Solskin/DigitalVision via Getty Images

We decided to re-analyze Alexandria Real Estate (NYSE:ARE) given our increasing concerns about the effects work-from-home will have on office REITs. One of the key areas where companies are reducing spending is on real estate. We already discussed the subject in our last article on Boston Properties (BXP), but wanted to take a look at Alexandria’s results to see if they are seeing an impact as well. Our worries resurfaced as one reader shared with us this article that discusses a survey of more than 200 CFOs and finance executives that revealed “real estate/facilities management” is the corporate function most likely to face budget cuts during the next recession.

With Alexandria we are less worried compared to other office REITs for a number of reasons. The most obvious one is probably that it is a lot harder to do laboratory work from home, compared to other types of work. The other is that its tenants have high barriers to exit, given significant investment by tenants, coupled with FDA requirements. Most of its tenants are unlikely to risk their operations for a slightly reduced rent. Most important of all, Alexandria’s assets are for the most part in unique locations close to Universities and other important research clusters, and there is significant demand for these premium locations. All of these competitive advantages seem to be shielding Alexandria from the worst effects of work-from-home, as it continues to deliver very strong results and guidance.

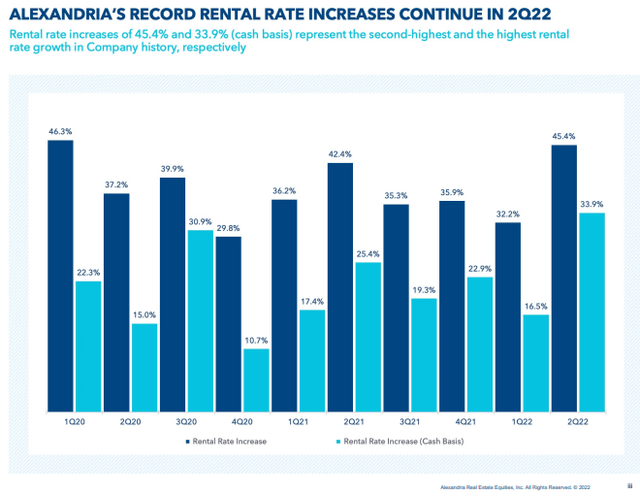

In the 2Q of 2022, Alexandria continued to deliver impressive rental rate increases of 45.4%, and 33.9% on a cash basis. This is some of the best growth the company has seen in its history, despite the headwinds of work-from-home and a weakening macroeconomic picture.

Alexandria Real Estate Investor Presentation

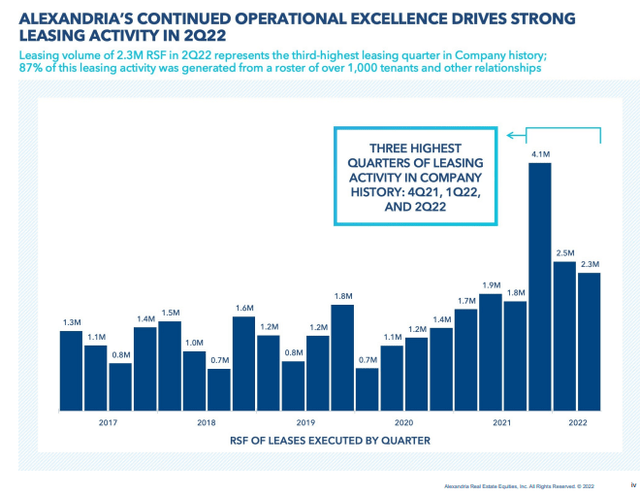

Not only were rental increases impressive, but there has been significant leasing activity as well, with the past three quarters being the three highest quarters of leasing activity in the company’s history.

Alexandria Real Estate Investor Presentation

Another positive sign for the types of assets the company has is that it has been able to sell some of them at extremely attractive prices. As part of its strategic value harvesting initiative, it sold a 70% interest in its 300 third street building in Cambridge at a price of $1,802 per rentable square feet, which resulted in a $113 million consideration in excess of book value. The transaction was at a 4.3% cap rate (cash basis). The company also disposed of 12 suburban properties in Greater Boston for a sales price per rentable square feet of $542, recognizing a $202 million gain, at a cap rate of 5.1% (cash basis). These transactions show just how much demand there still is from investors for the types of assets that the company has.

