Jeremy Poland/E+ via Getty Images

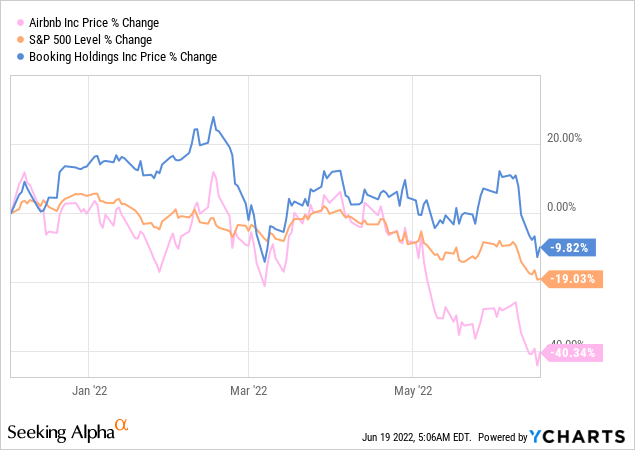

Airbnb Inc. (NASDAQ:ABNB), just like many other growth stocks, had a rough half a year since our previous article: I Was Wrong About Airbnb But I Still Prefer Booking Holdings, losing 40% of its value and 50% from its high of $200/share.

In contrast to that, Booking Holdings (BKNG) performed much better, in fact outperforming S&P 500, but still losing almost 10% during the timeframe.

When share prices suffer such dramatic 25% and larger blows in a short period of time, it’s due to investors revaluating company’s investment case. Which in its turn can be traces to two components: company’s expected performance and investor’s return requirements.

In our article today we will look at these two components answering the following questions:

- Did ABNB’s fundamentals drastically worsen in the past half a year?

- AND/OR did market assumptions and required risk return change?

Airbnb’s Fundamentals and Performance in 2022

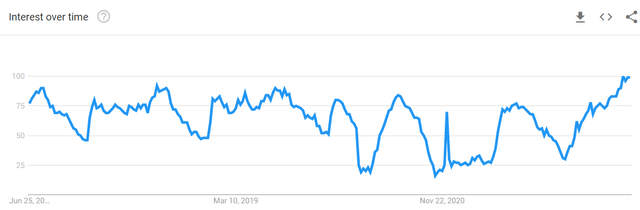

As the COVID pandemic finally eased its grip on the world in 2022 (or the world learned how to live and cope with COVID) the long-awaited travel demand finally hit the booking websites. Here’s anecdotal evidence from Google Trends that the search for the word “airbnb” is at all time high right now and about a third higher than last summer.

Airbnb in Google Trends (Google Trends)

ABNB is one of the stocks long-prophesied to benefit enormously from the recovery in travel and from the emergence of new types of travel, such as long-term stays.

Source: Seeking Alpha

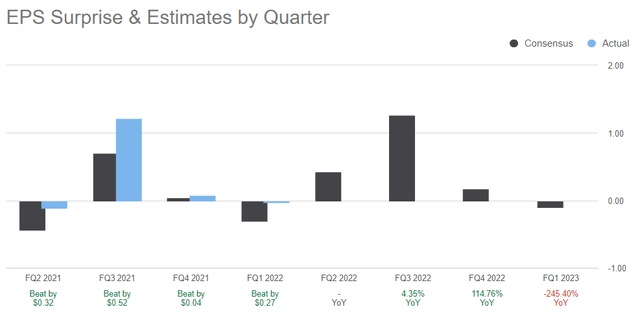

The past two quarterly results the company announced (Q4 ’21 and Q1 ’22) beat analysts expectations just slightly as ABNB stayed around the break-even mark. As ABNB is a seasonal business, the analysts expect the company to earn most of its money in Q2 and Q3, as you can see from the graph above.

To watch: Airbnb is expected to announce its Q2 results around Aug 2, 2022.

Looking at Airbnb’s expected results for FY2022, 100% of analysts raised their expectations, with us following suit. The company is now expected to earn $8.3bn in revenues and $1.9 in EPS in 2022.

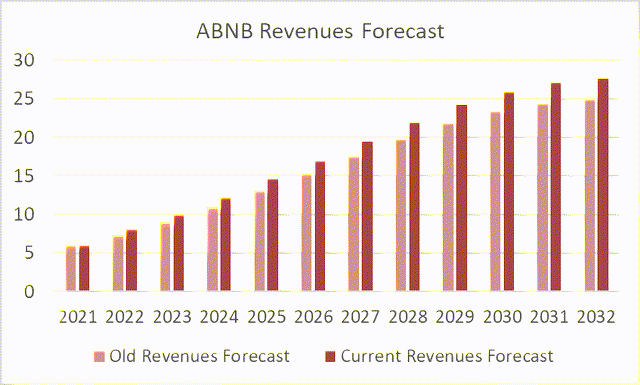

Our Original and Current Forecast pf ABNB’s revenues in 2022-2032:

Source: ABNB, author’s calculations

We raised our revenue forecast for 2022 from 7.3bn to 8.1bn by (10%), guided by strong 70% y-o-y growth in Q4 ’21 and Q1 ’22. We keep the growth assumptions for other years as well as profitability assumptions unchanged for now.

Therefore, in our view, the answer to the first question above is that there has not been any drastic detrimental change to Airbnb’s expected performance compared to December 2021. In contrary, we increase our 2022 revenue forecast based on Q4 2021 and Q1 2022 numbers.

