Vertigo3d

Investment Thesis

Albemarle Corporation (NYSE:ALB) is a solid pick for those interested in participating in the booming EV supply chain economy, which is expected to grow tremendously over the next decade. Analysts have projected that the global electric vehicle market will reach $823.75B by 2030, growing at an impressive CAGR of 18.2%. With nearly 500 ktpa conversion capacity by the end of this decade, we expect ALB to report a potential quintupling of its revenues and net income then – triggering a long-term stock price appreciation for existing stockholders.

Assuming that the lithium prices remain elevated for the next few years, we expect to see an upwards re-rating of ALB’s revenues and net incomes as well – allowing the company to harness this massive momentum even faster. In contrast, investors with a lower tolerance for volatility may want to take a step back and observe the stock market for a little longer. The Fed’s continuous hike in interest rates and potential recession could possibly dampen the red hot market demand for EVs and consequently, lithium in the short and intermediate term. We shall see.

ALB Is Showing Much Promises For Long Term Growth & Investing

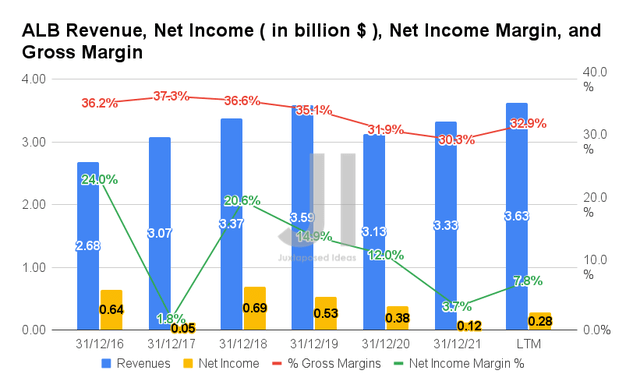

Despite the apparent dip during the height of the COVID-19 pandemic, it is evident that ALB has managed well for itself in the past year. By the LTM, the company reported revenues of $3.63B and a gross margin of 32.9%, indicating an increase of 1.1% though a slight decline of 2.2 percentage points from FY2019 levels, respectively.

However, ALB reported net incomes of $0.28B and net income margins of 7.8% in the LTM, representing a notable decline of 47.1% and 7.1 percentage points from FY2019 levels, respectively. Nonetheless, it is essential to note that these declines are attributed to the legal case with Huntsman Corporation, resulting in a $0.66B legal settlement in FQ3’21. Therefore, we expect ALB to report much-improved earnings henceforth.

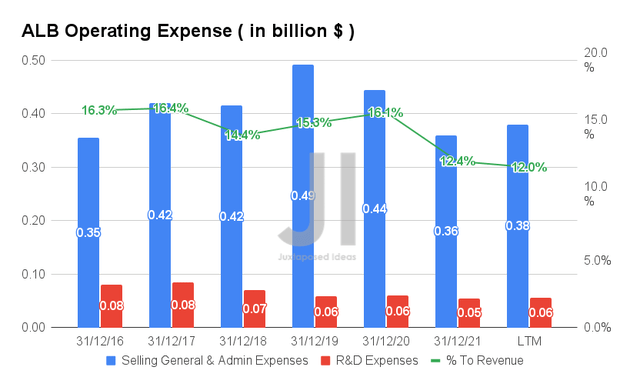

The declines in ALB’s gross margins are mildly attributed to the rising costs of goods sold accounting for 69.6% of its revenue in FY2021, which grew by 4.7 percentage points compared to FY2019 levels. Nonetheless, the company has also shown its capability in operation management, from its continually moderated operating expenses of $0.44B in the LTM, representing a notable decline of 20% from FY2019 levels. Thereby, accounting for only 12% of ALB’s revenue and 36.9% of gross profit in the LTM, instead of 15.3% and 44% in FY2019, respectively.

