SanyaSM/E+ via Getty Images

Investment Thesis

When a company becomes a noun, it’s always a good sign. Airbnb (NASDAQ:ABNB) is an asset-light cash flow machine (when it wants to be) with one of the best-known brands in the world. The company has shown its mettle over the past 2 years, and I believe that it has come out of the pandemic a stronger, more streamlined business that is ready to drive forward a new age of travel.

Business Overview

15 years ago, a conference in San Francisco resulted in almost all hotels in the area being fully booked. Roommates Brian Chesky and Joe Gebbia decided to take advantage of this by blowing up an air mattress in their apartment and offering accommodation – thereby creating the world’s first airbed & breakfast. This has grown into the $60 billion company that we know today as Airbnb.

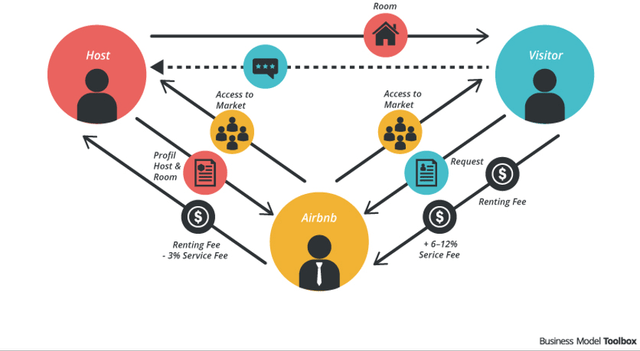

So, what is Airbnb? Simply put, it is an online marketplace which has traditionally focused on holiday rentals. The company itself doesn’t own any properties, but instead ‘Hosts’ can list their homes on Airbnb, and ‘Guests’ can use Airbnb to find somewhere to stay. It may have only launched 15 years ago, but the company has enjoyed rapid growth, and is now home to 4 million Hosts who have welcomed more than 1 billion Guest arrivals across more than 220 countries and regions.

The business model is that of a classic digital marketplace: Airbnb charges fees to both theirs Hosts and their Guests when a booking is made for accommodation using their platform. It also generates some revenues through experiences, where a fee is only charged to the Host, but currently these make up a very small portion of the overall revenue. The below graphic does a good job of visualising this:

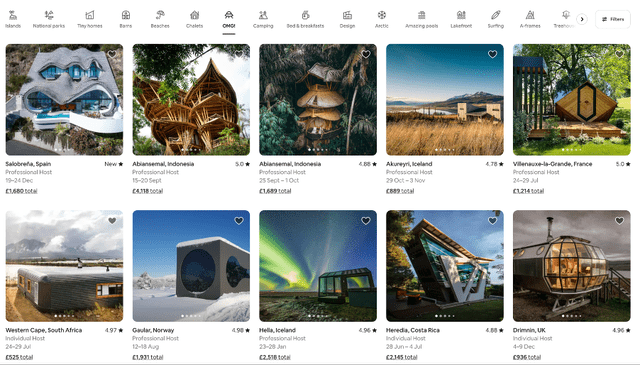

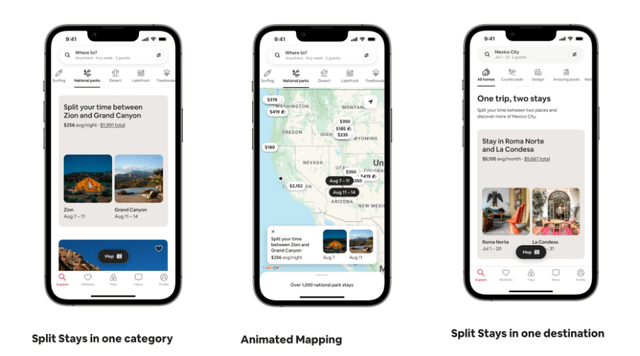

Airbnb launched its 2022 Summer Release last month, in what CEO Brian Chesky described as “the biggest change to Airbnb in a decade”. The addition of ‘Airbnb Categories’ revamped the way in which Guests could search for properties to stay at – so rather than trying to decide on a city or country to travel to, Guests can search for accommodation in categories such as Islands, National Parks, Tiny Homes, Camping, or even have a category called OMG!, with some of the quirkiest properties out there.