Airbnb’s Expansion Model

As you could note from the forecast above, Airbnb Inc. is trusted with double-digit growth in revenues for the years to come. The company is currently about half the size of Booking Holdings in terms of revenues. Over the next decade Airbnb is expected to quadruple it’s tope line. In order to achieve that, the company has to venture onto new markets or create them as was the case in the past.

Strong future growth is a constant topic of interest among equity analysts. Apart from returning travel and demand, Brian Chesky, company’s CEO, sees the immediate sources of growth in redirecting demand to match supply. The company hopes to achieve this through “I’m flexible” feature, where Airbnb suggests locations for guests, who are not yet set where to go. This can turn out to be a power tool for growth for Airbnb, as historically the demand for accommodation was concentrated in larger cities or more popular tourist destinations and simultaneously limited those locations. By diverting demand to other locations, Airbnb creates new accommodations and new sources of revenue.

In addition to that, on May 11th, Brian Chesky announced Summer Release 2022, with new search options and other features designed to boost demand: Airbnb Categories, Split Stays and AirCover for guests.

Now guests when looking for a place to stay can browse through the categories like Camping, Surfing, Desert, Yurts, you name it. Another feature includes the ability to split guest’s stay at two destinations and all while getting some booking protection.

Airbnb is going an extra mile to meet any accommodation requirements its guests might have. The company also has initiatives to simplify new listings, where individuals can become hosts in a matter of clicks. All these initiatives, coupled with strong marketing budget should be enough to catch any potential demand coming to the market and fuel short-term growth.

On the negative side, Airbnb announced in May that it is exiting domestic business in China, citing stringent government regulations and lockdowns. Due to the sheer size of Chinese market and Airbnb’s low penetration on it, company’s presence there could have provided growth opportunities. However, understanding the difficult environment, we see it as positive that the company’s management was able to draw a line in the sand and focus its effort on other initiatives, which are easier to implement.

Another potential growth-driver for Airbnb could be Airbnb Experiences – the category that is currently so small, that it doesn’t even deserve a separate line of revenues on the income statement. When asked during the analysts’ call, Brian Chesky responded that he likes to focus on one thing at a time and that they would definitely focus on Experiences and other product categories at the right time.

We are optimistic that Airbnb has some promising growth stories in the next couple of years. However, in the long-term, above-average profitability will attract new entrants to the market, who in turn will chip off market share and with it revenue growth and profitability. Therefore, in our model we reduce Airbnb’s growth rate after 2025.

The Market is not what it has been in December

On a macro level a lot has happened in the past half a year. The perception of inflation changed from transitory to potential long-lasting risk to global economy. As a measure to fight inflation, Fed raised short-term interest rates and is expected to continue on its path. 10Y T-bond rate more than doubled to 3.25% now from 1.58% in December ’21.

Energy prices skyrocketed, fueled by Russia’s invasion in Ukraine in February 2022, which exacerbated further inflation concerns. Stocks plunged and investors became more risk-averse, requiring higher returns. Equity risk premium increased from 4.77%, which we used in our December model, to 5.17% in June.

What does it mean for ABNB valuation using a DCF model? It means that since December, the discount rate for the cash flows aka the required return for investors, has increased from 6.5% to 7.8%. As you will see in the section below, changes in required return have very sizable implications to the expected fair value per share.

Updated DCF Model Suggests 33% Upside

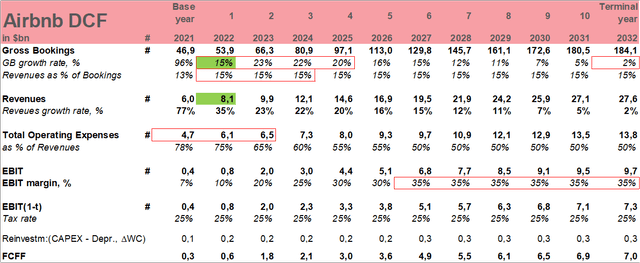

As mentioned above, we kept ABNB’s forecast growth rates stable, apart from increasing 10% revenue growth in 2022, which triggered a waterfall in higher revenues for the whole forecast period.

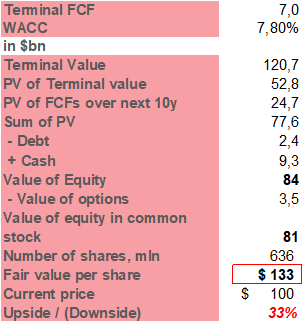

To recap, in our December article using 6.5% WACC, we set ABNB’s target price at $146. Having run our model with the WACC of 7.8%, which reflects current market risk requirements, we come up with a target price of $133, suggesting 33% upside to the current share price.

Author

Had we kept our growth forecast intact and used a new WACC, the estimated fair share value then would have been $111, still suggesting some 11% upside potential to the current share price. That makes $35 difference in the target price due to the changes in the required rate of return. Should the interest rates continue to go up, so will the discount rate, thus decreasing the net present value of future cash flows and the estimated fair share value respectively.

Conclusion

Airbnb is currently ripping the fruits of resumed travel, as the company is expected to achieve 35% revenues growth to over $8bn in 2022. Company’s management seems to have a number of ideas to boost the revenue growth even further.

On the profitability side the company was slightly beating analysts’ expectations, however, it’s profitability is still far below Booking Holdings.

On the other hand, there has been a major risk repricing on the market in the past half a year, which calls for the adjustment of the DCF model and a new estimated target price of $133/share, suggesting 33% upside to the current share price.

To watch: Airbnb is expected to announce its Q2 results around Aug 2, 2022.

Be the first to comment