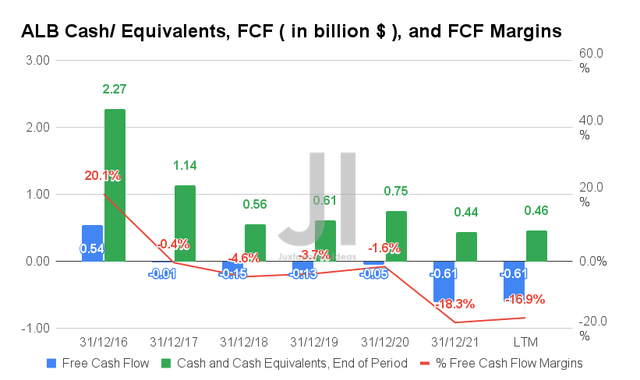

Therefore, it made sense that ALB had been struggling to improve its Free Cash Flow (FCF) generation thus far, with an FCF of -$0.61B and an FCF margin of -16/9% in the LTM. It represented a massive decline of 469.2% and 13.2 percentage points from FY2019 levels, respectively. Therefore, further impacting its cash and equivalents on its balance sheet to $0.46B in the LTM. Nonetheless, we expect much improvement ahead – with a potentially positive FCF generation from FQ2’22 onwards.

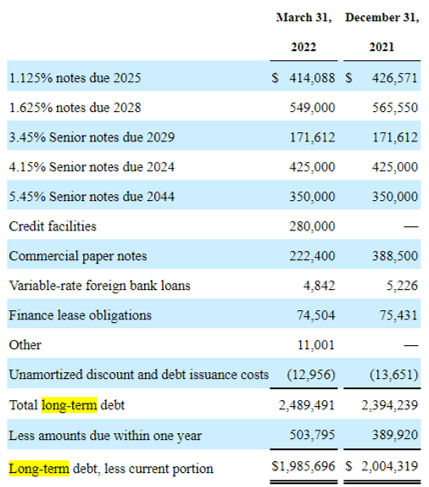

ALB Debt Maturities

Seeking Alpha

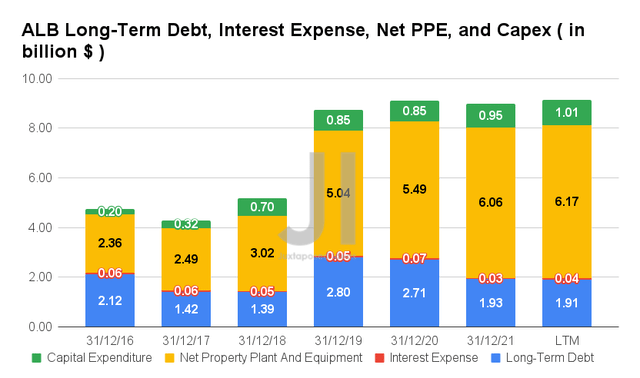

Therefore, despite the appearance of deleveraging in the past year, it is evident that ALB needed to rely on more long-term debts moving ahead. In fact, the company had priced $1.7B Notes in May 2022, post FQ1’22 earnings call, to sustain its growing operations and redeem its outstanding 4.15% Senior Notes of $0.42B due 2024. In the short term, we expect the raised capital to go towards redeeming its 1.125% Notes of $0.41B due 2025 as well. However, we are not overly concerned, due to its lower interest expenses of $0.04B thus far.

ALB’s Aggressive Expansions

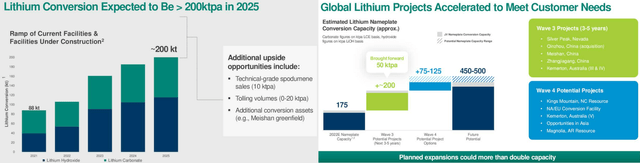

ALB also guided up to $1.5B in capital expenditure for FY2022, while boosting its net PPE assets to $6.17B in the LTM. These strategies highlight the management’s plan for growth-at-all-costs to ride the momentum in Lithium’s massive demand, since the company is also planning to expand its production capacity in the US, on top of the Qinzhou acquisition closing by H2’22 and its existing ones in Australia, Brazil, and China. We are highly encouraged by these aggressive plans to bring its total conversion output to nearly 500 ktpa (speculatively by the end of the decade), since these investments would eventually be top and bottom lines accretive.

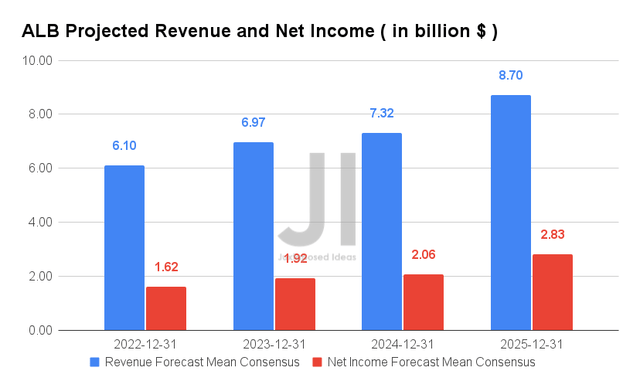

Over the next four years, ALB is expected to report revenue and net income growth at a CAGR of 27.23% and 118.72%, respectively. Its net income margins are also expected to improve tremendously from 3.7% in FY2021 to 32.5% in FY2025. For FY2022, consensus estimates that ALB will report revenues of $6.1B and net incomes of $1.62B, representing impressive YoY growth of 83.3% and 1309.9%, respectively.

