Thomas Barwick

Airbnb (NASDAQ:ABNB) reported second quarter earnings which showed continued strength in spite of tough comparables and a worsening economic outlook. What’s more, while one might hold fears that other travel stocks are experiencing only a near term boost due to pent-up demand, ABNB still remains a secular-growth disruptor in the lodging space. While ABNB’s growth beyond this year is likely to decelerate considerably, this is a name which is generating robust profits and continuing to innovate. I continue to rate the stock a buy.

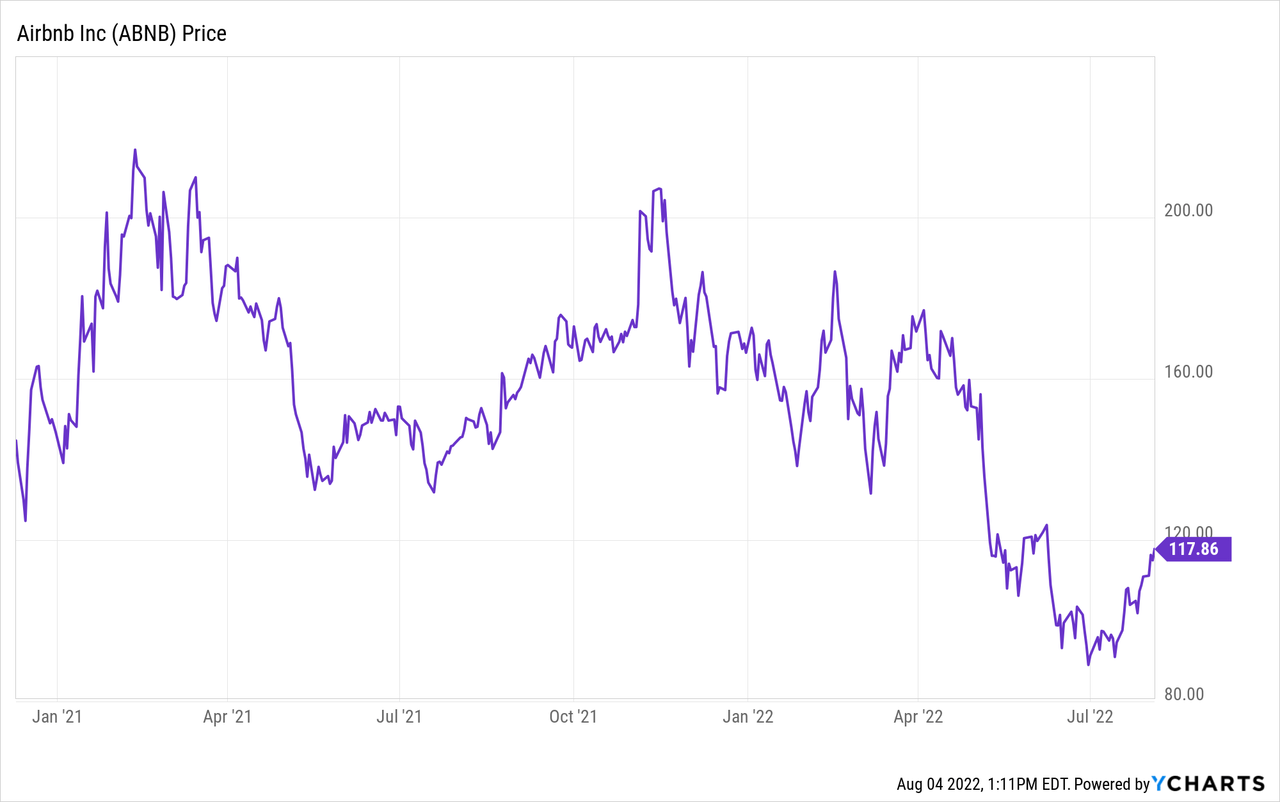

ABNB Stock Price

ABNB peaked above $212 per share in early 2021 soon after coming public. The stock has since fallen over 40%.

I last covered ABNB in May where I discussed why the stock should have soared after that earnings report. The stock has since fallen another 24%, increasing the attractiveness of the buying opportunity.

