Carl Court/Getty Images News

Investment Thesis

Despite delivering excellent results for FQ1’22, it is apparent that the pessimistic market had dragged down Airbnb, Inc. (NASDAQ:ABNB) to its lowest point yet. Since its earnings call, the stock had fallen by 36.2%, from $156.18 on 04 May 2022 to $99.49 on 17 June 2022. ABNB had also lost 31.8% of its value since its IPO on 10 December 2020.

Therefore, it appears that market sentiment is working against ABNB, despite the company reporting massive revenue growth in the last quarter and finally approaching sustained profitability in the coming year. Given the market uncertainties, investors with a lower risk ratio may prefer to wait it out. However, we are of the opinion that the bottom is near. Therefore, speculative investors with a higher risk tolerance may choose to nibble here, given that ABNB will likely report monster quarters in FQ2’22 and FQ2’23.

ABNB Is Finally Profitable After 15 Years

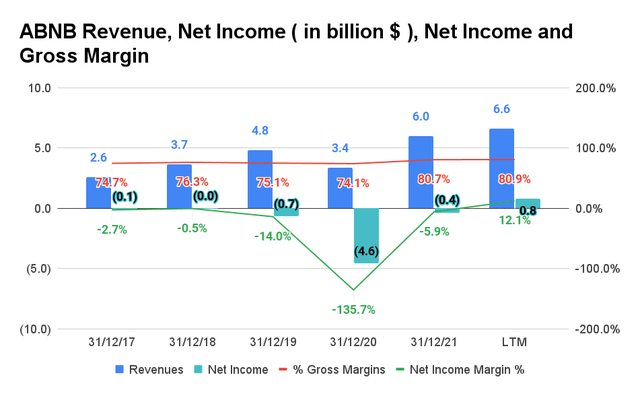

ABNB Revenue, Net Income, Net Income, and Gross Margin

ABNB reported revenues of $6.6B in the last twelve months (LTM), while improving its gross margins over time, from 75.1% in FY2019 to 80.9% in the LTM. In the meantime, the company also finally reported net income profitability of $0.83B in FQ3’21 and $0.05B in FQ4’21. Given the reopening cadence and the massive pent-up travel momentum, we expect ABNB to produce a repeat performance for its net income profitability in FY2022, despite the macro headwinds, the exit from China, and the Ukraine war.

With a strong travel rebound for summer 2022, ABNB is expected to report record Gross Booking Values in FQ2’22 and FQ3’22, given that it experienced a 30% increase in Nights & Experiences Booking from 2019 levels. That has partly contributed to the company’s $1.7B of unearned fees in FQ1’22, representing a massive growth of 88.8% QoQ. In addition, with the return of demand for urban destinations, the company may also experience a boost in its Average Daily Rates (ADR), which have been historically higher than the industry rates. In FQ1’22, ABNB reported an ADR of $168, higher than the industry average of $155.37 in the second week of June 2022.

Furthermore, with the gradual reopening efforts in the APAC region by Q2’22, we may also expect the region to contribute strong revenue growth. Nonetheless, with many major companies potentially ending their flexible work-from-home arrangements after the summer, ABNB may experience temporary headwinds to their long-term stays of over 28 days. Only time will tell.

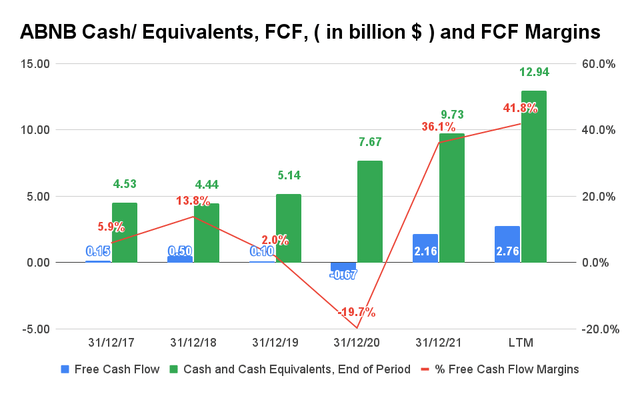

ABNB Cash/Equivalents, FCF, and FCF Margins

It is evident that ABNB has been generating positive Free Cash Flow (FCF) in the past year, at an FCF of $2.76B and an FCF margin of 41.8%. In addition, the company has been growing its massive war chest of cash and equivalents over time, to $12.94B in the LTM. Therefore, assuming that ABNB continues to report stellar performance post-reopening cadence, we may expect to see improved profitability moving forward.

