mi-viri/iStock via Getty Images Albireo

The successful investor is usually an individual who is inherently interested in business problems. – Phillip Fisher (Warren Buffett’s one of two mentors)

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on September 25, 2022.

In biotech investing, an interesting theme is to “invest in specialists.” That is to say, it usually pays off when you invest in companies that focus in a particular sector, say orphan (i.e., rare) diseases. That being said, I’d like to revisit an orphan disease innovator dubbed Albireo Pharma, Inc. (NASDAQ:NASDAQ:ALBO). Since I made my initial recommendation, the stock was hit by the bear market and lost some ground. Just because a stock tumbles doesn’t mean you’re wrong, and vice versa. The fundamentals determined the stock performance in the long run. On that note, Albireo’s fundamentals are stronger than ever.

Already launching its lead medicine (Bylvay), Albireo is enjoying significant sales growth. Meanwhile, the company continues to execute prudent collaborations while expanding the Bylvay label. In this research, I’ll feature a fundamental analysis of Albireo and share with you my expectation of this intriguing growth equity.

Figure 1: Albireo Pharma chart

About The Company

As usual, I’ll provide a brief overview of the company for new investors. If you are familiar with the firm, I recommend that you skip to the subsequent section. In noted in the prior research:

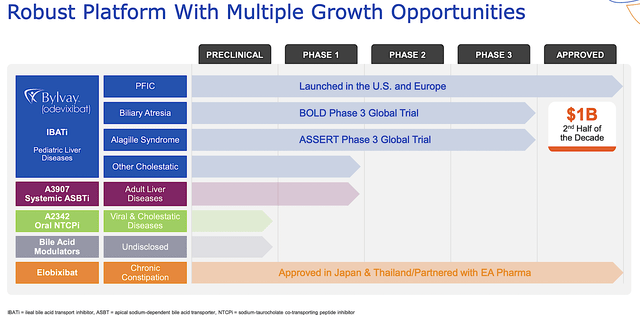

Operating out of Boston, Massachusetts, Albireo Pharma is focused on the innovation and commercialization of novel medicines to fill the unmet needs in orphan liver conditions. As shown below, the company has an interesting portfolio of two approved drugs and other early-stage developing therapeutics (i.e., A3907 and A2342). As the crown jewel of this pipeline, odevixibat (Bylvay) is authorized to treat the rare genetic liver condition, progressive familial intrahepatic cholestasis (i.e., PFIC) that is characterized by extreme itching. The other notable molecule is elobixibat, approved for the treatment of chronic constipation (of which Albireo receives royalty payment from EA Pharma).

Figure 2: Therapeutic pipeline

Tracking Albireo Investment Thesis

Before proceeding with this analysis, you should place Albireo into its appropriate investment category. That way, you can better track its progress to know when to buy, sell, or hold. Notably, Albireo fits into the “growth biotech” group.

The investing thesis (i.e., story) of Albireo is highly dependent on the success of Bylvay. Already approved for PFIC and launching in both the US/EU, Bylvay sales are increasing. Meanwhile, the company is expanding its label for other rare liver diseases (i.e., Alagille syndrome and biliary atresia).

Both of these later conditions are already in their Phase 3 studies. As such, you want to pay attention to any Bylvay developments like increasing sales and for the potential label expansion. So long as you continue to see positive development here, you know that your investment thesis is working out.

And while there are other molecules designed to treat other liver conditions, they are not as important as developments for Bylvay. Well, at least, not at this point in their growth cycle.

Healthcare Royalty Partner

As you track the investing thesis of Albireo, you want to pay attention to any deal and partnership. Accordingly, Albireo entered into a term loan with Hercules Capital (HTGC) back in June 09, 2020 for $80M. Furthermore, the company restructured their royalty payment with HealthCare Royalty Partners (i.e., HCR) for Bylvay in the treatment of chronic constipation in Japan where it is approved.

Recent Sagard Deal

As you can see, it’s a huge challenge for a small company like Albireo to launch its drug alone. By forming a partnership, the partner would offer the upfront cash to help the smaller firm absorb the costly and arduous innovation/launch process. Of note, the partners (particularly the big well-known companies) would usually be responsible for the launch while giving the smaller company sales royalty.

On September 22, Albireo announced an interesting deal with Sagard Healthcare Partners. Here, Albireo would receive $115M upfront from Sagard. Upon FDA approval/launch of Bylvay for biliary atresia, Albireo would deliver Sagar mid-single digit average royalty.

Now, this collaboration differs from the typical partnership because Albireo is still launching Bylvay on its own. Nevertheless, you know that the partnership offers upfront cash for a variable amount of royalty. As a small company, Albireo can easily face cash flow constraints. Having another $115M significantly extends the cash runway.