In the meantime, analysts will be closely watching its FQ2’22 performance, with consensus revenue estimates of $1.5B and EPS of $3.27, representing excellent YoY increases of 94.37% and 267.46%, respectively. Given its stellar execution for the past eight consecutive quarters and the lack of legal settlements ahead, we expect a smashing report ahead, potentially triggering a short-term rally ahead, before being unfortunately digested by the bearish market sentiment, as experienced by the S&P 500 Index with a 21.8% fall in H1’22.

Do Not Look At ALB As A Dividend Stock – Take It As A By-The-Way Bonus

ALB 10Y Stock Price, Dividend Payout, and Dividend Yield

ALB has had a discernible stock price uptrend over the last seven years, discounting the fall between 2017 and 2020. Though the stock had a notable decline in its dividend yield from 2.7% in 2020 to 0.69% in 2022, its dividend payout has been increasing at a CAGR of 5.54% in the past nine years, from $0.96 to $1.56. As an added bonus, the company’s dividend payout has increased three times in the past three years, indicating that it is a decent (though not especially impressive) dividend stock.

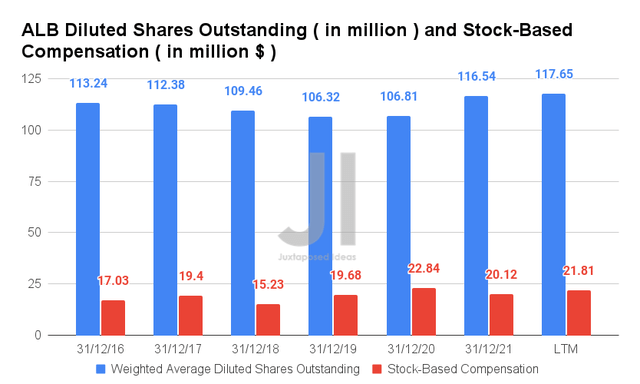

In addition, ALB has kept its share count and stock-based compensation expenses relatively stable in the past few years, with a total of 117.65M and $21.81M reported by the LTM. Nonetheless, it is important to understand that the company has no plans for share buyback programs in the foreseeable future.

Hence, ALB is not worth investing based on the strength of its dividends alone, but rather for its speculative leading position in the EV supply chain over the next decade – thereby potentially triggering a long-term price appreciation. Investors, take note.

So, Is ALB Stock A Buy, Sell, or Hold?

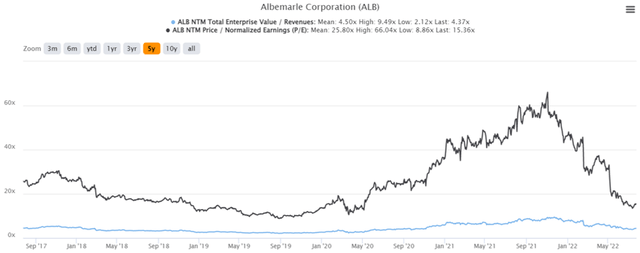

ALB 5Y EV/Revenue and P/E Valuations

ALB is currently trading at an EV/NTM Revenue of 4.37x and NTM P/E of 15.36x, lower than its 5Y mean of 4.5x and 25.8x, respectively. The stock is also trading at $255.10, down 12.8% from its 52 weeks high of $291.48, though up 50.1% from its 52 weeks low of $169.93. It is evident that ALB is riding another upwards curve by mid-July 2022, after digesting the FQ1’22 rally in early May.

ALB 5Y Stock Price

Despite the consensus estimates attractive buy rating with a price target of $280.58, we are not convinced of ALB’s 24.65% upside, due to its slight over-valuation. Investors should consider $180s as a more attractive entry point, given the historical support for the past few dips. It would also offer a wider margin of safety for long-term investing, due to the massive volatility in the past few months.

In addition, we prefer to glean information about its FQ2’22 earnings call first before making any buy recommendation for this excellent EV supply chain stock.

Therefore, we rate ALB stock as a Hold.

Be the first to comment