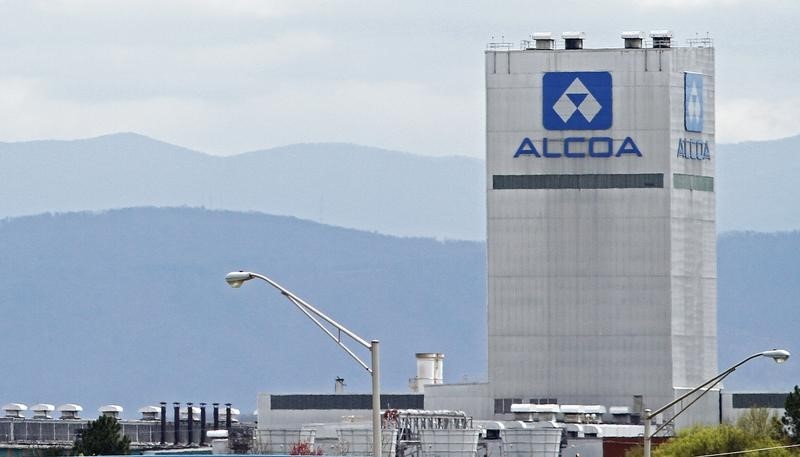

© Reuters. Alcoa (AA) Drops 10% After a Big Q3 Miss and Guide Down, Goldman Sees Attractive Entry Point

By Senad Karaahmetovic

Shares of Alcoa (NYSE:) are trading 10% lower in pre-market Thursday after the aluminum business reported weak .

Alcoa reported a loss per share of $0.33, a significant miss relative to the market consensus of a profit per share of $0.19. Revenue for the quarter came in at $2.85 billion versus the consensus estimate of $3.01 billion.

The adjusted EBITDA fell -71%, led by the -75% drop in the company’s biggest business unit – Aluminum. Alcoa reported that Aluminum production slipped nearly 9% to 497,000 metric tons, while third-party shipments dropped 14% YoY.

“Despite a challenging quarter that saw significantly lower prices, and high costs for energy and raw materials, we maintained a strong balance sheet, including transferring pension obligations and returning cash to our stockholders,” CEO Roy Harvey said.

For the full year, Alcoa now sees Alumina shipments between 13.1 million and 13.3 million metric tons, down from the prior 13.6 million and 13.8 million. Aluminum shipments are now seen between 2.5 million and 2.6 million metric tons.

Goldman Sachs analysts noted that the miss was driven by a weaker Aluminum segment. The analysts reiterated a Buy rating, as well as the Conviction List designation on the AA stock, and see an attractive valuation “particularly for investors who maintain a positive view on the secular growth story for longer-term aluminum demand.”

“We believe the recent pullback in shares offers an attractive entry point for those seeking leverage to commodity price upside, once near-term earnings expectations have been recalibrated.”

Morgan Stanley analysts see an “important downside to 4Q22 estimates if aluminum and alumina prices remain close to current spot levels.”

BMO analysts added:

“While AA shares are down meaningfully vs. peaks, if underlying prices do not improve, in our view a) the deterioration in Alcoa’s profitability remains underappreciated, and b) implied valuations suggest AA shares are at risk of further downward pressure.”

Be the first to comment