.00/lb. The rise in zinc prices isn’t a huge deal, given that the primary metal is silver, but it certainly doesn’t hurt. Let’s look at the valuation below to see if the stock is at a low-risk buy point:

Valuation & Technical Picture

Following the most recent capital raise, Alexco has ~174 million fully diluted shares, translating to a market cap of ~$265 million at a share price of US$1.52. This is a very reasonable valuation for a Tier-1 jurisdiction silver producer, assuming that the company can deliver on its mine plan. However, the key will be avoiding further share dilution and delivering on the mine plan, with operations to date being well below my expectations, especially with design capacity now expected to be reached in Q3 of this year.

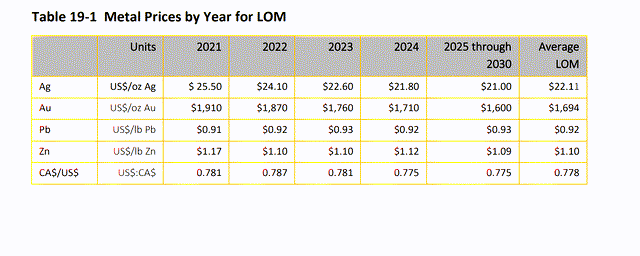

Estimated Metals Prices (Base Case) – KHSD Operations (Company Technical Report)

Fortunately, the disappointing share dilution last year (~153 million –> ~174 million shares) and delayed ramp-up have been offset by higher metals prices, arguably making the company’s metal in the ground more valuable. This is based on zinc prices soaring above $2.00/lb, gold prices heading back above the $1,925/oz level, and silver prices continuing to hold above the $24.00/oz level. If we compare these figures with the long-term metals price assumptions from the previous mine plan, it’s clear that there’s some upside to the After-Tax NPV (5%) figure of $154 million, especially when factoring in growth in the resource base at Bermingham.

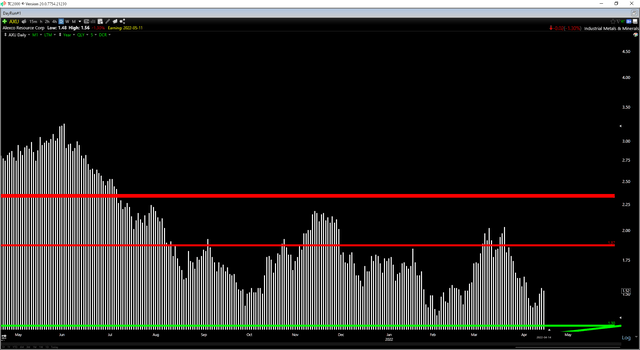

AXU Daily Chart (TC2000.com)

Based on what I believe to be an updated net asset value of $225 million and a P/NAV multiple of 1.40, I see a fair value for the stock of US$1.70. This is down from my previous estimates of US$1.95, which was before 13% share dilution last year. The price target of US$1.70 suggests that while there is some upside, there isn’t a meaningful margin of safety here at current levels. Hence, I have revised my low-risk buy point to US$1.30, which is in line with the stock’s long-term uptrend line from its 2016 lows.

Alexco Operations (Company Website)

I had high hopes for Alexco last year, reinforced by the company’s continued exploration success at its KHSD Operations. However, with the ramp-up delayed further, it’s tough to be overly optimistic, even if the worst looks to be over. This doesn’t mean that AXU can’t head higher, but I think there are lower-risk ways to get exposure to precious metals, and I continue to favor multi-asset producers that are under-promising and over-delivering. So, while I would view pullbacks to US$1.30 as buying opportunities, I continue to remain on the sidelines, with this story not progressing at the pace I expected.

Be the first to comment