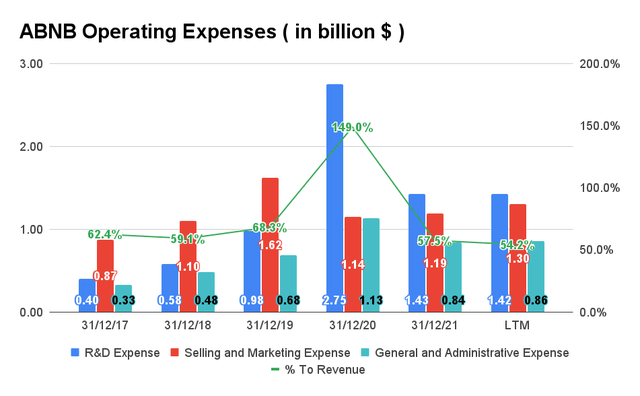

ABNB Operating Expenses

On the other hand, ABNB reported massive operating expenses of $3.58B in the LTM, representing 54.2% of its revenue, 447.5% of its net income, and 129.7% of its FCF then. Nonetheless, since the company has committed to a fully remote work arrangement from April 2022 onwards, we may see improved operating margins moving forward, thereby improving its future profitability. In addition, given the competitive edge over its peers, ABNB continues to lead the home-sharing industry with a 74.6% market share, thereby justifying its elevated R&D and marketing expenses.

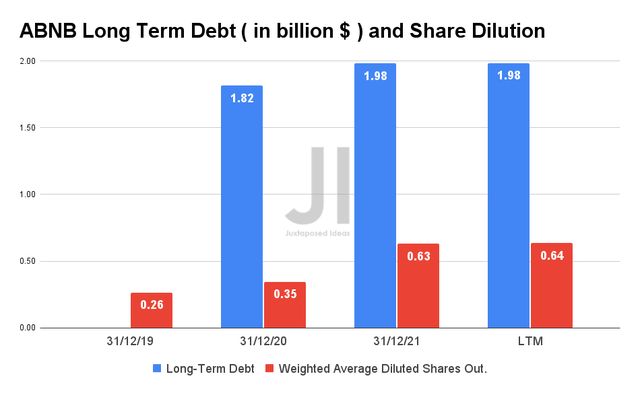

ABNB Long-Term Debt and Share Dilution

ABNB also reported stock-based compensation (SBC) of $898.8M in FY2021, representing 15% of its revenue and 255.3% of net losses then. For FQ1’22, the company continues to incur high SBC expenses of $194.9M, representing 12.9% of its revenue and 103.7% of its net losses for the quarter. Thereby, it is safe to surmise that ABNB would also be reporting high SBC expenses for FY2022, at a projected sum of $779.6M. Combined with its high operating expenses, we may expect to see the company rely on a mixture of debt leveraging and/or SBC moving forward, given its lower net income and FCF profitability.

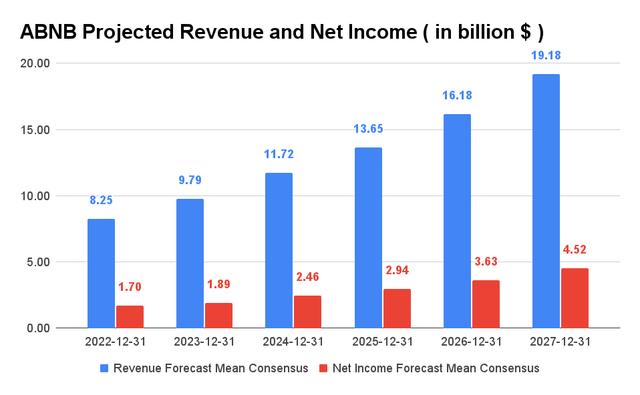

ABNB Projected Revenue and Net Income

Over the next six years, ABNB is expected to grow its revenues at a remarkable CAGR of 21.41% and net income by 21.6%. For FY2022, consensus estimates that the company will report revenues of $8.25B, representing YoY growth of 37.7%. ABNB’s long-term investors would also be delighted to learn that the company is finally expected to report net income profitability of $1.7B for FY2022. The company will also likely report an improved projected net income margin moving forward, from 20.6% in FY2022 to 23.5% in FY2027.

For FQ2’22, ABNB had guided favorable revenue guidance in the range of $2.03B to $2.13B, representing an impressive increase of 41.2% QoQ, 60.1% YoY, and 615% from FQ2’19. Thereby, potentially triggering a rally post-earnings call.

So, Is ABNB Stock A Buy, Sell, or Hold?

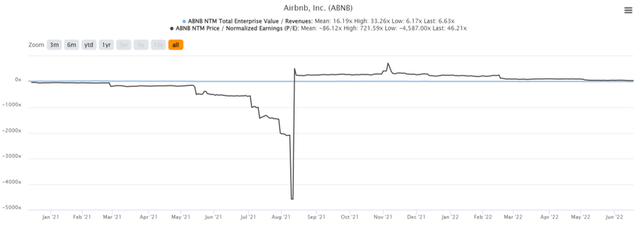

ABNB Historical EV/Revenue and P/E Valuations

ABNB is currently trading at an EV/NTM Revenue of 6.63x and NTM P/E of 46.21x, lower than its historical EV/Revenue mean of 13.19x though much improved from its historical P/E mean of -42.13x. The stock is also trading at $99.49, down 53.1% from its 52-week high of $212.58, nearing its 52-week low of $92.09.

ABNB Historical Stock Price

Despite consensus estimates’ hold rating on ABNB stock with a price target of $175.83, we are more optimistic given its excellent execution and projected growth moving forward. Therefore, speculative investors with a higher risk tolerance might want to consider buying here, though they should always size their portfolios accordingly, given the potential volatility.

Therefore, we rate ABNB stock as a Buy.

Be the first to comment