Taking a closer look at the royalty, it is interesting that the percentage changes based on Bylvay sales. In other words, Sagard would receive a 12.5% annual royalty for the annual global sales that reaches $250M. However, the royalty rate reduces to 5% as revenues climb above $250M. Beyond $350M, Sagard would only get 1%. Taking into account the sales forecast, the royalty would average around mid-single digit.

As you can imagine, it seems like Albireo believes that their drug would easily exceed $350M in sales. Why else did Albireo substantially drained the royalty percentage down to 1% beyond $350M sales? That made sense, as orphan drugs tend to get reimbursed at a premium (on average $150K annually) to offset the lengthy and costly developmental process. And, the premium reimbursement translates into more revenues and a healthy profit margin.

More Favorable Terms

Asides from what we discussed, you can see that Albireo structured the deal highly in its favor. Specifically, the total royalties are also capped at 1.6X the invested capital (i.e., the $115M x 1.6 = 184M) if repaid by December 2028. After that date, the total royalties would be capped at 2x the invested capital (i.e., $115M x 2 = $230M). Moreover, the agreement would terminate (i.e., Albireo no longer has to pay any additional royalty) when the cap is reached.

As I interpreted the terms, I strongly believe that Albireo is highly confident that Bylvay will clear those hurdles (i.e., reaching way beyond $350M in sales). As such, it made perfect sense for Albireo to place a cap on royalty. That way, the company doesn’t have to pay more.

Now, what is even more interesting is that Albireo has the buy-out option to terminate the deal. In the first Third-year, Fourth-year, and Fifth-year, Albireo can respectively buy out at 1.3x, 1.45X, and 2.0X invested capital (i.e., $149.5M, $166.7M, and $230M). Commenting on the development, the President and CEO (Ron Cooper) enthused:

With this agreement, we are significantly strengthening our balance sheet, providing us flexibility, and extending our cash runway beyond at least the topline data readout of our BOLD study in biliary atresia in 2024. These additional resources allow us to build Bylvay into a billion-dollar product and advance the development of our early asset pipeline.

Latest Bylvay Results

Shifting gears, let us check the latest Bylvay operating results. After all, it gives stronger indication to future revenues. Accordingly, Bylvay product for PFIC tallied at $5.9M for 2Q2022. Of this figure, the sales for the U.S. and international market were $3.5M and $2.4M, respectively.

Now, there are only 245 patients on Bylvay which represents over 18% year-over-year (i.e., YOY) growth rate. Even at only 245 patients, Bylvay already has enjoyed $5.9M in sales. Imagine if that figure would be ramped up to 100 folds, you’d be looking at $590M.

As you recall, Bylvay was only approved for PFIC as early as 3Q2021. That is to say, it’s only been on the market for three quarters. There are currently only 73 prescribers, which increased from 57 from the previous quarter.

Launching a drug is like rolling a snowball down the hill. If the substance is great (i.e., an excellent drug), you can expect sales/marketing efforts to compound on itself. As the drug penetrates into other countries beyond the USA, you can project that sales would increase aggressively.

Of global expansion, Albireo is sending Bylvay into key markets like German, UK, Italy, and Belgium. In Italy, Bylvay is made available in the fall because pricing and negotiation is already completed. Moreover, Bylvay was granted Full Therapeutic Innovation status by the Italian Medicines Agency (AIFA). In Belgium, Albireo achieved reimbursement for Bylvay starting October 1 this year. The drug also scored a victory in Scotland with the Scottish Medicines Consortium as it will be available through the ultra-orphan pathway. In his optimism, the President and CEO (Ron Cooper) remarked:

We continue to make meaningful progress with the global Bylvay launch as we increase the number of patients on Bylvay, including reimbursed patients and those covered through our managed access programs. Compliance and persistency continue to be strong, providing these patients an effective and well tolerated drug that has potential to be their lifetime therapy, and we look forward to our planned expansion beyond PFIC with the imminent ASSERT Phase 3 trial in Alagille syndrome readout this fall.

Important Catalysts

Of catalysts, Albireo is busy expanding Bylvay’s label. Specifically, the company is poised to deliver good news for Bylvay as a potential treatment for Alagille syndrome and biliary atresia. The company anticipated that Bylvay revenues for those two aforesaid conditions should reach blockbuster status (i.e., at least $1B in annual sales) in the first half of this decade.

As a general rule of thumb, you can trust what the management of most public companies say. They typically tell you most of the truth. Else, they would lose investors’ trust the following years. That mentioned, I believe the management’s projection is reasonable because those two conditions are orphan diseases to boost sales.