At the end of the quarter occupancy was at 94.6%, up 60 basis points since December 2021, and the company’s occupancy guidance range for 2022 is 95.2% to 95.8%. This too reassures us that Alexandria is really a one-of-a-kind REIT with much more solid fundamentals compared to other office REITs. Co-CEO Peter Moglia had this to say during the last earnings call as to why Alexandria is succeeding where others are struggling, including some of their competitors in the life science real estate sector:

Our results in the wake of others struggling should tell you something. Life science real estate is not for everyone, success takes years of experience in designing and building the right product in the right location, deep relationships with the highest quality life science companies and company creators, operational excellence and most important during times like these, a very deep understanding of the industry.

The most important conclusion we got from the company’s recent results, and the corresponding management discussion, is that you can find a lot of real estate product almost anywhere, but Class A lab product is still very hard to find.

Development & redevelopment pipeline

The company took advantage of the last earnings report to update on the state of its development and redevelopment pipeline, which is expected to generate greater than $665 million of incremental annual rental revenue, primarily commencing from 3Q22 through 2Q25. The company shared that this pipeline is leased or negotiating at roughly 78%, which we view as extremely positive given the macroeconomic environment.

Balance Sheet

Alexandria continues to have one of the strongest balance sheets in the entire REIT sector. It has got no debt maturities until 2025, and over 98% of its outstanding debt is subject to fixed interest rates. Alexandria has $5.5 billion of liquidity, and its net debt to adjusted EBITDA is on track to hit 5.1 times by year end. Forecasted cash at the end of the year of about $250 million is expected to reduce its incremental debt capital needs for 2023. Its credit ratings remain strong with a Baa1 given by Moody’s and BBB+ by S&P Global.

Venture Investments

Another thing that makes Alexandria a one-of-a-kind REIT is that it has a venture capital arm that invests in promising biotech companies, many of them their tenants, and which has historically delivered impressive returns. Realized gains from this part of the business for the second quarter were $28.6 million, and $51.8 million for the first half of the year. The company is on track with projected realized gains for 2022 similar to the $105 million in realized gains it delivered in 2021.

