Cavan Images/iStock via Getty Images

Background

Albemarle Corp. (NYSE:ALB) is an international lithium conglomerate with solid global ties. Lithium is becoming an expensive commodity that has helped Albemarle shares over the past 12 months. This may continue with higher interest rates and other geopolitical factors improving the price of these commodities. The lithium industry is entering into an exciting territory because most of the lithium and rare earth minerals mined come from CCP-owned corporations. However, Albemarle can combat this with its expansive network of producers in southeast Asia and global investments.

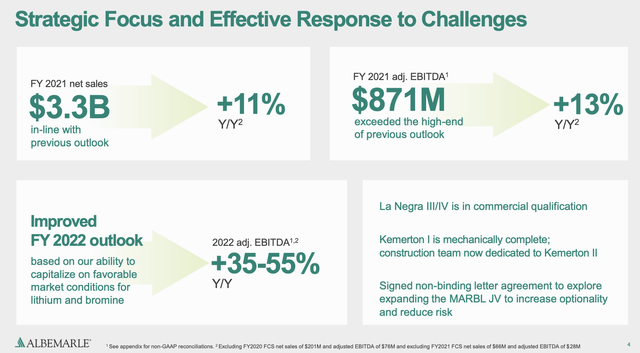

Albemarle Q4 21 Earnings Presentation

The macroeconomic picture has not slowed down the company’s short-term milestones. Albemarle is looking to make +11% net sales YoY with an EBITDA increase of +35-55%. These are impressive stats for an otherwise dull mining sector. Lithium is enabling these major conglomerates to grow profitability and reward shareholders simultaneously.

Enhancements in Production and Efficiency

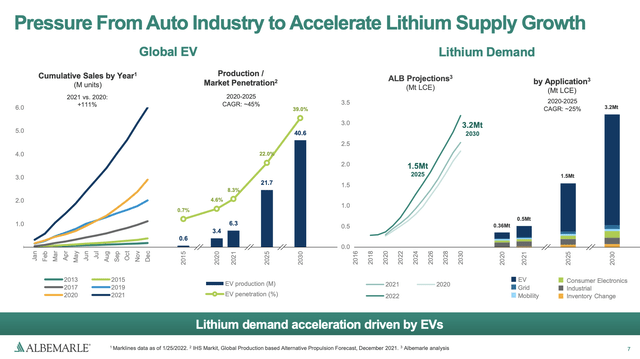

The company’s portfolio primarily revolves around the central idea that lithium will power electric vehicles and the entirety of our renewable supply chain in the future. This is a real possibility, and investors need to recognize Albemarle as a powerful lithium miner prepared to start taking on the international land grab. Companies such as Rio Tinto (RIO) have controlled global assets. In terms of earnings growth, investors today are paying a lower price than what they were paying a year ago for earnings.

Albemarle Q4 21 Earnings Presentation

The demand for lithium will cause Albemarle to continue to grow. The company plans on capitalizing upon this demand through its expansive portfolio, with operations across East Asia and more in the pipeline. Albemarle is much better positioned for OEMs due to its size and the variety of locations they can source lithium from. This gives them a competitive advantage over stock such as Livent (LTHM) and MP Materials (MP). These companies are great, and I have a bullish rating on them. However, Albemarle is a much larger conglomerate with the ability to supply both US and Chinese suppliers IF Albemarle can navigate the complex political process. They will be able to generate profits that competitors can’t match.

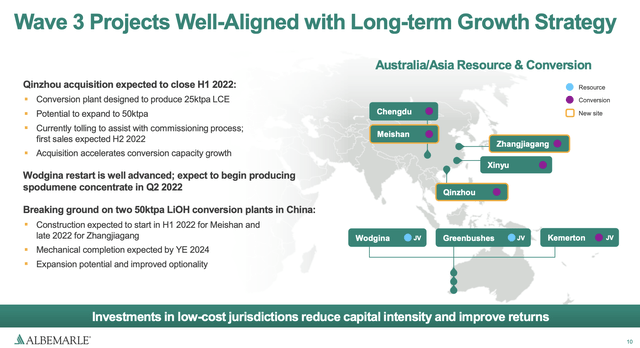

Albemarle Q4 21 Earnings Presentation

The variety of locations where Albemarle operates gives them a unique market advantage when dealing with foreign governments. There are six conversion locations in China that signal a clear need for the Chinese government to approve what Albemarle is doing. The company also has two explorations locations and one resource location in Australia. Exploring and producing from these mines is risky but could prove crucial to Albemarle’s future earnings.

