Ivan-balvan/iStock via Getty Images

Investment summary

AirSculpt Technologies, Inc. (NASDAQ:AIRS) has piqued our interest since listing back in FY21. It operates in a novel segment of ‘body contouring procedures’ and is best known for its AirSculpt procedure, under the subsidiary brand Elite Body Sculpture. The proprietary procedure is touted due to its minimally invasive nature that contrasts to traditional liposuction. Its growth strategy is to open new centres and expand/relocate existing ones, ultimately driving up revenue per case, cases per room and overall case numbers as part of its growth strategy.

Exhibit 1. AIRS 6-month price action

Despite the allure, forensics over its financial statements reveal there to be a loose fit to the kind of equity premia we are seeking exposure to in H2 FY22. Valuations are supportive of a neutral view and regulatory headwinds in adjacent markets [Australia, to be specific] has us cautious on the ramifications for global peers. With these points in mind, we rate AIRS a hold.

Q2 earnings indicate growth trends

We see the differentiated strengths of AIRS’ procedures in its most recent earnings, with upsides to consensus at the top and bottom lines. Forecasts on the global cosmetic market growth published in April 2022 predict a geometric growth of 3.6% per year from 2021 until 2028. Contrary evidence suggests a 9.6% CAGR into 2030. AIRS printed revenue of $49.7 million for the period, up 42% YoY. Presuming either of the above forecasts are true, then AIRS above top-line growth suggest it gained additional market share during the quarter. As a side note, however, this is a murky segment – recent controversies in the Australian cosmetic surgery market surrounding regulation are a potential risk for global participants.

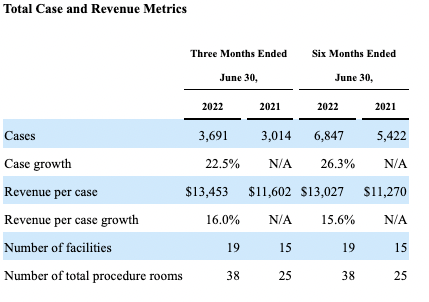

Cases also increased 22.5% YoY to 3,691 total cases, as seen in Exhibit 2. The company records each case as 1 visit, with doesn’t factor in that each patient may have multiple treatment areas per visit. Nevertheless, it opened 4 new centres during Q2 FY21, bringing total centres to 19.

Meanwhile, revenue per case increased 16% YoY to ~$13,450, supported by the company’s access to 38 procedure rooms versus 25 the year prior. However, the 10-Q did note that cases per procedure room declined due to the addition of the 13 new centres and expansion of existing ones, versus an organic decline over the 12 months. There is good reason to estimate that trends will normalize as procedures per room level to overall company growth trends.

Exhibit 2. Above-market growth statistics imply the company might be gaining additional market share

Image: HB Insights, AIRS SEC Filings

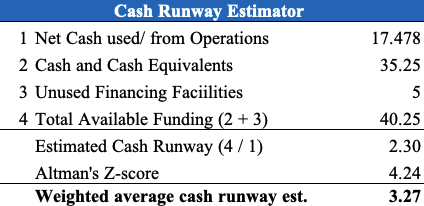

Despite the upsides in booked revenues for the quarter, our findings indicate there are drains and pulls on liquidity that may place stress on AIRS’ current position. As seen below, we estimate there to be around 3-4 quarters of cash runway remaining with the company’s most recent earnings. It needs a substantial growth in cash conversion from net income to bolster its position here and prevent additional dilutive equity raise(s) and/or expensive debt issuance/origination in the high yield debt capital markets. Noteworthy to this point, however, is the company declared a $0.41/share special dividend to be paid in September.

Exhibit 3.

