Jeff Swensen/Getty Images News

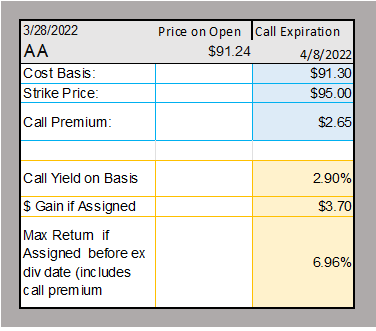

Underlying Security Symbol: AA

Certain stocks just command high options premiums. Whirlpool Corp. (WHR) has been such a nice run, and Qualcomm (QCOM) is always giving back. Alcoa (AA) is in the category of money machine, but it’s not a dividend machine.

I am basically chasing Alcoa. I buy and it goes higher. I sell a call and the shares are assigned. The dividend yield is not big enough or of enough duration that I want to hold AA as one of my dividend machines. So, I work it for call income.

- Dividend yield .43%

- October 2021 first dividend since 2016

- P/E ratio very high at 42

- D/E ratio very safe at .37

- Revenue growth but AA is building investing in its business, so earnings lag

The above fundamentals reinforce the use of my using this chunk of money to create income, not build a portfolio around AA. I want to keep the risk as low as possible, and therefore, I am picking calls with big premiums, short durations, and strike prices highly likely to be assigned. In this case, I picked a $95 strike and an April 14, 2022 expiration, for a premium of $2.65.

Author

This is a 12-day call. I am hoping AA will reach the $95 mark and my shares are taken and I can book the whole 6.96%. If not, I will keep the $2.65 premium and decide what to do with the shares at that time.

These short-term calls do fill the coffers.

MM MoneyMadam

Data from Schwab.com and MarketXLS

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment