Petmal

Investment Thesis

Albemarle (NYSE:ALB) is well-positioned to renegotiate high prices for its lithium business. Everyone ”knows” that lithium-ion battery demand remains very high, but few investors are willing to get involved in a cyclical lithium business as we are most likely facing a mild recession.

Consequently, despite its rapidly growing topline and even more impressive improvements on the bottom line, this stock still remains absurdly cheap at around 4x next year’s EBITDA.

What’s more, I’ll highlight that in my previous bullish article going into Q2 earnings I said:

[…] keep in mind that Albemarle doesn’t have any positive free cash flow. Yes, it has significant adjusted earnings, as it guides for $15 of adjusted EPS, but the vast majority of its earnings needs to be reinvested back into the business as capex.

Since that was written a lot has changed for ALB. On the back of a significant raise of ALB’s guidance, the business now expects to end 2022 as free cash flow positive.

Consequently, I rate this stock a buy.

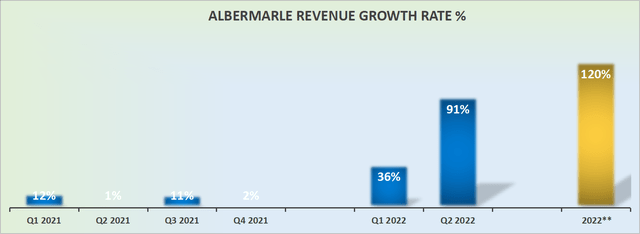

Albermarle’s Revenue Growth Rates Accelerate

ALB revenue growth rate

Note, in the graphic above revenues don’t account for the Fine Chemistry Services (“FCS”) business sold in June 2021. These are as-reported GAAP revenues.

Consider the following, when ALB reported its Q4 2021 results at the start of 2022 and guided for the year ahead, the high end of its revenues pointed to $4.5 billion.

Then, during the next couple of quarters, ALB proceeded to increase the high end of its guidance to $5.6 billion, and now further increased to its latest guidance of $7.5 billion at the high end.

What’s more, not only is this a significant acceleration of its revenue line but there’s no reason to expect this strong growth rate to slow down any time soon.

Why Albemarle? Why Now?

ALB is predominantly a lithium business with a significant bromine unit.

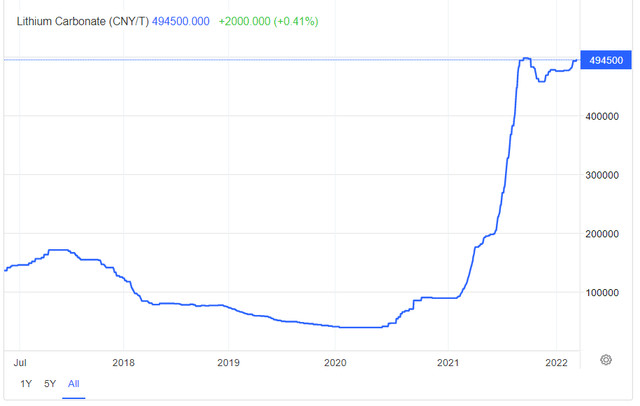

The fact of the matter is that lithium prices are not coming down. There’s simply too little supply relative to meet demand that we are all seeing from EVs.

TradingEconomics.com

Particularly when it comes to ALB, management noted on its earnings call that it has renegotiated contracts and most of its contracts are now locked in over the next year or two.

This provides ALB with a significant amount of visibility. Hence, given its high visibility together with the meaningful price increases, this is allowing ALB to drop a large proportion of its revenues to free cash flows.

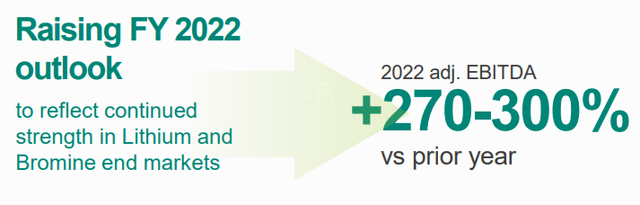

Profitability Profile Continues to Improve

Once again, let’s take a step back. When ALB reported its Q4 2021 results and guided for its free cash flow line for 2022 the middle of its range pointed to approximately $1.0 billion of negative free cash flow.

This figure would then proceed to be upwards revised so that its renewed guidance now points to end 2022 as a free cash flow positive enterprise.

For a company with a $30 billion market cap to seamlessly progress from burning $1.5 billion at the start of 2022 to now expecting to end 2022 as free cash flow positive puts a spotlight on the strong demand for this company’s offering.

ALB Stock Valuation – 4x EBITDA

ALB Q2 2022 presentation

If we take ALB’s guided EBITDA of $3.5 billion and presume that conditions next year substantially slow down so that its EBITDA line ”only” grows by 100%, rather than the 270% we are expecting this year, this would see ALB reporting $7 billion of EBITDA next year.

This would see this stock priced at approximately 4x next year’s EBITDA. Surely this is cheap enough to compensate investors for the cyclicality of this business?

Indeed, this multiple is low enough so that if its bottom line EBITDA ends up only growing by 50% y/y in 2023, its multiple would still only be around 8x EBITDA. Still very attractive.

The Bottom Line

I recognize that ALB is a cyclical enterprise and therefore its multiple will never be proportional to those of the tech sector. But it’s shocking that something that’s growing at such a fast clip, with so much operating leverage should not trade more expensively.

The bearish considerations here are obvious. If we were to see a deep recession in the US, demand for EVs would rapidly come down, thereby taking lithium demand down with it.

Also, the big question mark here is whether China will be able to materially raise lithium production to flood the market. This is something to keep an eye on.

That said, I believe that ALB’s current valuation of 4x next year’s EBITDA is cheap enough to factor in the above-mentioned risks. I rate this stock a buy. Happy investing.

Be the first to comment