Additionally, the two Phase 3 investigations — ASSERT for Alagille and BOLD for biliary atresia — are progressing well. Specifically, ASSERT will report topline data this fall. I forecast 65% (i.e., more than favorable) chances that ASSERT would generate positive results. I based my forecast on decades of experience, my intuition, and the disease context.

As to BOLD, it’s the first and only Phase 3 study of an IBAT inhibitor in biliary atresia in the U.S., Europe, China, and Latin America. Full enrollment is expected to complete this year with data reporting as soon as 2024. For BOLD, I also expect similar or better chances of success.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 2Q2022 earnings report for the period that ended on June 30.

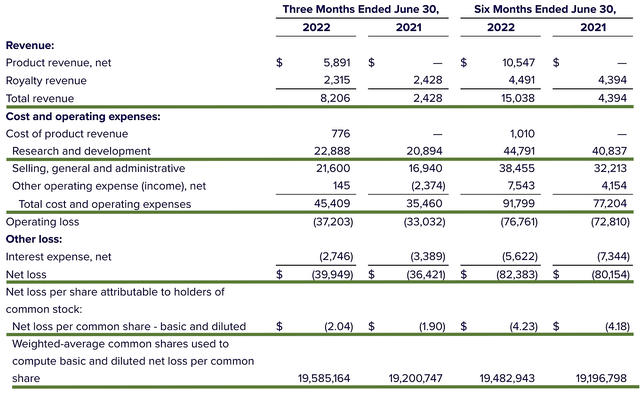

As follows, Albireo procured $8.2M in revenue compared to $2.4M for the same period a year prior. On a YOY basis, the topline grew by 241.6%. Of that figure, $5.8M accounted for Bylvay sales whereas the remaining (i.e., $2.3M) came from royalty sales from HCR. Though this figure is not substantial, it signifies a meaningful 18% sales improvement.

That aside, the research & development (R&D) for the respective periods registered at $22.8M and $20.8M. I viewed the 9.6% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $39.9M ($2.04 per share) net losses compared to $36.4M ($1.90 per share) decline for the same comparison. As you can see, the more money invested into R&D translated into a widening bottom line depreciation. That aside, the company invested more capital into its sales/marketing program.

Figure 3: Key financial metrics

About the balance sheet, there were $181.0M in cash and equivalents. On top of the recent $115M deal, the total cash position is increased to $296.0M. Against the $45.4 quarterly OpEx (and on top of the $8.2M quarterly revenue), there should be adequate capital to fund operations into 2024. Simply put, the cash runway is adequate relative to the burn rate.

Valuation Analysis

It’s important that you appraise Albireo to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 19.2M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Bylvay for PFIC, Alagille syndrome, and biliary atresia. |

$1B (Estimated from the 4,500 total patients in the US. I focus on the US market because that’s where an orphan drug gets its premium reimbursement. Now there are also 14K patients ex-USA). |

$250M | $130.20 | $78.12 (40% discount because Bylvay is launched for PFIC while pending on Phase 3 data for the other two conditions). |

|

Elobixibat |

Royalty has been insignificant. |

N/A | N/A | N/A |

| A3907 for systemic ASBTi | Too early in development (Will assess with more advancement) | N/A | N/A | N/A |

| A2342 for Oral NTCPi | Too early in development (Will assess with more advancement) | N/A | N/A | N/A |

|

The Sum of The Parts |

$78.12 |

Figure 4: Valuation Analysis

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Albireo is whether the company can continue to ramp up Bylvay sales. It’s tough for a small company “going at it alone” in commercialization to see a quick sales ramp up.

That aside, there is a 35% chance that ASSERT won’t deliver positive data this fall. Moreover, there is a similar odds that BOLD would generate negative data in 2024. In case of a failed data, I believe that the stock would tumble but not as aggressively as 50% because Bylvay already secured one approval.

Final Remarks

In all, I recommend Albireo Pharma as a speculative buy with 4.8/5 stars rating. Albireo Pharma is a highly promising therapeutic innovator that is delivering the answer for various rare liver diseases. Already secured its first victory with Bylvay for PFIC, the company is now expanding its label for biliary atresia and Alagille syndrome. The recent $115M deal with Sagard for royalty sales of Bylvay in biliary atresia is a testament to the drug’s upcoming conquest for the latter condition.

Very soon, you can expect to see the data report for the Phase 3 (ASSERT) trial for Alagille. If positive, and I believe it will be, you can expect the stock to enjoy a decent rally. In the longer horizon, you have the data report for the other Phase 3 (BOLD) study for biliary atresia.

Be the first to comment