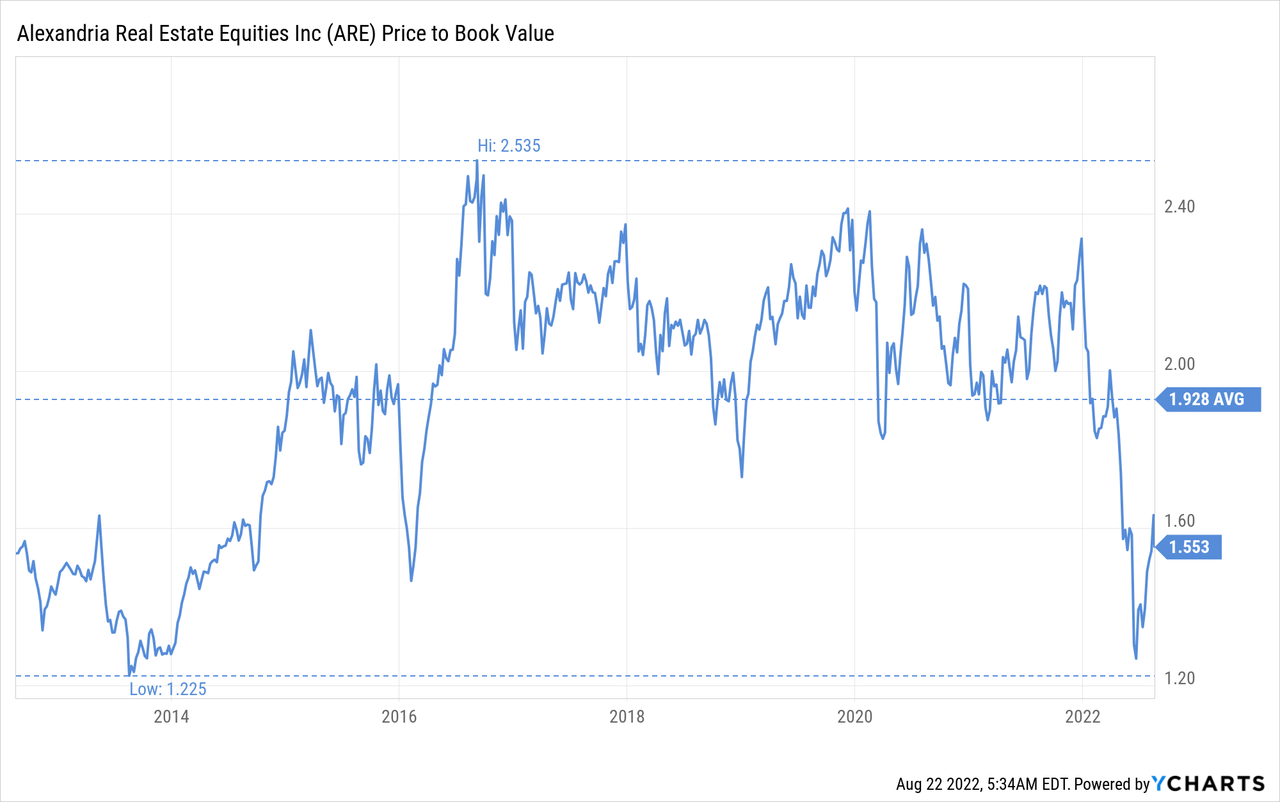

Valuation

While shares are far from being a bargain, they still offer decent value to investors, especially once its strong competitive advantages are taken into consideration. Shares are currently trading below the ten-year average price/book value of ~1.9x, and the recent decline almost brought them to the ten-year low of ~1.2x.

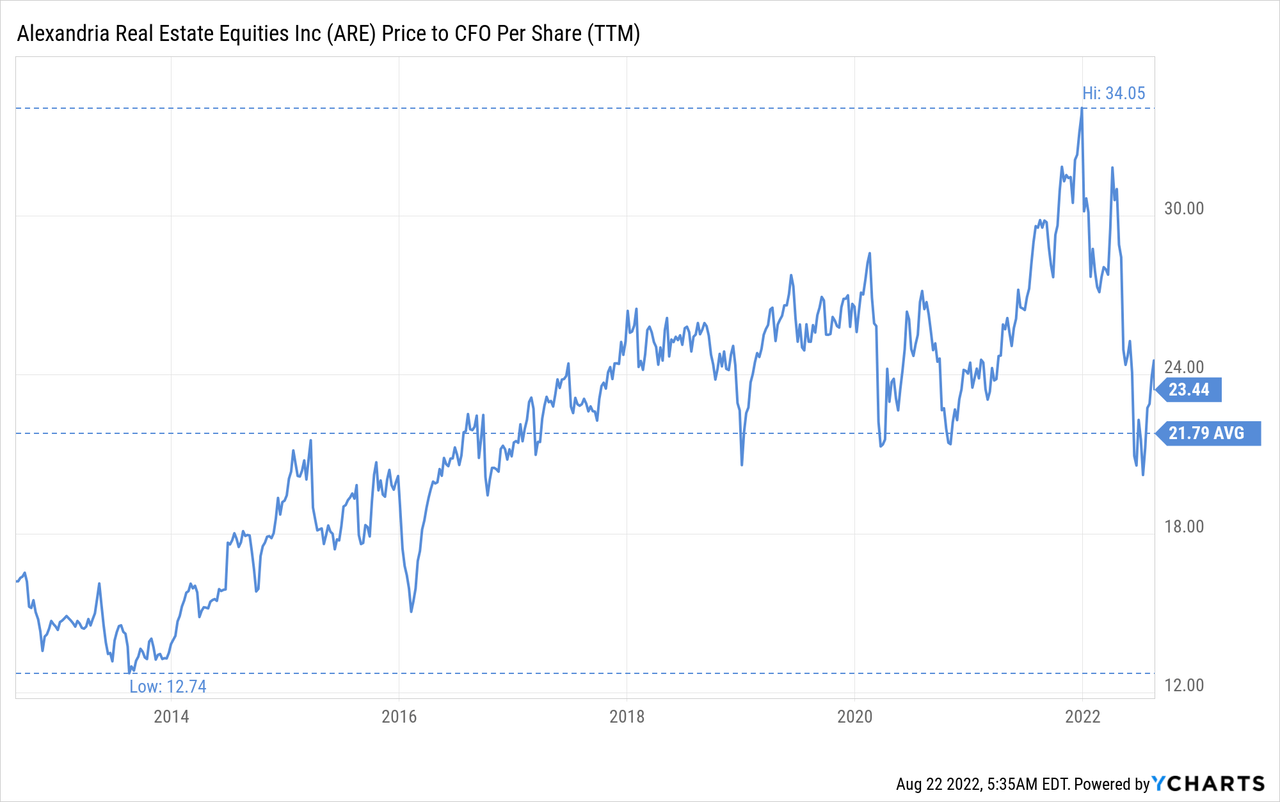

Shares look a bit more expensive when using price/cash flow, with shares trading at a price to CFO per share of ~23x.

