z1b

Investment Thesis

We reckon that analysts were overly worried about Airbnb’s (NASDAQ:ABNB) seemingly lower QoQ Gross Booking Value of $17B in FQ2’22 compared to $17.2B in FQ1’22, since these numbers represent massive growth of 34% YoY from $13.4B in FQ2’21 (ex. FX). The company also reported a tremendous 103.7M Nights and Experiences Booked and an excellent Average Daily Rate of $164 in the latest quarter, compared to 102.1M/$168 in FQ1’22 and 83.1M/$161 in FQ2’21, respectively. In addition, ABNB continued to post improved ADRs compared to the hotel segment in the US, with the latter reporting an average ADR of $151.61 in Q2’22.

Though the worsening macroeconomics and the Fed’s hike in interest rates through 2023 may pose temporary headwinds to ABNB’s short-term performance, we reckon that most of the shift in consumer behavior from established hotels to vacation rentals is here to stay. The company’s flexible unconventional stay offerings will prove to be a winning strategy over the next few quarters, especially aided by the surge in professional remote work opportunities in North America, from 4% in pre-pandemic levels to 25% by the end of 2022.

Therefore, given the steady return of international travel at 70.8% of pre-pandemic levels and the 24% YoY growth in demand for long-term stays of 28 days or more in FQ2’22, we reckon that ABNB is well poised for growth ahead, due to its unique positioning in the global travel industry. The global leisure travel market is also expected to grow decently from $4.4B in 2021 to $6.34B in 2026, at a CAGR of 5.7%. IATA’s Director General, Willie Walsh, said:

Demand for air travel remains strong. After two years of lockdowns and border restrictions people are taking advantage of the freedom to travel wherever they can. (IATA)

ABNB’s Management Proved Highly Competent – Triggering Expansion In Profit Margins

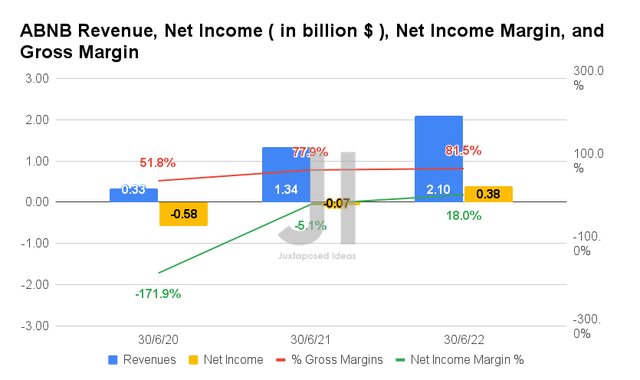

In FQ2’22, ABNB reported excellent revenues of $2.1B and gross margins of 81.5%, representing YoY growth of 56.7% and 3.6 percentage points, respectively. This has, in turn, improved its profitability, with a net income of $0.38B and net income margins of 18% in the latest quarter. It indicates a tremendous increase of 728.5% and 23.1 percentage points YoY, respectively.

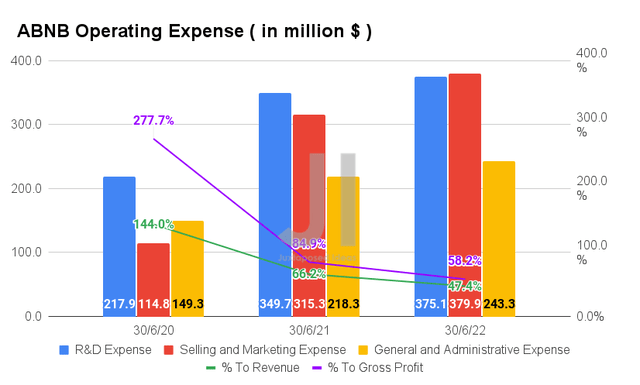

The ABNB management has proved prudent in expanding its operations, given the minimal 13% YoY increase in its operating expenses to $998.3M. As a result, further aiding the reduction of ratio in its operating expenses to growing sales, to 47.4% of its revenues and 58.2% of its gross profits in FQ2’22, compared to 66.2%/84.9% in FQ2’21 and 144%/277.7% in FQ2’20. Therefore, demonstrating outstanding cost management, resulting in an impressive expansion in margins and profitability.

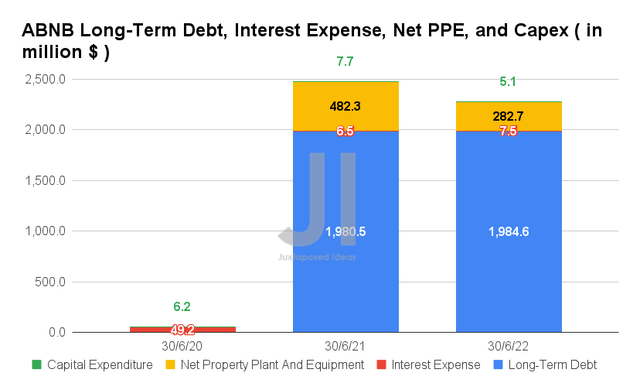

It is evident that the remote work strategy employed by ABNB has helped reduce its overheads, with the company reporting reduced net PPE assets of $282.7M and capital expenditure of $5.1B in FQ2’22. It indicated a notable moderation in expenses by -41.3% and -33.7% YoY. Additionally, investors need not be concerned about its $1.98B in long-term debts and $5.1M in interest expenses in the latest quarter, since these would only mature by 2026.