ABNB Stock Key Metrics

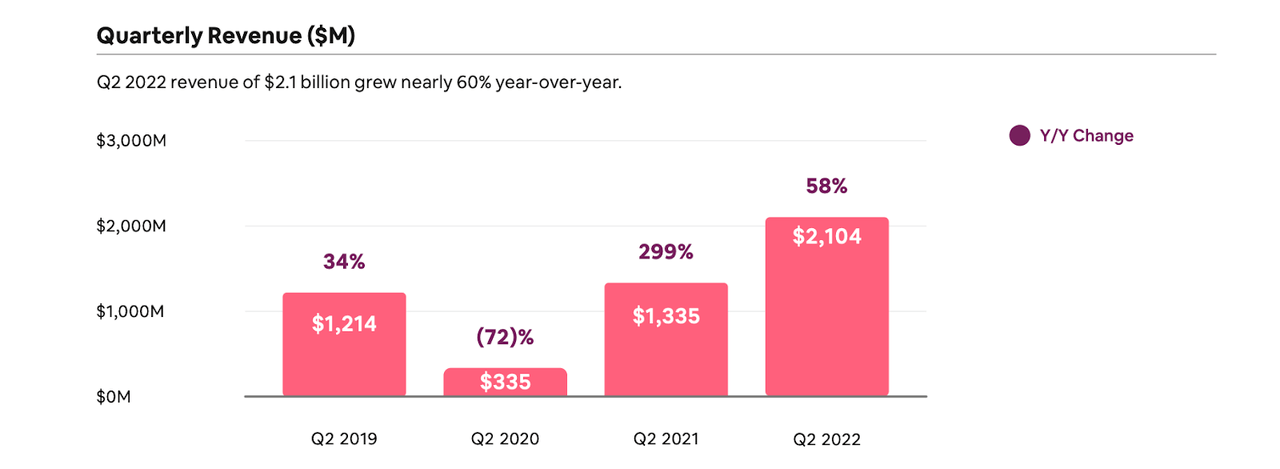

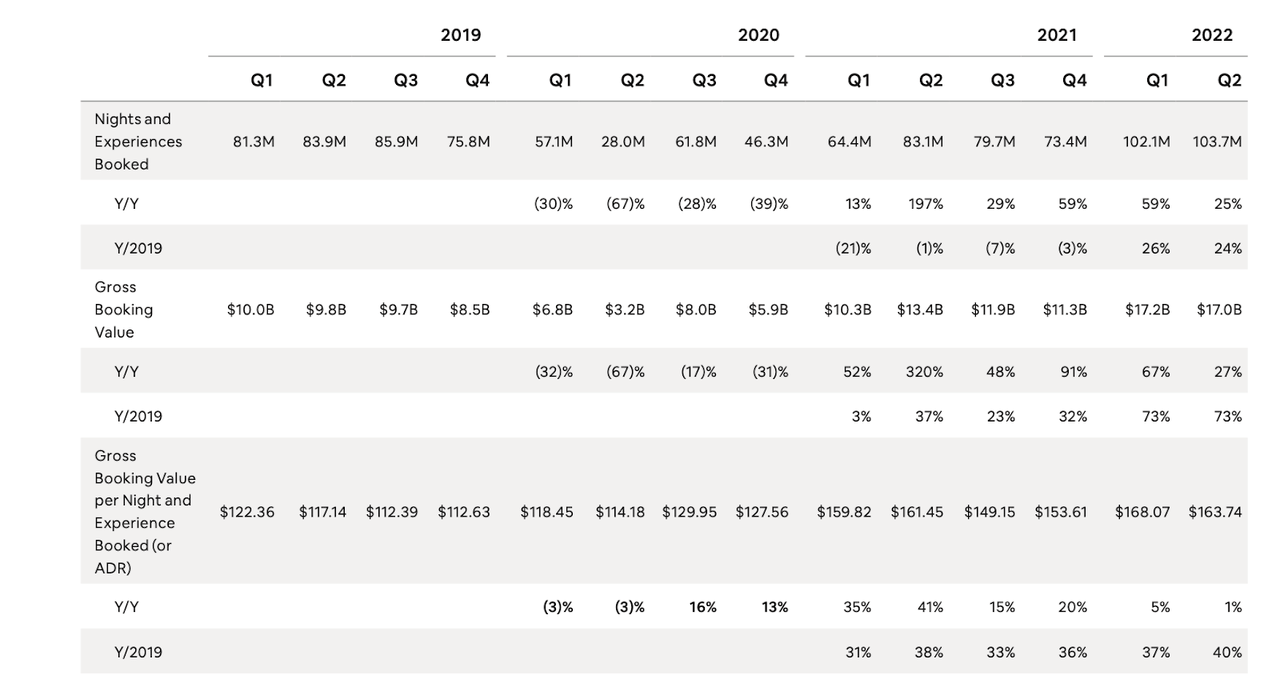

ABNB posted 58% revenue growth in this quarter as the company continued to benefit from pent-up demand and the strong pricing environment.

