Khanchit Khirisutchalual

Anyone who is reading this bit of prose is probably seeking a source of income for their future years, whether that is retirement or something else that requires additional capital. In my personal retirement investment account, which I refer to as my No Guts No Glory portfolio, I hold several CEFs and other high yield income funds and stocks that generate 8% or more annually in total returns over the long term. The past five to six years has been a bull market for many technology and growth stocks, but that changed in 2022. The first half of the year has been a bear market for most asset classes, except for the energy sector. But technology stocks were especially hard hit through July before they began to recover.

One fund that I decided to invest in for both the monthly distributions as well as potential capital appreciation is the Virtus Artificial Intelligence & Technology Opportunities Fund (NYSE:AIO). Up until June 2022, the fund name also had Allianz in it. But as of July, the fund manager was changed and is now Voya Investment Management Company, LLC. The following text is from the proxy statement for the upcoming shareholder meeting to be held September 27, 2022, to approve the fund proposal to give the sub-advisory duties to Voya.

… on May 17, 2022, Allianz Global Investors U.S. LLC (“AllianzGI US”) settled certain government charges about matters unrelated to the Funds with the U.S. Securities and Exchange Commission and Department of Justice. As a result of the settlement, AllianzGI US will not be permitted to manage the Funds starting September 17, 2022. On June 13, 2022, AllianzGI US announced that it had entered into an agreement with Voya Financial, Inc. to transfer the investment teams who currently manage the Funds to Voya Investment Management Co. LLC (“Voya”) on or before July 25, 2022, after which AllianzGI US would not be able to continue managing the Funds.

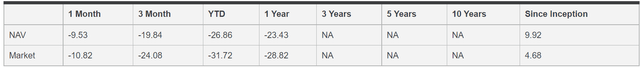

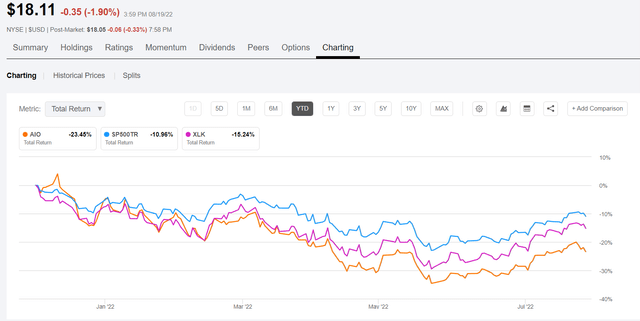

At the time of this article, August 21, 2022, the fund has struggled to keep up with either the technology sector as a whole (XLK), or the S&P 500 based with a YTD total return of -23.45% (the YTD market-based TR was even worse at -31.72% as of June 30, 2022, according to the fund website).

AIO fund performance (fund website)

The fund’s inception date was 10/31/2019 so the since inception numbers are not a good indication of the long-term future potential for total returns because most of the negative return has occurred in the past 8 months. That negative return may have been exacerbated by the Allianz sub-advisor issue, but now Voya is managing the fund and it appears to be trending in the right direction since July.

YTD TR comparison (Seeking Alpha)

About the AIO Fund

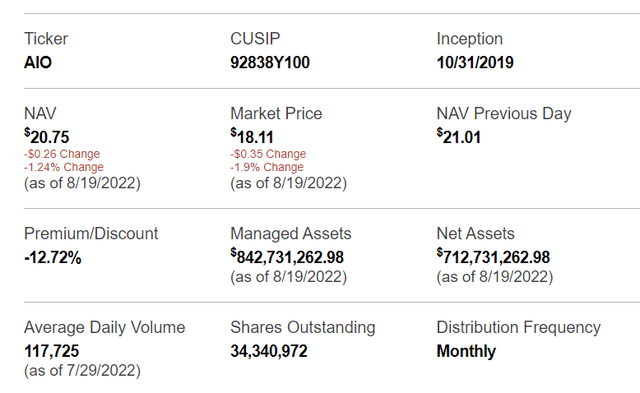

AIO fund overview (fund website)

Even though the fund is not exactly a “technology” fund as fellow SA contributor Nick Ackerman explains in his article, it does hold several tech sector names, especially those focused on the AI aspect of the fund’s emphasis. I believe that because Technology is in the name of the fund it gets treated by investors as a tech sector fund. However, that is not necessarily the correct classification as the fund holds several non-technology securities. Here is the fund overview from the website:

The Fund seeks to generate a stable income stream and growth of capital by focusing on one of the most significant long-term secular growth opportunities in markets today. A multi-asset approach based on fundamental research is employed, dynamically allocating to attractive segments of a company’s debt and equity in order to offer an attractive risk/reward profile.

Innovators and Disruptors — The Fund invests in a growing universe of opportunities across a broad spectrum of technologies and sectors embracing the disruptive power of artificial intelligence and other new technologies.

Differentiated Approach — The Fund employs a differentiated, multi-asset approach which strives to create an attractive risk/reward profile through fundamental research and dynamically allocating across public and private investments in convertible securities and equities.

Specialist Managers — The Fund leverages one of the leading global investment managers with deep expertise in technology, multi-asset, and closed-end fund strategies.

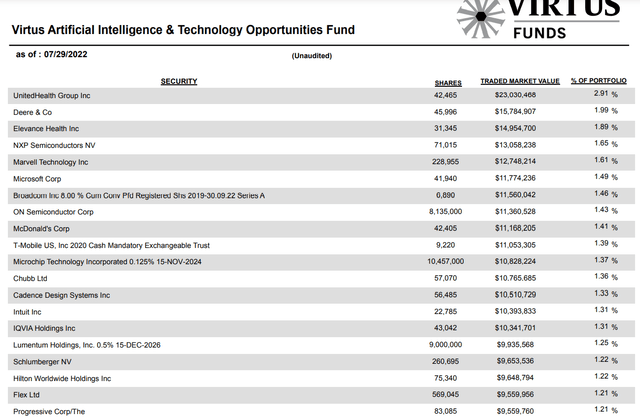

Top Fund Holdings

AIO top 20 holdings (fund website)

As of July 29, the top 20 holdings include several names in healthcare like UnitedHealth (UNH) up 9% YTD, and Elevance Health (ELV), which was Anthem, up 8% YTD. Other companies that are not technology-oriented but do utilize AI technology include Deere (DE), up 5.5% YTD, McDonald’s (MCD) up 12% in the past year, Chubb Ltd (CB) up 4.8% YTD, and Hilton Worldwide (HLT), up 13.6% in the past year.

Some technology sector names that are top holdings include Marvell Technology (MRVL), down -40% YTD and due to announce their latest earnings report on August 25, Microsoft (MSFT), down -14.5% YTD, and NXP Semiconductors (NXPI), down -22% YTD. Another top tech holding is ON Semiconductor (ON), which I wrote about recently in an article that discusses “chip” stocks that should benefit from recent events like the Chips Act and the growing EV industry demand. ON is up 3% YTD and 77% in the past year.

I believe that AIO was unfairly punished for being considered a tech equity fund, and possibly due to the Allianz fiasco in addition. With the recently increasing NAV, the fund discount is now widening, offering new investors a good opportunity to start a long position in the fund, or for existing shareholders like myself to add to their holdings. The discount is likely to shrink as the new Voya fund managers get the portfolio back on track and continue to increase the portfolio value as the market recovery continues into the second half of the year unless that recovery gets derailed.

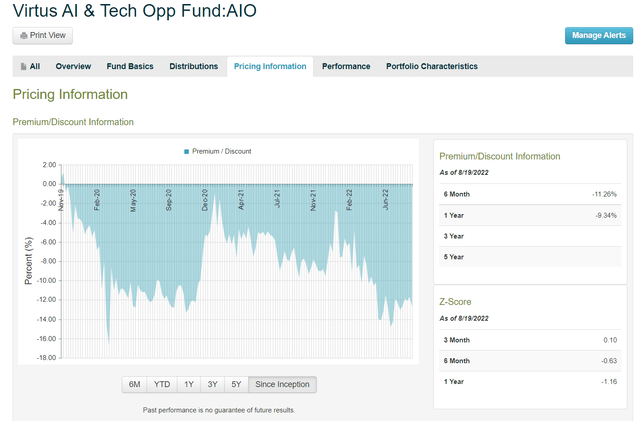

The screenshot below shows the premium/discount history since inception of the fund from the CEFconnect website.

AIO Premium/Discount (CEFconnect)

As you can see, the fund is now trading at a more than -12% discount which is well below the 1-year average discount of -9%.

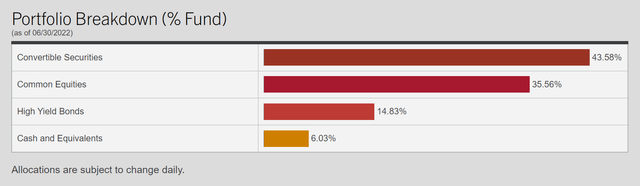

The fund’s holdings include mostly convertible securities, common equities, high yield bonds, and a small cash buffer of about 6% as of June 30.

Portfolio breakdown (fund website)

Distributions

The distribution history has been very good since the fund began paying monthly dividends in December 2019 when it paid $0.1803. It paid that same monthly distribution for one year and paid an annual special dividend in December 2020 of $1.1558. The dividend was then raised to $.1250 and paid monthly for all of 2021. Another special annual dividend was paid in December 2021 in the amount of $3.4497. Then in January 2022 the regular monthly dividend was again raised, this time to $.15 which the fund has paid monthly and declared through September.

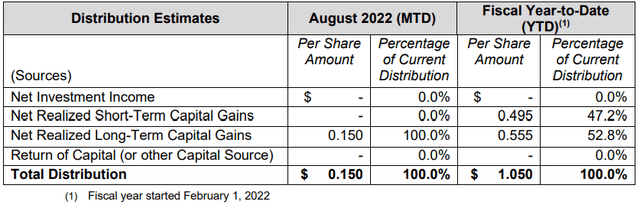

The fund has a managed distribution policy and seeks to maintain a consistent distribution level that is paid in part or in full, when possible, from net investment income and net realized capital gains. The fund has not paid any ROC (return of capital) in the distributions that it has paid thus far, although in the past few months it has all been paid from short and long-term capital gains as shown in the August distribution announcement.

Distribution sources (August form 19a)

So far in 2022 it appears that all the distributions have been paid from capital gains and that is a bit of a concern for shareholders who are expecting another annual special dividend, as that may not be in play this year.

Summary and Conclusion

With Voya taking over management of the fund, it may be desirable to wait and see what occurs over the next few months, and especially given the uncertainty over inflation, expectations of additional rate raises by the Fed, and ongoing concerns of a possible recession increasing or receding (depending on who is talking).

In my current situation, this is one fund that I am very deep in the red on, having bought initial shares of the fund in October 2021 when the market price was over $27. I have been periodically adding shares and reinvesting dividends each month this year to bring down my cost basis and increase my income.

This is a long-term hold for me unless the Voya managers change the fund’s structure or cut the distribution. I feel that the risk/reward is favorable given the current holdings and direction of the fund’s NAV. I will be watching closely and looking for any signs that a change is in the wind before investing more. If I was new to the fund, I would be cautiously buying shares at the $18 level, or if you are comfortable with the risks going forward you may want to add at this discounted price.

Depending on the direction of the market over the next few days I would recommend buying shares if the market recovery appears intact but would hold off if it looks like the bear market will resume downward pressure. Some of the fund’s holdings like MRVL may give more clues as to what the future looks like depending on what sort of guidance they give on their earnings call.

If anyone has additional information on the fund that they would like to share, please respond in the comments section. This is still a relatively new fund and with the recent advisor change it is difficult to predict what the future holds (not that it’s easy otherwise). Short-term it may continue to pull back in price but I feel that as a long-term investment the pieces are in place to generate strong returns over the next 5 to 10 years or more.

Be the first to comment