jittawit.21

Thesis

Agree Realty (NYSE:ADC) is a high-quality triple net-lease REIT that benefits from a diversified, strong, and highly stable tenant base. It has also significantly outperformed the SPDR S&P 500 ETF (SPY) YTD, demonstrating the resilience of the market’s confidence in its portfolio.

Our analysis suggests that ADC has had a robust long-term uptrend over the past ten years. Therefore, astute buyers have benefited tremendously by leveraging on significant dips, capitalizing on downside volatility to add exposure.

Given its robust portfolio, high revenue, and AFFO per share visibility, we don’t expect its long-term trend to change.

Notwithstanding, we believe the risk/reward profile in the medium term seems neutral, given its current premium. Also, we observed that ADC had moved markedly into a potentially strong resistance zone that could see sustained selling pressure.

Therefore, we rate ADC as a Hold for now. We encourage investors to wait for another deep retracement before adding exposure.

ADC – Keep Buying On Significant Dips

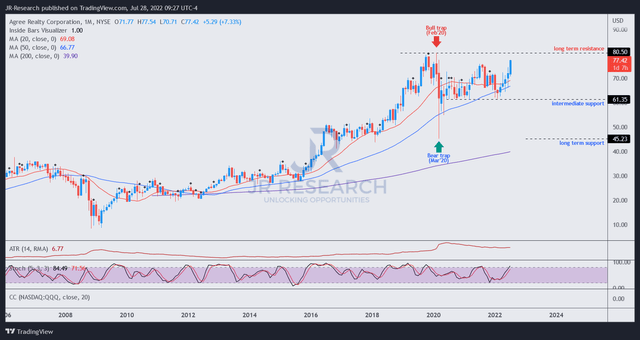

ADC price chart (monthly) (TradingView)

As seen in ADC’s long-term chart above, investors can glean the market’s bullish bias on ADC over time. Significant dips to its critical 50-month moving average (blue line) have consistently found robust buying support.

For instance, the bear trap (indicating that the market decisively rejected further selling downside) in March 2020 represented ADC’s most significant dip and a tremendous dip-buying opportunity.

ADC has also found robust buying support at its intermediate support ($60), which has underpinned its upward momentum since June 2020. Therefore, investors considering a significant support zone may assess the buying support at the $60 level at the next retracement opportunity.

However, the market’s momentum has also brought ADC closer to its long-term resistance ($80). Furthermore, the price action is emblematic of a move to set up a potential top, which warrants caution.

ADR – Valuation Is Less Attractive Now

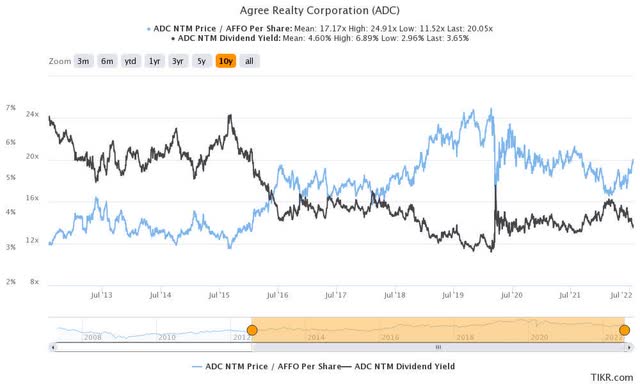

ADR NTM valuation metrics (TIKR)

Given ADC’s robust portfolio of stable tenants, there’s tremendous operating visibility on its rental revenue base. As a result, the market has also given ADC a premium valuation.

ADC last traded at an NTM P/AFFO per share of 20.05x, well above its 10Y mean of 17.17x (17% premium). Notwithstanding, the premium seems markedly lower if we consider its FY24 P/AFFO per share of 18.5x. Therefore, some investors may even argue that ADC deserves its premium valuation, given its clear AFFO runway.

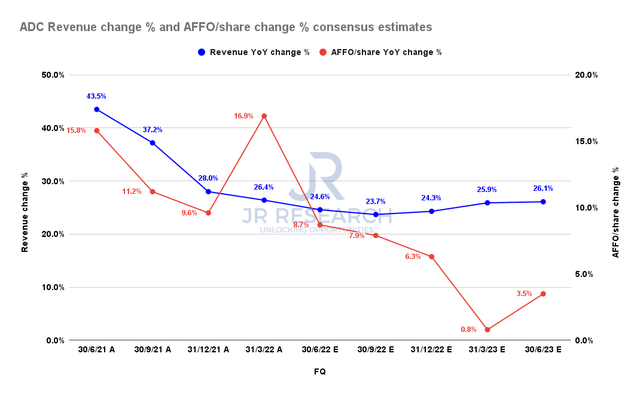

ADC revenue change % and AFFO/share change % consensus estimates (S&P Cap IQ)

However, the consensus estimates (bullish) suggest that ADC’s AFFO per share growth could come under pressure through FY23, given its previous growth momentum.

Therefore, we believe the market could factor in the expected growth deceleration, digesting its current embedded premium. Consequently, we urge investors to be patient and wait for a significant dip first before adding.

Is ADC Stock A Buy, Sell, Or Hold?

We rate ADC as a Hold for now.

It’s clear that ADC is a solid stock that has demonstrated the market’s confidence in its operating model and execution over the past ten years.

ADC has a robust long-term uptrend, consistently attracting dip buyers on significant dips. Given its AFFO per share visibility moving ahead, we expect its long-term uptrend to be maintained.

Notwithstanding, we also observed that ADC could be facing significant selling pressure as it closes in on its long-term resistance. Coupled with a premium valuation, investors can consider waiting for a retracement first before adding.

Be the first to comment