Data: HB Insights Estimates

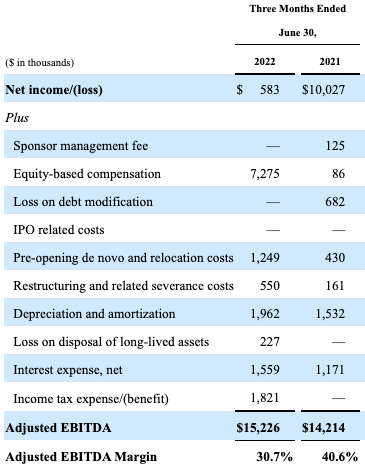

The company also reports non-GAAP EBITDA and recorded a $1.01 million YoY increase to $15.2 million as seen in Exhibit 4. This is despite earnings narrowing by 94% YoY from ~$10 million to $583,000. According to the 10-Q, “management assesses and believes investors should assess our operating performance” [using non-GAAP EBITDA]. We take some issue with this recommendation.

Firstly, the company booked ~$7.3 million in stock-based compensation (“SBC”) for the period, and saw an interest expense of $1.5 million – each up substantially on the year. Moreover, as seen below, AIRS asks us to ignore the impact of new centre opening and relocation costs, plus the SBC, plus the loss on asset disposals. We argue these are expenses that must be realized in the analysis of free cash flow and valuation. We can’t simply ignore that these 3 expenses in particular total to $9.3 million, and removing them from the equation, non-GAAP EBITDA is ~$5.9 million. Not to mention, it also recorded a $60 million payment to its parent organization. Therefore, whilst it converted $8.5 million in quarterly cash flow, this was more than offset by these expenditures.

Exhibit 4. Non-GAAP EBITDA includes several expenditures that we argue should be included in cash flow analysis

Data: AIRS 10-Q, Q2 FY2022

Valuation

AIRS’ growth strategy involves opening de novo centres, expanding existing ones and acquiring additional assets into its portfolio. In that regard, AIRS’ corporate value stems from its popular set of procedures – particularly AirSculpt liposuction – as an intangible plus its tangible book value. Any value manager will also familiarize this information with cash flow multiples and forecasts.

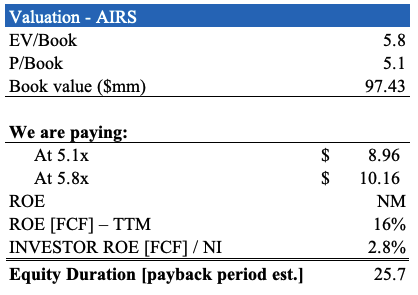

The company trades at 5.1x its book value but has negative tangible book value of $37 million. It is also priced at 5.8x Enterprise Value (“EV”) to its book value. Moreover, goodwill of ~$82 million combines with other intangibles to comprise 61% of the asset base and 139% of equity value.

At these measures, we are theoretically paying $8.96-$10.16 per share. This, for more than $81 million in goodwill and a negative tangible book value of $37 million, with growth of cash flows priced distantly into the future. Moreover, AIRS generated a FCF return on equity of 16% for the quarter – however, at 5.8x EV/book we’d receive just 2.8% of that, pushing the equity duration on the investment to more than 25 years, as seen below.

Exhibit 5.

Data: HB Insights

Moreover, it trades at ~14x our FY22 FCF estimates of ~$33 million, setting a price objective of $8.30 per share at today’s weighted shares outstanding. Each of these measures corroborate that AIRS is likely fair and reasonably priced at its current market cap. However, we need more in the realms of profitability and market certainty to justify the immediate investment.

In short

AIRS’ novel operating segment and organic growth strategy are appealing on face value and certainly pique one’s interest. However, our findings indicate the company doesn’t qualify for the strict equity premia we are seeking exposure to in H2 FY22, namely profitability at a reasonable price.

Shares do appear fairly priced however we are paying these levels for a negative tangible book value and cash flows priced distantly into the future. With healthcare catching a serious bid in H2 FY22, there may be more profitable opportunities elsewhere for investors to budget equity risk towards. With the culmination of these points, we rate AIRS a hold.

Be the first to comment