There are a number of reasons to love this transformation from a shareholder perspective, since Airbnb is unlocking regions that Guests would never have thought to go to. Regulation is a risk for Airbnb, and we’ve seen cities that have cracked down hard on Hosts, but by offering unique accommodation in different, almost undiscovered places across the globe (rather than just cities and ‘typical’ holiday destinations) Airbnb is reducing its concentration on the places where regulation poses the greatest risk.

Another new feature that could be transformational for the business is Split Stays, which provides Guests with more options for longer stays by splitting their trip between two Airbnb accommodations. When viewing Split Stays on a map, an animated line connects the two homes to show Guests the distance between them and the order of the stays. Once Guests select a Split Stay, they are guided through Airbnb’s user-friendly interface to book each stay.

A trend that’s has been clear across Airbnb’s recent quarterly reports is long-term stays (28 days or more) are continuing to be the fastest-growing category by trip length, having more than doubled from 2019. The Split Stays feature has clearly been added to capitalise on this trend, which is only going to grow further with the trend towards remote or hybrid work. Some properties do not allow Guests to stay for over 28 days, so the ability to easily split a stay between two properties for, say, 16 days each, gives Guests all the tools they need for these longer stays – which, naturally, results in more revenue for Airbnb.

As a shareholder, I am very excited to see what impact these changes will have. I think that the trends of experience-based bookings (via Categories) and the trends towards longer stays (via Split Stays) have yet again opened up a completely new way to travel.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

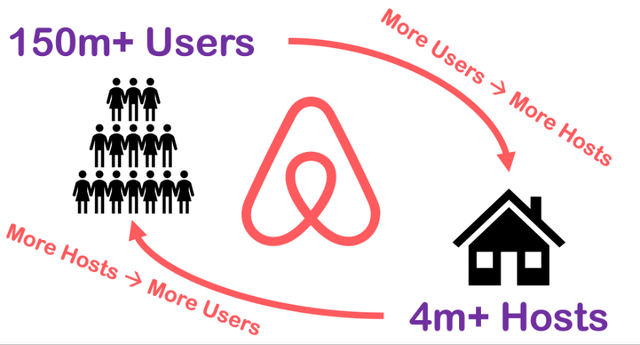

Let’s start with the most obvious economic moat that Airbnb has, and that is a very strong network effect – arguably one of the most powerful network effects of any business in the world. Airbnb is the clear leader in this space, having welcome more than 1 billion guests across the globe in 2022. If I’m looking to list my property or spare room as a holiday rental, I want to reach the largest possible audience in order to increase my chances of successfully renting it out. I know Airbnb is the leader in this space, so naturally I would list my property there to reach the largest audience possible.

Let’s now change the viewpoint. I’m looking for a property to rent out for my holiday, and I know that Airbnb has the broadest offerings. This means that I’m more likely to go there and search for a property since it’s probably going to have something I want, and as a result more potential Guests use Airbnb. But as we saw before, more Guests leads to more properties, and more properties leads to more Guests. This is a virtuous cycle that has enabled such rapid growth for Airbnb, and should allow it to maintain its leadership position for the foreseeable future.

My Own Incredible Graphic Design Skills – Powerpoint

A strong brand is another economic moat, and I don’t think anyone can deny that Airbnb has the strongest brand in its industry. It joined Kantar’s Top 100 Global Brands in 2022, with a notable mention:

As a group, 2022’s Newcomers defy easy summary. They hail from nine different categories – including Airbnb, which essentially invented a category of its own upon its founding in 2008.

The report goes on to highlight how Airbnb’s brand strength is driven by its product differentiation:

To date, Airbnb has achieved Difference primarily through the initial uniqueness of its offer: from the start, the platform created an entirely new way of seeing the world – and on the flipside, of monetising property. As COVID-19 restrictions continue to lift and we begin to travel frequently once more, Airbnb talked about the need to build brand as a differentiator and key means of driving growth – prioritising brand building over performance marketing with the recent ‘made possible by hosts’ campaign. CEO Brian Chesky said recently: “We’re seeing great success in the brand marketing that we did last year and we’re going to be expanding it to more countries. There will be incremental brand marketing spend this year.”

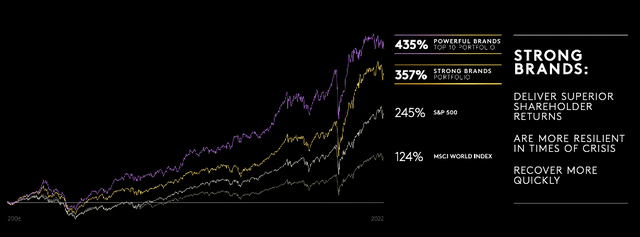

Brands can be a competitive advantage since they are (like most competitive advantages) difficult for competitors to effectively replicate; when we think of Expedia’s (EXPE) Vrbo or Booking.com (BKNG), the brand recognition just isn’t there when compared to Airbnb (Booking.com has a strong brand in the hotel / resort style holiday market).

As a result, companies with strong brands have often performed extremely well – just take a look at the below extract from Kantar’s report, demonstrating how the companies in its Top 100 brands have outperformed the S&P 500 since 2006 (and the companies in its Top 10 have thumped the market).

Kantar BrandZ Global Report 2022

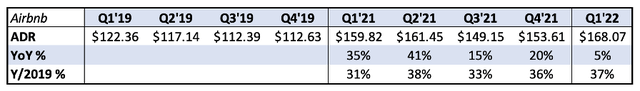

These moats have enabled Airbnb to benefit from pricing power, which is often seen in companies with strong brands and clear leadership in a certain industry. This can be seen in action when we take a look at the average daily rate (or ADR) for Airbnb bookings.

Excel – Airbnb Q1 2022 Shareholder Letter

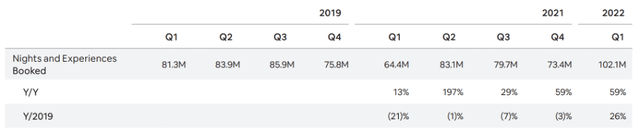

Quite incredibly, the ADRs in 2021 increased by more than 30% when compared to 2019. Although this shouldn’t be a surprise to anyone who has used Airbnb – it is getting more expensive – but it has been achieved in a difficult Covid-impacted environment, with Nights and Experiences booked remaining stable in 2021 (given the circumstances). In fact, in Q1 2022 the Nights & Experiences booked grew 26% compared to 2019, and the ADR grew 37%, so clearly Guests are not being put off by the higher prices… yet.

Airbnb Q1 2022 Shareholder Letter

I personally would expect prices to fall as the economy braces itself for a tough time, but this does give me confidence that Airbnb is in a position to protect itself & come out of the other side stronger, as it already has done in a post-Covid world.

Outlook

You may look at Airbnb as a ~$60 billion company and wonder how much room it has to grow – well according to management in their registration filing, quite a lot. They estimate Airbnb’s total addressable market to be a whopping $3.4 trillion, including $1.8 trillion for short-term stays, $210 billion for long-term stays, and $1.4 trillion for experiences. This is more than 270x Airbnb’s revenue for the last 12 months. Whilst I think this is a bit of a long shot, it does demonstrate that the industry Airbnb operates in is huge, and there is ample room for future growth.

I can also see a huge tailwind for Airbnb with regards to remote working. It is probably why the company has seen such rapid growth in stays of 28 days or longer, as people are able to work from wherever they want. Yes, this was exacerbated by Covid-19, but I think the world of hybrid work is only going to continue & increase demand for Airbnb’s services.

Management

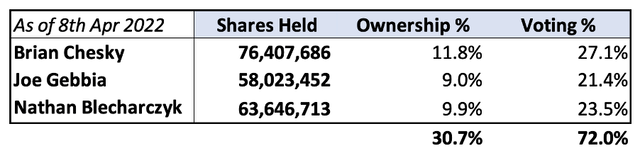

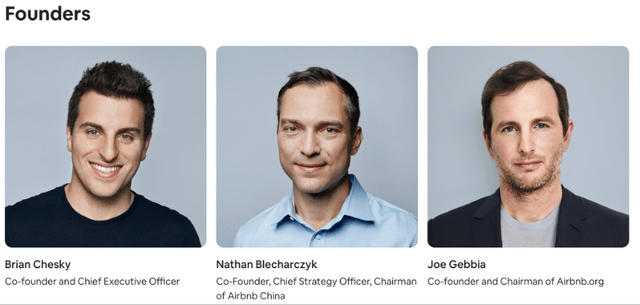

When it comes to fast-paced, disruptive companies, I always aim to find founder-led businesses where insider ownership is high, and Airbnb gives me a bonus with not one, not two, but three founders still involved in the business! Co-founder Brian Chesky heads up the company as CEO and Chairman, but his former (I assume?) roommate Joe Gebbia is the Chairman of Airbnb’s non-profit arm, and the third co-founder Nathan Blecharczyk is the Chief Strategy Officer and Chairman of Airbnb China – although now seems like an appropriate time to mention that Airbnb took the decision last month to close down its domestic business in China, following numerous lockdowns in the country with “no end in sight”.

As mentioned, insider ownership is key, and boy do the co-founders of Airbnb have a lot of skin in the game.

Excel / Airbnb 2022 Proxy Statement

The trio own more than 30% of the company with beneficially held shares, which is incredible for a business of this size. Clearly, the leaders of Airbnb will be highly incentivised to create long term success for shareholders, as they too will benefit significantly.

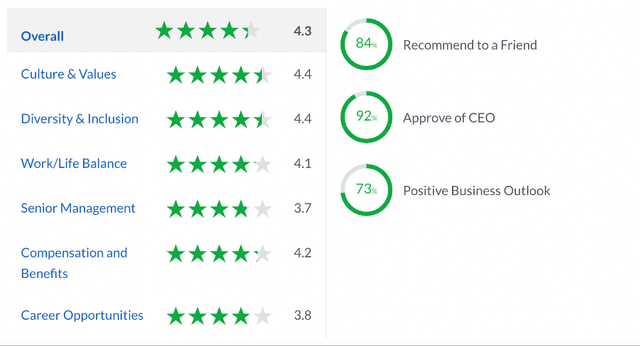

I also like to have a quick look on Glassdoor to get an idea about the culture of a company, and Airbnb gets some great scores from its 1,577 reviews. Any score over 4.0 is impressive, and Airbnb achieves this in a lot of areas – with especially high scores in Culture & Values and Diversity & Inclusion, which make for a successful workplace and will help drive a mission-led business such as Airbnb forward. The 92% approval rating of CEO Brian Chesky is another tick in the box.

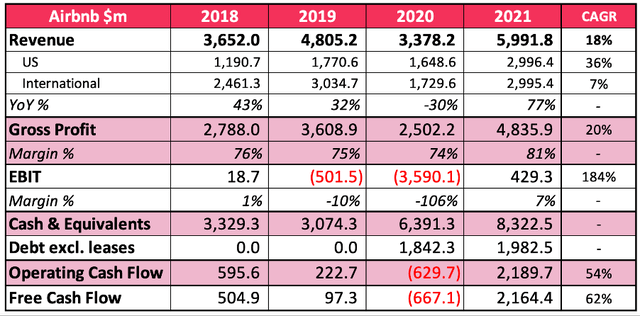

Financials

The financials of Airbnb are extremely impressive, especially when you consider that (along with any other company in the travel industry) it has been put through a very difficult couple of years. Airbnb’s revenue in 2021 recovered from the pandemic driven drop in 2020 to exceed its 2019 revenue, which is particularly impressive when you consider that Covid-19 was still impacting travel in 2021.

Furthermore, when you look at revenue by region, it’s clear to see that International is still struggling & below its 2019 levels – again, no surprise due to stricter lockdowns in Europe compared to the US. Personally I think this just provides Airbnb with another opportunity to boost their revenue as the International segment opens up, albeit with a slight hit from the closure of their China business.

Excel / Airbnb Annual Reports & S-1

Looking at the free cash flow generated by Airbnb in 2021 makes my eyes water – if this was a struggling travel company, you wouldn’t know it! Free cash flow was more than 1/3rd of revenue, and highlights just how much of a cash generating machine Airbnb could be in the future. Also, Airbnb has a net cash position of more than $6 billion, meaning that if a crisis should strike (again…) then it is well prepared to handle it.

Now if you’re looking at that 2020 EBIT and want to throw up, I can understand, but there is some explanation. Airbnb incurred $2.9 billion in stock-based compensation charges related to its 2020 IPO, with additional high SBC charges continuing throughout the year which then eased up in 2021.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Airbnb is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

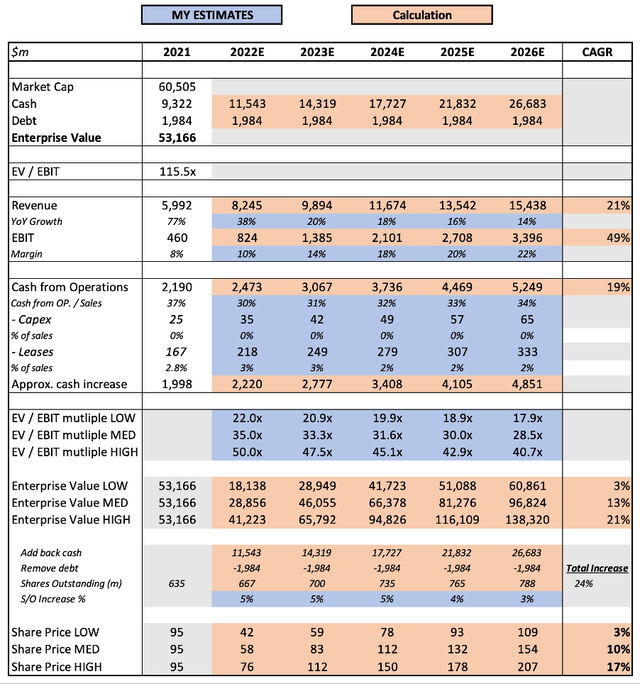

My model assumes a revenue growth rate of 38% in 2022 as the ‘travel boom’ continues, and the International recovery for Airbnb helps drive revenue growth. Following this, I assume a gradual slowdown in revenue, eventually hitting 14% growth in 2026. I do believe this is appropriately conservative; Airbnb could certainly exceed these growth expectations given all the reasons for optimism that I’ve mentioned in this article, but also the current economic outlook is gloomy which could negatively impact Airbnb’s recovery.

I’ve also assumed significant margin expansion, as I believe Airbnb will continue to reap the rewards of efficiencies made during the pandemic. As it continues to scale, its asset-light business model should enable it to churn out higher margins – particularly as Wall Street continues to put additional pressure on companies to prove their profitability.

I’ve also assumed that shares outstanding will increase by 24% over the 5-year period. It’s difficult to know exactly what Airbnb’s normalised shareholder dilution rate is given the IPO, but I think this assumption could end up looking a little bit too prudent.

Whilst I have used an EV / EBIT multiple to calculate Airbnb’s future value, I could well have used an EV / FCF multiple given that Airbnb is already generating a lot of cash. If I had chosen to take an EV / FCF multiple of 25x in 2026, based on FCF of ~$4.6b (30% FCF margin), then the forecasted 2026 share price for Airbnb would be $178; slightly higher than my current mid-range forecast of $154.

Risks

Unfortunately, there are a number of risks to Airbnb’s business – which is why I’m so glad it has some strong economic moats!

The first risk comes from regulation, as many residents and local councils are less than happy with the impact of Airbnb on their local house prices. Yes, Airbnb brings in tourists, but the flip side is that Airbnb’s can artificially increase house prices in those areas, pricing out locals from owning their own property. Yet this has always been an issue, and the Airbnb management team have handled it well so far, so any potential investor would have to trust in their ability to continue to handle regulation going forward.

Secondly, Airbnb is facing greater competition from the likes of Expedia’s VRBO and Booking.com; maybe I know this first hand, as the last apartment I booked was completed through Booking.com rather than Airbnb. But, I think the Summer Release & new categories feature will help to differentiate Airbnb and only build its brand power & popularity among travellers further. Perhaps Booking.com will dominate the ‘traditional’ holiday area, but I still think that Airbnb holds the most mindshare – only time will tell, but Airbnb has successfully grown over the past decade despite this competition, and I wouldn’t bet against it to do continue doing so.

Finally, don’t overlook the short-to-medium-term impact that a recession will have on Airbnb. Whilst we are currently experiencing high demand for travel, the economic outlook is not brilliant – inflation is high, interest rates are rising fast, and this should lead to a slowdown in economic activity, resulting in less disposable income & as a result I could see some people forgoing their travels. As we saw, Airbnb has a strong cash pile & an asset-light business model to protect itself, but it could succumb to some short-term pain yet again.

Summary

I believe that Airbnb is continuing to execute as a category defining leader, and the impact of Covid-19 has actually been a bonus due to the efficiencies it made within the company and the increased demand for long-term stays as remote work becomes the norm. Its shares aren’t cheap, and it could face some short-term headwinds, but I am very comfortable buying shares at the current level in this high-quality business and holding them for the next decade.

Be the first to comment