a-lesa/iStock via Getty Images

Investment Thesis

AgroFresh Solutions, Inc. (NASDAQ:AGFS) is a global leader in AgTech, focusing on food preservation and reducing food waste in the fresh produce market. It offers a variety of solutions, digital technologies, and services to various actors along the fresh produce value chain to improve the quality and extend the shelf life of the products.

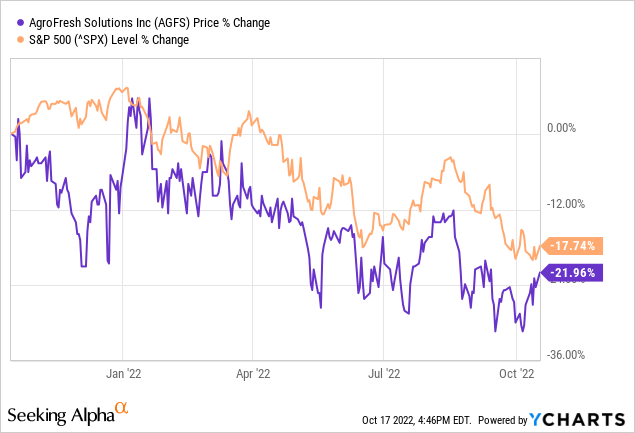

The company has been very turbulent, and this is because agricultural stocks are very volatile. Since 2020, the corporation has been on a downward trend, possibly because of the Covid 19 pandemic, which has negatively impacted the world economy, disrupted consumer spending and global supply chains, and produced volatility and upheaval of financial markets.

Post-Covid 19, the company seems to rebound from the downward trend. At the moment, AGFS is trading at about $1.7, outperforming the market with a margin of about 4% YTD.

I expect them to do better in the coming quarters because of the following;

- They have a very efficient diversification strategy enabling them to offer a wide range of products to a vast geographical area. This strategy is helping them to execute pervasive market participation and protect them from crop size variation.

- They offer exclusively unique technologies that provide solutions to the most delicate part of the agricultural cycle, the post-harvest phase.

- Their integrated direct service model offers them a sustainable competitive advantage.

In addition, the company appears to be undervalued, making it a more affordable addition to the portfolio of those seeking to diversify into the agricultural sector. However, investors should be wary of the potential risks of investing in the stock as covered under the risk section.

The Problem

Due to the increasing stress of feeding the world’s population, the smart agriculture business is expanding rapidly. Particular challenges need solutions to keep up with the ever-expanding markets and the ever-increasing need for food from the vast global population. Such challenges include post-harvest losses and the need for value addition. The utilization of cutting-edge technologies is essential for meeting these challenges.

At the same time, recent sales and margin losses resulting from those challenges in agrochemicals highlight problems, including:

- How can agrochemical firms keep adding value?

- How can agrochemical businesses hedge against post-harvest losses?

Innovation, geographic expansion, and farmer engagement will remain significant strategy themes to address these concerns. Based on my research, AGFS’s diversification strategy seems to be meeting these difficulties head-on. It also provides them with an edge over the competition.

The Solution: Diversification Strategy

AGFS has developed and is offering products for a wide variety of consumers in several different geographies as part of a deliberate strategy of diversification aimed at taking advantage of market opportunities while mitigating risks in the company’s operating environment.

Their products range from fresh produce, primarily fruits such as apples, avocados, kiwi, mango, etc., to post-harvest preservation technologies. By developing different products for different markets, the company can avoid the risk of market failure if they have one target market. In this section, I will break down the strategy into;

- Geographical coverage

- Fresh produce

- Post-Harvest technologies

Geographical Coverage

The company’s worldwide commercial platform spans six continents, offering AgroFresh solutions and high-touch advising services in every significant produce-growing region. It has its essential products approved in more than 50 countries.

AGFS’s Q2 2022 Results Presentation

Its vast presence across the globe benefits them and its customers. For them, it is a springboard for expansion, and a means to broaden their portfolio. They are resilient due to the diverse presence of crop size fluctuations. Geographic diversity helps them cope with seasonality, such as apple and pear harvests in the northern and southern hemispheres.

The company’s ability to enhance the shopping experience for customers across many products is a direct result of its physical presence.

Fresh Produce

In terms of adding to their product offerings, they diversified by offering a wide range of fresh fruits and vegetables such as pears, kiwis, avocado, broccoli, melon, tomato, mango, and stone fruit. The most important aspect of this move is that they diversified into one of the growing sectors; therefore, the future revenues could grow significantly in the coming years.

Demand for fresh produce is high, and revenues from the sector are growing yearly. According to Statista, the fresh fruits section volume will likely rise to 272,851.6 million kg by 2027, exhibiting a volumetric growth of 2.9% in 2023.

Post-Harvest Technologies

The post-harvest technologies offered by AGFS are unique offerings that address post-harvest challenges shortly before harvesting [near harvest] and in the long term along the value chain. Despite growing food supply concerns, one-third of human food is lost along the value chain. More than 40% of this loss occurs post-harvest. This considerable loss tells us how post-harvest loss control technologies are essential.

AGFS spotted the gap and has developed unique and efficient technologies to control post-harvest losses in fresh produce. The technologies address three critical stages of post-harvest losses: near-harvest, post-harvest, and transit.

AGFS 42nd annual growth conference presentation

To reduce post-harvest losses, they have devised four unique technologies employed along the value chain, including:

- Harvista: An ethyl management that promotes longer ripening time for improved quality and color and better labor and harvest management.

- SmartFresh: It is ethyl management to maintain freshness, firmness, and quality during storage, transport, and ripening.

- ActiMist/FreshStart/Control-Tech: It entails antimicrobials to prevent fungal decays, disinfectants for food safety prevention, and equipment cleanliness.

- VitaFresh Botanicals: These are plan-based coating to prevent dehydration and extend shelf-life solutions to maintain freshness in flowers.

Has The Strategy Helped Solve The Problem?

Investors would likely be concerned to know whether the strategy has filled the above-discussed gap or not. In my opinion, the plan has not only filled the void but has also provided significant benefits to the organization because of the following reasons:

- The value addition question: The post-harvest technologies are adding qualitative and quantitative benefits in both the extrinsic and intrinsic attributes of the agricultural products, hence value addition.

- Hedging post-harvest losses: The post-harvest technologies are helping extend the shelf life of products and improving the post-harvest handling procedures, thereby reducing the losses.

- The general implication: The strategy, in general, has significantly impacted AGFS. Firstly, their global reach serves as a buffer against economic uncertainty as they operate in several different economies, all of which, in my opinion, strengthen one another and protect the company from market failures, such as the ones being currently observed in different regions.

The diverse product offering ensures they meet a wide range of customer needs and cover a larger market space, maximizing their revenues. All this converges me to conclude that the strategy has extensively, if not entirely, addressed the problem.

Results Of Diversification

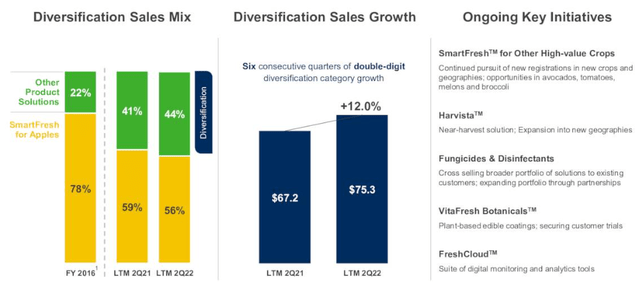

Diversification is paying off for the company through improved sales mix and growth.

AGFS Q2 2022 results presentation

In their Q2 2022, AGFS reported that net sales increased by almost 18% to ~$26million, and adjusted EBITDA increased by $1.5million to $2.4 million compared to Q2 2021. The company attributes these positive results to its diversification strategy.

Our diversification strategy continues to drive results, as evidenced by a 21% increase in our diversification revenue in the first half of the year compared to the prior year period, with double-digit growth in each of our diversification product solutions categories. Clint Lewis

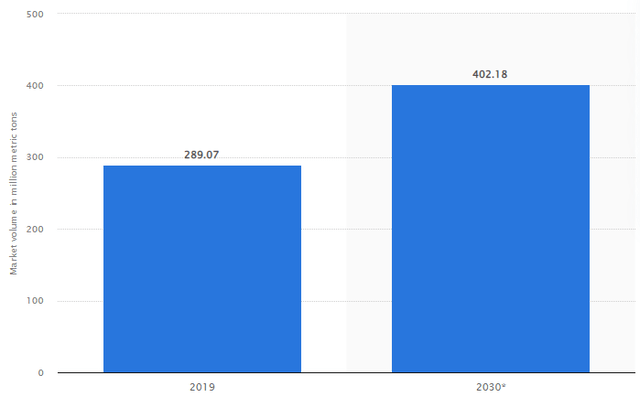

It would be of great importance to assess the industry’s growth potential because that would give an insight into what we expect in the future as far as the company’s revenue growth is concerned. Statista’s forecast shows that the agrochemical market will grow to around 402 million tons worldwide by 2030.

Statista

The diversification, being the company’s competitive advantage and having proven itself as a great strategy, benefits AGFS significantly in the growing market. Investors should expect more remarkable revenue growth in the coming quarters and financial years.

AGFS’s Business Model

Besides the diversification strategy, their business model is crucial for the company’s success. They use an integrated service model, which offers them a sustainable competitive advantage. AgroFresh’s direct service approach combines product applications with technical advising services.

Their sales and technical support staff communicate directly with customers on product selection, application best practices, contract negotiations, and general customer service. Additionally, they have around 40 research and development [R&D] scientists, about half with advanced degrees, working around the world at research institutes and customer sites. This infrastructure helped them to build a database of applicable plant physiology data over 40 years.

Their database is an excellent resource for providing insights into the causes of produce spoilage and other vital aspects. This facility enables their staff to give accurate advice and solutions to their clients, providing consumers confidence and peace of mind all year. They believe FreshCloud can boost its integrated offerings with data-backed solutions to monitor product quality across the supply chain.

In evaluating the company’s business model, the least I can award them is being at par with the competitor. But doing so would be underrating them. In my opinion, the company is far ahead of the competition, and I concur that its business model offers them a sustainable competitive advantage. The increasing revenue margins can support this.

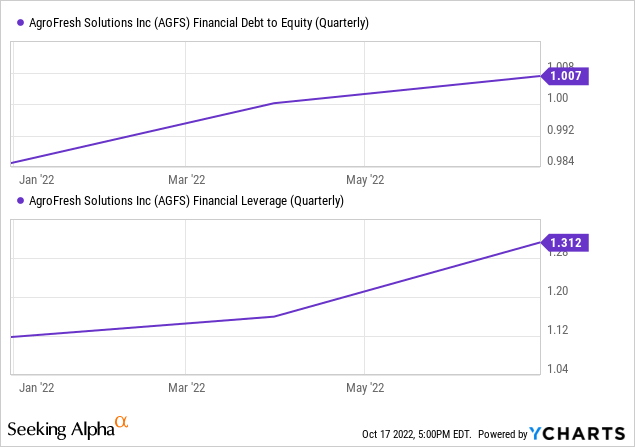

Risks

Although I am bullish on the stock, investors should be aware of the potential risks of investing in this stock. To begin with, the company has a weak balance sheet which needs improvements. It has a debt of $266.12 million, which is more than 200% compared to its market cap of $85.36 million. The debt is high because of the issuance of $150M preferred shares, which led to a deterioration in debt ratios.

In assessing their ability to pay the loan interest, the company’s interest cover ratio of 0.72x is also concerning. The ratio is below one and indicates that the earnings are not enough to cover the interest payments. Therefore, they need to either improve their profitability to pay interest or deleverage. If they don’t, they risk covenant defaults.

Additionally, the company operates in different countries with different currencies, giving rise to exchange risk. A weaker currency could see the company lose while converting to stronger currencies. Additionally, paying for expenses in countries with stronger currencies could lead to inflated business costs.

For instance, while they may be operating in the EU, they must pay for expenses in US dollars but could be doing so in euros. In such a case, the drop in the value of the Euro relative to the USD would hurt the company’s profit margins.

Investors ought to be wary of these two main challenges and keep a close eye on how they affect the company’s stability.

Valuation

The company is currently trading at a P/S of 0.49x and a P/B of 0.43x, lower than industry medians of 1.05X and 1.58X, respectively, an indicator that the company is undervalued by more than half.

The company currently has a levered FCF of $0.62 per share for the TTM and, even considering a 0% growth rate for the next 5 years discounted at 8.36%, derives a 62% upside potential, which is more than just conservative as the company has a 5-year levered FCF CAGR of over 27%. Despite the loss-making quarters, the company’s ability to generate cash makes the investment worth monitoring, especially considering that 60% of its market cap is held in cash.

Looking at both the company’s trading values and the model’s output, the company appears substantially undervalued with strong upside potential. Potential investors would benefit from seizing this opportunity and opening a position in the stock at a significant discount.

Conclusion

Statistics show that the agrochemical industry has been growing and will continue growing as the demand for agricultural inputs increases. The demand is because of the urge to increase agricultural productivity to meet the food demands of the growing world population. The market has a lot of opportunities that demand any company to position itself strategically to explore and exploit the benefits. AGFS uses its diversification strategy to exploit opportunities and hedge the risks in the market.

Additionally, the company’s excellent business model creates confidence among its customers because its advisory services are based on and backed up with data. That would mean it is empirical and not theoretical, as it is in most cases. The direct link between their staff and clients results in a cordial business relationship which is significant for the business’s success.

With the above aspects proving to be the company’s competitive advantage and key to its success, I am bullish on the company. I rate it a buy for the same reasons and also because it is significantly undervalued. However, investors should keep an open eye on the risks.

Be the first to comment