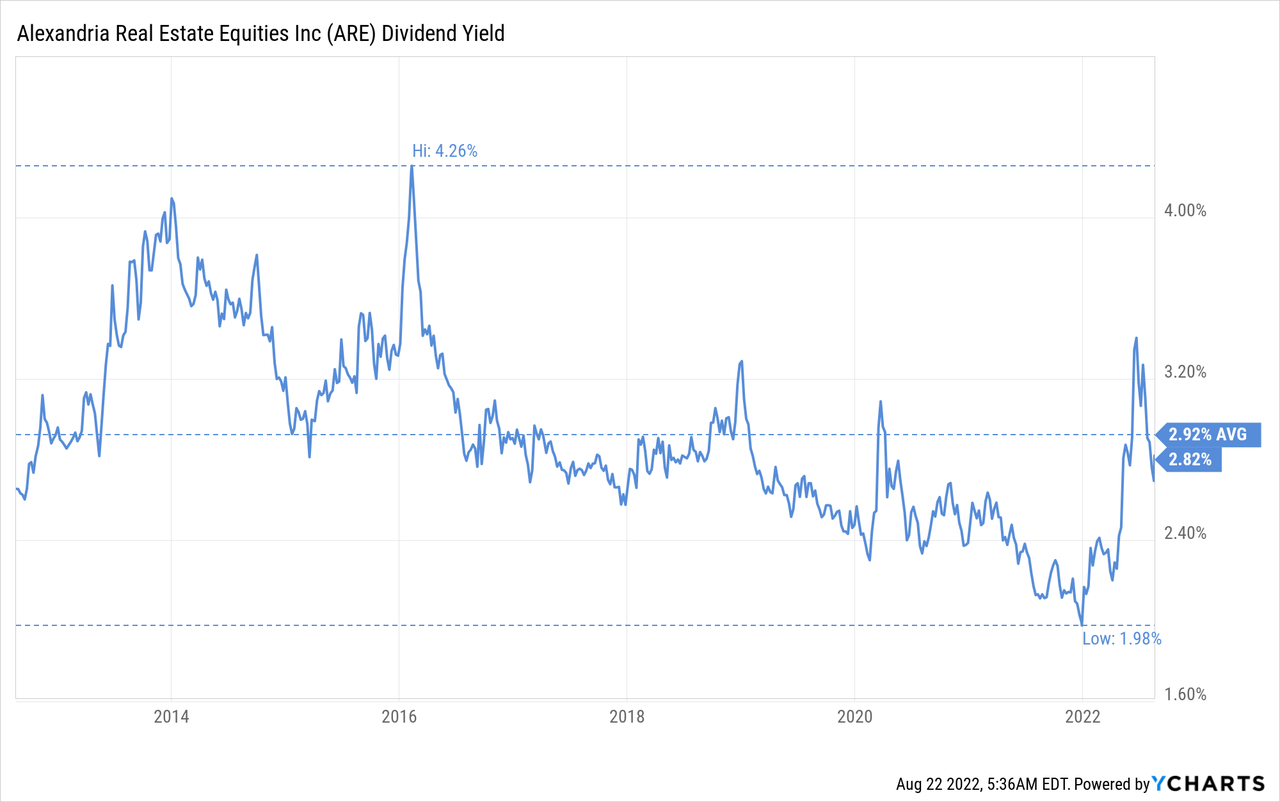

When analyzing valuation, we also like to see how the current dividend yield stacks up to its historical average. In Alexandria’s case, it is very close to the ten-year average, which together with the other two indicators leads us to believe that shares are currently fairly valued. Alexandria has raised its dividend by an average of ~7% over the last decade.

Risks

So far, its strong competitive advantages, including strong tenant relationships, premium locations, experienced management, and Class A buildings have for the most part insulated Alexandria from the work-from-home and macro weakness headwinds. There is no guarantee, however, that this will remain true in the future, with a lot of competitors trying to replicate Alexandria’s magic formula. There are a few things that mitigate this risk, one is that it is difficult to gain access to the best biotech clusters, this is truly a scarce resource. Also mitigating the risk is Alexandria’s solid balance sheet, which should help it weather a difficult period should a recession or increased competition put pressure on its business model.

Conclusion

After reviewing the most recent quarterly results from Alexandria we remain confident in its solid position. It continues to see impressive rent growth and significant leasing volumes, despite the work-from-home and macro uncertainty. The fact that it has been able to dispose of assets at high valuations as part of its strategic capital recycling program also gives us confidence on the value of the company’s assets. We plan to continue holding our investment in Alexandria, and feel confident about its future. There is also significant growth in the pipeline, and we therefore believe potential returns go beyond the dividend yield and should include capital appreciation for long-term investors. While an investment in the company is not without risks, we believe the risk/reward balance is positive here.

Be the first to comment