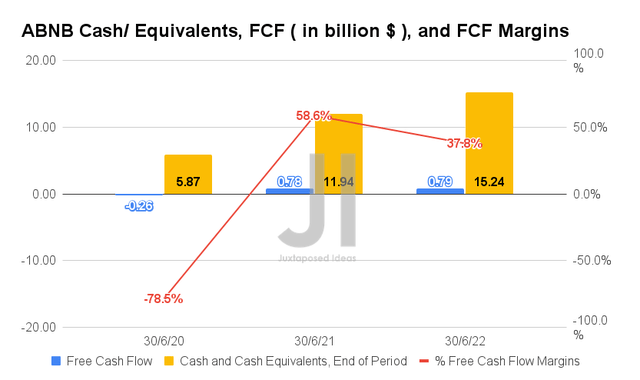

In FQ2’22, ABNB also reported a robust Free Cash Flow (FCF) generation of $0.79B and an FCF margin of 37.8%, representing in-line though a decline of -20.8% YoY. Nonetheless, its impressive cash and equivalents of $15.24B should assure investors of its liquidity for the intermediate term. Even after adjusting for $2B in unearned fees and deducting $7.5B held on behalf of guests, the company still reports an excellent adj. cash of $9.74B on its balance sheet for the latest quarter. Thereby, demonstrating its ability on making good on its financial obligations by 2026.

With this splendid liquidity, it is no wonder that ABNB finally announced an excellent $2B repurchase program in its latest earnings call. It would help to counter the significant share dilution of 97.6% since the company’s IPO in December 2020 and substantial Stock-Based Compensation of $878.52M in the last twelve months. Assuming current stock prices, the sum would be equivalent to a reduction of -2.7% in share count, triggering a decent increase in shareholders’ value then.

ABNB To Report Deceleration In Long-Term Growth, Post Pandemic Boost

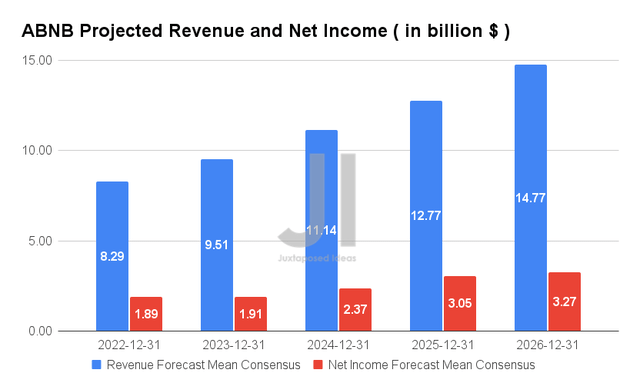

Over the next five years, ABNB is expected to report revenue growth at a CAGR of 19.78%, while finally reporting net income profitability from FY2022 onwards. It is an impressive development, given the projected net income margins of 22.7% in FY2022 and 22.1% in FY2026, compared with -5.9% in FY2021 and -14% in FY2019. These numbers unfortunately represent a notable moderation of -9.9% in consensus estimates since June 2022, pointing to ABNB’s slower growth ahead, post-revenge-travel during the reopening cadence. However, it is important to note that no company is able to sustain the hypergrowth experienced during the peak pandemic levels, given the obvious once-in-a-lifetime outbreak.

For FY2022, consensus estimates that ABNB will report revenues of $8.29B and net incomes of $1.89B, representing a remarkable YoY growth of 38.3% and 640%, respectively. The management has also guided FQ3’22 revenues between $2.78B and $2.88B, representing an increase of 37.1% QoQ and 29.1% YoY. Therefore, it is apparent that the company will experience exemplary growth over the next two quarters, since analysts have also upgraded its profitability by 11.1% from previous estimates. Thereby, potentially triggering further upsides to ABNB’s stock performance ahead, after hitting another bottom in September.

In the meantime, we encourage you to read our previous article on ABNB, which would help you better understand its position and market opportunities.

- Airbnb: Monster Quarters In Q2 And Q3 2022 – Buy Now On Weakness

So, Is ABNB Stock A Buy, Sell, or Hold?

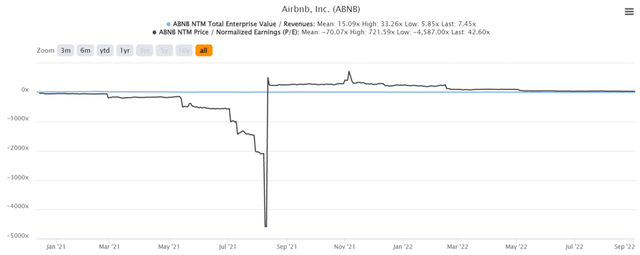

ABNB 2Y EV/Revenue and P/E Valuations

ABNB is currently trading at an EV/NTM Revenue of 7.45x and NTM P/E of 42.60x, lower than its 2Y EV/Revenue mean of 15.09x though massively improved from its 2Y P/E mean of -70.07x. The stock is also trading at $113.64, down 46.5% from its 52 weeks high of $212.58, though at a premium of 31% from its 52 weeks low of $86.71.

ABNB 2Y Stock Price

Consensus estimates remain bullish about ABNB’s prospects, given their price target of $133.68 and a 17.63% upside from current prices. Nonetheless, it is also evident that the stock is trading at a slight premium now, above its 50-day moving average of $108.06. In addition, we may speculatively witness a more attractive entry point of below $100 nearing the Fed’s upcoming interest rate hike on 20 September 2022. This stock price weakness is already evident in the recent -3.5% fall, following Powell’s hawkish commentary on 26 August 2022, as well as the current sideways movement since then.

Keen investors should load up the boat at the next bottom.

Be the first to comment