2022 Q2 Shareholder Letter

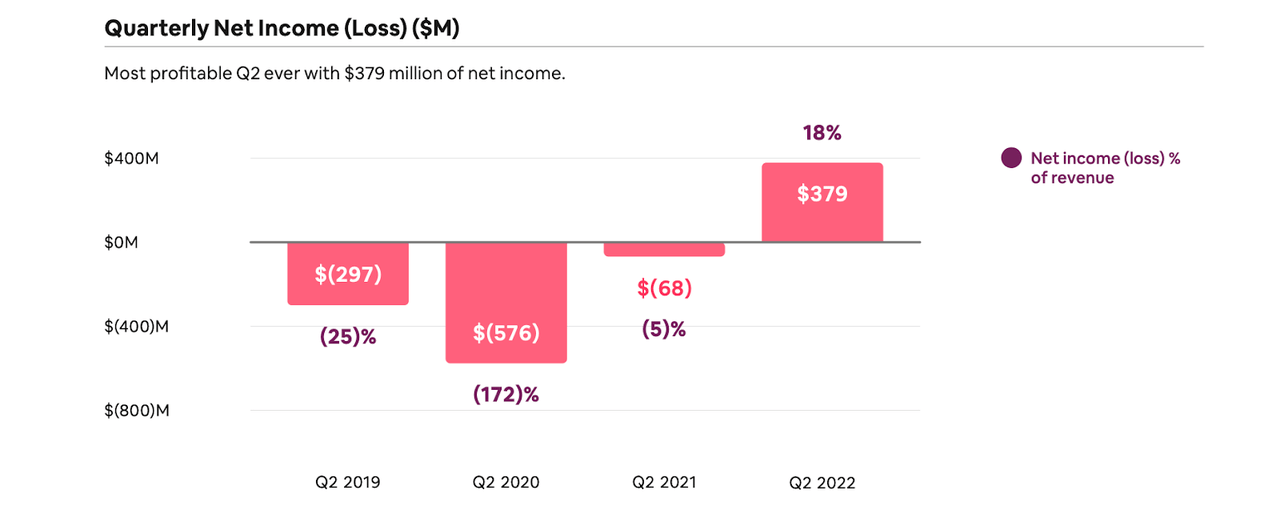

That top-line growth led to strong operating leverage, as net income swung from a net loss to $379 million, representing 18% of revenue.

2022 Q2 Shareholder Letter

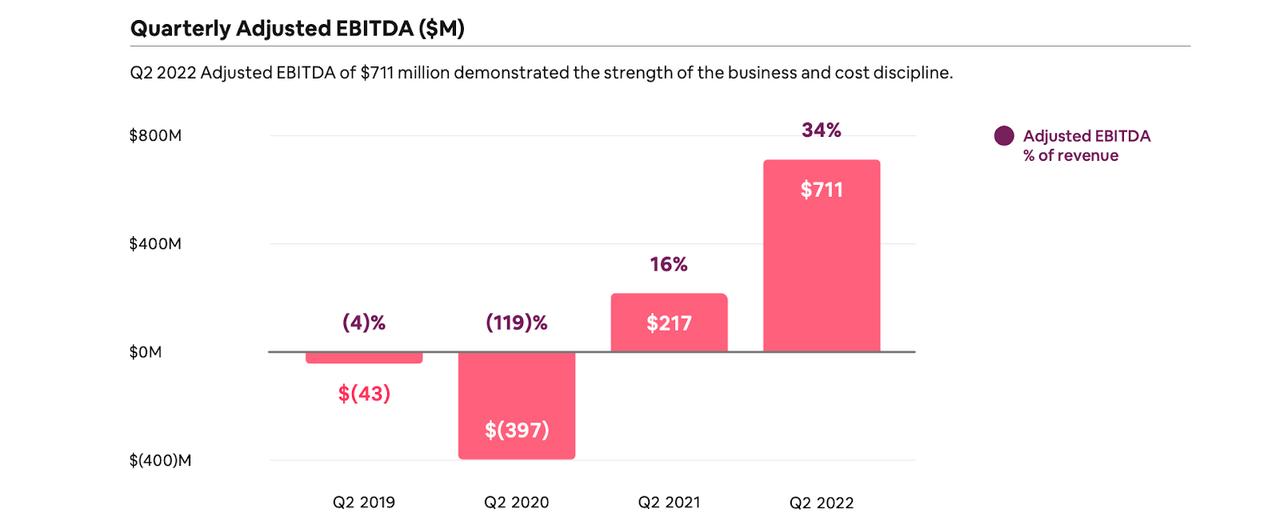

The main difference between net income and adjusted EBITDA for a net cash company like ABNB is equity-based compensation. ABNB generated $711 million in adjusted EBITDA, making up 34% of revenue.

2022 Q2 Shareholder Letter

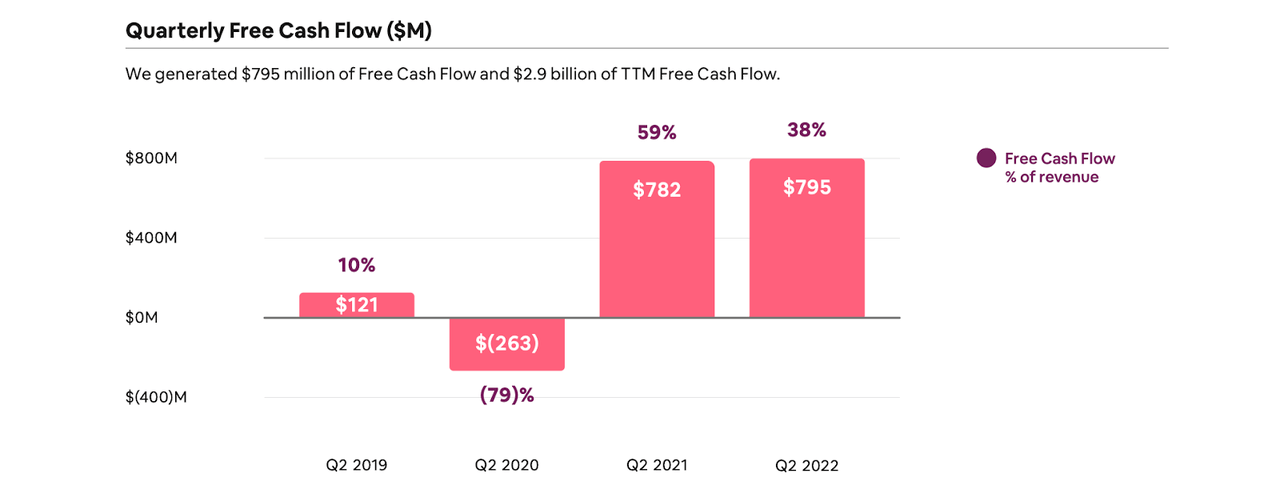

Some investors like to look at free cash flow, which stood at $795 million, but in my view adjusted EBITDA is a better proxy for operational free cash flow due to the fact that guests pre-pay for their stays.

2022 Q2 Shareholder Letter

ABNB ended the quarter with $9.9 billion of cash versus $2 billion of debt.

Looking forward, ABNB expects the third quarter to see revenue growth of up to 29% to $2.88 billion – and that is inclusive of foreign exchange headwinds. The company notes that year over year comparisons are now more relevant as it has lapped the beginning of the travel rebound in 2021.

ABNB expects adjusted EBITDA in the next quarter to be the strongest ever, up “meaningfully” from last year’s high, with the margin being at or slightly below last year’s 49% all time high.

ABNB also authorized a $2 billion share repurchase program which looks reasonable considering the significant cash flows that it is currently generating (not to mention the nearly $8 billion of net cash on its balance sheet). What could investors expect beyond 2022? The 27% bookings growth may be a good foreshadowing for what to expect, though an imperfect one as the bookings could be for any future date. Based on the strong bookings growth, I expect 2023 to remain a strong year.

2022 Q2 Shareholder Letter

Is ABNB Stock A Buy, Sell, or Hold?

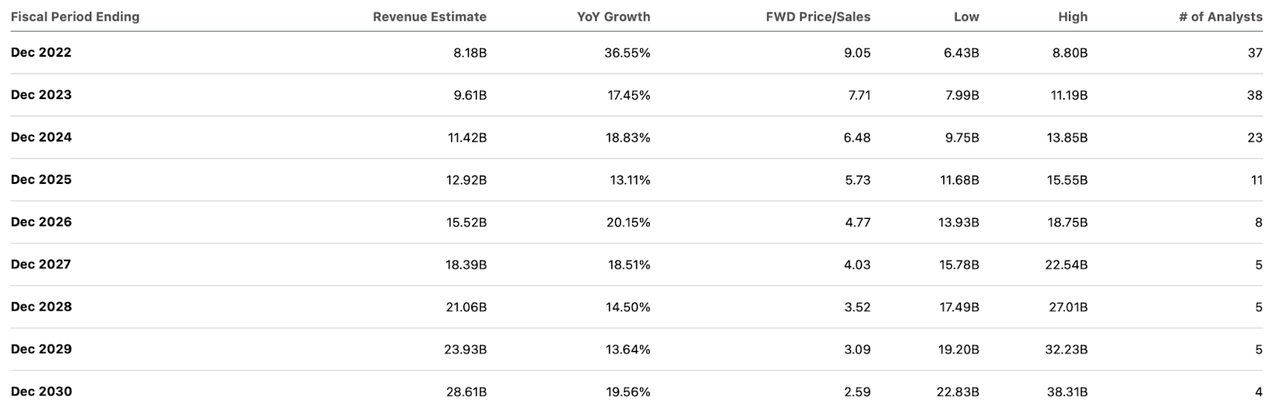

Consensus estimates call for revenue growth to decelerate to 17% in 2023 and remain above 15% for the next decade.

Seeking Alpha

That outlook makes sense considering that ABNB is disrupting the travel and lodging market – replacing what has traditionally been “just” hotels with residential houses and more unique experiences. After staying at an Airbnb location for the first time this year, I can say from anecdotal experience that it offers increased value for consumers, especially those traveling in large groups or with family. I can see ABNB sustaining 40% net margins over the long term. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see ABNB trading at 10.2x sales next year – a stock price of $156 per share. I note that I have worked some conservatism into those assumptions, as a 2x PEG ratio may be more appropriate given the high profit margins and ABNB may be able to generate stronger growth rates than the 17% consensus estimate. This is a market in which certain industries like travel and energy are experiencing what appears to be cyclical booms – it is reasonable to be concerned that ABNB might be operating at peak earnings, with a steep decline on the horizon. Considering what we are seeing with e-commerce stocks, those concerns are not so unreasonable. I nonetheless expect ABNB’s secular story to help growth remain strong even as it eventually laps tough comparables. Another risk is that Alphabet (GOOGL) (GOOG) may encroach on profit margins, as it has for Booking (BKNG) and Expedia (EXPE). It is possible that competitors catch up to ABNB and eventually are able to offer similar listings, which would increase the odds that consumers begin their search on Google.com instead of Airbnb. If that were to occur, then I would expect profit margins to deteriorate considerably as the company would have to invest heavily in advertising. Given the strength of the fundamentals and the $2 billion share repurchase program, I rate the stock a buy.

Be the first to comment