Financial Stability and Progress

The stability generated from the mines will be an essential part of the company’s valuation. Now that Albemarle has these mines up and running, they should generate profits that will help the price to earnings ratio. This is the hope in financial terms for many of these younger mining companies trying to make their spot in the big leagues. Turquoise Hill Resources (TRQ) and MP Materials are solid companies without a dividend like Albemarle. However, they don’t have the market cap size and market dominance like Albemarle.

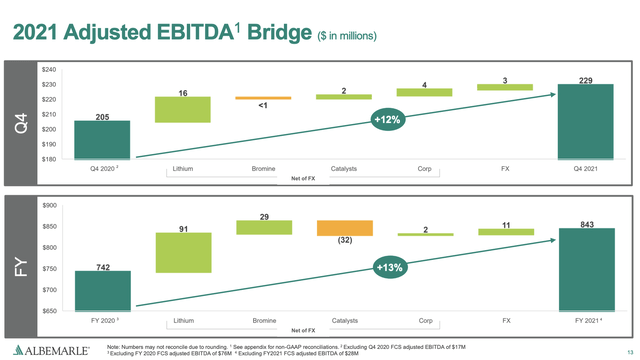

Albemarle Q4 21 Earnings Presentation

Earnings have has been solid and have shown stable increases for a company with a relatively high P/E for its sector. It is nice to see that the company has managed to remain stable internally and has a margin of safety in terms of its earnings picture on the earnings front. The full-year projection looks strong, and overall the increase from the lithium earnings should be meaningful in future quarters.

Albemarle is Exposed to Otherwise Unnecessary Risks

The risk exposure the company has is mainly sector-based. Albemarle prides itself on having rich lithium deposits. However, the market has not been very favorable. These mining companies primarily focused on future value. Considering the company has connections with the CCP and a 181 P/E, I don’t believe there is an upside from these levels. While Albemarle may use companies partially owned by the CCP as middlemen in these transitions, the geopolitical risks remain.

Sector-wise, Albemarle is a leader in lithium mining, and moving forward, the main risks Albemarle will see come from macro pressures. Internally the company is performing, but they are at the mercy of powers much more significant such as large centralized governments and institutions.

Valuation Is Pricing in Too Much Future Growth

Albemarle has a strong valuation potential given its exploration and production possibilities. Lithium is a growing industry, and there will be a variety of players in the field that require major contracts with Albemarle to buy lithium to meet their commercialization numbers due to the battery. Keep in mind many of these electric vehicles programs are trying to mimic closed technology and make it so that if one part of the car breaks, it all breaks. This model has worked well for companies like Toyota and will continue to work well for them, but I have to wait and see if GM and Ford will give the same level of support. These are massive concerns for the valuation because much of what’s being priced now is based upon future opportunities.

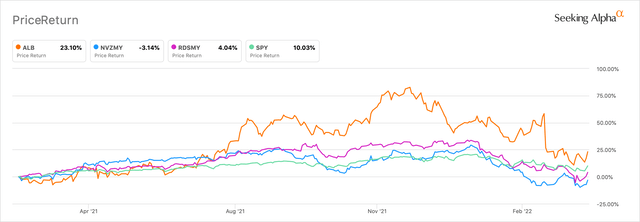

Albemarle Seeking Alpha Price Return Peer Comparison

Albemarle is not a buy as the price still needs to break higher through the S&P 500 Index barrier. When that happens, I will take Albemarle more seriously as an investment. The company still has much ground to cover. While Albemarle has made their footstep very clear internationally, they still lack the US presence needed to compete with some smaller mining companies.

Conclusion and Rating

Albemarle has a strong outlook. The company will remain a buy for the long term, but I will warn investors that, while it is a high-earnings company with excellent business development prospects, much of that opportunity is yet to be seen. I can’t overlook the risk, so I am forced to rate the company neutral for now due to the high P/E and international exposure. I look forward to Albemarle’s future developments and remain open-minded toward the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment