miketanct/iStock via Getty Images

Investment thesis

I like writing about undercovered stocks and today I’m taking a look at Canadian agtech solutions firm AgriFORCE Growing Systems (NASDAQ: AGRI). The company announced two acquisitions over the past few months, and it seems to have attracted significant retail investor interest. I think the purchases look expensive considering AgriFORCE is spending $98 million on two companies that have a combined annual net income of just over $4 million. Let’s review.

Overview of the business and financials

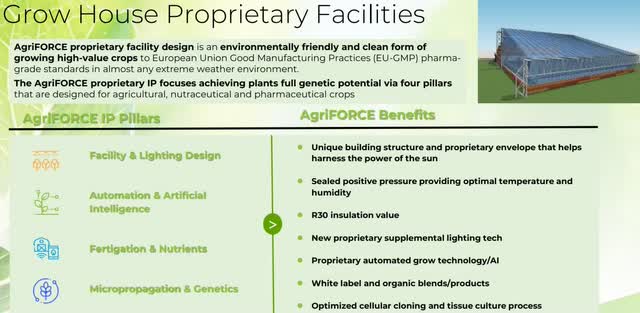

AgriFORCE was founded in 2017 and it has two divisions, namely AgriFORCE Solutions and AgriFORCE Brands. The goal of AgriFORCE Solutions is to transform modern agricultural development using the company’s proprietary patent-pending facility design and automated growing system.

AgriFORCE Growing Systems

AgriFORCE currently has four potential facility contracts in its pipeline and the first one is expected to be completed in 2023.

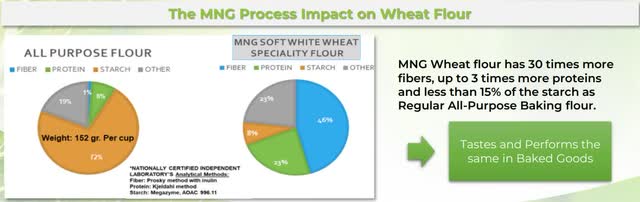

AgriFORCE Brands, in turn, specializes in the development and commercialization of healthy plant-based ingredients and products. In September 2021, AgriFORCE announced the acquisition of a proprietary process to naturally transform grains, seeds, and pulses into high-fiber, high-protein, and ultra-low-starch baking flours. The company claims that its flour has more than 30 times the fiber, 3 times the protein, and more than 80% less starch than conventional flour.

AgriFORCE Growing Systems

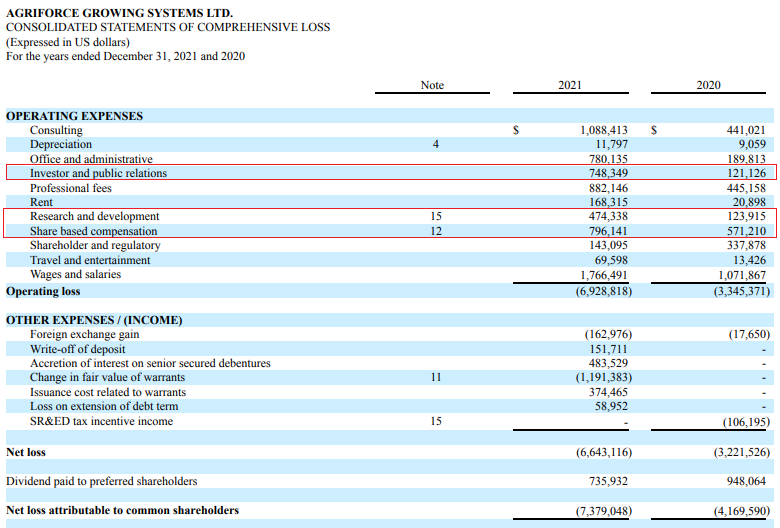

Turning our attention to the financial performance of AgriFORCE, there isn’t much to talk about considering that this is a development-stage company. In 2021, AgriFORCE booked a $6.92 million operating loss and I find some of the expenses worrying. For example, research and development expenses came in at $0.47 million while investor and public relations expenses stood at $0.75 million. In addition to this, AgriFORCE spent $0.8 million on share-based compensation. I think these expenses seem high for a company of such a small size.

AgriFORCE Growing Systems

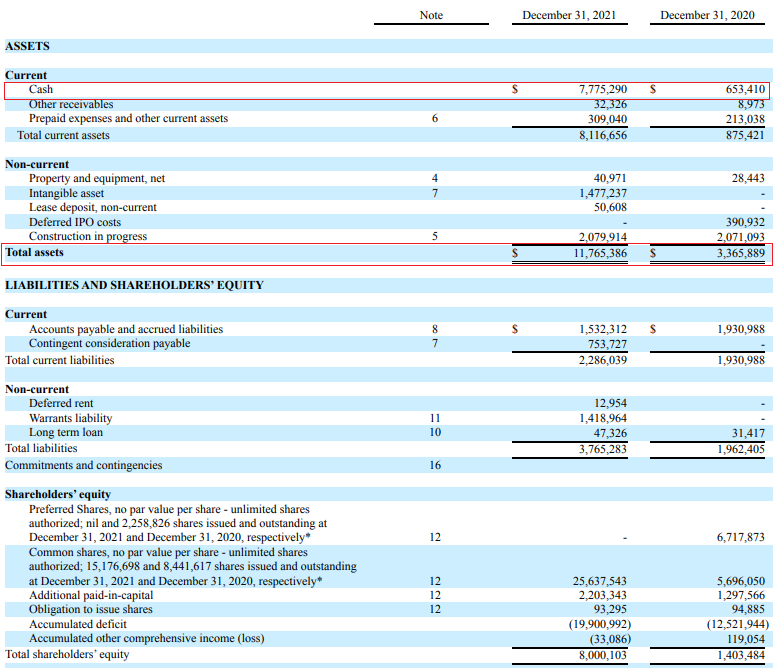

Turning our attention to the balance sheet, AgriFORCE had just $11.77 million in assets as of December 2021, with cash and cash equivalents accounting for two-thirds of this amount.

AgriFORCE Growing Systems

However, the business of AgriFORCE is set to change a lot in the near future thanks to two acquisitions. First, AgriFORCE is buying Dutch agtech consultancy firm Delphy for $29 million in cash and shares. The company optimizes the production of plant-based foods and flowers and employs about 200 people. In 2020, Delphy booked revenues of over $26 million and its net income came in at $2.39 million. Paying 12x earnings doesn’t seem that expensive, especially considering AgriFORCE says it aims to double the company’s revenues over the next four to five years. However, the revenue goals seem overly ambitious considering Delphy is expected to report sales of $28 million in 2021. Also, I expect the company’s results to be significantly affected by the Russian invasion of Ukraine considering Russia is one of its key markets. On top of that, you could argue that the purchase price isn’t exactly $26 million. You see, the cash component of the deal is €18.83 million ($20.48 million) which we know AgriFORCE didn’t have as of December. So, how does the company plan to fund this acquisition? Well, it aims to issue up to $20 million in notes that are convertible at $2.75 per share, which is over 20% lower than its current share price. In addition to this, the investor is getting 3-year warrants equal to 50% of the principal note amount that has an exercise price of $2.75 per share.

Seeking Alpha

Moving on to the second acquisition, AgriFORCE is buying a Dutch tissue culture propagation company named Deroose Plants. It has over 2.11 million square feet of laboratory and greenhouse facilities and employs over 800 people. AgriFORCE is paying $46.4 million for the business on a cash and debt-free basis plus another $22.6 million for Deroose’s intellectual property portfolio. In 2021, the Dutch company generated revenues of $40.5 million and a net income of $1.64 million. Considering the margins are low and Deroose has been around since 1980, it seems to be a mature business with little room for growth and this is why I think that AgriFORCE is paying too much. Also, the deal includes an earn-out of up to €10 million ($10.88 million) that is based on 2022 EBITDA. It’s still not clear how AgriFORCE is going to finance this acquisition and I find this concerning considering the share price of the company has more than doubled since March 10 when the transaction was announced.

Speaking of which, I have a theory that the recent share price and trading volume could be soaring as a result of high retail investor interest. You see, there are a large number of posts about AgriFORCE on websites like Twitter, and StockTwits. On YouTube, the company has been covered recently by several stock trading channels, including ClayTrader, MAKING EASY MONEY, red2green, Cyber Trading University, Hustle-with-Tony, The Mighty Scalper, and Pack-A-Punch Traders. Several of the videos have more than 1,000 views each. Note that the company isn’t doing the promotion of its business or shares itself, but this is being done by a significant number of private investors and traders.

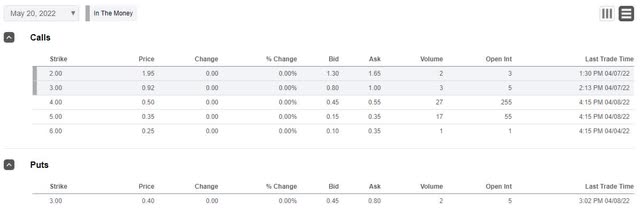

So, where do we go from here? Well, I think that retail investor interest is likely to fade off in the near future and the share price is likely to return to levels of around $2.00. In my view, the acquisitions of Delphy and Deroose look expensive and the second one is likely to be difficult to finance. Even with the $4 million in annual net income coming from the two Dutch companies, AgriFORCE is still unprofitable and I think there is a good short selling opportunity here. However, data from Fintel shows that the short borrow fee rate stands at 143.11% as of the time of writing. The only put options available at the moment are at $3.00 and expire on May 20. I think they look expensive.

Seeking Alpha

Looking at the risks for the bear case, I think there are two major ones. First, I could be wrong about the growth potential of Delphy and Deroose and they could allow AgriFORCE to become profitable and significantly increase its revenues in the next few years. Second, meme stocks are often unpredictable and it’s possible that the market valuation of AgriFORCE remains high for a while despite little change in the company’s fundamentals.

Investor takeaway

This year is set to be transformational for AgriFORCE as it’s buying two Dutch companies with combined revenues of $68.5 million for 2021. However, I think these purchases look expensive and AgriFORCE’s $6.93 million operating loss in 2021 is higher than the combined net profit of the two Dutch firms. Also, I think AgriFORCE could find it difficult to finance the purchase of Deroose.

AgriFORCE’s market valuation has been soaring over the past few weeks and I think the reason for this could be high retail investor interest. I expect the share price to return to around $2.00 as this interest eventually fades off. However, the short borrow fee rate is above 140% and I think investors should wait for it to drop to double-digit levels before considering opening a short position.

For risk-averse investors, I think it could be best to avoid AgriFORCE.

Be the first to comment